Is WeChat Mini-app a Waste of Time for Pure Play E-commerce?

How should pure play e-commerce retailer leverage WeChat mini-app function? Where to find traffic for mini-apps? What kinds of business are suitable for mini-app?

by AzoyaLab

Earlier this year, WeChat’s launch of mini-app had created a buzz in the e-commerce industry. Integrated into the WeChat app, the mini-app developed by 3rd party developers can serve as a fully functional app, and users can install the mini-app without complex process through AppStore or Google Play. Compact, simple, and easy-to-use, the mini-app is great for low-frequency scenarios with a big demand.

However, for e-commerce retailer, and pure play e-commerce specifically, achieving sales growth via mini-app sounds like a distant dream. Mini-app is still very restricted in terms of in-app marketing, and not everyone can benefit from the ‘traffic bonus’ that mini-app carries at the moment.

Download the Internet Retailer's Asia 500 report before September 8th for free Or get it at discounted price with code: Azoya50 |

According to third party researcher ALD (aldwx.com), among top 100 mini-apps in the market, only 9 are pure play e-commerce retailers. Full-category retailers include Pinduoduo and JD.com, and both were invested by Tencent. Rest of the pure play e-commerce retailers are heavily combined with offline services, such as JD Home Delivery and Everyday Fresh that focus on fresh food delivery. Overall speaking, retailing via mini-app is not a popular phenomenon.

* Among the 9 mini-app, there are 3 full-category retailers (4, 12, 56), 2 focusing on fashion apparel (5, 37), 3 providing fresh food delivery service (45, 50, 90) and 1 digital devices & household product retailer (20).

Driving traffic to mini-app for pure play e-commerce can be difficult

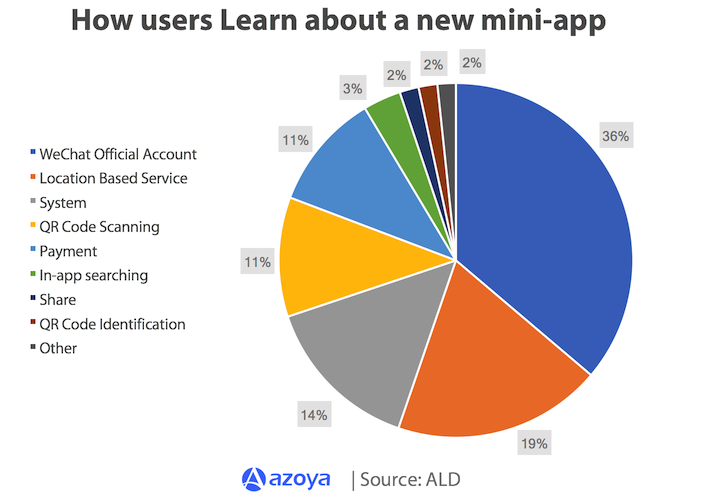

For retailers, WeChat’s hyperactive and massive user base is a goldmine, but mini-app didn’t solve the most prominent demand of retailers: to acquire new traffic and retain them. ALD’s report shows that most users (36%) find new mini-app through WeChat Official Accounts. Within a WeChat Official Account, users can find the mini-app associated to the account via customized menu bar (59.3%), articles (25.56%), automated messages (11.53%) and profile page (3.18%). Users that find the mini-app via WeChat Official Accounts are likely subscribers of the account already.

If a mini-app owner wants to find new users without relying on existing subscribers, LBS, QR Code Scanning and Payment are the channels to look for, but these would require mini-app owners to have a strong offline presence. For example, the bicycle sharing industry, who have millions of bike placed on the streets, tagged with unique identification code registered in WeChat. People can access bicycle sharing mini-apps simply by scanning the QR code with a phone camera. Searching, social sharing and QR Code identification sounds like a viable solution to acquire new users for pure play e-commerce retailers, but it can be difficult, and costly (if WeChat were to allow SEM ranking for in-app search results in the future).

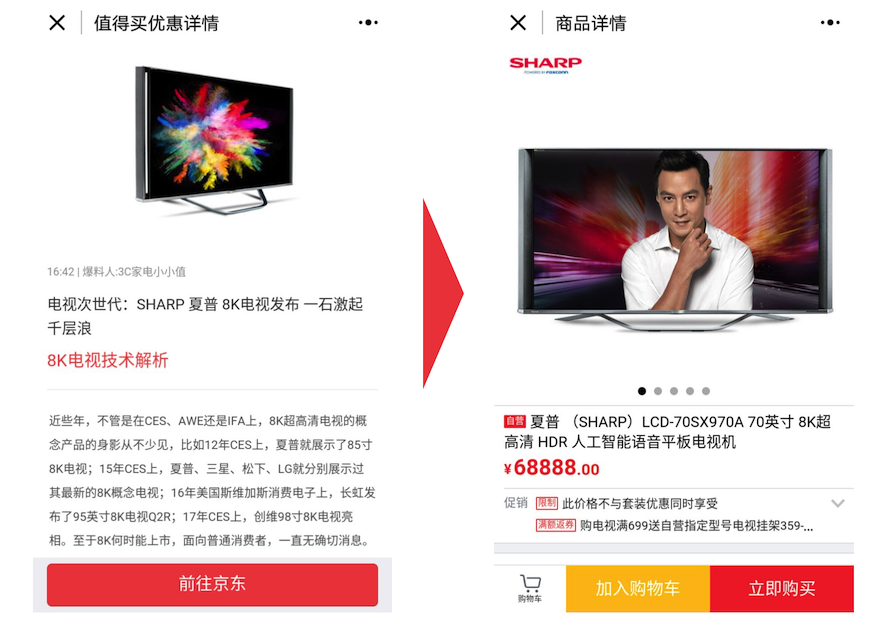

SMZDM driving traffic to JD.com

The mini-app is also a closed system with the purpose to drive users to the transaction. To rephrase this to retail language: if retailers cannot complete the transaction with customers inside a mini-app, they can only make the transaction in another mini-app – they cannot drive customers to an HTML website, or external app with full function because the designers of WeChat mini-app function forbid that to happen. The result is that retailers need to tailor offer at the mini-app: best sellers, bundles, flash-sale and limited-time offer are commonly seen on mini-app retailers.

For pure play e-commerce business, the biggest challenge at the WeChat platform is to acquire new users. Due to the decentralized design, WeChat benefits numerous individual account operators. If businesses were to access to more customers, they will need to transact with the online influencers. In this sense, mini-app, HTML5 Weidian, and third-party HTML5 are on level ground, because all of them can be leveraged to land traffic coming from online influencers.

Who is the biggest winner in mini-app so far?

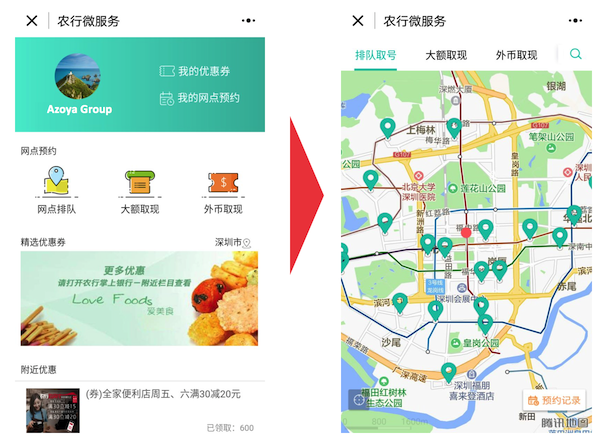

Although retailing is a popular scenario of mini-app, WeChat’s vision is more than that. We can tell from the ranking of top 100 indexed mini-app that a lot of industries with a focus on offline services can use mini-app to improve the overall experience. Banks, for instance, can leverage mini-app to accept appointments from customers.

Making appointment with mini-app

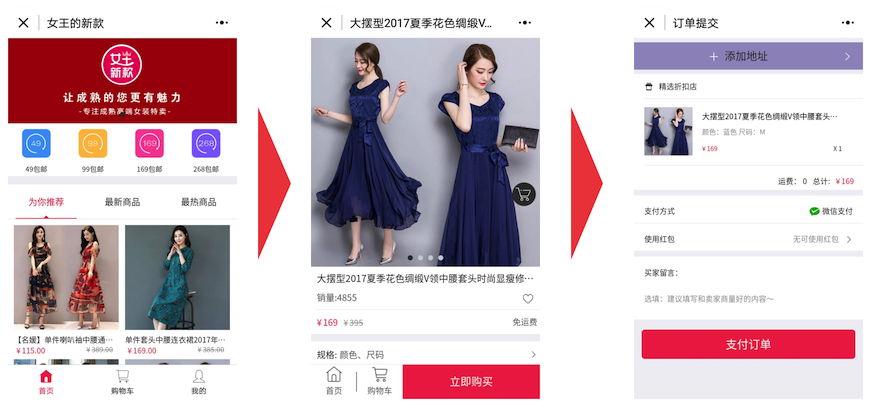

We have discovered an interesting case with Queen’s New Collection, a social commerce app ranked 37 in the list of top 100 mini-app by ALD. The mini-app sells female apparels at 49 RMB, 99 RMB, 169 RMB and 268 RMB, and provide free shipping for every order. After purchasing the products, customers can receive a social bonus if they decide to share their shopping experience with friends. The mini-app was associated with 42 WeChat Official Accounts – quite an unusual practice when peer retailers usually own less than 3 official accounts. By exploiting the feature of the yet matured mini-app function, QNC have the chances to maximize the reach of their services via multiple social media accounts.

Purchase flow of Queen's New Collection

To sum up the winners in 4 groups - they are ‘Tencent and friends’, ‘Traffic landlord’, ‘Offline giants’, ‘Social masterminds’. These businesses are currently benefiting from the mini-app function.

How should pure play e-commerce leverage WeChat mini-app?

Mini-app is positioned as a tool to replace apps that are not frequently used, thanks to the convenience of installation and the compact size. But it cannot replace apps – it doesn’t even have the basic function of sending notifications to users. Mini-app’s native functions may not directly help retailers acquire massive online traffic, and for now transacting with major traffic holders inside WeChat platform can be a way for retailers to acquire new traffic.

For e-commerce business that already has mobile compatible sites, mini-app is not a must have, but it can offer customers differentiated services from the HTML site or the apps. Bear in mind that WeChat’s mini-app is not yet a finished program, and e-commerce businesses should keep a closer look on future updates.

A version of this article is also on PaymentSource