Alibaba and JD.com adapt to slower growth in China ecommerce

China’s two dominant online retail companies are partnering with smaller companies to shore up weaknesses in their platforms. These moves have implications for foreign brands entering China via ecommerce.

by Internet Retailer

This article appeared on Internet Retailer

China’s two dominant online retail companies are partnering with smaller companies to shore up weaknesses in their platforms. These moves have implications for foreign brands entering China via ecommerce.

Franklin Chu, managing director, Azoya International

Last year’s sales on Singles Day—the biggest global retail event—sales growth dropped from 36% a year earlier to 27%, a sign that growth is slowing in China, the world’s largest ecommerce market.

New internet user growth is plateauing, and, in response, powerful online marketplaces Alibaba and JD.com are strategically partnering with popular smaller competitors like Vipshop and Little Red Book to capture new niches.

Foreign brands new to the China market should first focus on the higher end of the market and serve a niche that domestic competitors can’t appeal to as well.

This collaborative approach represents the future of China e-ommerce, as it becomes clear one platform can’t satisfy everyone’s online shopping needs. US brands looking to enter China ought to take notes to differentiate themselves in an increasingly crowded market.

Alibaba Partners with Little Red Book for its Trusted Reviews

While Alibaba’s Taobao platform excels at selling low- to mid-end women’s apparel and accessories, it struggles with attracting higher-end customers. This is because Taobao, as a marketplace for hundreds of thousands of third-party sellers, has long been plagued by reports of fake goods and fake product reviews.

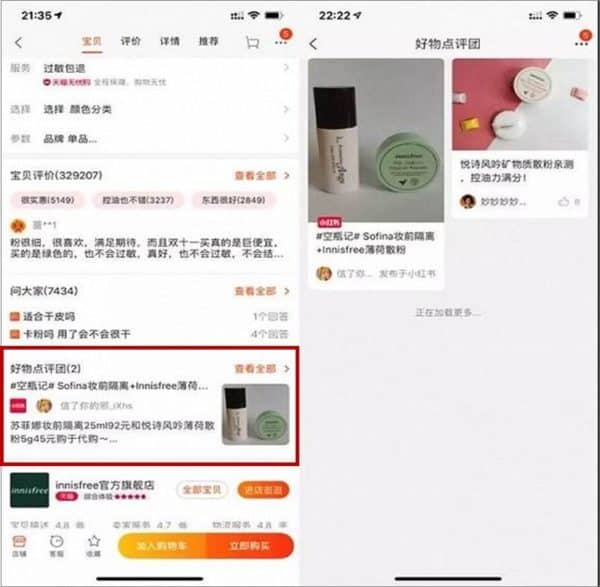

To improve consumers’ perception of Taobao products, in December the platform began incorporating peer product reviews from Little Red Book, a popular online social community with over 100 million registered users.

On the platform, users post Pinterest-like content about their experiences traveling or using products such as cosmetics and face cream. The reviews can be either negative or positive, and Taobao’s algorithms decide which ones are shown.

An Innisfree product on Taobao displays product reviews from Little Red Book.

Source: Jiemian

Since Little Red Book started out as an overseas travel community platform that later shifted to ecommerce, its content tends to be more original and trustworthy, elevating the platform in the eyes of many Chinese female consumers.

Alibaba led Little Red Book’s $300 million Series D financing round in June 2018, and this new function represents a deepening of their relationship with each other.

Alibaba Targets Luxury Customers

Alibaba has also struggled to get consumers to buy luxury products on its platforms. So in 2015, Alibaba invested over $100 million in Mei.com, a leading flash-sales site offering higher-end European brands. Mei.com now has a direct link on Tmall’s front page and benefits from its large base of organic user traffic.

Additionally, in 2018 Alibaba inked a partnership with luxury retailer Yoox Net-a-Porter, pledging to help the global luxury goods platform set up its own e-commerce business and lending its IT and logistics infrastructure. In turn, e-commerce platforms Net-a-Porter and Mr. Porter are setting up shops on Alibaba’s Luxury Pavilion page on Tmall. YNAP will contribute its global expertise and wide selection of luxury goods.

Tmall’s Luxury Pavilion store.

JD.com Seeks to Attract More Female Customers

JD.com has long struggled to appeal to female consumers, as the company made its name by selling electronics to predominantly male customers in Beijing’s famed Zhongguancun tech district.

While females account for a majority of ecommerce consumption, on JD.com they comprise a minority. They’re willing to buy basic FMCG [fast-moving consumer goods] products such as baby lotion and diapers, but are more reluctant to turn to JD.com for higher-end beauty and luxury products, a key weakness since these products have much higher margins.

JD.com has sought to make up for this by investing in and partnering with:

Farfetch (global luxury goods platform, June 2017)

Vipshop (women’s apparel & luxury flash sales site, Dec 2017)

Meili (livestreaming + 18-24-year-old female apparel, Jan 2018)

Secoo (online luxury retailer, July 2018)

These four are part of JD.com’s global retail alliance, and act as a bulwark against Alibaba, which built an early advantage in the womens’ apparel sector.

These partnerships are a win-win situation for both JD.com and its partners. JD.com can provide substantial logistics support with its in-house, nationwide JD Logistics network of warehouses and fulfillment centers. This enables merchants to store goods closer to customers, and fulfill orders within 1-2 days—faster than Alibaba’s Cainiao network of third-party logistics providers.

In turn, JD.com benefits from a wider product selection and data insights on women’s apparel and luxury items, which it can use to improve its merchandising selection, as well as fine-tune its product recommendation and advertising algorithms.

Lastly, Vipshop and Secoo both have large stores on JD.com’s platform, where they can benefit from exposure to JD.com’s large organic user base.

JD.com’s Vipshop flagship store

Key Takeaways

These strategic partnerships show that even the largest, most well-funded ecommerce platforms can’t cater to every customer group out there. There will always be a place for smaller players that can serve a niche better than the big mainstream players.

Data is a key aspect of these partnerships. Obtaining access to data on an underserved customer segment can help improve product recommendation and advertising algorithms, and pinpoint which items are selling and not selling.

Foreign brands new to the China market should first focus on the higher end of the market and serve a niche that domestic competitors on the big platforms can’t appeal to as well. Having an official brand website or WeChat mini-program store (WeChat is China’s popular, pervasive social media platform) can go a long way in communicating your brand story to increasingly affluent Chinese consumers.