How to Capitalize on China's Booming Mom & Baby Sector

Health and food scandals are driving up demand for mom & baby products, and Chinese moms are willing to pay a premium for quality

by Azoya Consulting

China's latest vaccine scandal has made headlines across China, as parents around the country are protesting the central government's weak oversight of vaccine quality for their children.

Changchun Changsheng Bio-tech Co. was recently exposed for doling out over 350,000 doses of faulty rabies and DPT (diphtheria + tetanus) vaccines.

This is the latest in a series of health scandals that have eroded the public's trust in China's health and nutrition goods.

Because of incidents such as the country's notable melamine milk scandal in 2008, demand for imported maternity & baby products has grown rapidly, with foreign brands such as Gerber, Pampers, and Johnson & Johnson having become household names amongst Chinese parents.

China's Mom & Baby Market is Rapidly Growing

The abolishment of the one-child policy in 2015 and the emergence of wealthier millennial parents are also driving demand for this booming market. According to a 2017 survey by JD.com and 21st Century Business Herald, 73%-84% of millennial respondents were interested in having second children, depending on their income bracket.

A joint report by Frost & Sullivan and maternity-oriented e-commerce platform Babytree shows that spending on maternity & baby products amounted to 2 trillion RMB in 2017, accounting for 18.2% of average family spending.

This figure is expected to double to ~4.3 trillion RMB and account for 20% of average family spending by 2022.

E-commerce, comprising 16.3% of industry sales, is playing a large role, having grown at an eye-popping 59.5% CAGR over the last five years to reach 325.1 billion RMB in 2017.

As millennial parents become increasingly busy with work obligations and having to take care of second children, they are turning to marketplaces such as Tmall and JD.com for daily essentials such as diapers and baby food.

Maternity & baby-related e-commerce is expected to grow at a ~30% growth rate through 2022, at which point it will reach 1.19 trillion RMB in market value and occupy 27.7% of total industry revenues.

We discuss how international retailers and brands can better understand their target consumers below.

Millennial Moms in China Are Willing to Pay Up for Quality Products

A study by Frost & Sullivan and Babytree shows that when it comes to finances, the mother is the primary decision maker in 82.3% of Chinese households.

Chinese moms are primarily looking for product authenticity and quality, and are willing to pay a premium for it.

When asked for the most important factor when shopping online, 92.4% of consumers answered product authenticity.

Secure and on-time delivery accounted for just 6% of respondents.

Because of this, product research occupies a large portion of their time, but it also depends on the product category.

For categories such as milk powder and diapers, parents are likely to stay loyal to a few select brands.

iResearch's 2015 report on the mom & baby sector explains that for categories like baby formula and diapers, online shoppers view an average of 14 product pages a week when making a purchasing decision.

For highly fragmented industries such as children's clothing, they may view up to 69 product pages before making a decision.

This means that brands may have a chance to break into more fragmented categories such as apparel and food, but they also have to create highly curated and useful content to grab the attention of their target customers.

Where Are Millennial Moms in China Doing Product Research?

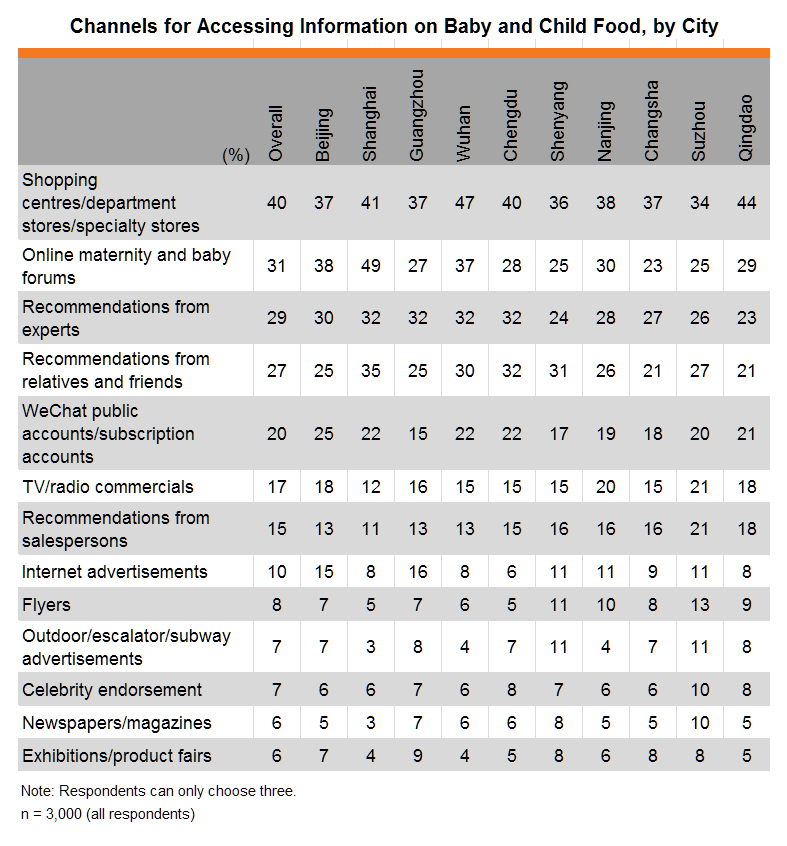

Reaching Chinese parents depends on which city they're in.

In a baby-food market study conducted by HKTDC, 31% of respondents mentioned that they find information on online maternity and baby forums, but this figure shoots up to 38% and 49% in places like Beijing and Shanghai, where customers are likely to be more digitally savvy.

Source: HKTDC

An omni-channel approach may be needed in smaller cities. An overall 40% of respondents mentioned that they go to offline retail stores to access information on baby products, but this figure goes up to 47% and 44% in places like Wuhan and Qingdao.

Mom and Baby Forums in China

Chinese parents, wary of fraudulent products, tend to think collectively when they make purchases.

They buy well-known brands, and when considering newer brands, they turn to other parents for advice on community forums.

They want to know how certain products look and feel in real life, such as how babies react to certain laundry detergent or lotion.

This type of information can’t be found in simple product descriptions, and a forum format is oftentimes more engaging than online product reviews.

Popular forums are MamaWang (妈妈网), YuErWang (育儿网), MamaBang (妈妈帮), LaMaBang (辣妈帮)and Babytree (宝宝树). For brands and retailers, these online communities can be good places to find out where your product fits in and place targeted advertisements.

Mom & Baby KOLs & Influencers in China

Since parents are oftentimes deluged with the amount of content and choices out there, having a go-to KOL/influencer they can rely on can help them cut the selection process down to just a few brands.

Short videos and livestreaming is oftentimes a good way for influencers to get their message across quickly.

Parklu lays out a list of top influencers in the maternity & baby space: LemonT, Nana, Tan Yuanwu, Huanzi, and Pity Flower Butterfly.

Their content provides both product recommendations and advice on parenting.

While larger brands can hire KOLs to sponsor their products, smaller brands with limited budgets can send free samples to a large number of smaller influencers and give them the freedom to write both positive or negative reviews.

Selling Mom & Baby Products Through E-Commerce

E-commerce is a popular avenue through which Chinese parents make purchases, especially due to the standardized nature of products such as diapers and baby wipes.

Even large, general marketplaces such as Tmall have created sections solely dedicated to the mom & baby category.

Here’s a quick overview below:

- General Marketplaces: Tmall, JD, Dangdang, Vipshop, RedBaby/Suning, Yihaodian

- Cross-border E-commerce Platforms: Kaola, JD Worldwide, Little Red Book, Tmall Global, Amazon

- Domestic Mom & Baby Platforms: Mia.com, Beibei.com, Babytree

- International Vertical-Specific Platforms: Babyhaven (mom & baby), Bodyguard Apotheke (pharmacy, mom & baby), De Online Drogist (pharmacy, mom & baby)

The emergence of category-specific marketplaces has been in part driven by content and community, in which both user-generated content and professionally generated content can answer parents' questions about product quality and child-rearing tactics in general.

Alibaba-backed Babytree began as an online forum and community first, and developed its e-commerce and advertising businesses subsequently. Today it has 139 million MAUs and over 1,500 KOL influencers on its platform, and recently went public on the Hong Kong stock exchange.

Even other vertical e-commerce sites like Little Red Book (Xiaohongshu) and Jumei, which historically focused on selling cosmetics and beauty products, are expanding into mom & baby products.

This is because their predominantly female user base makes them highly suitable for this product category.

However, retailers and brands have to make sure that their content is high-quality and on par with the quality of their products.

How to Woo Parents in the Chinese Mom & Baby Industry

- Having an omni-channel presence is important. E-commerce enables brands to target busy parents who don't have time to go to the supermarket, but offline retail enables parents in smaller cities to talk to knowledgable salespeople and test out products.

- Create alluring, useful content. Chinese moms are oftentimes first-time parents, and conduct a heavy amount of research before purchasing products for their kids. Having a presence on parenting forums and creating extensive parenting-related content provides a way for brands to build trust and stand out from the competition.

- Partner with KOLs/influencers in the mom & baby space. They can help lend a voice to your brand and gain trust from Chinese parents.