3 Things to Do If Your Brand Can’t Get on Tmall

by Ker Zheng

Tmall is by far the largest and best e-commerce platform for a foreign merchant to launch a flagship B2C e-commerce store in China.

Its place within the Taobao/Alibaba ecosystem, user base of >600mn people, and broad appeal amongst all types of customers makes it the default go-to option for e-commerce merchants.

But contrary to popular belief, it’s actually quite difficult for a foreign brand or retailer to get on Tmall or its cross-border e-commerce subsidiary, Tmall Global. Here’s why.

Brands: Tmall generally prefers brands that have some brand recognition already; most new brands become popular because Chinese influencers or gray-market daigou sellers have brought the brand to china in small quantities already. These guys take your brand's awareness in China from zero to one, and Tmall takes it from one to 100.

Retailers: Multi-brand retailers typically have to have authorization from brands to sell in their home markets before they can apply for a Tmall store. Which means that if they’re procuring inventory from middle-men distributors and gray market channels, it’s unlikely that they’ll be able to open a Tmall store.

If you’re a brand that doesn’t fit these qualifications, then it is highly likely that your Tmall application will be rejected. In this scenario, what can a new brand do to boost one’s Tmall prospects? We lay out three options below.

Start Working with Influencers to Drive Awareness on Chinese Social Media

Many foreign brands become popular in China because influencers, daigou, or ordinary customers have brought the brand back to China and started posting about them on social media.

This means channels such as WeChat, Little Red Book, and Weibo. Brands can build awareness by aggressively working with these influencers and gray-market sellers to market their products on the social media channels.

Here’s what a theoretical timeline looks like:

1. Chinese influencer in New York discovers emerging beauty brand, posts about it on Weibo, Little Red Book

2. Overseas Chinese students, influencers, gray-market daigou sellers in USA see the post, try out the product and start posting about it. Some bring it back to China

3. Chinese influencers in China discover the brand, buy products from gray-market daigou sellers or friends, start posting about it

4. Brand in US acknowledges that Chinese people are buying its products, starts marketing on Chinese social media

5. After 6-18 months, gray market product sales grow and US brand opts to set up an official flagship store on Tmall Global (cross-border e-commerce) to sell directly to Chinese consumers

Notice how the brand only sets up a Tmall store after some brand awareness has been built up amongst the overseas Chinese diaspora, influencers, and daigou sellers. This is because the costs of setting up a Tmall store are high and significant marketing investments need to be made to drive sales on Tmall, so it’s better to be sure that there is Chinese demand for the product.

This may seem counterintuitive to many brands – why start marketing before sales channels are even opened in China? This is because it is very difficult to get Chinese customers to buy new brands – they are distrustful of shoddy products, tend to buy based on recommendations from friends and family, and are already overwhelmed by the deluge of new brands in the market.

The customer journey is much longer in China, and there have been many cases of brands setting up Tmall stores only to generate less than US$50,000 in sales in the first six months.

It IS possible to open e-commerce stores on WeChat and Little Red Book, but in our experience they generally yield very little sales unless they already have a very large following on Chinese social media.

And even then Chinese people still feel more comfortable buying from an official Tmall store. So what new brands should do is build up a presence on Chinese social media for 6-18 months, and THEN apply to open a Tmall store.

Use Affiliate Marketing Channels to Drive Traffic to Your Home Website

Affiliate marketing channels such as SMZDM, 55haitao, Linkhaitao, Dealmoon, etc. can drive Chinese traffic and sales to your existing English website in exchange for commissions. They publish content, product reviews, and aggregate promotions such as cash-back deals and holiday deals to drive traffic.

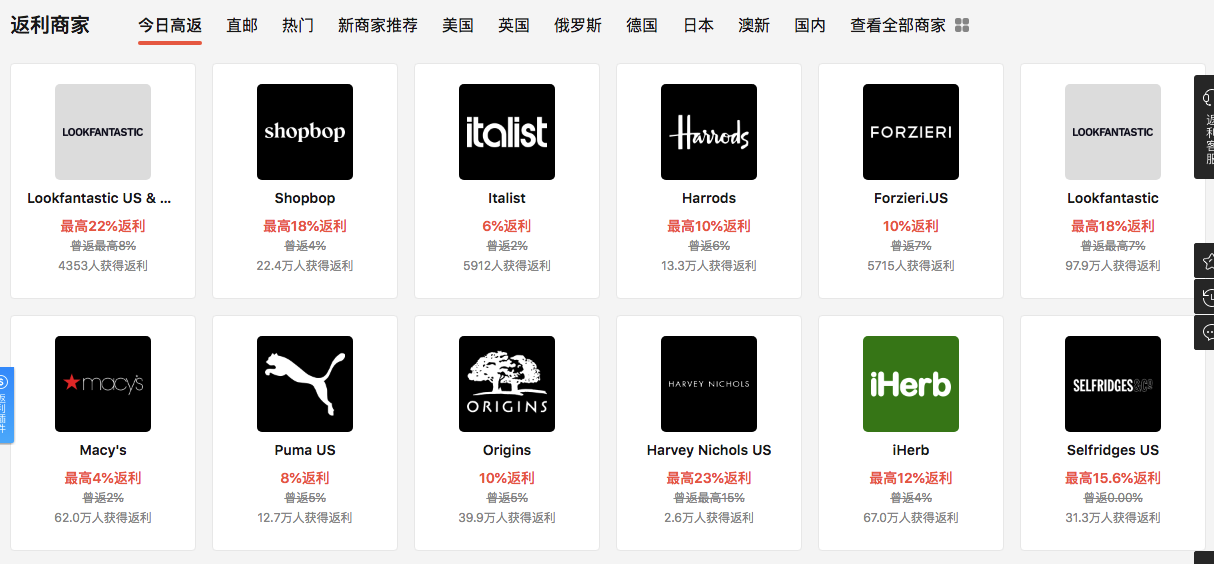

For example, the below screenshot from 55haitao shows how leading retailers such as Macy’s, iHerb, and T3 Micro (hair straightener brand) provide cash back deals.

Featured Cash Back Deals on 55haitao. Source: 55haitao Website

Once customers are directed to their sites and make a purchase, the merchant will pay the affiliate a commission based on how much the customer spent.

Such CPS (cost per sale) advertising models are common amongst merchants with limited marketing budgets and who are looking for high ROI on their advertising spend.

This is a convenient option for those who are looking to reach Chinese customers but aren’t ready to open a flagship store, customize their current website for Chinese customers, or spend hundreds of thousands of dollars on brand marketing in China.

But the downside is that 1. the commissions can be quite high (as high as 30%), 2. affiliates have to have confidence in your brand before they’ll market it for you, and 3. there may be logistics issues in shipping from international warehouses if your supply chain isn’t optimized for Chinese consumers.

There is also the challenge of processing returns, and dealing with Chinese customers that don’t have international credit cards and only use WeChat Pay/Alipay.

We generally recommend that multi-brand retailers with a large mix of both popular and niche brands use affiliates.

This is because affiliate marketing tends to be discount-driven and merchants need to rotate different items through promotions; a single brand with just five SKUs doesn’t have many products to discount, but a department store such as Macy’s with tens of thousands of SKUs has enough variety to rotate different items in every week.

Affiliate channels are also less willing to take small and emerging brands; they are more likely to take brands that have some brand awareness but no official sales channel in China, such as some luxury, fashion apparel, and cruelty-free brands.

For example, if Macy’s has a clearance sale on Calvin Klein polos that are hard to find in China, those items are more likely to get on an affiliate channel, than, say, an emerging cosmetics brand that no one has ever heard of and only has 5 million USD in global sales revenues.

Approach an Existing Multi-Brand Store or Distributor on Tmall, JD.com, etc.

For brands that have some existing brand awareness in China but aren’t ready to foot the costs of setting up a flagship Tmall store themselves, they can work with current multi-brand stores on Tmall to see if they would be willing to take your brand.

They might be willing to buy inventory from you in bulk (unlikely), or they might let you sell on their shop on consignment (more likely).

The downside of the latter option is that they may charge a very high commission for this (as much as 70% of sales), and you still need to invest in brand marketing outside of Tmall to build brand awareness.

Many of these multi-brand stores tend to be distributors that drive sales through discounting, and brand-building typically is not their strong suit.

We’ve seen many cases in which brands let distributors sell their products on Tmall, but then take back control of their brand because the distributor was discounting too heavily, portraying the wrong brand image, or not doing any marketing at all.

So if you do choose to open up a sales channels through a multi-brand store, we recommend that you still try to take control of the brand marketing part.

Key Takeaways

1. For a variety of different reasons, it can be hard for a brand or retailer to open a Tmall store. But there are other options for those looking to target Chinese consumers

2. One option is to start marketing on Chinese social media channels by working with influencers. Many brands become popular in China because of influencers and gray-market daigou sellers who bring back the brand from abroad

3. Another option is to work with Chinese affiliate marketing channels. These channels aggregate content, deals, and traffic from Chinese consumers, and get a cut of the sales if customers buy from the linked merchant website.

4. The last option is to work with existing multi-brand stores or distributors on Tmall, JD.com, etc. While some may be willing to buy your products in bulk, the vast majority are more likely to sell your brand on consignment in exchange for a commission.