How did Health & Nutrition Brands Perform on This Year’s Singles Day?

Health & nutrition products dominated cross-border sales on Tmall Global for this year's Singles Day. Azoya Consulting discusses which brands performed well and why.

by Azoya Consulting

This year’s Singles Day saw Alibaba’s Tmall platform rake in an eye dropping $30.8 billion in transactions[1], up 27% from last year’s figures. This year’s Singles Day fell on a weekend, and as a result, sales between the hours of 2am and 8am were higher than usual, according to Alibaba executives.

Top categories amongst imported brands were beauty & cosmetics, mom & baby, health & nutrition, apparel & fashion, and electronics. These categories demonstrate that Chinese consumers have more disposable income than ever and discretionary spending on quality products is rising.

Azoya Consulting digs deeper into the health & nutrition sector and takes a look at which brands and subcategories performed well.

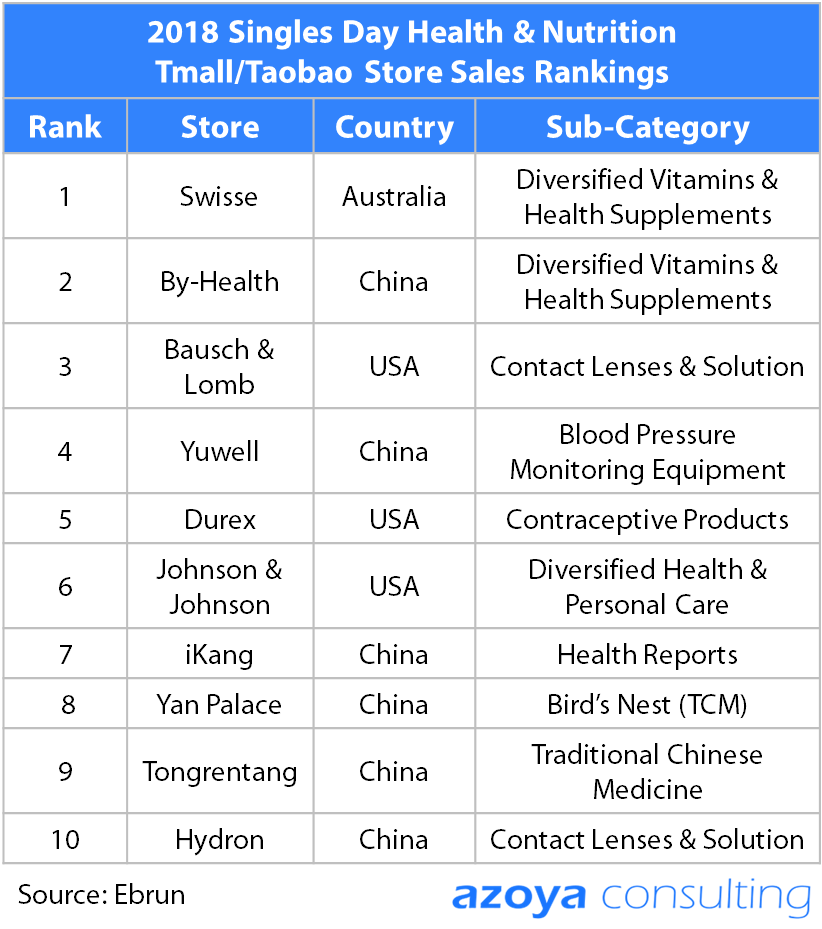

Chinese Health Brands Move Up Tmall Sales Rankings on Singles Day

Chinese brands occupied six out of the top ten slots on Tmall’s sales ranking tables this year, a new high. Though Australian supplements brand Swisse topped the list this year, By-Health, a diversified vitamins & health supplements company based in China, moved up the rankings from number five last year to become the second largest seller this year.

By-Health has made aggressive moves to expand its market share in China, having acquired Australian probiotics company Life-Space and Australian kids nutrition company Penta-Vite this past year.

Other top sellers included traditional Chinese medicine brands and contact lens makers.

Which Health & Nutrition Brands Performed Well on Tmall Global?

Health supplements Swisse and Bio Island claimed two of the top five[2] selling brands on Tmall Global, indicating that Chinese cross-border consumers are placing more and more importance on their health. The other three brands were Ya-Man (beauty), Moony (diapers), and Aptamil (milk powder).

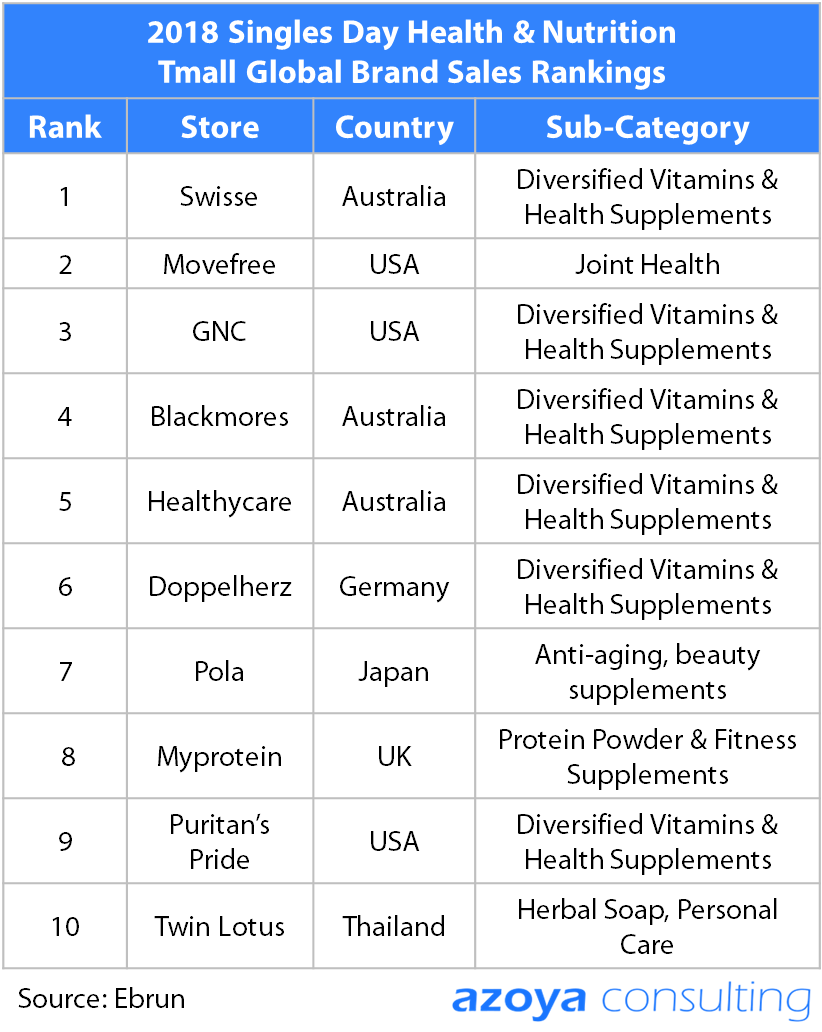

Chinese e-commerce media outlet Ebrun also published Tmall Global’s top ten health & nutrition brands. While general supplements brands such as Swisse, GNC, Blackmores, and Doppelherz continued to dominate the list, more niche-focused brands such as anti-aging supplements maker Pola, protein powder brand Myprotein, and herbal products brand Twin Lotus from Thailand also made the top ten.

As mentioned in our previous article on emerging health categories, protein powder makers such as Myprotein are on the rise because Chinese consumers are beginning to go to the gym for the first time. Protein powder brought in 1.4 billion RMB in sales last year, and occupied 60% of the fitness supplements category, according to Euromonitor.

Movefree’s performance is also in line with our previous note that joint health and relief supplements are growing in popularity as China’s population continues to age. A study conducted in 2018 demonstrated that 42.8% of Han Chinese women over the age of 60 suffer from symptomatic knee osteoarthritis[3].

Given Pola’s and Twin Lotus’s unusually well performance this year, brands and retailers ought to spend more time looking into anti-aging and herbal cleansing products.

Mom & Baby-Related Health Products Dominated Azoya’s Retail Network Sales on Singles Day

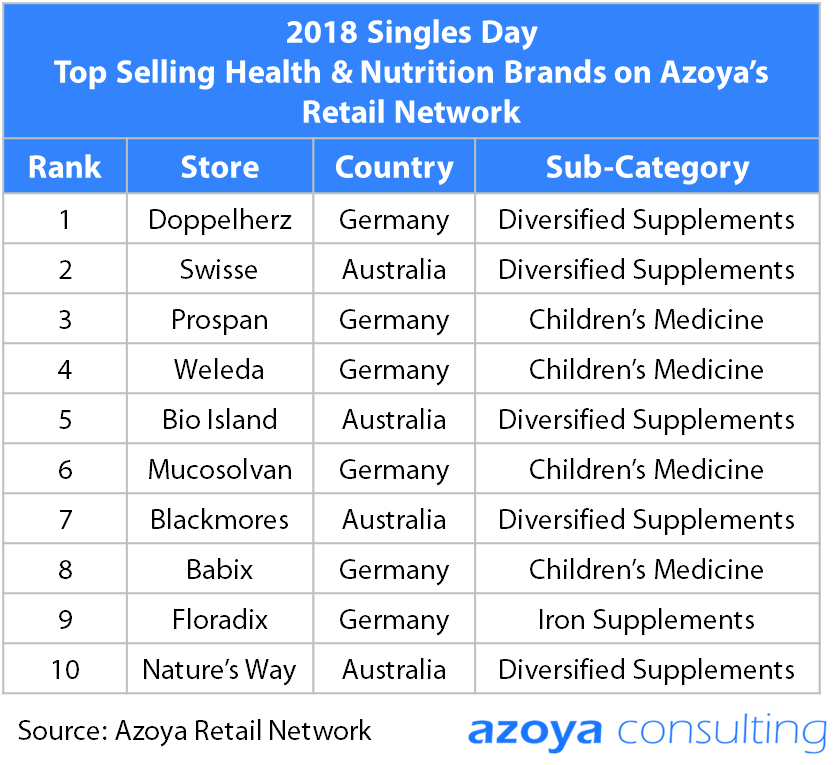

Our own cross-border retail network tells us a slightly different story. Not surprisingly, typical supplements brands such as Doppelherz, Swisse, Bio Island, and Blackmores made the list of top-selling brands.

However, what’s interesting to note is the list’s heavy tilt towards mom & baby products – four out of the top sellers were children’s medicine producers selling products such as cough syrup.

Even within the supplements category, many of Azoya’s individual top-selling SKUs consisted of calcium and iron supplements designed for pregnant women.

This makes sense, because many Chinese people place utmost importance on their children and are willing to spend what it takes to ensure their health. Many Chinese parents see spending on their children as a must, rather than as a discretionary purchase.

Key Takeaways

1. Western brands ought to think more critically about what their brand identity is and how it differentiates them from domestic competitors. While Western brands such as Swisse continue to dominate the supplements space, Chinese brands are continuing to grow their share of the market.

2. As Chinese consumers become more sophisticated, the health & nutrition sector will become more specialized and opportunities will arise for those targeting certain niches. While the usual supplements brands such as Swisse and Blackmores topped Tmall Global’s sales rankings, other more niche-focused brands such as anti-aging Japanese supplements brand Pola, UK protein powder brand Myprotein, and Thai herbal cleansing brand Twin Lotus also made the list.

3. Many Chinese consumers consider mom & baby-oriented health products as must-haves, rather than discretionary purchases. Top-selling health products on Azoya’s own retail network were those designed for the mom & baby category, which should be a focus for international brands and retailers looking to crack the China market.

[1] “New 11.11 GMV Record As Alibaba Ecosystem Goes All-In.” 11 Nov 2018. Alizila. 12 Nov 2018 < https://www.alizila.com/new-11-11-gmv-record-alibaba-ecosystem-all-in/>

[2] “天猫国际双11最全成绩单.” 12 Nov 2018. Ebrun. 13 Nov 2018 < http://www.ebrun.com/20181112/307356.shtml>

[3] “Common variants in the GNL3 contribute to the increasing risk of knee osteoarthritis in Han Chinese population.” 25 Jun 2018. Scientific Reports. 13 Nov 2018 < https://www.nature.com/articles/s41598-018-27971-4>