Hong Kong Protests: Bad for Offline Retail, Good for E-Commerce?

Hong Kong's protests have paralyzed the city and deterred mainland Chinese tourists from visiting. We discuss how e-commerce can help retailers bounce back

by Ker Zheng

The protests in Hong Kong have been ongoing for over two months now, and retailers are worried.

Luxury retailers Chow Sang Sang and Chow Tai Fook have seen their stock prices fall 17% and 20% since mid-July. Cosmetics retailer Sasa International has also seen its stock price fall 21% over the same time frame.

We draw parallels with the SARS crisis in 2002-03 and explain how leading players are using e-commerce to reach Chinese customers.

Lessons from the 2002-03 SARS Crisis

The last time we saw a significant drop in Hong Kong tourist traffic was during the SARS crisis, which claimed 299 lives in Hong Kong and 349 lives in mainland China.

People stayed away from stores and restaurants, and travelers canceled their trips to the city. Retail sales fell by half and Hong Kong-based airline Cathay Pacific canceled two-fifths of its flights.

The difference today is that Chinese tourists now contribute much more to the retail and tourism sectors than they did 16 years ago.

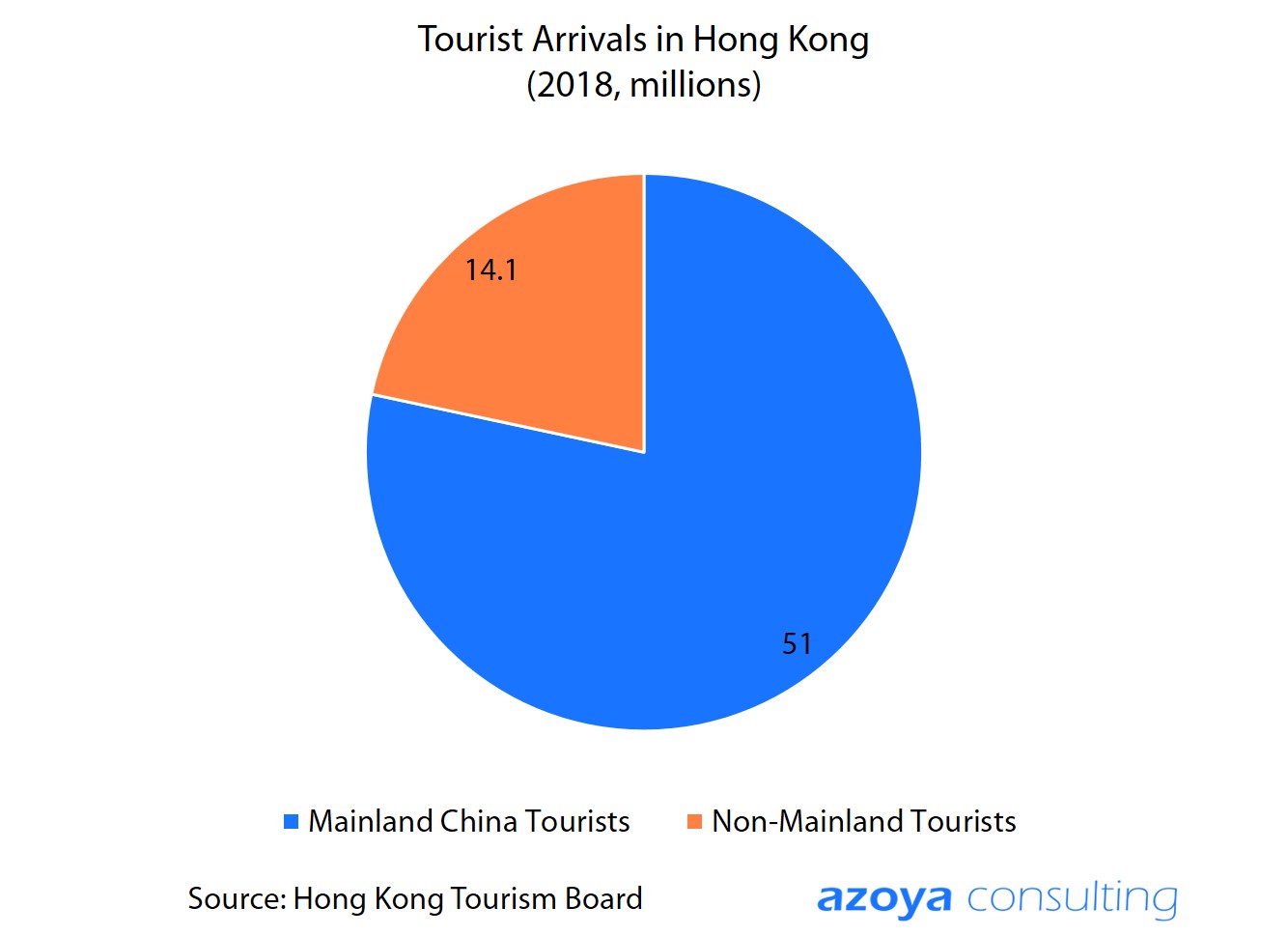

More than 65 million tourists from mainland China visited Hong Kong last year, accounting for 78% of total visitors. By deterring Chinese tourists from shopping in Hong Kong, the recent protests will continue to impact retail sales in the immediate future.

But in times of crisis, there are always opportunities.

In fact, two major Chinese companies got their lucky breaks during the SARS crisis in 2002-03: logistics provider SF Express and JD.com, which was previously known as 360buy.

SF Express was formed in the 1990s and focused on the transport of parcels between Hong Kong and Guangdong province.

In 2003, SARS caused the cost of airline freight to drop significantly, and SF Express took the opportunity to charter five planes for air delivery, giving it a reputation for reliable service.

This helped the company grow its market share and today, SF Express is the largest express delivery service provider in China, with a market capitalization of ~US$24 billion.

JD.com, which was founded in 1998 as a small electronics shop in Beijing's Zhongguancun district, also took advantage of opportunities in the SARS crisis.

When customers stopped going to his stores, founder Richard Liu started shipping electronics, CDs, and DVDs to Beijing customers by courier.

E-commerce boomed that year, and thereafter JD's founder Richard Liu doubled down on online retail. Today, JD.com is the largest online retailer in China, with a market capitalization of US$45 billion.

Cross-Border E-Commerce could help Hong Kong Retail Bounce Back

E-commerce has never been a strong driver of sales in Hong Kong retail.

The physical layout of the city - tightly packed with shops and restaurants on every corner, ensures that most commodities are always within a few minutes walk.

This reason and the relative absence of mobile payments means that e-commerce was never able to really take off in Hong Kong.

A report by Nielsen shows that e-commerce revenues in Hong Kong will reach just US$6.4 million in 2023, a paltry sum compared to the US$62.2 billion in total retail sales that the city generated in 2018.

But the recent protests will force Hong Kong retailers and brands to improvise as Chinese tourists stop coming to the city.

Some retailers have already begun expanding to China through cross-border e-commerce, either through Tmall, WeChat mini-programs or their own cross-border e-commerce websites. The protests only place more pressure on them to double their online retail efforts.

Cross-border e-commerce is one option. It is a separate trade channel that enables retailers to sell and ship products directly to Chinese consumers without having to register a China entity or set up a China-based team.

It provides an asset-light, low-risk way for retailers outside of China to access the market. And since Hong Kong is just across the border, the shipping times are relatively fast when compared to items shipped from Europe or the US.

Below we take a look at how Hong Kong retailers such as Sasa International, Lane Crawford, and I.T are using e-commerce to reach Chinese customers.

Lane Crawford

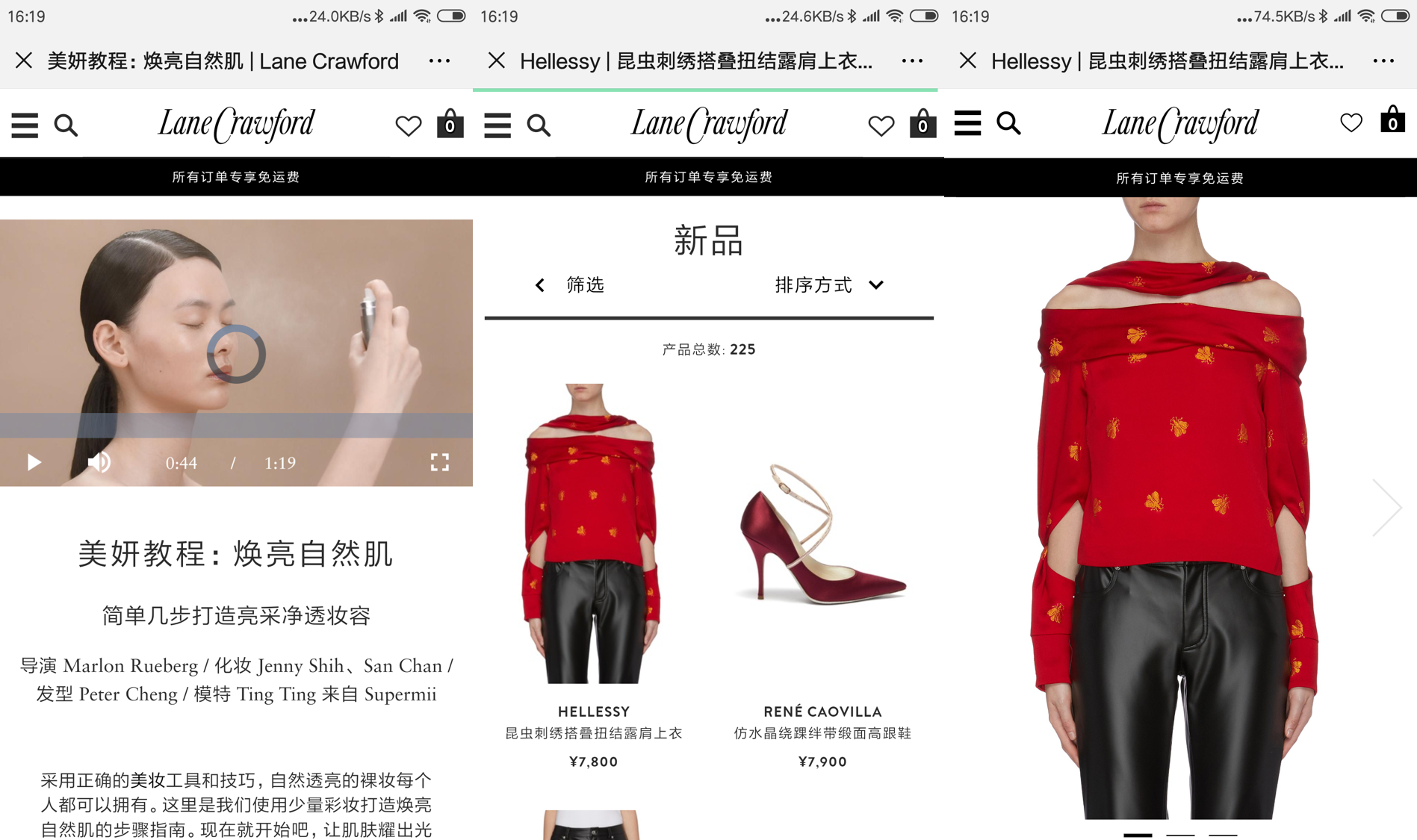

Above, a video on Lane Crawford's website highlights a multi-step makeup process that is designed to help sell its beauty and cosmetics products.

Lane Crawford, an iconic department store chain that has over 100 years of history, has an elaborately designed cross-border e-commerce website that is customized for mainland Chinese customers.

Cross-border e-commerce makes sense for department stores and retailers with lots of SKUs because importing all of those products one-by-one through general trade would require a tremendous amount of time and effort. The site also offers free shipping to China and Chinese mobile payment methods such as WeChat and Alipay.

The design is highly sophisticated, matching Lane Crawford's upscale product selection. Lane Crawford sells over 1,000 labels, many of them from the UK. There are pages entirely dedicated to new fashion trends.

The official website even displays videos that demonstrate multi-step makeup application procedures.

Lane Crawford's reputation is so strong that it is widely seen as a stepping stone for international brands to reach Chinese customers before building out a China presence. Right now, Lane Crawford also runs offline retail stores in Beijing, Shanghai, and Chengdu.

Sasa International

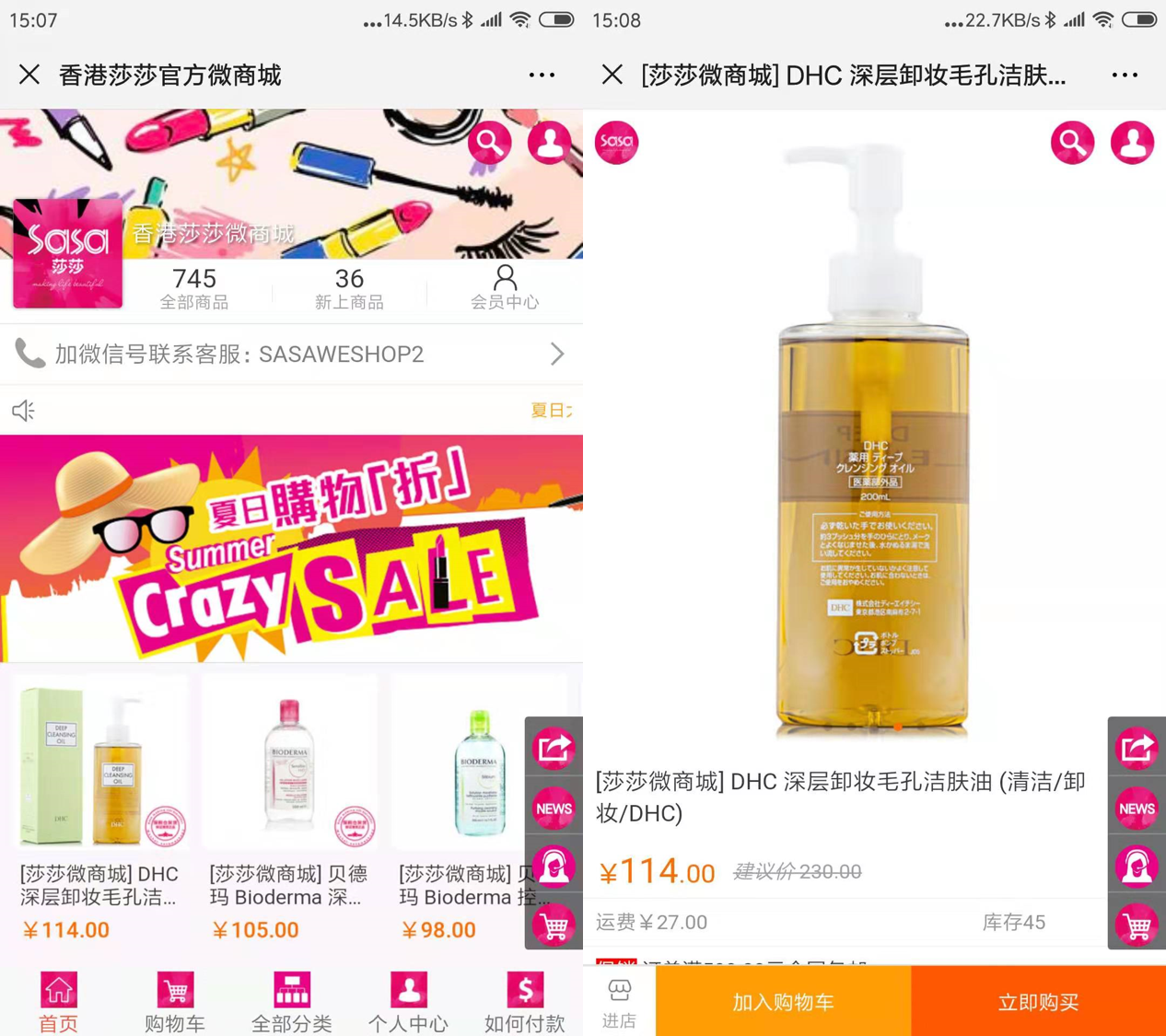

Sasa's mobile e-commerce store. Source: Sasa Official Website

Sasa International is Hong Kong's most visible cosmetics retail chain, operating over 270 stores in Hong Kong, Macau, China, Singapore, and Malaysia.

Its Hong Kong stores are normally a top destination for visiting Chinese tourists, who account for over 70% of the company's sales and spend an average of HK$700 per store visit.

Its cross-border e-commerce site sells top-selling brands such as DHC and Bioderma. International beauty and cosmetics products are difficult to find in China because of animal testing requirements that cruelty-free brands refuse to adhere to.

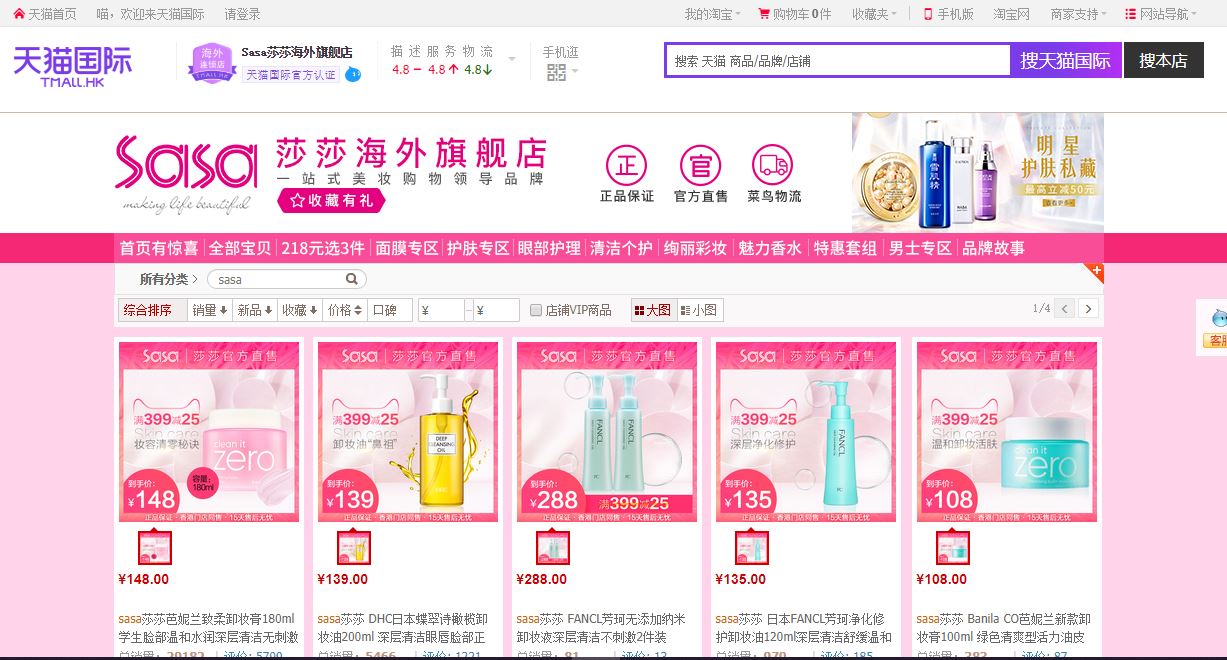

Sasa's e-commerce operations also offer cross-border payments through Alipay and customer service through its WeChat account. In addition to its own website and WeChat presence, Sasa runs stores on Tmall Global and JD Worldwide.

Sasa International Official Tmall Flagship Store. Source: Tmall Global

I.T. Limited

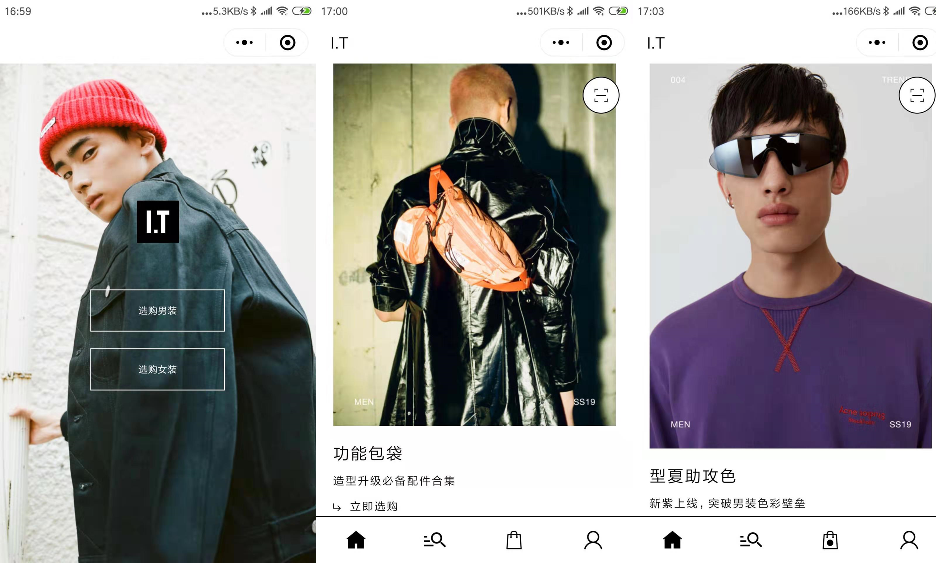

![]() I.T. is a Hong Kong fashion group that was founded in the 1980s to import hard-to-find brands. Since then, it has branched out to build its own brands, such as A Bathing Ape and Izzue. I.T. brought in revenues of US$1.1 billion in the fiscal year 2018.

I.T. is a Hong Kong fashion group that was founded in the 1980s to import hard-to-find brands. Since then, it has branched out to build its own brands, such as A Bathing Ape and Izzue. I.T. brought in revenues of US$1.1 billion in the fiscal year 2018.

I.T. is different from the above two brands in that it has extensive retail operations in mainland China, running 532 I.T retail stores. This means that it imports most of its products through general trade and not cross-border e-commerce.

I.T runs two different WeChat mini-programs - one that just highlights limited-time sales and collections, and another that lists all of its products. The design of the mini-programs heavily emphasizes large-display pictures, which makes sense given that I.T is a fashion retailer. It displays pictures of different styles to grab customers' interest.

Limited Collection mini-program

I.T's mini-program store is heavy on the photos and lookbook galleries.

Key Takeaways

1. Hong Kong retail is likely to continue to suffer as anti-China protests deter Chinese tourists from visiting

2. Crises can be good sometimes. Both logistics courier SF Express and e-commerce platform JD.com benefited by continuing to offer quality delivery services during the SARS crisis in 2002-03.

3. E-commerce can be a good way for Hong Kong retailers to sell to Chinese consumers who might be reluctant to visit Hong Kong now. Sasa International, Lane Crawford, and I.T all have robust e-commerce operations that cater to Chinese customers.