Black Friday in China: What's new in 2017

Azoya's Black Friday campaigns generated 220% incremental revenues compared to this year's Single's Day, and 88% incremental change compared to last year's Black Friday.

by Azoya

The Black Friday concluded last week created a buzz in the e-commerce sector: major retailers and B2C platform such as Amazon and Kaola had recorded impressive sales result and increasing number of participants. While Black Friday is still a relatively small online shopping festival in China compared to the shopping bonaza Single's Day, the day represent a huge opportunities for international retailers to reach out to the Chinese customers who have good perception of foreign products, brands and retailers.

Before introduced to the Chinese masses by China's domestic e-commerce businesses, the Black Friday used to be limited to groups of tech-savvy online cross-border shoppers that shop directly from foreign retailers' sites. The day was taken more seriously by the retailers who targets Chinese customers in 2014, when cross-border e-commerce started to take off, and more customers became aware of the campaign.

Why Black Friday, not Single's Day?

Just a fortnight prior to the Black Friday campaign, the entire China e-commerce industry was drenched in the crazy Single's Day sales - and this year, more overseas retailers and brands had participated in the sales bonanza, and Alibaba, again, invited international pop stars to live stream during the sales campaigns to turn the day into a global sales festival.

While there were unusually high traffic to land on foreign retailers' online stores during the Single's Day sales, the day is essentially a day for Chinese domestic brands - who priced lower, supports faster delivery and can sell a lot more. Price sensitive customers natually choose to buy from brands that offer steeper discounts, and as Azoya's Black Friday result shows, customers that made a purchase during the Single's Day campaign this year generally shop 26% less compared to those that shopped during the Black Friday campaign.

It is likely that customers attracted by the Single's Day discount are extemely price sensitive and are looking for instantaneous deals, rather than those that shopped during the Black Friday, who value foreign products from more perspectives, including quality, source of the products, post-sales services, and the value of the price paid. For international retailers, the Black Friday campaign have higher chance to attract trageted and loyal customers.

The Black Friday is easier for international to market their campaigns in China due to less competition from domestic brands and retailers. Azoya monitored a surge of traffic at 10 A.M. on 24th of November and mostly contributed by affiliate programs and deal sites.

What's new this year?

The postponed effective of the registration and filing required for cross-border import at duty-free-zone was a shot in the arm for many major e-commerce players. They would have one more year to stock products in the free-trade-zone without having to go through lengthy process to acquire import permit and filing.

We are also seeing the direct shipping model become more important for domestic cross-border e-commerce operators such as Alibaba and Kaola, who has started to establish warehouses in Europe, Japan and the United States since 2016. Direct shipping from overseas warehouses, though less favourable in terms of shopping experience, can offset the risk from change of import policy.

Amazon has risen fast to rank as the second favourite destination (47.5%) to acquire Black Friday campaign information, while other members of the top 5 destination include Tmall Global (59.1%) JD.hk (46.7%), Taobao (30.5%) and Kaola (26.9%), according to a recent report published by China E-commerce Research Center (CECRC).

As commented by CECRC researchers, Amazon's Black Friday campaign for Chinese customers starts from the 13th of November with a hundred of operation centers to support orders from China. By leveraging strong sourcing capabilities and inventories, Amazon is repositioning itself as a destination for cross-border shopping, and compete directly with major marketplaces in China. However, un-friendly shopping experience and localization issues could hinder Amazon's growth in China.

The second draft of China's E-commerce Law released positive signals towards cross-border e-commerce import. The 2nd draft encourages SMEs to engage in cross-border e-commerce, promotes transparency at Customs and relative regulatory authoratives, accelerates information flows between businesses and regulatory authoratives, and create a better shopping environment for Chinese consumers. (CECRC)

Case study

Azoya's Black Friday campaigns were joined by over 25 retailers from over 11 countries. Altogether, Azoya's international retail partners brought over 1 million of SKUs, covering beauty, fashion, accessories, mom & baby products, personal care, nutrition and sports categories to the Chinese customers via cross-border e-commerce. The campaign started from the 20th of November and concluded on the 27th of November.

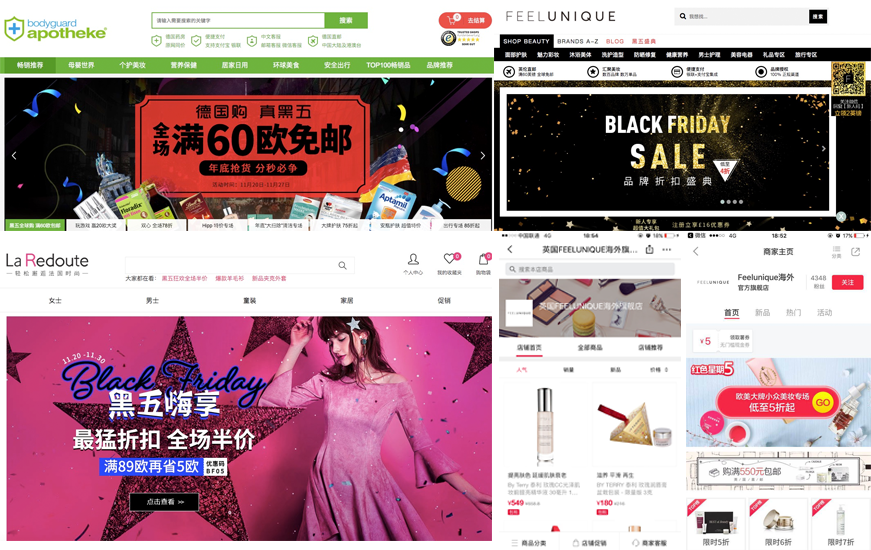

Azoya launched tailored campaigns for retail partners during Black Friday sales

To prepare for the Black Friday sales, Azoya team had been liasing with retailers to prepare stock, securing various marketing channels, collaborating with UnionPay to launch 5 retailers on U Plan marketing platform, and optimizing logistics solutions.

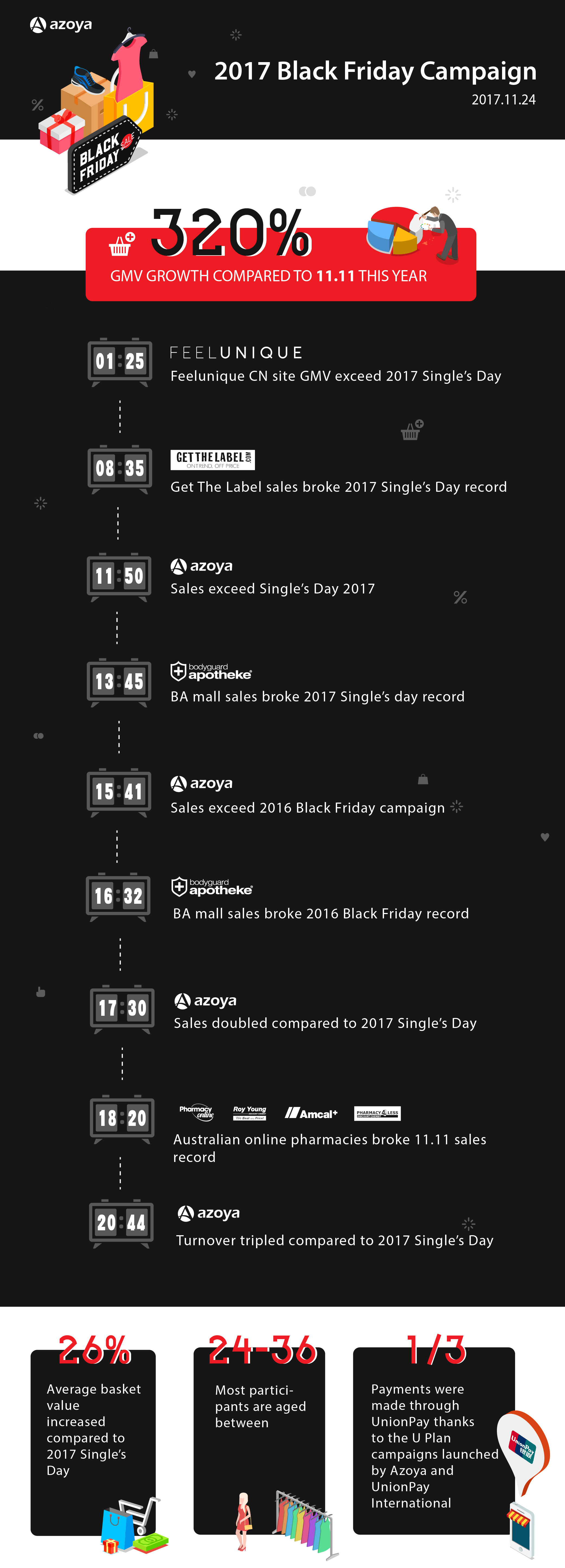

On the 24th of November, Azoya's Black Friday campaigns generated 220% incremental revenues compared to this year's Single's Day, and 88% incremental change compared to last year's Black Friday. European beauty retailer Feelunique recorded close to 600% compared to this year's Single's Day. Australian online pharmacies generally saw 140% to 270% growth compared to this year's Single's Day.