Behind China Duty Free Group’s Shift Towards Cross-Border E-Commerce

by Ker Zheng & Queenie Yao

Most people have never heard of China Duty-Free Group (CDFG), but the Sunrise Duty-Free chain that it owns operates over 240 duty-free stores across China. As China’s pre-eminent player in duty-free shopping, it is present in most airports in China and works with over 1,000 global suppliers worldwide.

Just months ago, CDFG launched a cross-border e-commerce WeChat mini-program store, dubbed “CDF Member Shop”. The store offers members special benefits and shopping experiences, and was likely designed to counteract revenue declines caused by the Covid-19 pandemic.

This is the first major duty-free group to transition to cross-border e-commerce amidst the backdrop of the Covid-19 pandemic. After registering net losses in the first quarter of this year, its revenues grew 9.6% YoY in the second quarter, and net profit grew 52.9% YoY to reach 1.05 billion RMB. Online sales accounted for 50% of revenues, and the WeChat mini-program played a crucial role in reviving sales.

We take a look at the mini-program and explain why it’s become so popular amongst the past few months.

How the Mini-Program Works

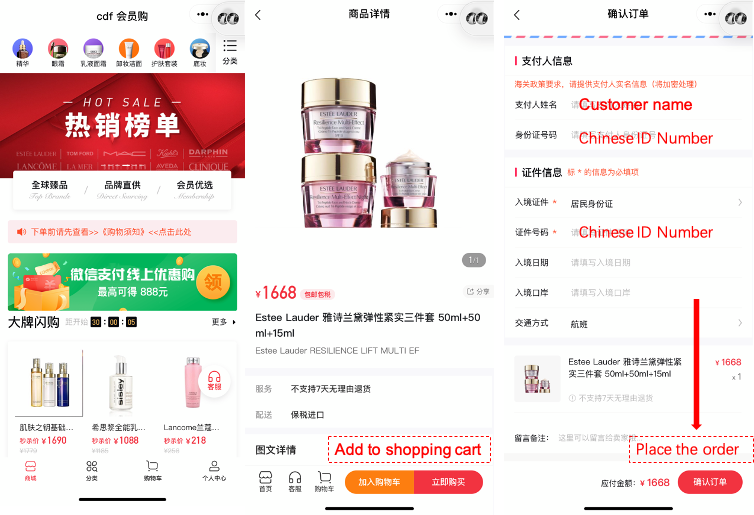

Previously, CDF focused on offering “book online, pick up offline” functions for its mini-program. Because of the Covid-19 pandemic, it shifted the purpose of this mini-program to cross-border e-commerce, selling skincare & makeup items, perfume, menswear, wine, food, watches, etc. All of CDF’s goods are sourced directly from the brands themselves.

Duty-free shoppers are required to obtain an invitation code to access the membership mini-program, through either CDF staff or other partner channels.

But apparently it’s not difficult to obtain such an invitation code. For example, CDF works with a large number of travel agents, including Ctrip Global Shopping, where users can get an invitation code by following their WeChat account and entering the keyword “CDF”. Travel players such as Ctrip and Meituan-Dianping have all been trying to partner with e-commerce players to recoup revenues lost to the Covid-19 pandemic.

The purchasing process follows cross-border e-commerce regulations. At the purchase page, first-time customers have to register with their mobile phone number in the personal center. Customers must fill in their real name, Chinese ID number and delivery address.

The packages, stored in Shenzhen’s Qianhai free trade zone, are then shipped and generally arrive within 10 days. The lengthy delivery times are due to customs clearance processes.

Due to the special cross-border nature of the goods, products cannot be returned or exchanged without a good reason. This is in contrast to Tmall and Tmall Global, which offer a 7-day no excuses return policy.

Qixi Festival Campaign

The mini-program offers different flash sales and discounts every day, with some top brands selling at discounts as steep as 60%.

For the Qixi Festival (Chinese Valentines Day) in August, it offered flash sales of product trials for just 9.9 RMB, with different items available at different times of the day. The Qixi Festival campaign also offered 30 RMB off orders of over 500 RMB.

CDF also launched a livestreaming session on its mini-program on August 24th (Qixi Festival is August 25), offering 30+ beauty brands. The livestreaming session included four rounds of lucky draws and gift-giving sessions as entertainment for viewers.

Ads of Qixi Livestreaming session

CDF Member Shop Highlights

• The annual quota on cross-border e-commerce purchases for individual buyers is 26,000 RMB (about 3,768 U.S. dollars). The limit on a single transaction is 5,000 RMB.

• Low prices, with discounts as high as 60% to draw traffic

• No minimum spending threshold to receive free shipping

• No need to input flight information or pick up items at the airport; products are shipped directly home because of Covid-19 impact.

• Products are shipped from Shenzhen’s bonded warehouse in Qianhai after passing through customs

This is the first major case we’ve seen of a duty-free group shifting their business model entirely to cross-border e-commerce. CDFG has demonstrated that it could adapt quickly to post-COVID-19 realities, and its mini-program has helped them to sell off unsold inventory.

Perhaps going forward, more and more players in the travel retail space will shift their business towards the cross-border e-commerce model. Even though such products will no longer be truly duty-free (cross-border e-commerce charges a 9.1% customs duty), the channel still provides a convenient way to purchase imported products.

Key Takeaways

1. China Duty-Free Group’s cross-border e-commerce WeChat mini-program was the first of a duty-free group to transition towards cross-border e-commerce.

2. The mini-program has proved to be highly popular, as it offers free shipping and discounts as high as 60% on top brand names.

3. It is possible that other duty-free groups worldwide could adopt WeChat mini-programs to continue selling to Chinese customers who are restricted by the global Covid-19 pandemic.