Top 10 Question Regarding Cross-border E-commerce to China (Part 2)

Following the part 1 of top 10 questions, the part 2 answers key questions regarding strategies, and how to launch via cross-border E-commerce.

by Azoya

Following the 'Top 10 Question Regarding Cross-border E-commerce to China (Part 1)' the part 2 of the top 10 questions, we answer key questions regarding strategies, and how to launch via cross-border E-commerce.

6. Is cross-border e-commerce a long-term solution for me?

CBEC can be a long-term solution for global businesses. As a new generation of international trading, CBEC is increasingly becoming popular worldwide for the ease of registration process compared to traditional bulk trade.

Take nutrition product as an example: when importing nutrition product via traditional import, it is required by the customs that the bulk of goods to complete expensive and lengthy registration process at the CFDA (China Food and Drug Administration) for each bulk import. But under current e-commerce model, retailers do not need to provide such registration for products entered via UPU or express parcels, as the buyers of the products are taking their own risks to purchase from overseas sources. For official e-commerce clearance, the 'Positive List' only requires certificates for first-time import - but given that the 'List' is not likely to be implemented soon, CBEC import still has advantages over traditional import.

The booming of CBEC has started to get serious attention from Chinese policy makers. In 2016, CBEC reached 917 billion USD and is estimated to exceed 1 trillion USD in 2017 according to iiMedia report. Apart from cross-border importing, Chinese manufacturers and vendors are also actively selling product across the border to Europe, North America, South Asia, etc. It makes sense to strike a balance between cross-border import and export – which means that China will continue to support cross-border import in the long term, and differentiate it from traditional bulk trade.

In fact, the Chinese customs is already making cross-border trading more regulated via the setting up of ‘transparent’ e-commerce clearance model, to rule out under-qualified participants (e.g. Daigou) and crack down on the grey markets.

For global retailers planning to launch a B2C business in China, here are some of the benefits of cross-border e-commerce compared to traditional import:

enter with less financial risks and burden,

do not need to set up local business entities,

faster access to capture the market opportunity,

no need for the complex registration process,

flexible to adjustment and changes to stay competitive in the local market.

7. Do I need a lot of investment for cross-border e-commerce to China?

Entering via cross-border e-commerce can potentially save retailers a lot of money, or bottom line, be friendly to retailer’s cash flow. Generally, retailers that choose to enter via cross-border e-commerce need to invest in these areas:

Setting up IT, maintenance, and update

Modification/upgrade of existing WMS/OMS/ERP systems

Warehousing and stocks

Cross-border shipping

Promotion campaigns and other marketing activities

Payments integration

Daily operation for China market and miscellaneous spending

In the ideal situation, that retailers make no modification or localization to their existing IT system and warehousing solutions, use domestic stock for the China market, there is an only limited up-front investment in setting up the sales channels.

If retailers wish to expand quickly in the China market, provide better shopping experience and faster delivery, they will need to invest more in marketing, promotions campaigns, stock as well as warehousing. Prudent retailers usually employ scalable solutions and upgrade their capabilities when sales increase in China.

8. Do I need a warehouse in the free-trade-zone?

Free-trade-zone warehouses, also known as the bonded warehouses, are warehouses established in the free-trade-zone (bonded zone) to keep goods that have not gone through customs clearance. From ordering to delivering, products stored in bonded warehouses generally takes less than a week to reach the Chinese customers, and some customs ports can shorten the clearance time to less than 10 minutes.

Bonded warehouse can significantly improve customer experience by shortening the delivery time, and reduce shipping cost, but for starters, it is not a ‘must-have’. Retailers that just begin to sell in China will find that stocking in bonded warehouses will be quite risky when sales volume is small and forecasting capability is weak.

But for retailers with a certain volume and are looking for growth, bonded warehouses will be a great logistics solution. Retailers can have better flexibility in terms of exploring sales channels, for example, wholesaling or drop-shipping to other B2C platforms.

9. Where should I launch my online store?

Generally, retailers set up their Chinese online sales channels via 2 main routes. The first one is launching stores on marketplaces, and the second one is developing their own retail channels.

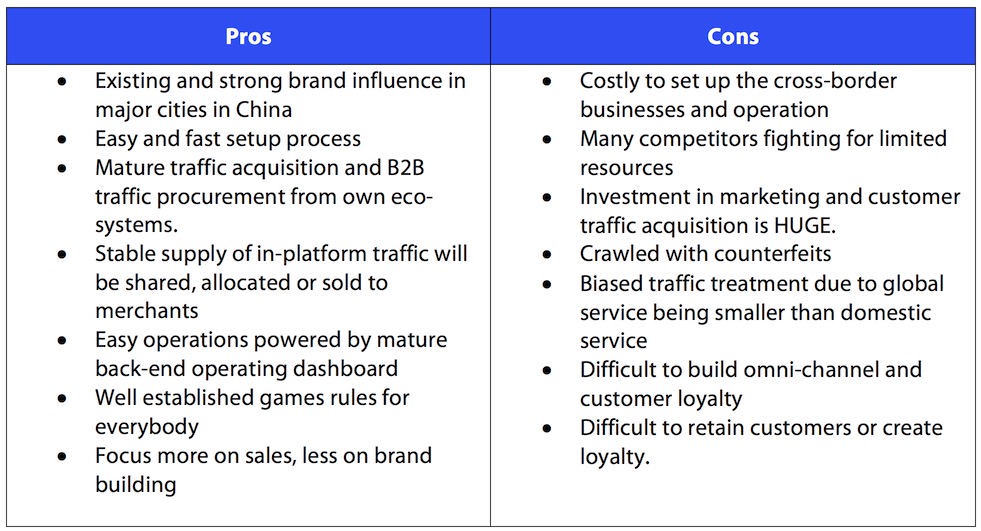

Marketplace approach:

Big retail marketplace in China, such as Tmall Global and JD worldwide accept retailers to open stores on their platforms. Marketplaces have a big influence in the domestic B2C e-commerce market, and to many retailers, it is a mainstream access. But marketplace entry and operation can be quite costly, which might eat up 40% of margin. It is better suited for brands rather than retailers.

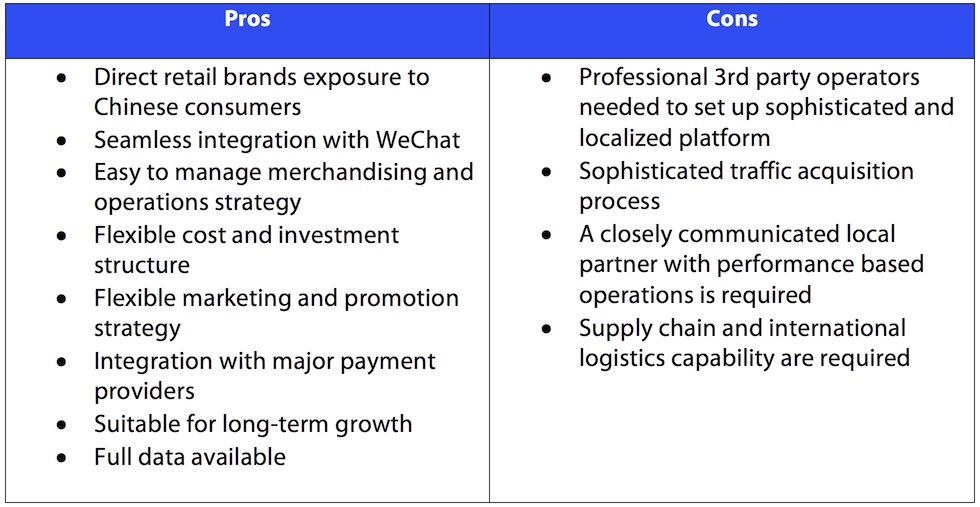

Own retail channel approach

Setting up own retail channel might seem daunting to many retailers, but it is not that difficult. With host in Hong Kong, retailers can have their fully functional online stores customized to their needs within 90 days.

10. Do I need a local partner for cross-border e-commerce?

Chinese e-commerce market is very dynamic and competitive, and it requires retailers to keep a closer look at the changing demands and practice. For sustainable growth in the China market, many retailers form strategic partnerships with local experts to minimize their financial and infrastructural investments. With local know-hows, retailers can better deal with China’s legal, financial, regulatory, linguistic and cultural barriers.

Value of a good local partners:

1.Providing turnkey and E2E solutions for optimal internal efficiencies,

2.Walking through the business expansion process and provide guidance from launch to sustainability,

3.Driving down overall cost of expanding to China and minimizing financial risks,

4.Keeping track of policy, regulatory and market dynamics and recommending strategies,

5.Dedicated to the e-commerce success of retail partners.