5 Trends Shaping Beauty in China’s eCommerce Market for 2020

A guest post by MeasureChina, an e-commerce data provider

by MeasureChina

This is a guest post by MeasureChina, an e-commerce data & insights provider

China accounts for 30% of the world’s eCommerce sales. With online revenue reaching USD 584 billion in 2018, the potential for explosive growth makes China an important market for many international brands. But popular opinion changes quickly and the market is always shifting. It’s important to stay abreast of trends and stay relevant to Chinese consumers.

We’ve used real data to identify five major trends that will shape China’s Beauty eCommerce market in 2020 and should also help to shape your strategy.strategy.

Is this data for real? To see a real world application of MeasureChina’s data, click here to see how we’ve helped Unilever stay ahead of competitors for the last two years.

“Ingredient-Geeks” (成分党) who double as influencers (网红) take a microscope to the ingredients label

The beauty market in China has always been focused on ingredients and the benefits of those ingredients. And in recent years, savvy consumers are making sure that products actually do what they say they will. Both international and local brands use ingredients in their marketing efforts. As the market continues to build and educate itself, the spotlight on ingredients will only grow stronger.

Influencers hyper analyze every single ingredient on the label, while consumers make personal comparison lists about what reacts best with their unique skin type. Growth plus development will inevitably equal more demand for good quality products with popular and premium ingredients.

Here’s a real world example of how “ingredient geeks” are driving trends. According to MeasureChina’s data, derma cosmetics (products that contain active ingredients proven to be effective) is one of the fastest-growing categories in 2019. Although the market penetration rate for derma cosmetics is relatively low compared to other countries, the market is expanding by 20% every year as consumers become increasingly interested in ingredients that don’t irritate their skin.

Further proof comes from prominent influencers. Key Opinion Leader (KOL) Li Jiaqi (one of the most popular KOL’s in China) introduced new products from Makeprem and Atopalm (well-known Korean derma brands) in a live broadcast on Taobao this year. His sole focus was on the non-irritant and non-toxic ingredients of the products. And by highlighting both the quality of the products and what was actually in them, he sold out his initial volume in the first airing.

In 2020, you can be sure that consumers and influencers will check and test products for their actual efficacy before buying them, rather than blindly trusting promotional material.

Advantages of focusing on the ingredient trend:

● Target ingredients that are growing in popularity

● Get more organic reach via “ingredient geek” influencers

● Stay current and relevant in the fast-moving Chinese market

Some potential ways you can use ingredient geeks:

● Product development and launches

● Ingredient-focused marketing campaigns

● Successful influencer-led events and partnerships

*Makepem and Atopalm are Korean derma brands

Consumers use live streaming (直播) to buy products

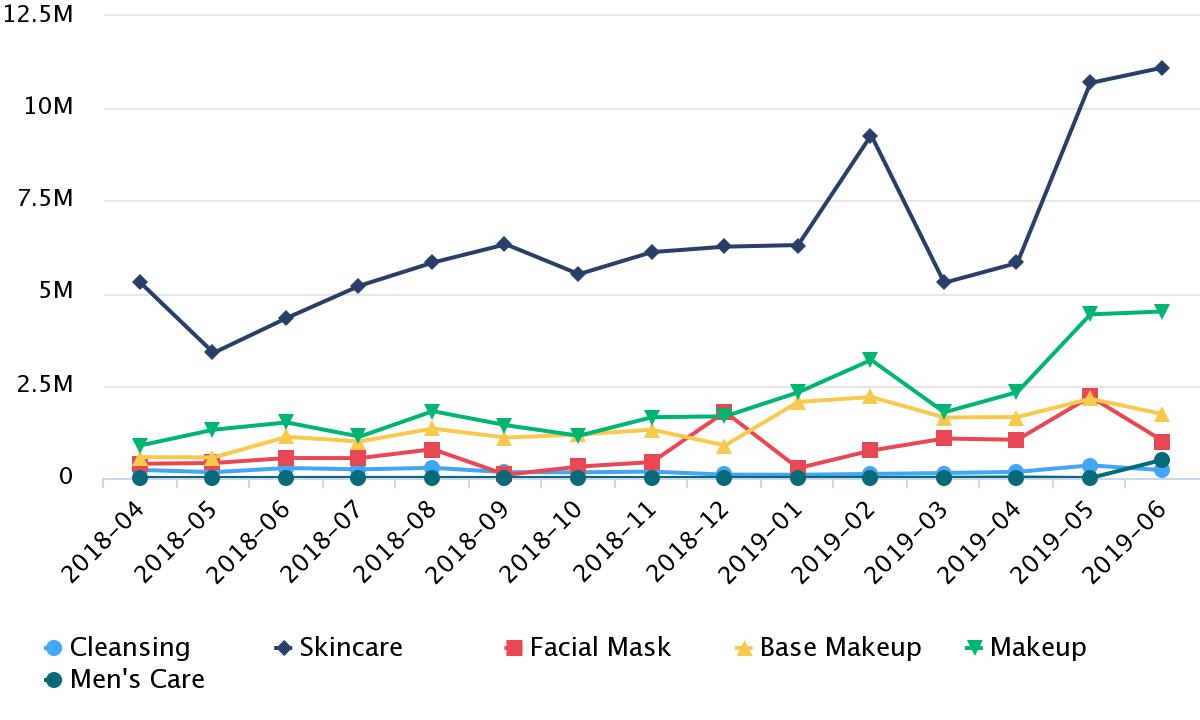

Using live streaming to sell products is not a new trend, but it’s increasingly popular year-after-year. The chart below shows category trend data on MeasureChina’s platform, filtered by the keyword ‘live streaming’. It’s clear that over the last year and a half Taobao and Tmall revenue from live streaming has increased steadily.

Revenue by product category using the keyword “直播”

Within makeup particularly, we’re getting massive spikes in volume sold month-to-month that could easily be correlated with special event days or influencer promotions.

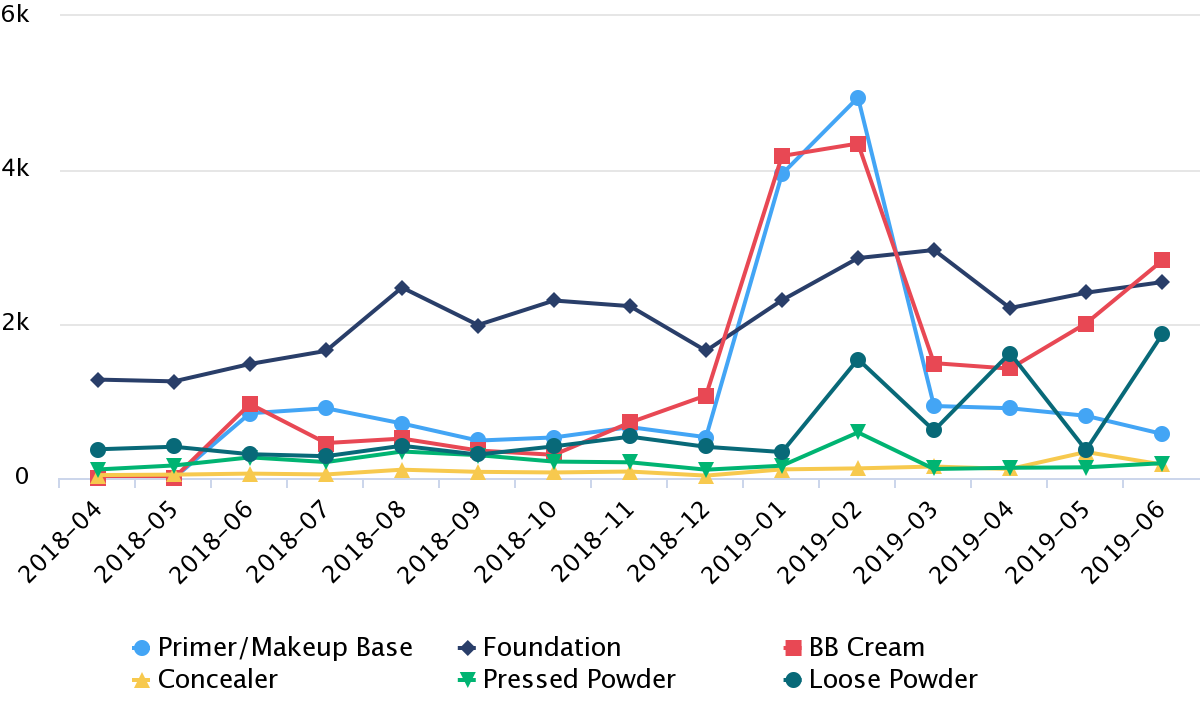

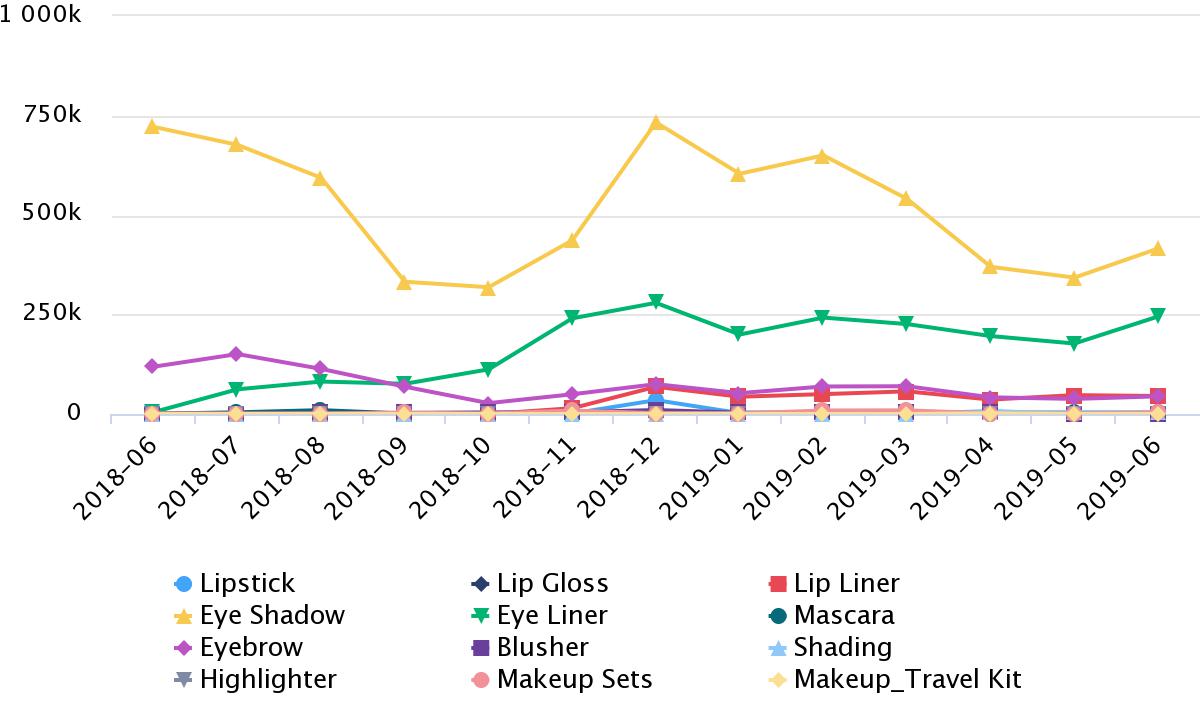

Volume by makeup category using the keyword “直播”

Influencers run special live streaming events (sometimes for 24 hours at a time) and often they’ll sell out of event items making this marketing technique particularly powerful to drive both awareness and sales.

When brands partner with Chinese influencers, they generally pay a sponsorship fee and provide a certain amount of product at a discounted rate for the influencer to sell in their store. When buying from a live stream, consumers get products at a cheaper rate, they can ask questions and get instant feedback, and listen to a thorough review of the product. It’s this combination of benefits that encourage consumers to make faster purchasing decisions and purchase products on the spot.

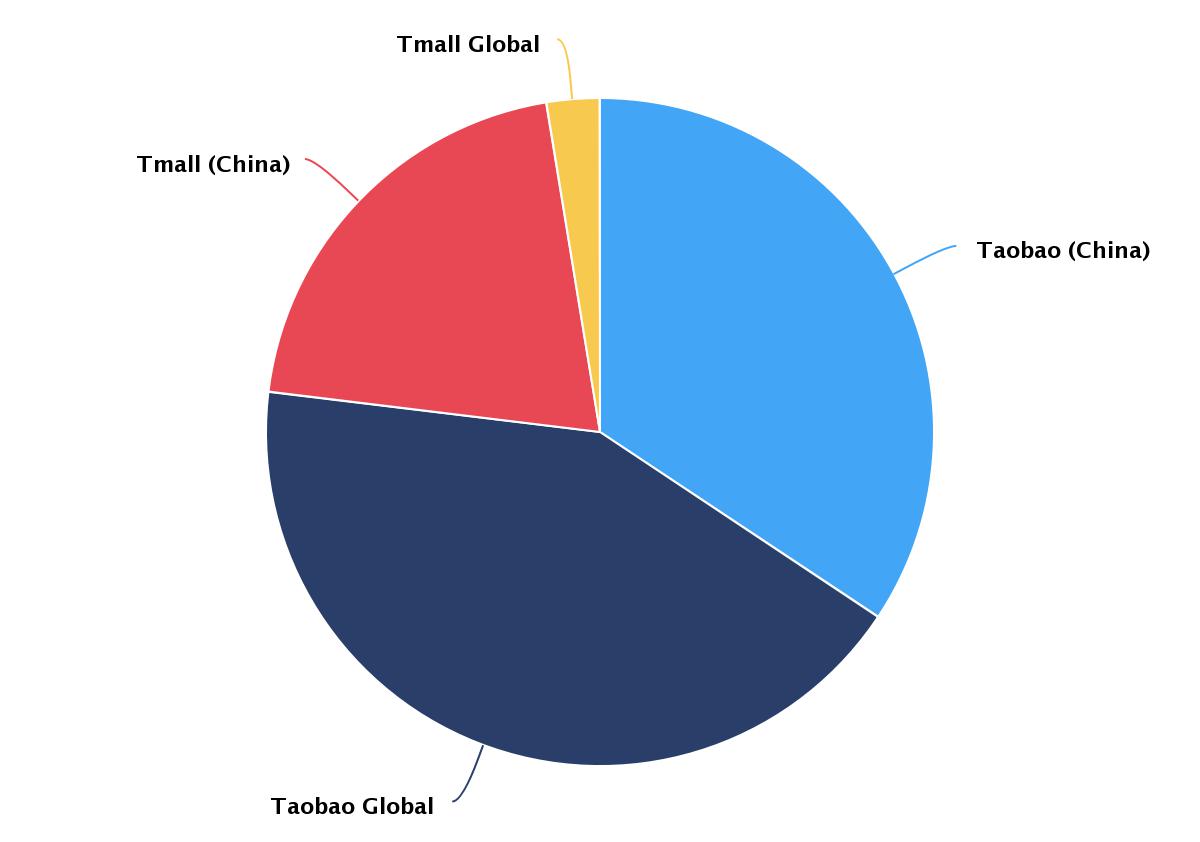

Posts that were tagged with the keyword ‘live stream’ over the past year and a half brought in the most revenue on Taobao Global and Taobao China with a smaller portion of revenue made in Tmall.

Revenue by Platform

Advantages of using live streaming as a marketing tactic:

● Quick boost of product popularity

● Increase in brand awareness AND sales

● Increasingly popular way for consumers to buy products due to discounts

Chinese Beauty (国潮) Keeps Majority Market Share and National Pride Goes Up Among Millennials

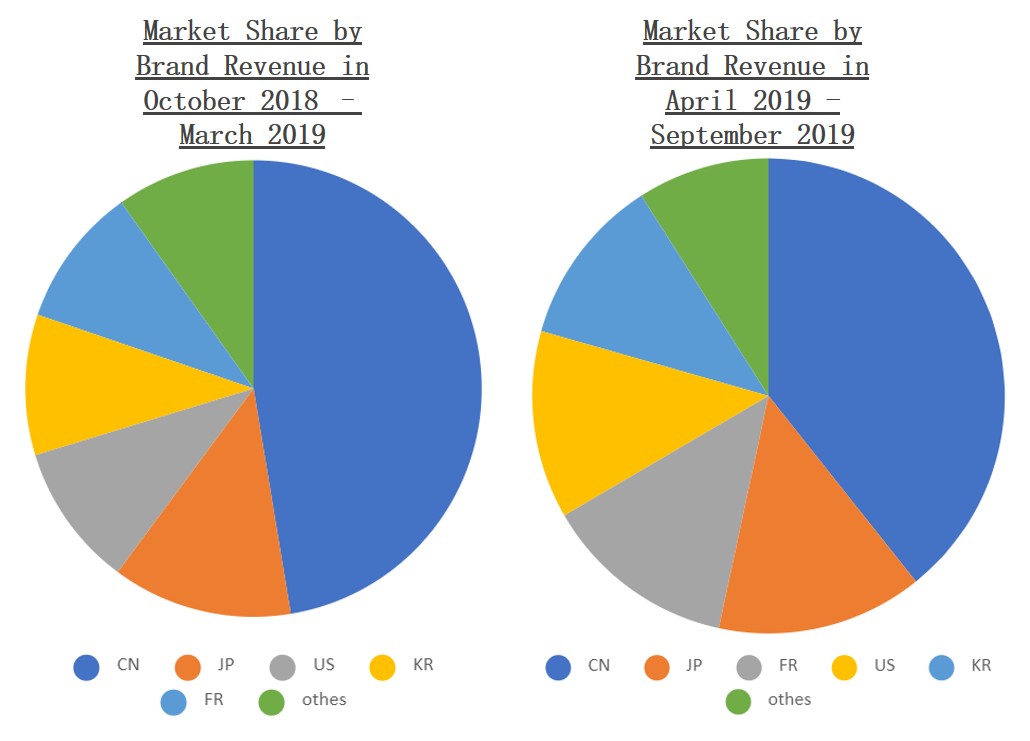

C-Beauty has historically maintained a majority market share in mainland China and the trend is set to continue in 2020.

As the economy matures, many analysts and influencers agree that Chinese consumers are leaning towards old, traditional things that speak to them on a cultural and historic level. As big brands (both global and local) start to incorporate ancient Chinese beauty ingredients into their product lines, it looks like C-Beauty is set to grow

Gen Z in particular is becoming a major player. Xiaofeng Gu, a director at marketing company Kollective Influence elaborated to the South China Morning Post: “Data is saying Generation Z is quite nationalistic, as they grew up in a time when China was in rapid ascent and they witnessed this transformation. This has given them a strong sense of national pride, and when they can, they buy goods made at home.”

Despite what experts are saying, when we look at the C-Beauty’s market share (by revenue) from the last 6 months, we see the opposite. From October 2018 to March 2019, Chinese brands accounted for 45% of the market. But in the next 6 months, from April 2019 to September 2019, they only had 39.7%. Interestingly, products from Japan, France, the US and Korea all gained roughly a percentage point each.

China’s revenue is still growing. In the last half of 2018, Chinese brands brought in just under 20 billion yuan, whereas in the first half of 2019, China brought in almost 21 billion yuan. But this is a result of overall market growth, rather than an increasing preference for Chinese brands. According to MeasureChina’s data, all metrics indicate that C-Beauty brands account for just under half of all products sold in China.

Chinese beauty brands tend to be more affordable to Chinese consumers, while luxury global brands like SKII and Lamore dominate the high-end sector.

Traditional Chinese Medicine (TCM) or “中草药” (Chinese Traditional Herbs) are being used in more and more products. As Chinese heritage becomes more popular among younger consumers, the market share is predicted to increase dramatically in the coming years.

"It's not just about cultural heritage. The mild nature of the TCM ingredients also caters better to Chinese skin." -Stephane Wilmet, chief consumer officer of L'Oreal China

Popular categories tagged with the keyword “中草药” (according to MeasureChina’s data):

● Base Makeup (Foundation)

● Facial Masks

● Skincare

● Skincare sets

● Emulsion/Lotion

Lazy people (懒人) are getting the spotlight

As the demands of modern society increase, consumers are looking to take shortcuts and keep their skincare and makeup routines quick and simple. The so-called ‘lazy people’ (懒人) are quickly being catered for by major brands who are predicting more and more demand.

According to a 2018 consumer-trends report by Alibaba Group’s Taobao Marketplace, spending on ‘lazy’ consumer products in China has increased by 70% from the previous year. Lazy beauty and makeup products like stamp eyebrows and one swipe gradient eyeshadows have increased by 150% in the same time period.

Looking at MeasureChina’s dashboard, eyeshadow, eyeliner, eyebrow, and lip liner products have been performing well in terms of sales volume.

Volume by makeup category using the keyword “懒人”

The skincare category accounts for more than double of the makeup category under the keyword ‘lazy people’.

The top category was emulsion/lotion with the top five benefits/attributes being:

● Moisturizing

● Brightening

● Revitalizing

● Repair

● Rejuvenation

Lazy products are popular with consumers born after 1990 who are familiar and comfortable with finding ways to optimize their busy schedules.

Within the lazy-people economy, is a new rising category poised to boom in popularity: Men’s grooming (男士). Unlike in the West, where men’s makeup is driven by trends in gender fluidity, men in China can maintain their macho when using makeup. Brushing your eyebrows up with a pencil before leaving the house is simply viewed as another method of self-improvement. In fact, many men think having better skin will lead to a better life.

In 2017, Lin Lin, the independent director of China International Beauty Expo said men's skincare and makeup category is set to grow as more men look to better themselves in a gender skewed economy. And two years on, sales are reflecting that.

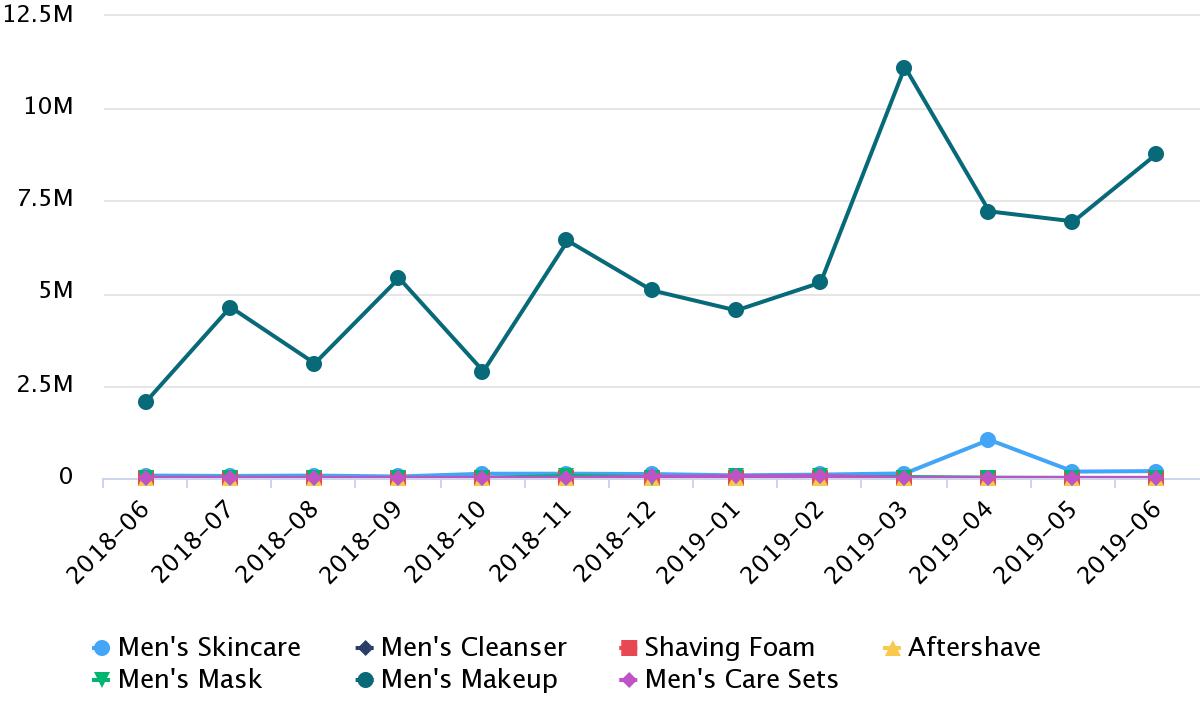

For example, if we look at MeasureChina’s data for the keyword ‘lazy people’ in the category ‘men's care’ for the past year, we can see a steady increase in revenue.

Revenue by men's care category using the keyword “懒人”

Men’s grooming is becoming more and more important., Holly Kim, head of Measure China’s Data Business, thinks there’s a growing link between the lazy economy and men's care. Particularly within the makeup and cleansing categories. However, she warns that the market “still needs to mature and grow.''

Advantages of following the men's care trend:

● Early product positioning

● Possibility for large growth in the next 5 years

● Emerging market

Chinese Consumers Go Crazy For Makeup As Self-Expression Flourishes

This upward trend is due to consumers embracing makeup more readily than before. Bored of the flawless look popularized by K-beauty, Chinese women are reaching for more individuality and self expression.

Historically China’s focus was on skincare, but there’s been a clear shift towards more makeup products (with base makeup being the most popular category). For example, foundation prices have risen 20% from 2018 to 2019 to match demand.

Base Makeup is one of China’s fastest growing beauty categories overall. In May 2019 the base makeup category grew year on year by 257.9% verse average growth rate of 151.3% across all categories.

And in 2019, base makeup brought in an impressive 7 billion yuan with sales showing no sign of slowing down.

Top 4 high-performing sub-categories within base makeup:

● BB Cream

● Foundation

● Primer

● Concealer

Keep Your Brand Growing in China

We’ll keep you up-to-date with the latest trends for China’s e-commerce beauty market through 2019 and into 2020, so remember to subscribe to our blog! If you’d like access to data via a trial of our dashboards or full quarterly reports, please send a request via our website or feel free to contact our head of business data, Holly Kim via email at holly@measurechina.ai.