China's 618 E-Commerce Festival Nearly Tops 1 Trillion RMB in Sales

The 6.18 mid-year shopping festival is the largest e-commerce holiday to happen in China since the Covid-19 pandemic

by Ker Zheng & Queenie Yao

The 6.18 mid-year shopping festival is the largest e-commerce holiday to happen in China since the Covid-19 pandemic

Results were strong, with sales rumoured to have almost reached 1 trillion RMB across the industry. Data from the National Post Office showed that from June 1st to 18th, express package deliveries surpassed 4.678 billion parcels, a year-on-year increase of 48.66%. Such performance indicates that China’s consumer economy is bouncing back from the coronavirus crisis.

We take a deeper look at how each of the major e-commerce platforms have performed.

Taobao/Tmall/Tmall Global

618 festival sales outpaced that of Labour Day (May 1-5) shopping promotions. Transaction volumes on Alibaba's Taobao/Tmall hit 698.2 billion RMB during the 18-day shopping festival (June 1st- June 18th).

For Alibaba's cross-border e-commerce arm Tmall Global, sales saw a dramatic increase of 43% YoY. The Tmall Global direct import business saw GMV grow by 199%.

Major regions for imported products like Japan, South Korea, France and Italy, saw transactions grow by 30%. Alibaba's 618 sales growth were derived from customers from rural areas, which contributed 70% of new users in the first quarter of 2020.

JD.com/JD International

The second largest e-commerce company in China, which invented the 618 festival, saw GMV surpass 269.2 billion RMB during the holiday period, an increase of 33.6% YoY from that of 2019.

JD.com's cross-border e-commerce segment JD International witnessed a year-on-year growth rate of 110%. Luxury products saw a surge of 400% in the first 60 minutes on June 18th, JD.com reported. Over 1000 new brands saw transactions grow by 150% during these 18 days.

Demand from younger customers drove JD.com sales this year. Consumers born after 1990 doubled their spending from last year. Over 70% of its newly registered users in 4th quarter 2019 were also from tier 3 to 6 cities.

Pinduoduo

Pinduoduo saw an increase in order volumes of 119%, but released little information about its performance this year. The platform saw orders surpass 1.1 billion orders by midnight on the 19th, with GMV increasing over 300% year-on-year.

Livestreaming was Key to Sales

From June 1 to 17th, Taobao's live streaming arm Taobao Live's GMV skyrocketed by 250% YoY. More than 13 livestreaming sessions broke 100 million RMB in GMV. To win consumers, Tmall teamed up with Jiangsu Satellite TV to bring the “618 Super Night” show online on June 16th.

During the 618 promotion period, JD.com experienced live streaming sales growing 44x compared to last year; the figure was 12x that of Singles Day last year. This time, many brands’ CEOs and senior executives livestreamed to help sell goods.

Pinduoduo cooperated with Hunan Satellite TV to air the first "618 Super Surprise Night" Gala on June 17th to compete with its rivals.

Pinduoduo’s “Super Surprise Night” Show

Homegrown Chinese Brands Topped Sales Rankings

Over 110 stores on Taobao raked in transactions of over 100 million RMB; 60% of them were domestic brands. There were six brands that generated over 1 billion RMB in GMV, five of them were homegrown Chinese brands: Huawei (smartphones), Midea (white goods appliance), Xiaomi (smartphones) Haier (white goods appliance), Aux (white goods appliance).

In the cosmetics and beauty category, Huaxizi and Perfect Diary ranked 1st and 3rd place.

How This Year was Different

All platforms and merchants offered deep discounts and subsidies for customers, making this year’s festival more straightforward and simpler in terms of marketing and promotions.

Livestreaming was the main show this year: everyone from KOLs to celebrities, government officials, CEOs/founders/executives, and even news anchors endorsed products to help boost consumer spending.

The e-commerce giants focused on offering subsidies and coupons to users directly rather than offering raffles and games. Tmall offered subsidies of 14 billion RMB on more than 10 million SKUs. JD.com partnered with short-video platform Kuaishou to issue 10 billion RMB in subsidies. Pinduoduo also doled out 10 billion RMB in subsidies. Such subsidies and discounts help spur spending amongst more price-sensitive users.

Key Takeaways

1. Alibaba saw particularly strong results this year, driven by its advantages in livestreaming e-commerce.

2. Chinese homegrown brands are winning over the market. Foreign brands need to get creative to stand out amongst intense competition.

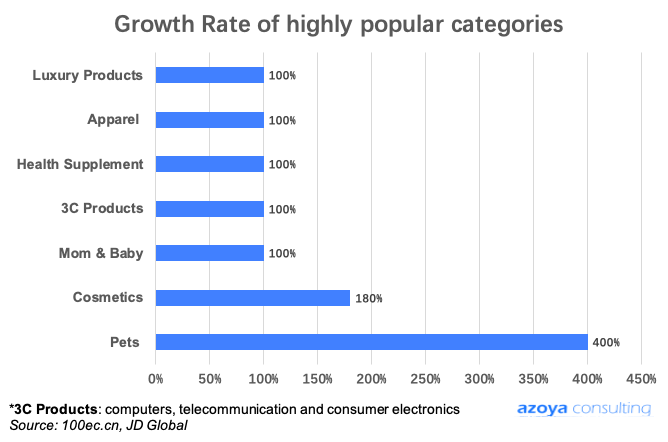

3. Cross-border e-commerce continued to gain popularity in the market. Hot categories included pet food, cosmetics, mom & baby, health products, luxury goods, etc.