Why These Emerging Health Categories Are The Ones To Look Out For On Singles Day

Protein powder, probiotics, and knee health meds - these are the emerging categories that the health & nutrition industry should be watching for on this year's Singles Day.

by Azoya Consulting

Sales holidays like Singles Day highlight the problem that all brands face on large marketplaces – how does one stand out in a sea of competitors when there are thousands of brands competing for traffic and customers?

The answer is specialization. While the general health & nutrition category is growing at an average rate of just 8.4% a year, subcategories such as probiotics, joint health, and fitness supplements are growing even faster. During last year’s Singles Day, top brands such as Move Free (joint health), Muscletech (fitness supplements), and GNC (fitness supplements, vitamins) scored in the top ten for health/nutrition, a major category for cross-border e-commerce.

While general players such as Chemist Warehouse and Swisse continued to top the rankings, we think that the market is diversifying and that there may be more opportunities for brands who focus on more specialized subcategories. We highlight some of the growth areas within health & nutrition and point out where the opportunities are.

Demand for Protein Powder is Growing Along with China’s Fitness Industry

The fitness-related supplements market is still in its early stages, as it accounts for just 1% of the total health & nutrition market in China, according to Euromonitor[1].

Generally, Chinese people don’t go to the gym to work out. Historically, Chinese people have engaged in light exercise activities such as walking or taichi, but even this group tends to consist of elderly retirees.

But this is changing, as younger Chinese millennials are becoming more conscious of their health and more enthusiastic about fitness. The gym industry in China has grown at a CAGR of 10% over the past five years and is expected to reach $6.9 billion in value by the end of 2018. Fitness-tracking app Keep reportedly has over 120 million registered users today.

Euromonitor also reports that 60% of fitness supplements sales in China comes from protein powder, which brought in 1.4 billion RMB in sales last year. While a relatively small figure, brands and retailers should expect the market for fitness supplements to grow. Amongst fitness-related keywords on Taobao this past August, “protein powder” ranked number one. L-carnitine and muscle-building powder ranked 15th and 16th, respectively.

Leading players in the industry include Muscletech and GNC, both of whom ranked in the top ten for health & nutrition stores on Tmall. Going forward, as more and more Chinese millennials go to the gym and become conscious of their health, the market for fitness-related supplements will continue to grow.

Probiotic Supplements Are Becoming the Go-To Products for Digestive Health in China

Another fast growing category is probiotic supplements, which grew 30% last year to reach 15.57 billion RMB in sales in China. Probiotics contain “good” bacteria such as lactobacillus complex that are generally beneficial to one’s digestive health. Consumer awareness of these products is growing in China.

Many Chinese parents purchase probiotic supplements to treat diarrhea and constipation that their baby children or elderly parents may be suffering from[2]. Top players include Culturelle, Biostime, and Life-Space. By-Health, one of China’s largest supplements makers, purchased Australia-based Life-Space in early 2018 to take advantage of this growing market[3].

And yet, probiotic supplements have a lot of room to grow, comprising a small percentage of China’s $8.3 billion[4] general probiotics market. Many Chinese consume probiotics through foods such as yogurt. This is in contrast to the US market, in which probiotic supplements have surpassed probiotic foods in market share.

China’s Aging Population is Driving Demand for Joint-Health Supplements

Degenerative knee arthritis is becoming a big health issue amongst China’s aging population, and Chinese consumers are purchasing glucosamine and chondroitin supplements to repair the cartilage in their knees and relieve joint pain.

As China population continues to age, there will be more and more demand for supplements targeted at the elderly. While in the past they have typically chosen to take traditional Chinese medicine, nowadays many younger consumers are purchasing more supplements for their parents.

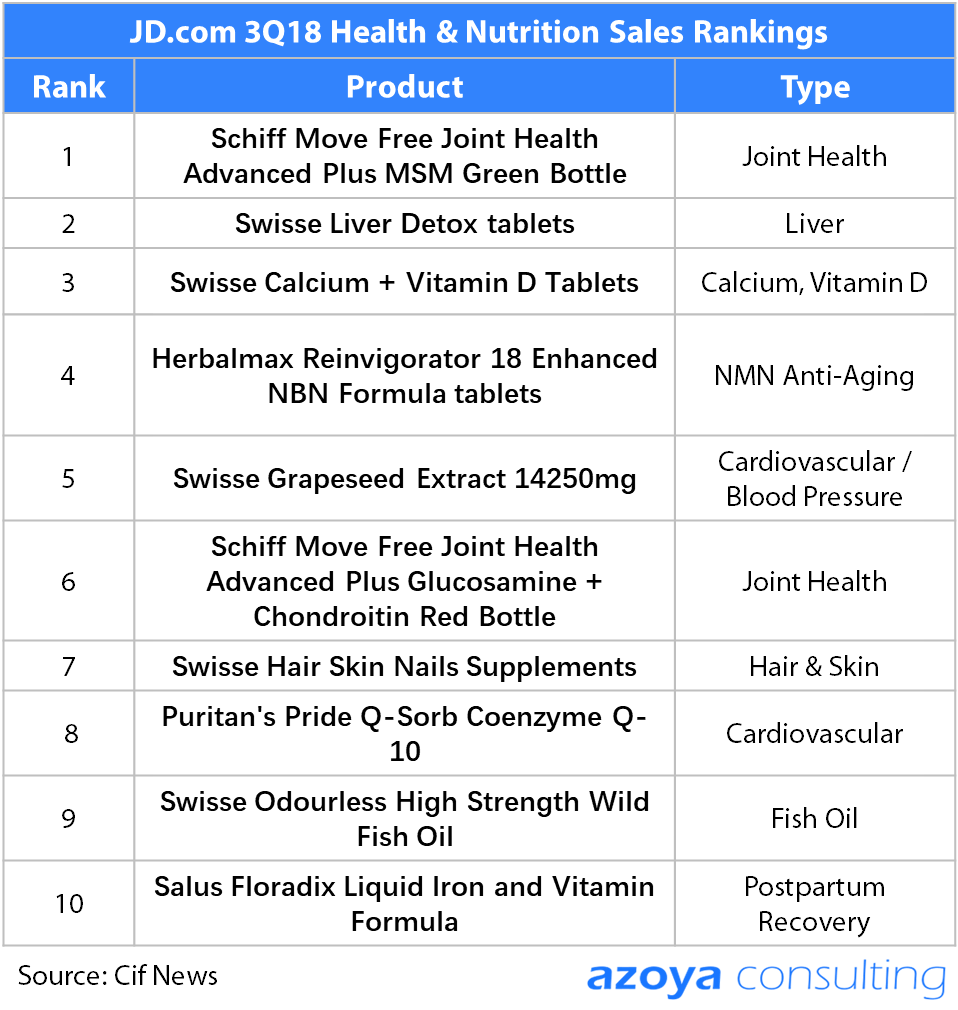

Move Free is the dominant brand in this subcategory, occupying a 36.4% share of the market[5]; By-Health and Puritan’s Pride each have 30.0% and 9.8% market share, respectively. Move Free’s products ranked number 1 and 6 on JD’s sales rankings for health & nutrition in the third quarter of this year.

Move Free’s branding strategy has focused on marketing an active lifestyle for the middle-aged and elderly. As part of its Tmall Super Brand Day in February 2017, it co-produced a documentary advertisement that highlighted the importance of knee health, noting that over 100 million people suffer from arthritis in China[6]. The video featured a middle-aged Chinese couple who are well-known for documenting their extreme adventures all around the world; this time Move Free followed the couple as they prepared for their trip over the South Pole, the first to be completed by a Chinese aircraft.

Key Takeaways

As Singles Day draws closer and over 19,000 brands on Tmall Global continue to battle it out for traffic and customers, brands should think about what their unique value proposition is and how they can stand out from the competition. Here are some key takeaways.

1. The market for health supplements will continue to splinter into different submarkets for different types of users. Different brands will dominate different subcategories: children’s health, arthritis relief, fitness supplements, etc. Brands will need to focus on the different pain points of each customer group and demonstrate how they can help resolve their issues.

2. By examining the current market and our own proprietary data, we predict that these categories and brands will perform well on Singles Day

General: Swisse, Chemist Warehouse, By-Health

Protein Powder: Myprotein, GNC, Muscletech

Probiotics: Culturelle, Biostime, Life-Space

Joint-Health: Move Free, By-Health, Puritan’s Pride

3. Marketing health & nutrition products will require a different approach that focuses on educating the customer and building trust. For example, many product descriptions have large, clear diagrams that demonstrate how supplements may help a certain body function. Some brands, like Move Free focus on marketing a healthy lifestyle. Other players use KOLs to help educate customers, as they oftentimes have already built up trust and are more willing to make quick purchases.

[1] “2017-2018年保健品行业研究报告.” 1 Nov 2018. 行研资本. 8 Nov 2018 < https://mp.weixin.qq.com/s/85bF4NxTRFdo_5kQYmx4JQ>

[2] “Japanese consumption, Chinese growth spur global demand for probiotics.” 7 Jun 2016. Nutraingredients-Asia. 7 Nov 2018 <https://www.nutraingredients-asia.com/Article/2016/06/06/Japanese-consumption-Chinese-growth-spur-global-demand-for-probiotics>

[3] “Dietary Supplements in China.” Sep 2018. Euromonitor. 8 Nov 2018 < https://www.euromonitor.com/dietary-supplements-in-china/report>

[4] “China now one of ‘most important players’ in global probiotics market as sales top $8bn: IPA.” 2 Jul 2018. Nutraingredients-Asia. 7 Nov 2018. <https://www.nutraingredients-asia.com/Article/2018/07/02/China-now-one-of-most-important-players-in-global-probiotics-market-as-sales-top-8bn-IPA>

[5] “2017-2018年保健品行业研究报告.” 1 Nov 2018. 行研资本. 8 Nov 2018 < https://mp.weixin.qq.com/s/85bF4NxTRFdo_5kQYmx4JQ>

[6] “Move Free x天猫超级品牌日:关节活力全开,激活销售活力.” 23 Feb 2017. HC360. 8 Nov 2018 < http://info.finance.hc360.com/2017/02/231728356952.shtml>