2018 China Cross-border Policy Outlook

New pilot trading ports indicating robust cross-border e-commerce strategy; foreign retailers might be exaggerating the impact of China's e-commerce law; China released new round of tariff cut.

by Azoya

Recent announcement from China’s State Ministry included 5 new cities into the regulation scope of cross-border e-commerce import and exempt check of import permit and which maintains a level of consistency to the earlier decision by the States Ministry to prolong transactional cross-border e-commerce regulation to the end of 2018. The pilot city list now expands to include a total of 15 cities and trading ports, which is an indication of robust strategy for cross-border e-commerce trading. While the regulation model post-2018 remains uncertain, the market is reacting positively to the short-term interest from the policy updates.

Status quo of current regulation on cross-border e-commerce

In the first three quarters of 2017, Ningbo’s cross-border import volume reached 4.5 billion yuan, a 30.03% growth from the first three quarters of 2016. As the largest among the 15 cross-border e-commerce trading ports in China, Ningbo bonded zone processed 6 million import declaration forms on November 11th, worth 970 million RMB in total during the Single’s Day shopping feast.

Another figure from the Ninbo’s postal exchange office shows that the postal exchange office now process 30,000 mails daily, with peak time over 10,000 per day. The processing power of the Ningbo postal exchange office had grown 3 times since 2014, and will maintain sturdy improvement.

Looking into 2018, we believe that cross-border e-commerce import in China will continue current hybrid structure of bonded import and postal import. With increasing number of pilot cities, they will be less room for under-the-table trading, and most imported parcels will need to go through proper clearance procedures.

Ningbo customs officials checking imported parcels

Regarding the clearance procedure of cross-border e-commerce import, recent update such as Ningbo Quarantine and Inspection Center’s abandonment of High-risk Appraisal System, and the embracing of fresh food’s e-commerce cross-border import are positive signs from the regional regulatory authorities to encourage cross-border e-commerce. The current approach of light supervision and heavy emphasis on importer credits will likely to be inherited post-2018.

E-commerce Law Second Draft

This November, the Second Draft of China’s E-commerce Law was submitted to discussion at People’s Congress. While they have been some voices that the enactment of E-commerce Law would potentially ban foreign business to engage in direct retailing to China, our policy analysts believe that this conclusion could be exaggerating.

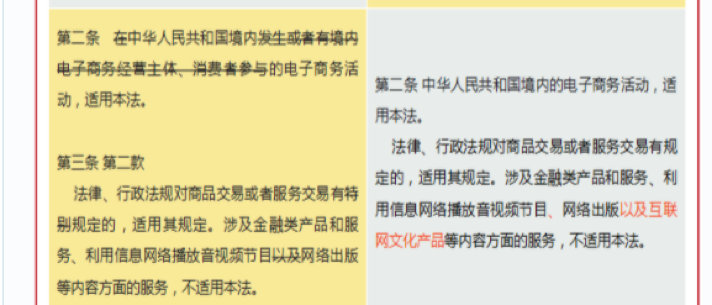

Comparing with the first draft, the second draft of the E-commerce Law deleted the following terms as shown in Figure 1: the e-commerce activities that consumers participate, or operated by e-commerce operators in China. This amendment shows that in the first draft the proposed law applied to all e-commerce activities, as long as consumers participated in China, which in a way any e-commerce including cross-border were covered, while the second draft removed such definition so that cross-border e-commerce will not apply.

Figure 1 (left column was the first draft and the right column is the second draft):

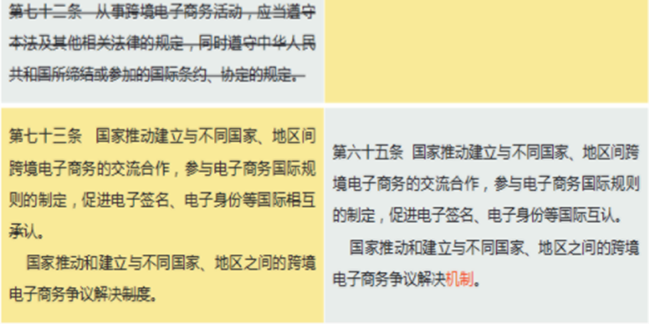

Furthermore, Article 72 in the first draft, “Any cross-border e-commerce activities shall be in compliance with this Law and other relevant law and regulation, as well as the international treaties and practices that People’s Republic of China have entered into or engaged” (translation by Azoya), was removed from the second draft as shown in figure 2. This is a complete deletion which clearly indicates the proposed law is not applicable to foreign retailers selling into China via cross-border e-commerce.

Figure 2:

One of the interesting changes in the second draft is that the title of Chapter Five, “Cross-border E-commerce” as in the first draft, was replaced by “Promoting E-commerce” which highlights Chinese government at all levels shall promote innovation and development of e-commerce.

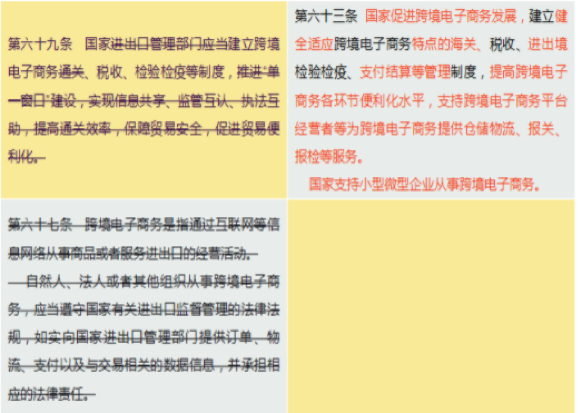

As shown in Figure 3, new stipulations are added in the second draft to promote and facilitate cross-border e-commerce, including formulating regulatory system to improve customs, tax, import & export inspection & quarantine, payment settlement for cross-border e-commerce.

Figure 3:

In summary, the legislative intention of the second draft lay more stress on supporting and promoting cross-border e-commerce instead of restricting it.

New Tax reforms

In November, Chinese government announced an ambitious tariff cut over general importation, effective December 1. The new round of tariff cut covers 187 goods to encourage consumption. Customs import duty on some special baby formulas had been reduced from 20% to 0%, while standard baby formulas were not affected.

In the short term, the tariff cut will stimulate the current stagnant import trading, and Chinese consumers will benefit from the more choices available at offline retail stores. However, “it’s unclear how fast the tariff cuts can be translated into ultimate price drop at conventional channel”, says Kantar Retail in a report by SCMP. Cross-border e-commerce’s advantage in hedging the risks from stocking and lower upfront cost are more favorable for starter brands and retailers.