Tencent’s ambition in converging social and e-commerce via WeShop and Mini-app

How Tencent is leveraging WeShop and Mini-app to recruit both micro-vendors and full-size retailers.

by Azoya

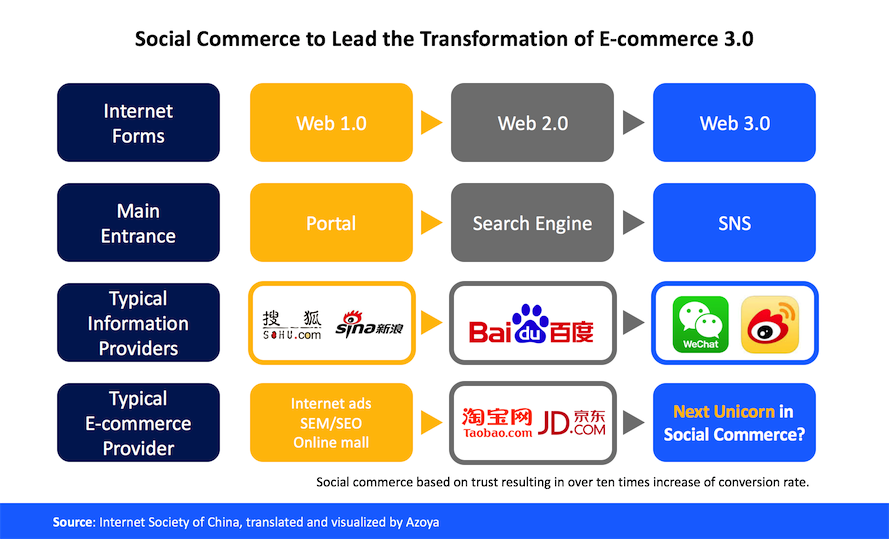

Pin Duo Duo’s sudden popularity is no surprise to the e-commerce industry in China – leveraging social power to boost visibility among 1 billion active users on WeChat had been widely researched.

Suffering from the setbacks of unsuccessful e-commerce ventures such as Paipai and Yixun, Tencent retreats to equity control of JD.com. But the launch of mini-app and the WeShop imply another story on WeChat’s ambition in e-commerce and social commerce.

Social commerce in WeChat

With over 1 billion active users, WeChat is the largest social platform in China. The app also supports various kinds of retailers from multinational brands to personal vendors. These micro-vendors don’t have direct shopping functions – customers place orders after chatting with the vendors, and pay with WeChat red packs[1] when they receive the goods.

A report by Internet Society of China pointed out that by October 2017, there were more than 20.1 million small vendors selling via social platforms, with an annual transaction over 683 billion RMB (approx. 108 billion USD). From another point of view, the 20.1 million vendors represent the most powerful digital distribution channel in China – they know their customers, and they are enthusiastic about their works.

However, the explosive growth of small vendors had crowded the social media platforms. Chinese customers are under-served by the poor experience of chat-to-buy social shopping model, as it lacks clarity about the source and prices of the merchandise. There is lack of supervision regarding the post-sales services and the credential of the sellers. And therefore, WeShop is born.

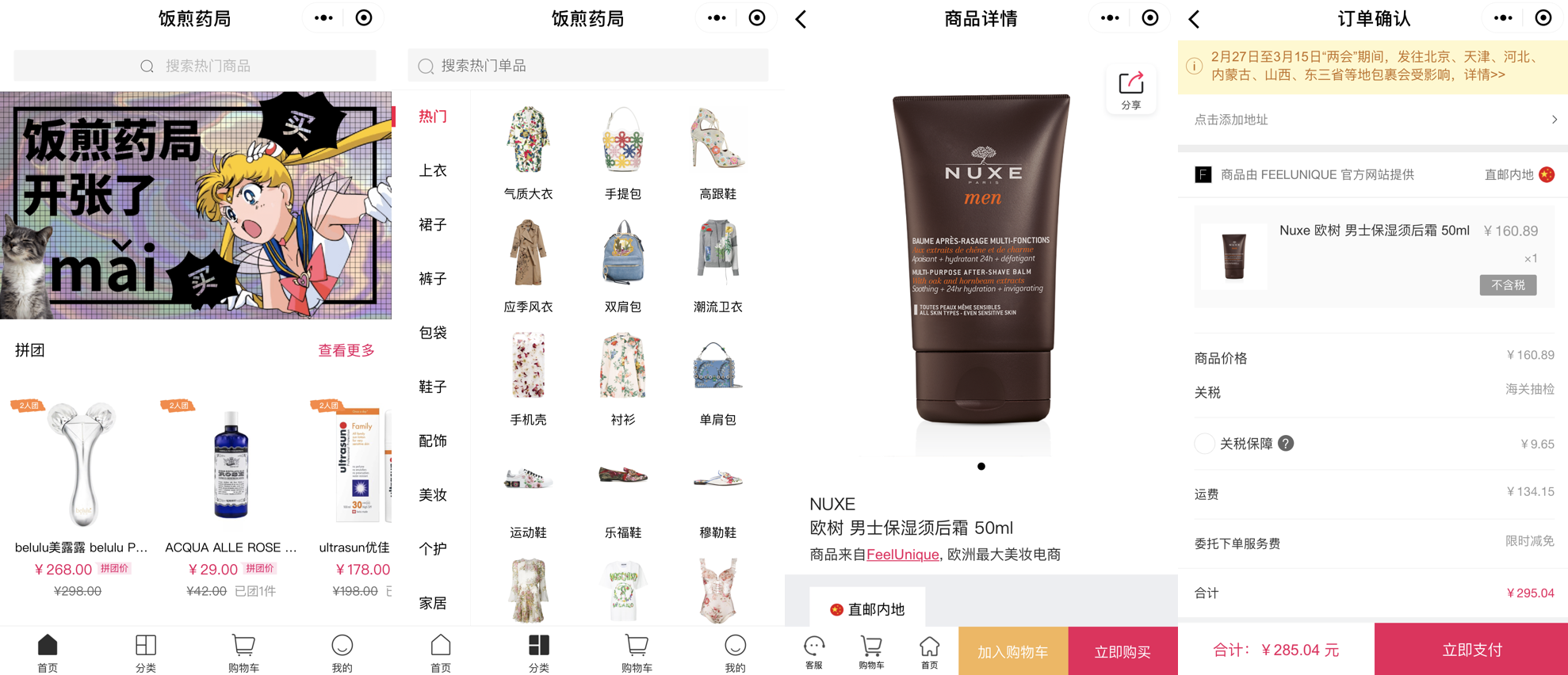

The new platform, initiated by a joint venture of JD and Meili Alliance, offers micro-vendors a marketplace to list their business and contact details. Although the transaction through WeShop is still based on chat-to-buy, the platform still managed to recruit over 100,000 in shortly 2 weeks after launch in March.

WeShop.com recruiting vendors

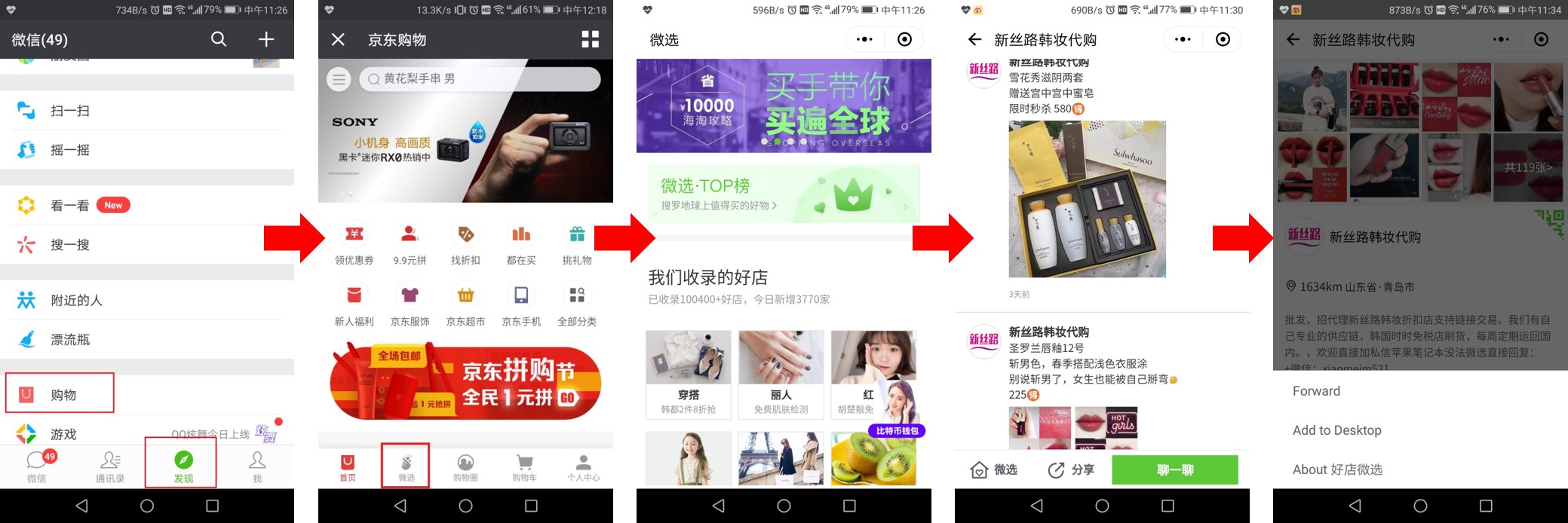

As of now, the WeShop platform looks half-finished. Customers cannot filter or search the products they are looking for. They need to ask for stock information and quotation vendors by vendors. The platform does show a ‘centralized’ design – leveraging JD.com’s secondary portal in WeChat, the WeShop will manage huge traffic coming from WeChat, and distribute the traffic to vendors based on category, credentials, and other mechanisms.

Accessing WeShop in WeChat

When centralization meets decentralization

Compared to WeShop, the mini-app launched earlier last year might be a perfect example of ‘decentralized’ design.

In case you haven’t heard of the ‘mini-app’ in WeChat, here’s a brief introduction of what it is.

The mini-app, or mini-program, is the sub-application inside WeChat[2]. Contrary to the HTML webpage, the mini-app is written in WXML (Weixin Markup Language), which enable full compatibility across different mobile operating systems. It is faster compared to HTML pages in terms of loading, and responding since the programs have very limited sizes, only 2 megabytes.

Mini-app’s ease of use and the sharing feature eliminates a range of barriers compared to a traditional web-based online store. Customers don’t need to worry about the security, registering and payment - these can all be done within a few touches.

Mini-app can be awoken in a variety of ways: from the chat window, the navigation bar, QR Code scanning, search results, WeChat articles, profile page of subscription accounts, etc. It can be loaded within a few seconds, saving the trouble of downloading a full-size app from AppStore.

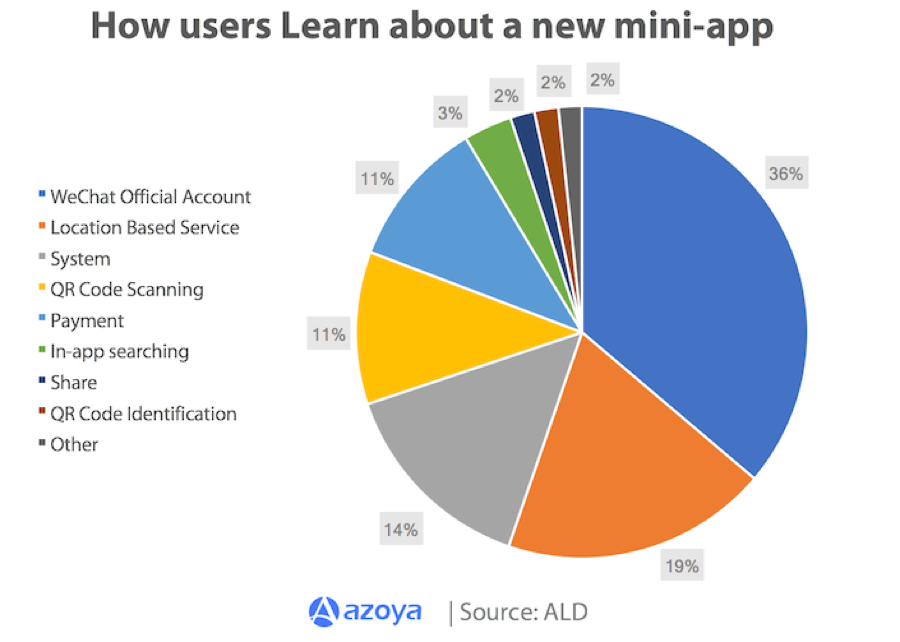

But since there is no permanent portal or marketplace to list all the mini-apps, the traffic of mini-app may come from different sources: from friends and relatives, alumni chat groups, KOLs who are promoting the mini-app, daigou who have a stake in the business, location-based services, QR Codes in bricks and mortar stores, etc.

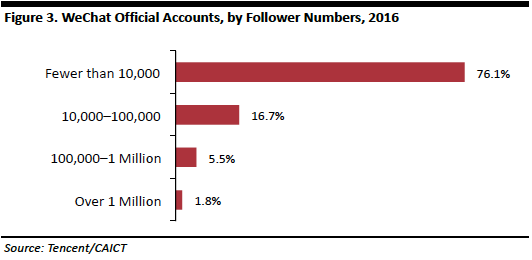

A report by Aladin showed that by 2017 September, the majority of traffic that go to the mini-app are coming from the subscription accounts, which represent 36% of total traffic. From the perspective of KOLs who holds massive follower bases, capitalizing their social influences via mini-app might be a way out. For retailers, it represents huge opportunity.

Chart by Coresight Research

The arrival of mini-app gives much more flexibility for KOLs to advertise. Mini-app can be easily integrated into the marketing content to convert readers to buyers. Some retailers even customize stores for KOLs and share commission with them, which also motivate the KOLs to combine their daily content with retailers or brands – a win-win situation for both parties.

Screenshot: Chinese KOL YangFanJame launched WeChat Mini-app store

Tencent’s ambition gets bigger

China’s largest social media platform now opened two doors for retailers to market and convert effectively. With social commerce transaction increasing at a staggering rate, the boundaries between e-commerce and social commerce is getting blurred.

There is no short of creativity in terms of viral marketing in WeChat, who is now laying a solid foundation in WeChat for retailers of different size and needs to grow business.

[1] A WeChat red pack refers to the digital cash which can be sent and received in the WeChat app.

[2] WalkTheChat: What are WeChat Mini-Programs? A Simple Introduction