Opportunities and Challenges in China Cross-Border E-Commerce

Azoya Consulting's joint report on China cross-border e-commerce with Frost & Sullivan surveys both Chinese consumers and international retailers to get a better sense of the market situation

by Azoya Consulting

Cross-border e-commerce is booming in China. An estimated 125 million Chinese consumers purchased $105 billion of overseas products through this channel in 2017.

Why? Chinese consumption levels are rising, powered by a rising middle class and robust economic growth.

This benefits international retailers, who are known for having higher quality, premium goods.

In the past, people purchased hard-to-find cosmetics or milk powder through gray-market daigou agents or friends/family overseas.

Now, cross-border e-commerce is overtaking these channels as consumers seek a more legitimate, formal avenue for purchasing overseas products.

In China, cross-border e-commerce is often referred to as haitao; our research shows that the average haitao shopper is spending RMB 5,300 a year (US$848 a year) on products bought through this channel, with fashion and beauty & cosmetics being the most popular categories.

Fashion and Beauty & Cosmetics are the top verticals for cross-border e-commerce

International Brands and Retailers are Disappointed with the China Market

However, while many retailers see China as a land of opportunity, not all of them are satisfied with their performance in China.

Competition, low profits, and high entry barriers are only a few of the many challenges they face.

19% of retailers say that China regulations can be too confusing, and another 19% say that the China market is too competitive.

Our newly published report on the cross-border e-commerce market, drafted in conjunction with research firm Frost & Sullivan, delves deeper into the trends behind cross-border e-commerce, as well as some of the challenges that retailers and brands face in entering the China market.

Competition is Fierce in the China Cross-Border E-Commerce Market

Global retailers see the China cross-border e-commerce market as a large opportunity, but competition amongst brands is more intense than ever.

For the many brands and retailers that enter the China market via e-commerce platforms, the vast majority of their sales and traffic are derived from large platforms such as Tmall and Kaola.

And yet only 21% of retailers that use marketplaces as their sales channel are satisfied with their online sales.

Why?

- Acquiring traffic is becoming more and more expensive, because the number of brands has increased, driving up ad biddint costs

- Marketplaces can also eat up margins as some require merchants to pay as much as 15% in commissions, not counting other expenses such as marketing, logistics, and discounts for e-commerce holidays.

- Brands are also finding it difficult to differentiate themselves from one another on platforms where there are thousands of competitors.

Picky Chinese consumers are forcing brands to tailor their content and products to local tastes

Haitao consumers are notoriously picky - they purchase overseas products primarily because they’re looking for superior quality.

In fact, 67% of the consumers in our survey report that the search for reliable, higher quality products was their primary motivation for buying through cross-border e-commerce.

Because of this, for cross-border transactions, shoppers are increasingly interested in the authenticity of a brand and the brand story around it.

Brand heritage and storytelling are important for brands to build a relationship with their customers now.

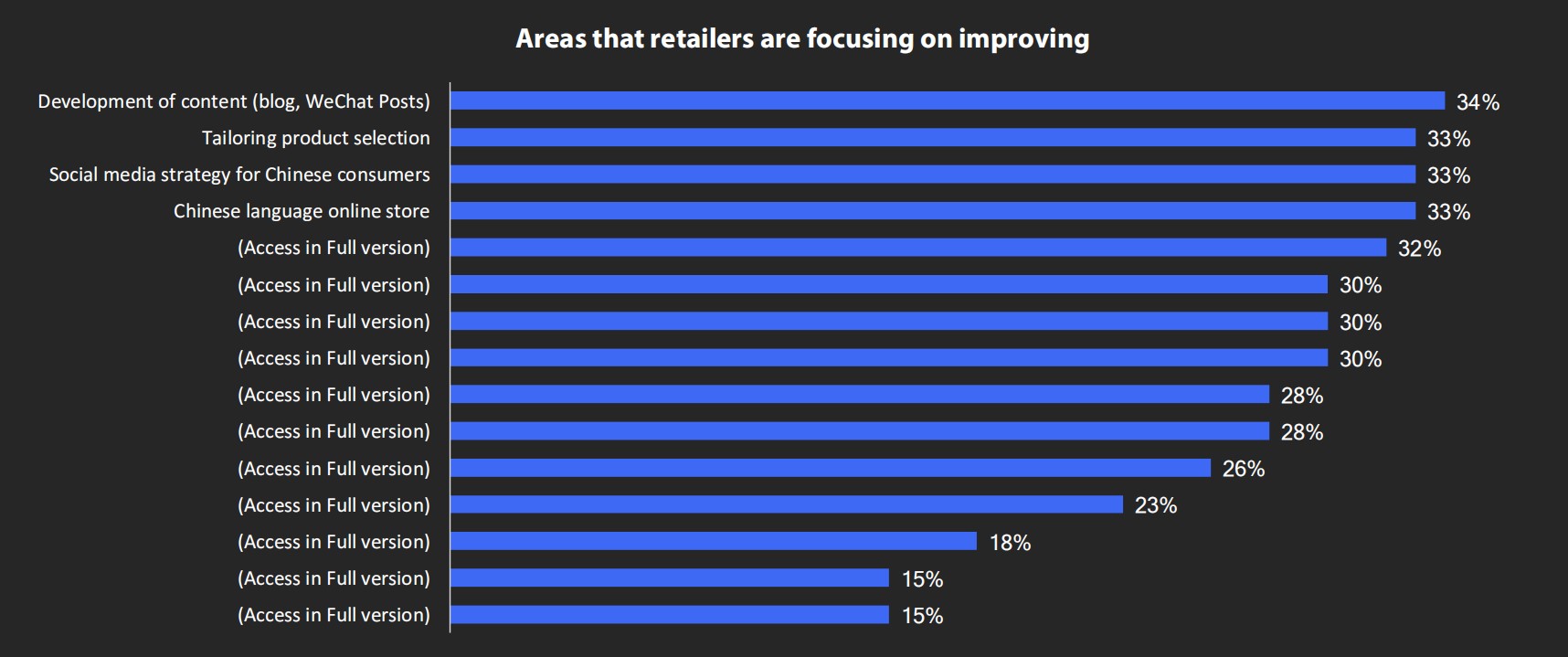

34% of the brands we interviewed are generating content such as blog articles to meet the tastes of Chinese consumers, and 33% are also tailoring their products to local demands to drive more sales.

Localization is becoming increasingly important as competition intensifies in the China market. This includes tailoring content for Chinese consumers, picking the right merchandise to sell to Chinese consumers, and other things like having Chinese mobile payments, Chinese customer service, etc.

Retailers are generating content and tailoring products specifically for Chinese consumers

Standalone China e-commerce websites enable brands to differentiate themselves from one another

Satisfaction rates with standalone e-commerce websites are higher; 31% of retailers are satisfied with their experiences selling through standalone e-commerce stores, whereas only 21% of retailers are satisfied with their experiences selling through marketplace platforms.

Marketplaces and standalone e-commerce websites each have different advantages and disadvantages:

1. On a marketplace, brands and retailers can benefit from the large amount of user traffic that already exist.

However, since there are so many competitors on the platform, it is difficult for a brand to distinguish itself and there are only so many tools they can deploy to build a rapport with their customers.

The intense competition amongst brands on a platform enables consumers to easily compare prices.

Marketplaces are also less friendly to up-and-coming brands, as those without sales volumes or brand awareness in China are often weeded out before they can even get onto the platform.

Those who are able to launch on a marketplace face high upfront costs and commissions; for smaller brands who are new to the market, it often does not make financial sense to launch on a platform, especially since it doesn’t necessarily guarantee sales.

2. Standalone e-commerce websites are challenging to operate because it's difficult to drive traffic

On the plus side, brands can own the whole user experience and build a stronger connection with their customers.

They can get more creative with their marketing efforts as they aren’t beholden to the rules and limited website space of a large marketplace.

This will be more and more important going forward as consumers start to look for more differentiated brands to distinguish themselves from their peers.

Overseas retailers and brands face a host of different challenges when entering the China e-commerce market

With the China market becoming more competitive, overseas retailers are increasingly falling short of expectations as they strive to maintain their brands’ relevance.

38% of the overseas retailers in our survey say that the biggest challenge they face is that they have to first focus on their own domestic market, which makes it difficult to compete with local competitors in China that can move faster and understand local trends better.

Additionally, 19% of retailers say that China regulations are too confusing, and another 19% say that the China market is too competitive.

If you’re a small or medium-sized company, chances are you won’t have the time or resources to invest in building out an entire China team to manage your operations in the China market.

However, given the intense amount of competition from domestic and larger international multinational corporations in China, having a team on the ground in China is crucial.

Finding a key partner that can offer comprehensive services and solutions can be a key aspect of a retailer’s China strategy.

Managing local China e-commerce operations can get messy as a brand grows

What does managing local China operations entail?

Aside from top-notch, high quality products, consumers are increasingly expecting a wider range of payment options, fast website performance, fast parcel delivery, and Chinese language customer support.

Many merchants have to set up a Chinese language website, which is one of the first steps of the market entry process.

Managing local operations can become complicated as a business grows, and in such a competitive market, the small details matter.

Seemingly simple aspects such as managing website operations can become increasingly complex when, say, an abnormally large volume of online shoppers on Singles’ Day crashes your servers or your logistics provider can’t get your products to customers on time.

When you’re an overseas retailer selling premium quality products, your customer service must also match the quality of your products, as Chinese consumers are more demanding than ever before.