Top 10 Question Regarding Cross-border E-commerce to China (Part 1)

But what is cross-border? What are the challenges? How should retailers leverage cross-border?

by Azoya

Cross-border E-commerce as an emerging import model has been favored by many global retailers that are interested in entering the China market at early stage. China is a huge market with 1.4 billion population, and the consumption upgrade fueled by the strong economic growth represents a big opportunity for global businesses.

For foreign retailers, entering China often means risks and uncertainties. The lack of a light-weight approach to the China market has been troubling global retailers that have concern over heavy degree of investment. But with cross-border E-commerce, retailers now have the chance to expand to the market without local entities and cut-away complex registration process.

But what is cross-border? What are the challenges? How should retailers leverage cross-border? Here you would find top 10 questions regarding cross-border model and related answers.

1.What is the definition of cross-border e-commerce in China?

Cross-border e-commerce, in the broad sense, means selling to customers via online channels across national borders. In China, the term is used to describe the activity of selling the products to Chinese consumers via online stores, and ship products across border by international couriers. The products do not enter China before order was submitted and they are being delivered one by one. Warehouses are usually located in retailers’ own country, in Hong Kong, or in China’s free-trade-zones.

2.What are the common ways for products to enter mainland China via cross-border e-commerce?

There are generally three legal ways for products to enter via cross-border e-commerce and it depends on where the warehouse is located.

For retailers with warehouses located in their home countries, retailers can deliver the products via national postal services or international couriers.

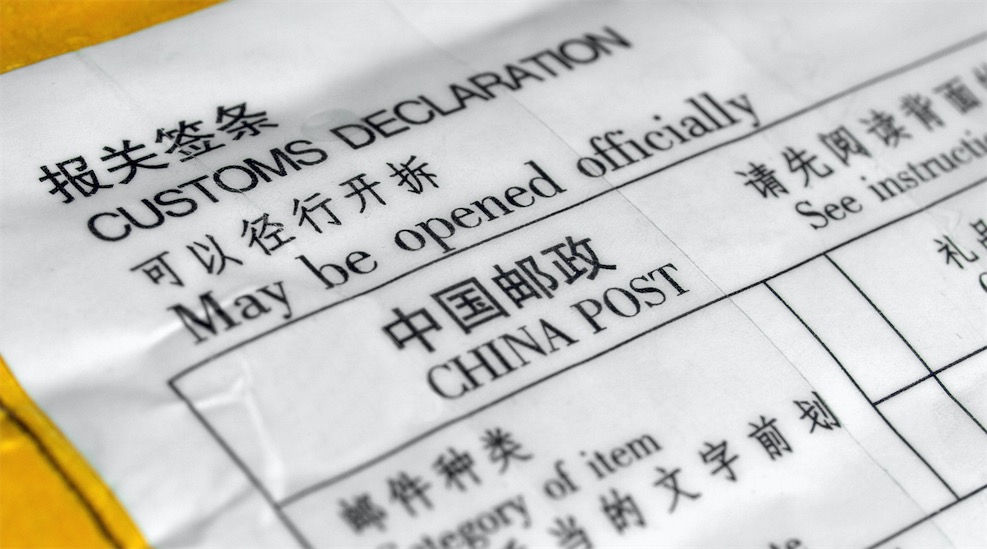

Postal services deliver the parcels under the UPU (Universal Postal Union) agreement and China post takes care of local delivery. Not all parcels are inspected at the customs, and when it does, customers should pay a postal tax at their nearest post office before retrieving their parcels. Postal delivery doesn’t require customer’s ID card number for customs clearance. This method is generally used by C2C personal shopping agents.

International couriers generally clear products via Business Commercial clearance model, which is much faster than postal clearance. However, it requires each order to provide payment serial number, order serial number and customer’s ID card number in order to be cleared. China last mile delivery is taken care of by designated express.

For retailers with stocks in free-trade-zones in China, they could import their products to China via bonded import. Upon receiving the orders and customer payments, retailers dispatch orders from their warehouses in free-trade-zones (also known as bonded warehouse) and pay tax at the customs. The last mile delivery after clearance is handled of by local express.

3.What are the tax rates for each clearance model?

UPU Postal Delivery Tax Rate

| Tax Rate | Applicable Categories |

| 15% | Metal products, food and beverage, telephones and other small electronic devices, furniture, recording devices and digital storage, ear phones, computer and parts, books, magazines, prints, education materials, game, stationery, toys |

| 30% | Footwear, non-luxury watches & clocks & parts, diamond jewelries, personal care, skin care, hair care, deodorant, cleansing products, textile, clothes, textile accessories, home textile, leather made clothes & accessories, bags, suitcases, luggage, electrical appliances & parts, camera (non-digital), camera accessories, art collections, sports products & equipment, bicycles & parts |

| 60% | Alcohol and alcoholic drinks, cigarettes, luxury watches, luxury jewelries (pearl, non-diamond gems), perfumes, toilet water, cosmetics (lip, eye, face, foundation, nails, powder, injected), golf and acessories |

For postal route, customers should pay a postal tax for their products. There are 3 levels of postal tax, 15%, 30% and 60%. The 15% postal tax applies to food, beverage, stationery, toys and electronics. The 30% postal tax applies to toiletries, sports, non-luxury skincare products, kitchenware, household appliances, textile, and most categories. The 60% postal tax applies to cosmetics products (such as eyes, lips and foundation make-up, etc) perfumes, luxury watches, jewelries, golf products. If applicable tax is under 50 RMB, then the postal tax is exempt for the customers.

Bonded Import & Business Commercial Tax Rate

Bonded Import (often interpreted as B2B2C import, as the products enters bonded zone before reaching customers) and Business Commercial import (often referred to as B2C import) share the same tax policy as they are regarded by the China customs as cross-border e-commerce import. Each parcel that enters via these two routes need to pay a consolidated tax before the goods were cleared by the customs.

| Consolidated Tax Rate | Applicable Categories |

| 11.2% | Baby formula, Mom & Baby products, nutrition supplements, food and beverage, accessories, watches, perfumes (non-luxury), cosmetics (non-luxury), personal care products (non-luxury), home appliances, and most categories |

| 25.5% | Cosmetics (luxury) for lips & eyes & foundation make up, perfumes (luxury), skin care (luxury) |

*What is luxury product: Customs value ≥10 RMB/ml(g)

*Consolidated Tax Rate has been adjusted after May 1st 2018 China VAT reduction

Most products have lower import duty when imported via cross-border b2c e-commerce, compared with general trade import. Products enter via general trade import need to pay a customs duty, and 17% of VAT.

4.Who gets the VAT refund?

The VAT refund refers to the exempt of VAT from the tax office in retailer’s home country, and the policy varies from country to country. For example, in the United Kingdom, when a retailer sells a product at £99 pound to a customer from China, and deliver the products from UK to China via international couriers, the retailer is entitled for a VAT exemption of £16.67 (20% VAT rate). To apply for VAT exemption, retailers should provide evidence that the products are sold to customers outside UK national border, and such evidence are often provided by the international couriers.

Customers cannot collect tax refund for cross-border shopping, but they can benefit from the reduced price. If the VAT of certain goods sold via cross-border e-commerce is zero or exempted (e.g. baby clothes in UK), retailers cannot apply for VAT exempt for these goods. In some countries like Japan, retailers can even get cash refund from the tax office if there are VAT incurred when purchasing from suppliers.

5.What are the restrictions for cross-border import? What is the ‘Positive List’?

Postal Import (or UPU for reference)

For postal import, each parcel should not contain more than 6 items, or with combined value over 2000 RMB. However, if the parcel only contains 1 item, there’s no restriction on the value (retailers should, however, consider whether postal service can guarantee the delivery of high-value products). And of course, your products cannot be on the list of banned items from either national posts or the China customs.

There is no requirement for the products to acquire import permit from the Chinese customs or registration filing. Retailers should provide details of the products and the recipient for customs declaration purposes.

Cross-border E-commerce Import

Not all products are allowed import via cross-border e-commerce, and only a handful of few on the ‘Positive List’ are approved. The ‘Positive List’ is introduced by the China authority on April 8th of 2016, and it is a ‘yes or no’ list. Products not on the list need to obtain import permits, registration from (e.g. nutrition products need to apply for CFDA permit for domestic circulation and sales) and other fillings, which are pre-requisites of customs clearance certificates.

But thankfully, the ‘Positive List’ is not effective yet. It has been postponed twice to the end of 2017 – which means that, for now, products can still enter via cross-border e-commerce import free of customs check over documentation.

And this is likely to continue. On March 17th, China’s Ministry of Commerce talked on the imported goods via cross-border import, and temporarily defined these imported goods as personal articles (personal belongings). This means that Chinese customers are purchasing these products at their own risks, and the authority will not treat these goods as general imported goods.