‘Consumption Downgrade’: Trend or Pseudo-statement

With expanding of middle class size, the consumption upgrade is an ongoing and irresistible trend – while the ‘consumption downgrade’ reflects the reasonable need of certain groups of customers.

by Azoya

Chinese consumers are increasingly engaged in buying overseas imported products through online channels, and it has been widely interpreted as a sign of consumption upgrade happening in China. Amid discussion of the Chinese online consumers, the phenomenal popularity of Pin Duo Duo, a social e-commerce known for unbelievable low price and bargain, drives people to question the real purchase power of Chinese consumers.

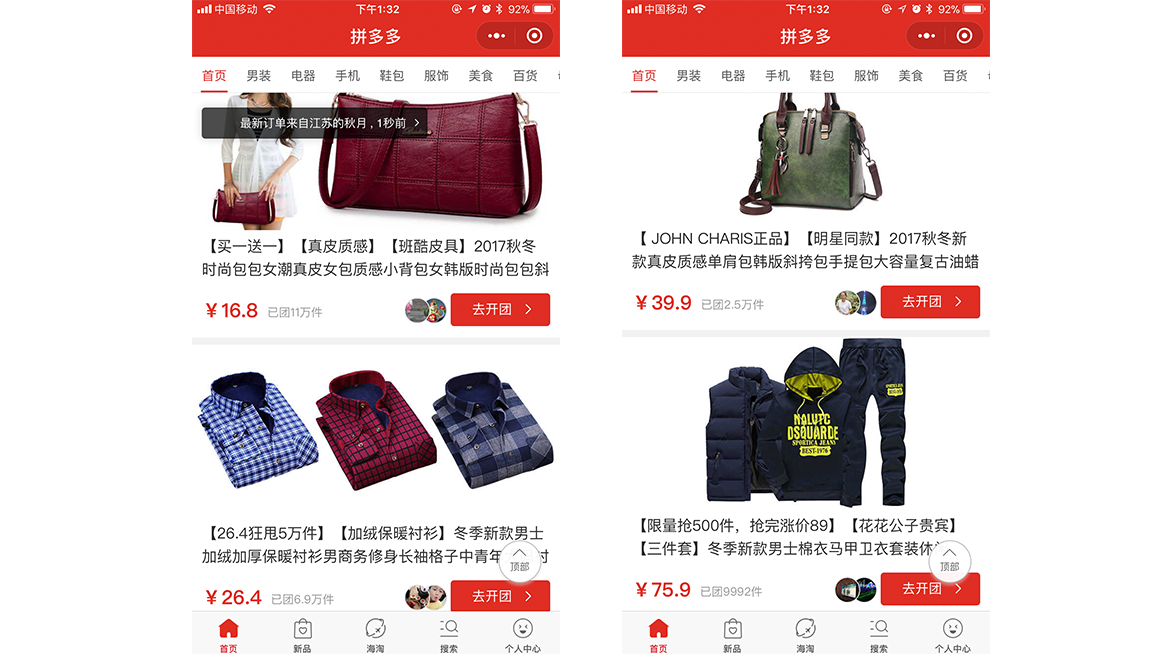

The ‘consumption downgrade’ argument, boasted by media from newspapers to WeChat official accounts, says that Chinese customers are less willing to pay for over-priced products. Pin Duo Duo (PDD), a mash-up of social and e-commerce, amassed over 200 million users within 2 years, was labeled as the leader of ‘consumption downgrade’. Most products sold in the PDD marketplaces are priced under 100 RMB (around 15 USD), and some even accept free shipping as low as 10 RMB (1.5 USD) for group purchase.

Group purchase of PPD is made easier through WeChat. Customers can share the link of the products and make group purchase with friends, and will receive a 10 – 20% discount from merchants. Social sharing function of PPD allows merchants to market products at lower costs. However, it also means to sacrifice margin in order to stand out from competition, which could result in a poor shopping experience. Customers of PPD are complaining in the comment zone about the poor quality of the products they receive.

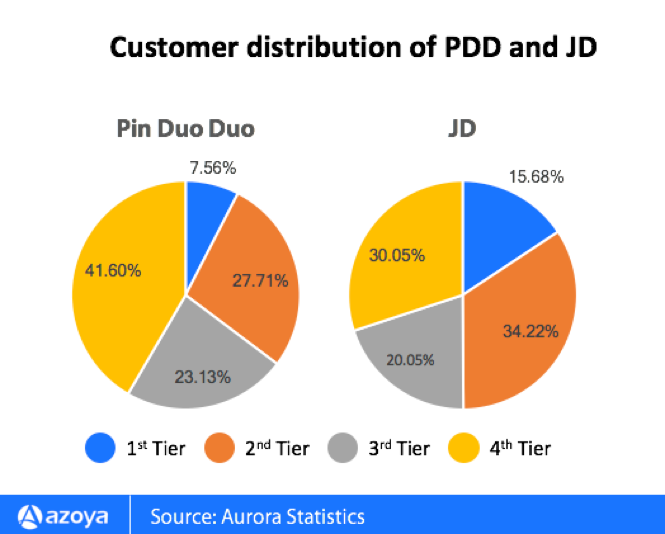

A peek into the customer structure of PDD may reveal where the customers come from. Figures from Aurora Stats shows that more than 60% of PDD customers are from 3-4 tier cities, while customers from first-tier cities only account to 7.56%. Aurora stats also show that 70% of users of PDD are female. As a comparison, JD’s first-tier city customer accounts to over 15% of total customer base. Customers from less affluent regions tend to use PDD more.

Surging transaction volume and the customer base of PPD could likely be explained by its pricing strategy and the social feature of the app. Low-priced products attract those that are looking for bargains, and are easily shared among friends that have similar demands – which results in viral reach for good bargain. PPD successfully targets the customer segments that are very sensitive to prices. Even if they encounter bad quality products or poor shipping experience, the customers won’t go through a lengthy process to complain to the platform, and it won’t hurt much to simply just cast away.

To shoppers that have successful shopping experience on PDD, the app might encourage them to shop more. To some extent, PDD represents the ‘consumption upgrade’ in some regions that don’t have much coverage of major online marketplaces or retail chains. On the other hand, when 1st tier and 2nd tier cities are cleansing the market of low-end manufacturers and suppliers, these merchants went deeper into the 3rd and 4th tier cities, where consumption recognition and average spending power are still at a low level. These customers demand variety and are not sensitive to quality, and the e-commerce channel meets their requirement.

We have recently discovered that JD’s WeChat store had developed a ‘Pin Gou’ section (which means group ordering in Chinese) that offer merchandise around 10 – 15 RMB. Pin Gou also supports finding group order partners within WeChat, which is likely to compete against Pin Duo Duo for customers in lower-tier cities.

‘Consumption downgrade’ in first-tier cities

While first-tier city shoppers are less likely to become long-term shoppers of PDD, they are also seeking to buy products at a lower cost – which is referred to as another facet of the ‘consumption downgrade’.

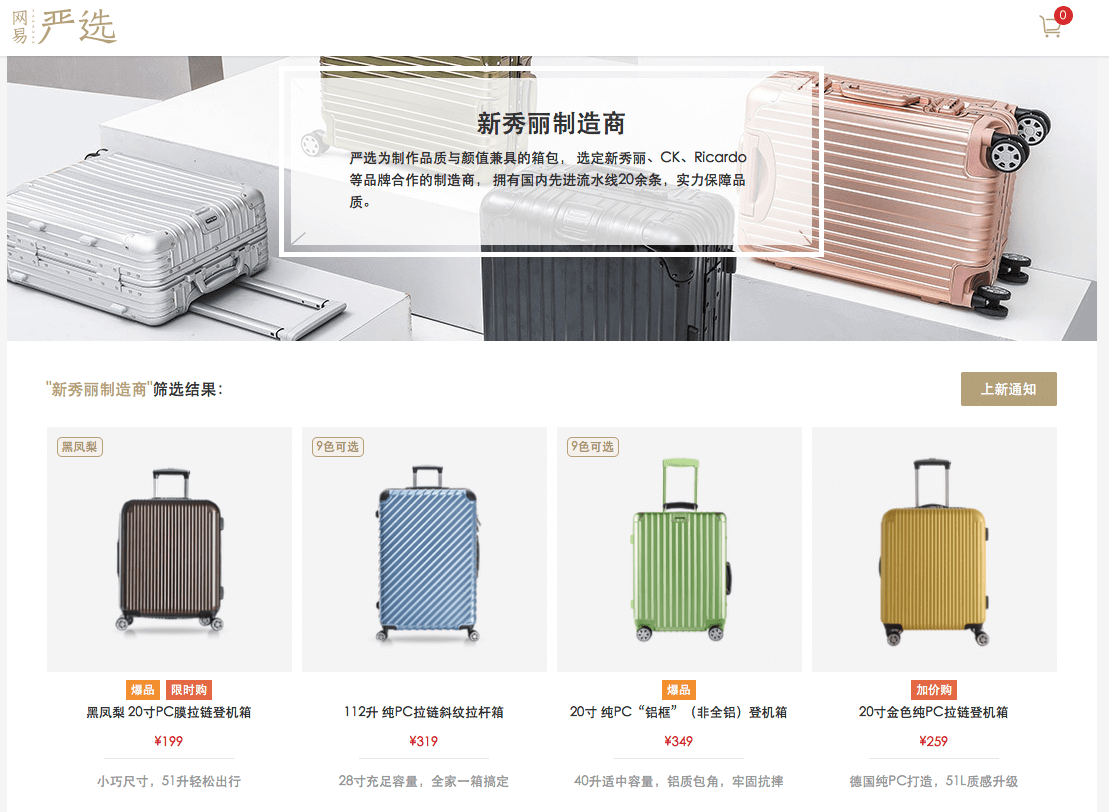

In recent years, a new form of e-commerce has emerged in the China market that features Muji-like quality and lifestyle but at a manufacture price. Such form is led by NetEase’s Yan Xuan and Xiaomi’s You Pin, who reportedly estimated their 2017 sales over 7 billion RMB and 3 billion respectively. Offline retailer Miniso is also expanding fast in the China market to offer high-quality products around 10 to 50 RMB.

Instead of buying a Samsonite suitcase at 800 RMB, Chinese white collars can purchase a 199 RMB substitute that are claimed to be manufactured by Samsonite’s Chinese factories from Yan Xuan. While Xiaomi’s You Pin claims that they leverage local ODM supply chain to develop their private label suitcase that has better shock-resistance than many foreign brands.

To respond to the fast expansion of these retailers, Muji China announced a new round of price cut in 2018 – some products will have permanent price cut of over 50%.

The rise of Yan Xuan and You Pin is a sign that some Chinese consumers are not willing to pay for overly priced products, and they are more likely to buy substitute of such products that have similar quality and are priced lower. In fact, Chinese city residents are not as affluent as they look – due to expensive housing, mortgages and urban living costs, first-tier city residents could have less spending power than lower-tier city residents.

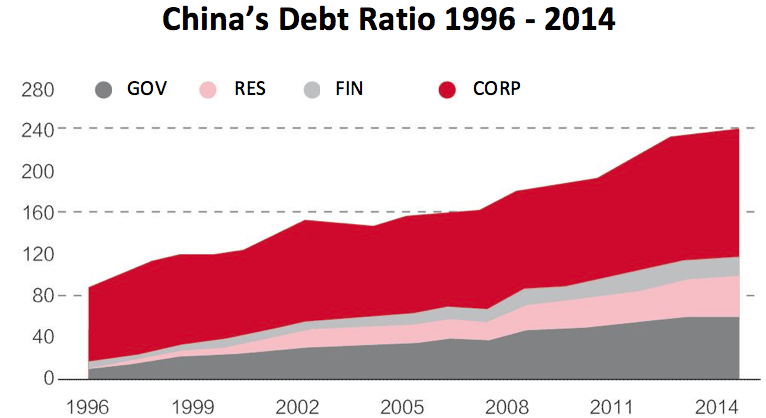

Source: Wind Info

Chinese residential debt ratio (debt/disposable income) exceeds 100% in 2016, which is close to U.S. household debt ratio in the 90s, according to Wind Info. Economist Wu Ge estimate the figure will continue to rise but at a steady pace, which will not be harmful to domestic consumption. Some of Chinese city dwellers will be more rational in terms of purchasing premium products, and are more willing to shop during discount, or search for domestic substitute. Imported products, or 'Haitao' products at the moment still fill up a big gap in the domestic retail markets.

Demand is more diversified

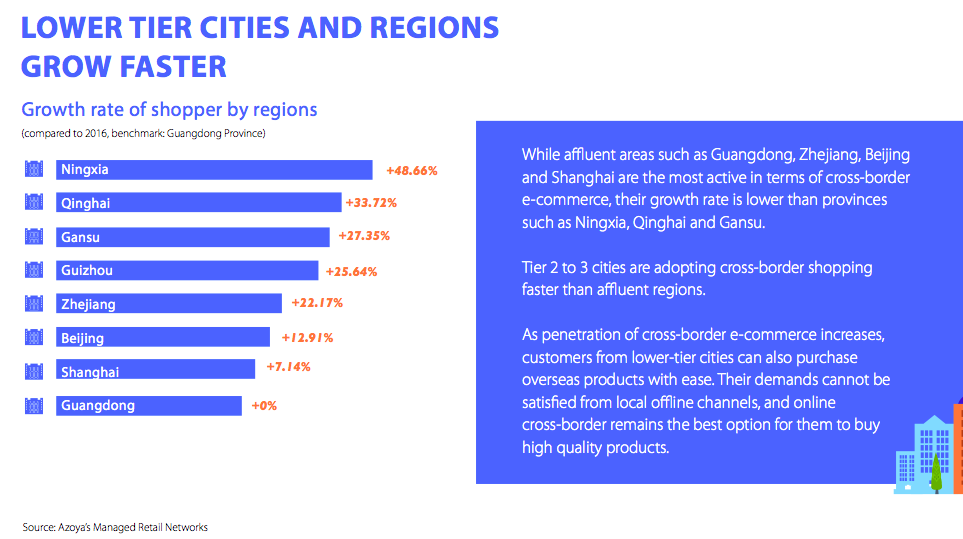

In an earlier white paper published this year, Azoya’s research team have discovered that cross-border shopping activity is catching on faster in lower tier cities than in first tier cities. Azoya has monitored growth rate of customer number of retail partners to be 30% higher in provinces such as Ningxia and Qinghai compared to Guangdong.

While total retail sales growth in China is below 5%, e-commerce channels, and cross-border in particular, had recorded over 40% CAGR growth in the last three years. With expanding of middle class size, the consumption upgrade is an ongoing and irresistible trend – while the ‘consumption downgrade’ reflects the reasonable need of certain groups of customers. The market is diversifying into multiple segments, and it is important that retailers should make careful plan of strategy, as well as a clear positioning before investing in expansion.