Could Vegan Meat be the Next Big Thing in China?

The emergence of new vegan meat products that look and taste like real meat has drawn attention and capital from top investors. Omnipork‘s successful launch on Tmall Global means that the industry could be set for take-off.

by Ker Zheng

For this year's Black Friday promotions, Hong Kong-based GreenCommon began selling its new plant-based meat product Omnipork on Tmall Global, Alibaba's cross-border import platform.

The pink vegan meat is minced and designed to mimic pork used in ramen and dumplings.

And within just two days, it sold over a ton of products, highlighting Chinese demand for healthier alternatives to meat.

The promotion offered 230g of Omnipork for 28 RMB (US$4), more expensive than typical pork but within the reach of everyday consumers.

We take a look at the case for vegan meat in China, Omnipork's quest to be the market leader, and how it and other local players match up against US brands Impossible Foods and Beyond Meat.

An Omnipork patty. Source: Official Tmall Global website

The Case for Vegan Meat in China

Omnipork's launch in the China market comes at a sensitive time.

The African Swine Flu virus has forced China to slaughter millions of hogs to curb its spread, and pork prices across the board have doubled since last year.

Not to mention that China needs imported corn feed and soybeans to feed its population of half a billion pigs; because of this, China is highly dependent on US agricultural imports.

The US-China trade war and US tariffs on agricultural trade have highlighted this dependency and the country's broader food security issues.

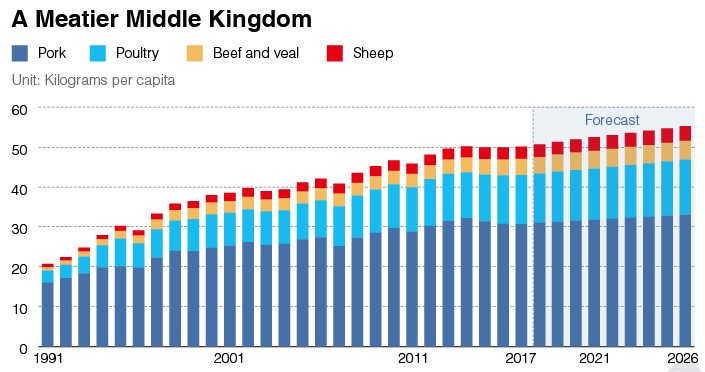

As a nation with over 1.4 billion people, China consumes 27% of the world's meat consumption; it is difficult to produce enough quality meat to feed such a large population.

The domestic market is wrought with food quality issues, with many cases of middlemen cutting corners and substituting ingredients for cheaper ones to raise profit margins.

In September 2011, Walmart was found to have sold over 30 tons of fake organic pork. In March 2011, pork producer Shuanghui was found to have slaughtered hogs containing clenbuterol and ractopamine - illegal feed additives designed to improve feed efficiency and increase the muscle-fat ratio.

These issues were partly why Shuanghui, China's largest hog producer, purchased US-based Smithfield Foods for US$7.1 billion in 2013. Smithfield's access to low-priced pig feed, efficient supply chain operations, and quality control processes provided a guide for China to modernize its pork industry.

With issues like these plaguing China's meat industry, the environment may be ripe for vegan meat to take off.

Vegan substitutes aren't susceptible to food safety issues common in the meat supply chain, such as animal viruses or hormone residues, and China's millennial population is looking for healthier alternatives to improve their lifestyles.

Why Now?

While vegan meat has existed for years, only in recent years have consumer-facing brands such as Impossible Foods and Beyond Meat began to make it look and taste like real meat.

These new players use genetic engineering to create yeast-derived soy heme - this is what makes their products look and taste like real meat - even making burger patties that bleed red liquid.

It is this new development that has enabled them to raise massive amounts of venture capital funding.

Impossible Foods raised US$300 million in series E funding in May 2019, valuing the company at $2 billion. Its investor base includes Singaporean sovereign wealth fund Temasek and Horizons Ventures, the private investment office of Hong Kong tycoon Li Ka-Shing. This indicates the company's broader ambitions for the Asia-Pacific region and the China market.

Beyond Meat went public in May and is now valued at US$4.7 billion. These newer brands are using new technology to manipulate the structure of the plant-based proteins to simulate the appearance and taste of real meat.

In China, Impossible Foods is awaiting approval of its burger products and Beyond Meat is looking to set up local production by the end of 2020.

An Impossible Foods burger patty. Source: Shutterstock

Both consider China to be the next big opportunity because rising middle-class consumers are making more money and willing to spend that money on healthier lifestyles.

In recent years, detox, juice cleansing, and health food companies have taken off amongst Chinese millennials, who are working longer hours at the office and more conscious of potential health issues than before.

80% of consumers who had eaten plant-based meat in 2019 were born after 1990, according to the China Plant Based Foods Alliance.

Spending on health & wellness in China is estimated to hit US$70 billion by 2020, and the plant-based meat market is expected to be worth US$11.9 billion by 2023.

Behind Omnipork's Quest to be the Market Leader

Omnipork's entry in the China market made a splash because it became the first imported plant-based meat brand to sell through cross-border e-commerce.

Selling through cross-border e-commerce is designed to test the market and avoid lengthy, multi-year long registration processes with the China Food & Drug Administration.

The launch was also designed to highlight Tmall Global's new cold chain logistics services. The pork is stored in bonded warehouses in Ningbo and delivered using special temperature-controlled containers; a delivery from Ningbo to Beijing can be completed in just 1-2 days.

Omnipork is also notable for its uniquely Asian attributes. While better funded American players such as Impossible Foods and Beyond Meat focus on beef burger patties, in China, pork is the preferred choice of meat.

In fact, the pork-to-beef ratio in China is 7:1, partly because there isn't enough arable land to breed cows, and partly because pork is more versatile and can be cooked using many different methods.

Per-capita meat consumption in China. Source: Caixin Data

Omnipork believes that it can beat out foreign competitors by adapting their products to Asian palates and preferences.

Designed by Asian scientists in Vancouver and manufactured in Thailand, Omnipork is made of soy, pea protein, shitake mushrooms, and rice. It contains zero cholesterol and higher traces of calcium and iron, but with less protein.

Omnipork currently sells through over 1,000 distribution points across Hong Kong, Macau, Singapore, Taiwan, and Thailand, with its customer base being primarily restaurant chains. It plans to expand this presence to 10,000 outlets and 15 countries by 2020.

In mainland China, Omnipork has already been selling bulk orders to Western chain Wagas, Taco Bell, Hong Kong eatery chain Tsui Wah, and top hotels such as the Grand Hyatt in Beijing and the Park Hyatt in Shanghai. The company plans to expand this presence to over 180 restaurants in Beijing and Shanghai by the end of 2019.

Other Vegan Meat Players and the Road Ahead

Other players in China's vegan meat market include Whole Perfect Foods, which traditionally sold soy-based imitation chicken, fish, and shrimp to China's Buddhist population. It generated 2018 revenues of 300 million RMB (US$42.88 million).

Another player includes Starfield, which collaborates with leading research universities to produce new products. Its five production lines can produce a monthly output of 1,500 tons of meat. It made a splash during this year's Mid-Autumn Festival when it used pea-based meat in special mooncakes.

But these local players have yet to produce a product that can simulate real meat as well as Impossible Foods and Beyond Meat.

These companies use genetic engineering to alter the structure of the plant-based proteins in their meat products.

However, the industry is still in its early stages. Foreign players have yet to enter the market in full and local players do have the advantage of better understanding their end customers. They can better adapt their products to local tastes.

Key Takeaways

1. China's African Swine Flu crisis and US agricultural tariffs have highlighted China's food security issues and challenges in feeding such a large population

2. New plant-based meat brands Impossible Foods and Beyond Meat are creating new products that look and taste like real beef patties; they are also making big plans for entering the China market.

3. Omnipork, a Hong Kong brand, was the first foreign brand to sell directly to Chinese consumers through cross-border e-commerce. It is designed specifically for Asian customers and shipped using special Cainiao cold chain logistics. Other local players in China exist but have yet to produce any products on the level of their American competitors.