Cross-Border E-Commerce Cashes in on Singles Day While Tmall Growth Decelerates

Cross-border e-commerce players reaped gains on this year's Singles Day. Azoya Consulting looks at how things have changed.

by Azoya Consulting

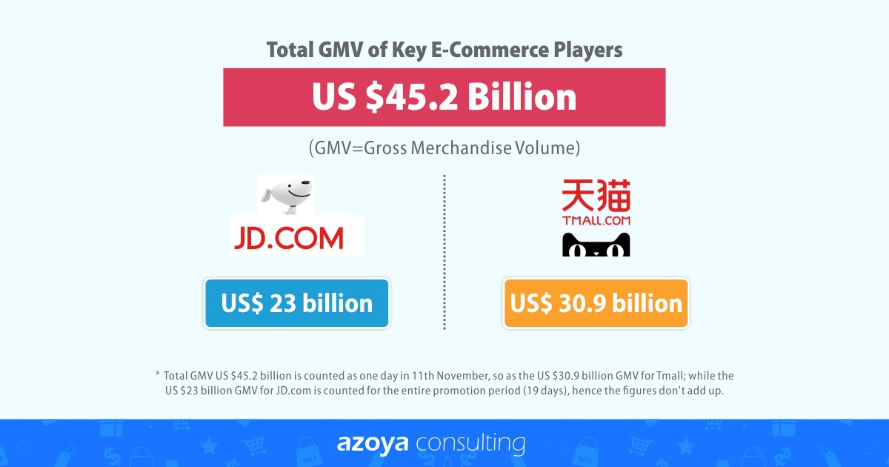

The final results for Singles Day are in and media outlets everywhere are buzzing about China’s biggest sales holiday of the year. Singles Day transactions on Tmall jumped 27% to reach $30.8 billion this year, while rival JD.com generated $23 billion over a 19-day time frame. Including minor players such as VIP.com, Amazon China, and others, it is estimated that $45.2 billion was generated on Singles Day alone, according to Syntun data.

Source: Syntun

But some argue that Singles Day growth is slowing, and that competition on marketplaces is fiercer than ever, making it difficult for smaller players to compete. After all, consumers can only shop so much in a single day and it is getting more and more difficult to grab their attention.

But data is showing that cross-border e-commerce is becoming a bigger portion of general e-commerce sales as Chinese consumers continue to place a premium on quality. We dig deeper into what’s happening and how this year’s Singles Day reflects positive developments in the cross-border e-commerce segment.

Singles Day Growth Slows in China While Tmall Becomes More Crowded

Singles Day growth is slowing[1], as this year’s transactions grew at a slower pace than last year’s rate of 40%. Tmall transaction growth peaked in 2014, when it grew 65% year-over-year.

There is only so much time in a single day for consumers to shop, though this year’s Singles Day was aided by the fact that it took place on a Sunday. Because of the number of players involved, it is getting more difficult for brands to grab consumers’ attention. Tmall alone had over 180,000 Chinese and foreign brands participate in Singles Day promotions.

Including the likes of Apple, Xiaomi, and Midea, eight brands raked in over one billion RMB in transactions, and 237 brands passed the 100 million RMB mark. But it’s tough to say how smaller players fared. Many smaller merchants have spoken out against the focus on Singles Day, claiming that the traffic acquisition and advertising costs are too high to generate any significant profits[2].

Alibaba recognizes that e-commerce can only grow for so long, so this year it emphasized Singles Day promotions from offline retail partners such as supermarket chain RT-Mart and on-demand services subsidiaries Ele.me and Koubei. Alibaba also expanded Singles Day promotions to its cross-border businesses: Lazada, Aliexpress, and Tmall Global.

Cross-Border E-Commerce Becomes a Key Highlight of Singles Day as Chinese Consumers Seek Out Quality Products

Cross-border e-commerce is one area that is growing rapidly, as indicated by the 19,000 brands who participated in Singles Day on Tmall Global. Over 40% of consumers on Tmall purchased from international brands on the big day[3].

Cross-border e-commerce businesses sell quality imported goods that can’t be found in China or are difficult to import through general trade. Consumers purchase directly from overseas retailers because of quality & authenticity issues within China.

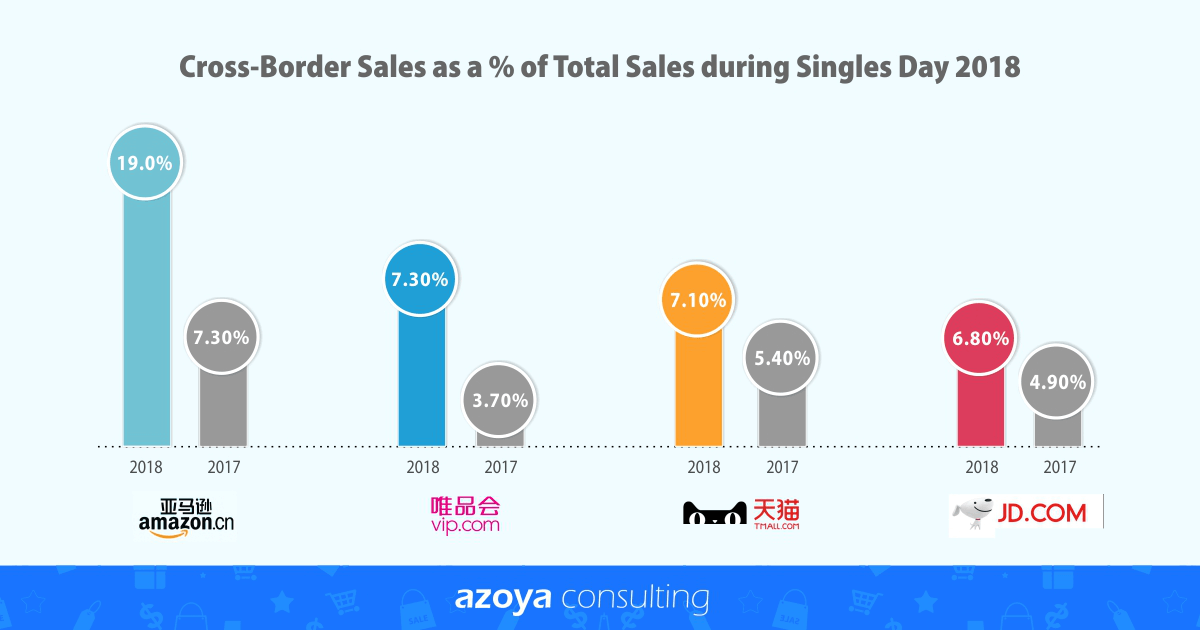

7.1% of Tmall’s sales for this year’s Singles Day came from cross-border e-commerce; for JD.com, this figure was 6.8%[4]. Last year, these figures were 5.4% and 4.9%, respectively[5], indicating that cross-border e-commerce is becoming more and more important.

Source: Syntun

Main cross-border e-commerce categories include cosmetics, health supplements, and mom & baby products such as milk powder and organic body lotion. The same data from Syntun shows that 13.7% of beauty & personal care items sold on Singles Day were cross-border goods. This figure was 12.1% for the mom & baby category and 6.6% for the food & beverage category.

On Tmall Global, cross-border sellers who surpassed 100 million RMB in sales included Swisse, Moony, Chemist Warehouse, and Aptamil. 14 brands surpassed 50 million RMB in sales, and 123 brands surpassed 10 million RMB in sales[6].

We list top-selling products for Tmall Global and Netease Kaola below.

Trends To Watch Out For in China Cross-Border E-Commerce

US supplements brand Nature’s Bounty and Australian probiotics brand Life Space were two of the top three emerging brands on Netease Kaola’s platform for health & nutrition. Both Nature’s Bounty and Life Space are owned by By-Health, China’s largest health supplements & vitamins maker. By-Health was Tmall Global’s second largest health & nutrition seller on Singles Day this year, next to Swisse, which is owned by Hong Kong-based H&H Group.

Both By-Health and H&H Group have been purchasing foreign brands and leveraging their own extensive distribution networks to expand their reach in China. H&H Group purchased Swisse in 2015 and grew it to become the number one top seller within the health & nutrition category on Tmall Global. H&H Group also owns milk powder brand Biostime, US childrens food brand Healthy Times, and French baby care brand Dodie.

By-Health purchased Australian probiotics company Life Space for $700 million and children’s nutrition brand Penta-Vite for AU$21 million this year[7][8]. Probiotics and children’s nutrition were both hot categories within the health & nutrition space this year.

One new cosmetics brand that stood out in particular was Huda Beauty - an American cosmetics brand that rose to fame on the back of founder Huda Kattan’s makeup tutorial videos. A former make-up artist, Huda Kattan now has over two million subscribers on YouTube and 28 million followers on Instagram[9].

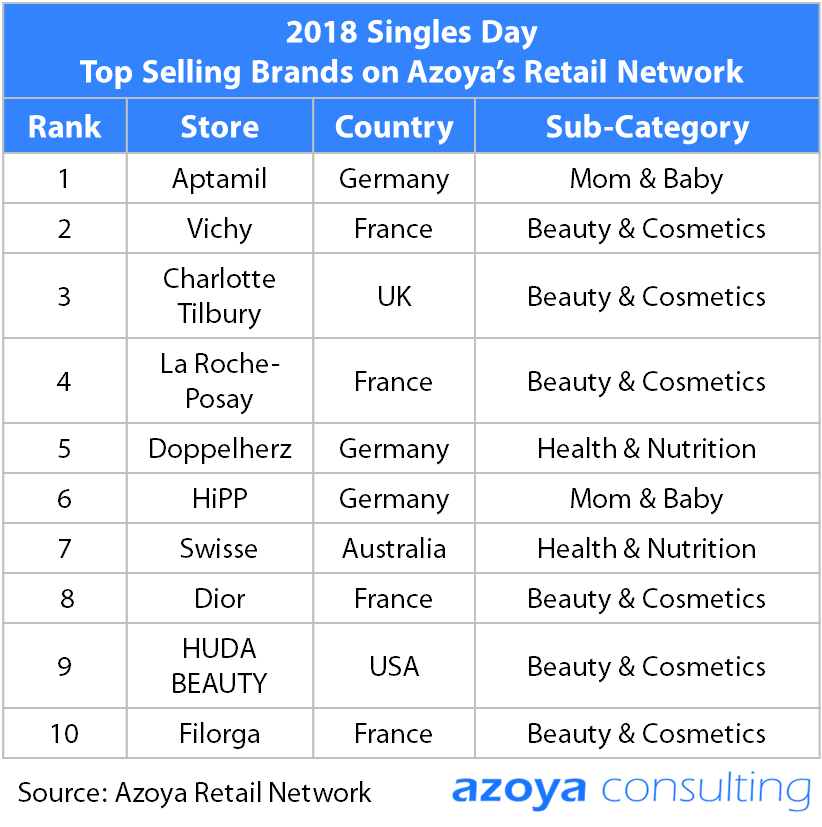

This year Huda Beauty has soared in popularity this year in China, coming from near obscurity to become the ninth top-selling brand on Azoya’s retail network, ranking alongside the likes of Dior and Filorga.

The brand’s New Nude Palette eyeshadow has been particularly popular, selling out on multiple platforms in China. Its eighteen highly pigmented shades provide female customers with a comprehensive set of choices.

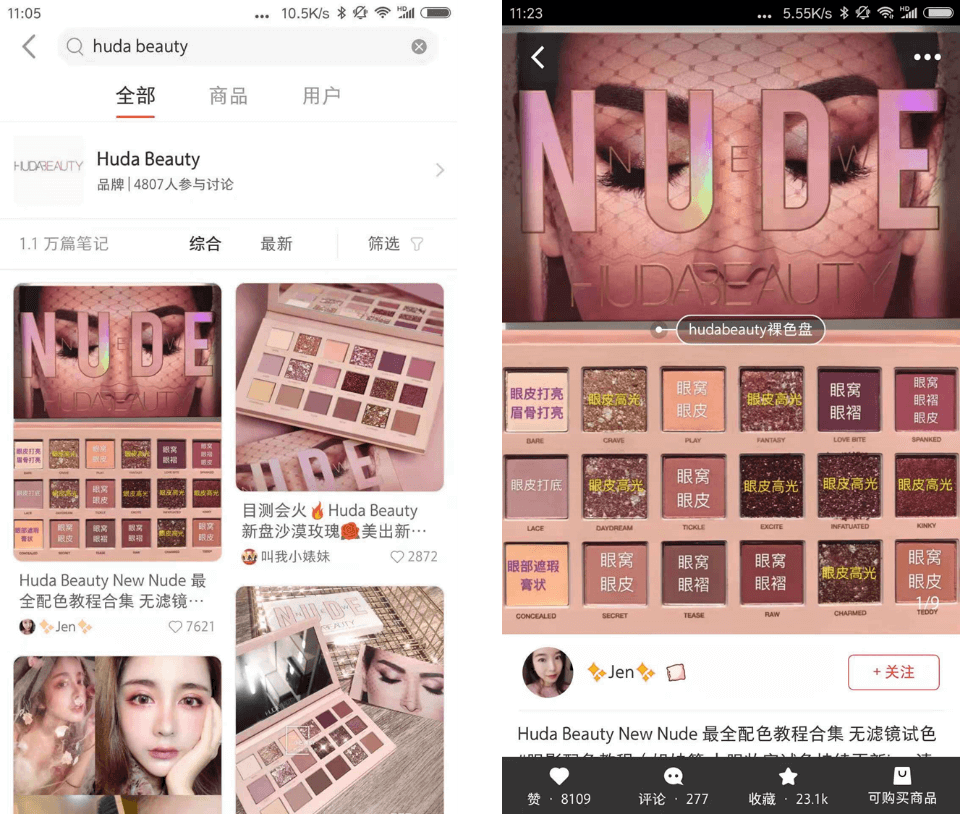

Huda Beauty has been written about over ten thousand times on social commerce platform Little Red Book, demonstrating just how popular the brand has become.

Huda Beauty on Little Red Book

While in the past, Chinese women stuck to basic cosmetics items such as lipstick and BB cream, recently they have begun adding steps to their makeup routines. HUDA BEAUTY’s eye shadow palette has been a beneficiary of this trend.

Retailers and brands should expect the cosmetics industry to evolve in this manner over time. Combining the use of KOLs and makeup tutorial videos is a good way to help educate new customers.

Key Takeaways

1. Growth is slowing on Tmall, but cross-border e-commerce is set to be one of the key growth areas. Smaller brands and retailers looking for higher profit margins might be able to negotiate better terms on smaller platforms. They can also consider setting up their own e-commerce sites or launch low-cost stores on WeChat mini-programs.

2. Cross-border e-commerce continues to grow in importance. This year, over 40% of customers purchased international brands. For Tmall Global and JD Worldwide, 7.1% and 6.8% of transactions were derived from cross-border sales. Of personal care & cosmetics items, 13.7% of items sold were from cross-border transactions. This figure was 12.1% for the mom & baby category.

3. Chinese health & nutrition brands are purchasing foreign supplements brands and using their extensive local networks to help them expand. Health & Happiness International purchased Swisse in 2015, and By-Health has done particularly well in growing the Life Space (Australian probiotics) and Nature’s Bounty (US supplements) brands in China.

4. The Chinese cosmetics industry is evolving, as Chinese consumers are upgrading their makeup and cosmetics routines. HUDA BEAUTY eye shadow palette’s strong performance on Singles Day this year is one example. Brands and retailers that expand their content and KOL marketing with makeup video tutorials may have a better time connecting with customers.

[1] “Alibaba sets new Singles’ Day record with $31B in sales, but growth is slowing.” 12 Nov 2018. TechCrunch. 15 Nov 2018 <https://techcrunch.com/2018/11/11/alibaba-singles-day-2018-31b/>

[2] “小商家眼中的双11:无处安放的焦虑.” 15 Nov 2018. 100ec. 15 Nov 2018 <http://www.100ec.cn/detail--6481344.html

[3] “New 11.11 GMV Record as Alibaba Ecosystem Goes All-In.” 11 Nov 2018. Alizila. 15 Nov 2018 <https://www.alizila.com/new-11-11-gmv-record-alibaba-ecosystem-all-in/>

[4] “星图数据: <2018双十一全网网购大数据分析报告> (PPT).” 15 Nov 2018. Syntun. 15 Nov 2018 <http://www.100ec.cn/detail--6481225.html>

[5] “双11直邮商品被清退 天猫国际商家遇到了啥.” 11 Nov 2017. Ebrun. 31 Oct 2018 <http://www.ebrun.com/20171111/254564.shtml>

[6] “天猫国际双11最全成绩单.” 12 Nov 2018. Ebrun. 16 Nov 2018 <http://www.ebrun.com/20181112/307356.shtml?eb=hp_home_lcol_kj6>

[7] “China’s By-Health makes $700m local vitamins play.” 31 Jan 2018. The Australian Financial Review. 16 Nov 2018 <https://www.afr.com/street-talk/chinas-byhealth-to-acquire-lifespace-sources-20180130-h0qy0i>

[8] “BY-HEALTH acquires Penta-vite, an Australian brand with 70-year history.” 31 May 2018. By-Health Official Website. 16 Nov 2018 <http://www.by-health.com/en/newsitem/15277>

[9] “How to build a huge social media following – from an Instagram star who built a billion-dollar brand.” 8 Nov 2018. CNBC. 15 Nov 2018 <https://www.cnbc.com/2018/11/08/instagram-star-huda-kattan-how-to-grow-a-huge-social-media-following.html>