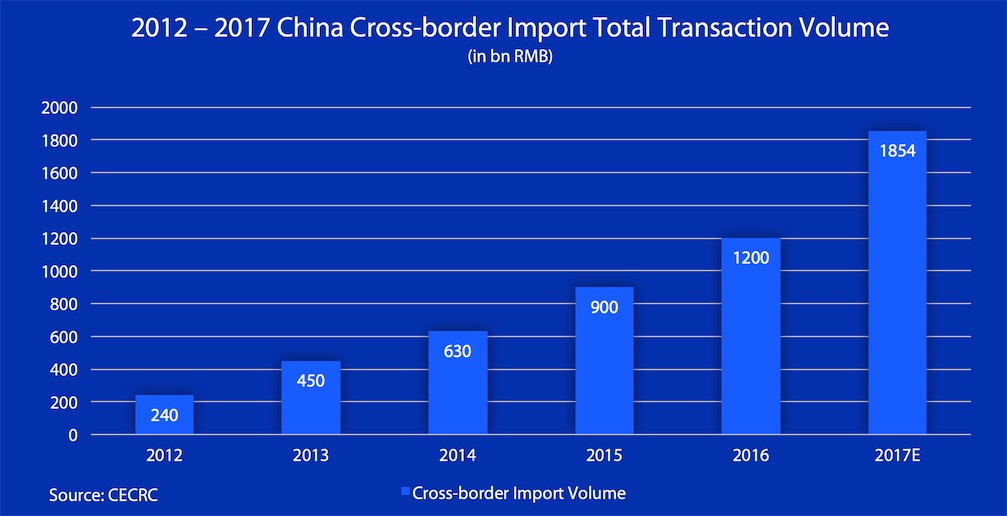

CRCEC: Cross-border E-commerce Import Volume Estimates at 1.8 Trillion RMB

Latest report on China cross-border e-commerce by CECRC estimates over 50% of increase in 2017.

by AzoyaLab

China E-commerce Research Center (CECRC) recently published a report on the China cross-border e-commerce import, and released core data about transaction volume, shopper volume, and user profiles extracted from data made public by governments, research facilities, listed companies and major e-commerce platforms.

Key takeaways:

In 2016, China cross-border e-commerce sees explosive growth. In the future, it will continue steady growth.

Cross-border e-commerce is favored by the capital industry. Average single investment in 2016 for cross-border e-commerce participants was around 33 million USD.

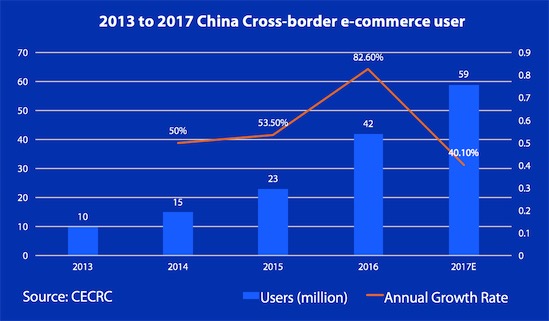

Cross-border e-commerce shoppers are increasing, but the rate is getting slower. In 2016, a total of 42 million shoppers participated in cross-border online shopping, with 82.6% of growth compared to 2015. In 2017, the figure is estimated to increase by 40% to reach 59 million.

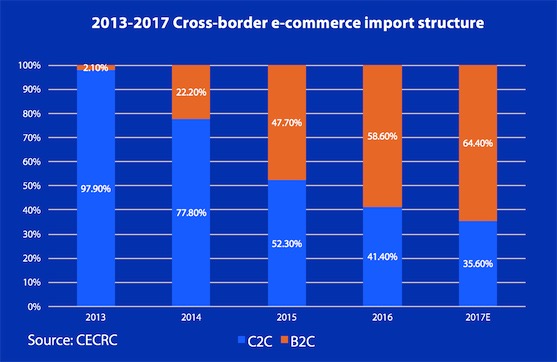

Cross-border B2C import becomes mainstream. B2C vendors takes 58.6% of market share, overtaking C2C (personal vendors) as major cross-border e-commerce participants.

3 main cross-border logistics routes are: direct shipping from overseas warehouse, shipping via transit service providers, cross-border bonded import.

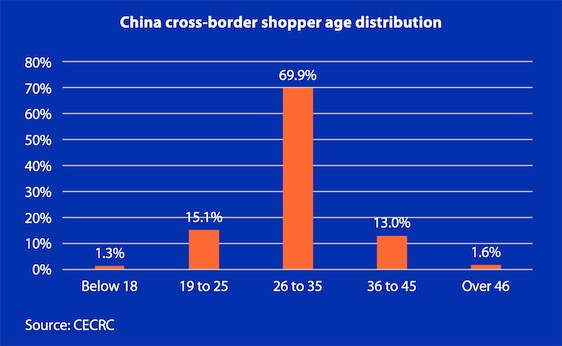

The majority of cross-border shoppers are aged between 26 to 35. These young shoppers are featured with high education, stable jobs and good income.

Most popular categories of cross-border online shopping are beauty and personal care and mom & baby products. Shoes, apparels, food, accessories, bag and luggage are also popular categories.

The policy makers are positive towards cross-border e-commerce, and allow the sector to develop with fewer restraint.

Core Data:

China cross-border e-commerce user growth

As consumption upgrade continues, more Chinese consumers will buy products from overseas. They are benefited from increasing venues to purchase products originated from overseas.

Cross-border shopper age distribution

Most of the cross-border e-commerce buyers are aged between 26 and 35.

Cross-border e-commerce import structure

B2C is now becoming mainstream in cross-border shopping. Cracking down of personal shopping agents (Daigou), concern over authenticity and better shopping experience offered by B2C channels are making C2C transaction less popular.

Cross-border shopper geographical distribution

Majority of shoppers are based in Tier 1 cities. Affluent regions (Eastern and coastal provices) saw higher transaction volume than the less affluent regions (Western provices).