The Hottest Trends in China E-Commerce

As Amazon's Prime Day approaches in the US, we highlight some of the newest e-commerce trends in China

by Azoya Consulting

Amazon’s Prime Day is approaching, and US retailers are gearing up for the big event, which is scheduled to take place on July 16th.

Last year, Prime Day was estimated to have facilitated $2-3 billion in transactions.

And yet little do Americans know that, halfway around the world in China, JD.com’s 618 festival brought in US$25 billion in transaction value, up 37% from that of last year.

The success of the 20-day festival, which concluded on June 18th, demonstrates that China e-commerce is growing by leaps and bounds.

E-commerce players there, faced with increasingly stiff competition, are devising new methods to market and sell to their target customers.

And yet despite the festival pulling in a record $25 billion in transaction volumes, some merchants reported less than stellar sales figures.

This is bound to happen on a centralized marketplace platform in which there are millions of brands competing for the user’s attention.

As the marketplace grows, more and more brands sign up, saturating the platform and causing costs for product listing ads and keyword-based traffic to rise.

While others compete on cost by providing discounts, at some point those discounts cut into margins so much that they become less worthwhile.

So brands and retailers have to find other ways to stand out, and this goes for Amazon’s Prime Day in the US as well.

How Social Commerce is Changing the Game of E-Commerce

In China, merchants are integrating social promotions into their marketing strategies to increase user engagement.

This “social commerce” concept involves merchants offering group-buying discounts and mini-games that offer promotions and awards only to customers who successfully pull in a friend or family to make a purchase as well, often through WeChat, the primary social media application in China that contains both a messaging function and a news feed that displays your friends’ updates.

The rollout of WeChat’s mini-program function last year enables brands to set up a mini-store within the WeChat ecosystem. This makes it easy for users to share products and promotions and decentralizes the user acquisition process, as merchants can “activate” potential customers that didn’t intend to make a purchase in the first place.

One example is Pinduoduo, an upstart e-commerce platform that has grown to 300 million registered users in the span of just three years.

Pinduoduo’s promotions, targeted at consumers in smaller cities, offer steep discounts of up to 50% for group purchases, but the kicker is that 65% of its transactions are conducted through its WeChat mini-program.

This makes the process more social and interactive because it’s easier for users to share their shopping experiences and have friends participate in your promotions.

This is different than group-buying promotions in the US, where most invite-a-friend promotions are conducted through private e-mail.

JD.com itself is looking to leverage WeChat mini-programs to grow its social commerce presence as well.

During this year’s 618 festival, the number of users that accessed the JD.com mini-program topped 164 million, with over 10,000 brands having set up mini-stores on JD.com’s mini-program.

JD.com also notes that the number of group-buying orders increased 24 times over that of last year, and the number of group-buying customers increased 17 times.

Content is King in China

E-commerce is very content-driven in China, primarily because there is a much higher prevalence of fake and shoddy products, so merchants have to provide more details to assuage customers’ concerns of product authenticity. It’s not uncommon for a Chinese e-commerce product page to be stacked with 10+ pictures and in-depth, technical information about the product and its origins.

UK beauty retailer Feelunique displays substantial product information on its JD.com store

But in addition to having more detailed product listing information, Chinese marketplaces also have live-streaming channels in which well-known influencers review the latest products.

In addition to relying on friends and family, Chinese consumers also flock to well-known influencers when searching for reliable, trustworthy products.

Both JD.com and Alibaba’s Tmall placed an emphasis on livestreaming during this year’s 618 festival. For JD.com, over 130 celebrities and influencers were involved with promoting the festival itself, in addition to the ones hired by brands.

Alibaba’s Tmall collaborated with 18-year old Jackson Yee, member of the hit boy band TFBoys, to sell autographed photos through an interactive game.

In this game, users have to feed a virtual cat, as the main mascot for Tmall is a feline cat.

Users had to follow certain brand stores, such as Nokia, Elle, and M&G in order to win cat food.

This game was shared amongst users on WeChat, inviting users’ friends and family members to play as well.

This is just one creative way in which e-commerce players are trying to make the shopping experience more fun and interactive for users, retaining their attention.

Moving from Online Retail to Offline Retail

As e-commerce growth slows and it becomes increasingly difficult to acquire users online, e-commerce players ironically are setting up offline retail stores to acquire more customers.

For this year’s 618 festival, JD.com launched JOY SPACE pop-up stores in 292 cities throughout China, offering products from over 1,400 different brands.

These stores attracted 43 million visitors and racked up $49.6 million in sales.

And this year, Amazon in the US is extending Prime Day to its Whole Foods stores around the country.

Prime members will be able to receive an additional 10% off hundreds of sale items, as well as large discounts on other popular products.

Those who carry Amazon Prime Rewards Visa credit cards are also eligible to receive 10% back on up to $400 in purchases at Whole Foods.

The catch is that those who want to participate have to download the Whole Foods app and scan a QR code.

This enables Amazon to collect data on customer purchases and send targeted promotions to them in the future – an omnichannel marketing practice that is commonly used in the China market.

Amazon Adapts to the China Market

In China we can also see Amazon adopting some Chinese e-commerce practices.

This year, Amazon China is extending its prime sales to a prolonged 52-hour period; while not quite as long as JD.com’s 618 festival, it is longer than the 36-hour period that constitutes Prime Day in the US.

Each day leading up to the final day will feature a different category with ultra-low prices.

This year Amazon is also featuring a special promotion with WeChat Pay, in that customers who spend over 200 RMB on Prime Day will have a chance to win anywhere from 1-100 RMB off their order, specifically for cross-border orders from the US, UK, Japan, and Germany.

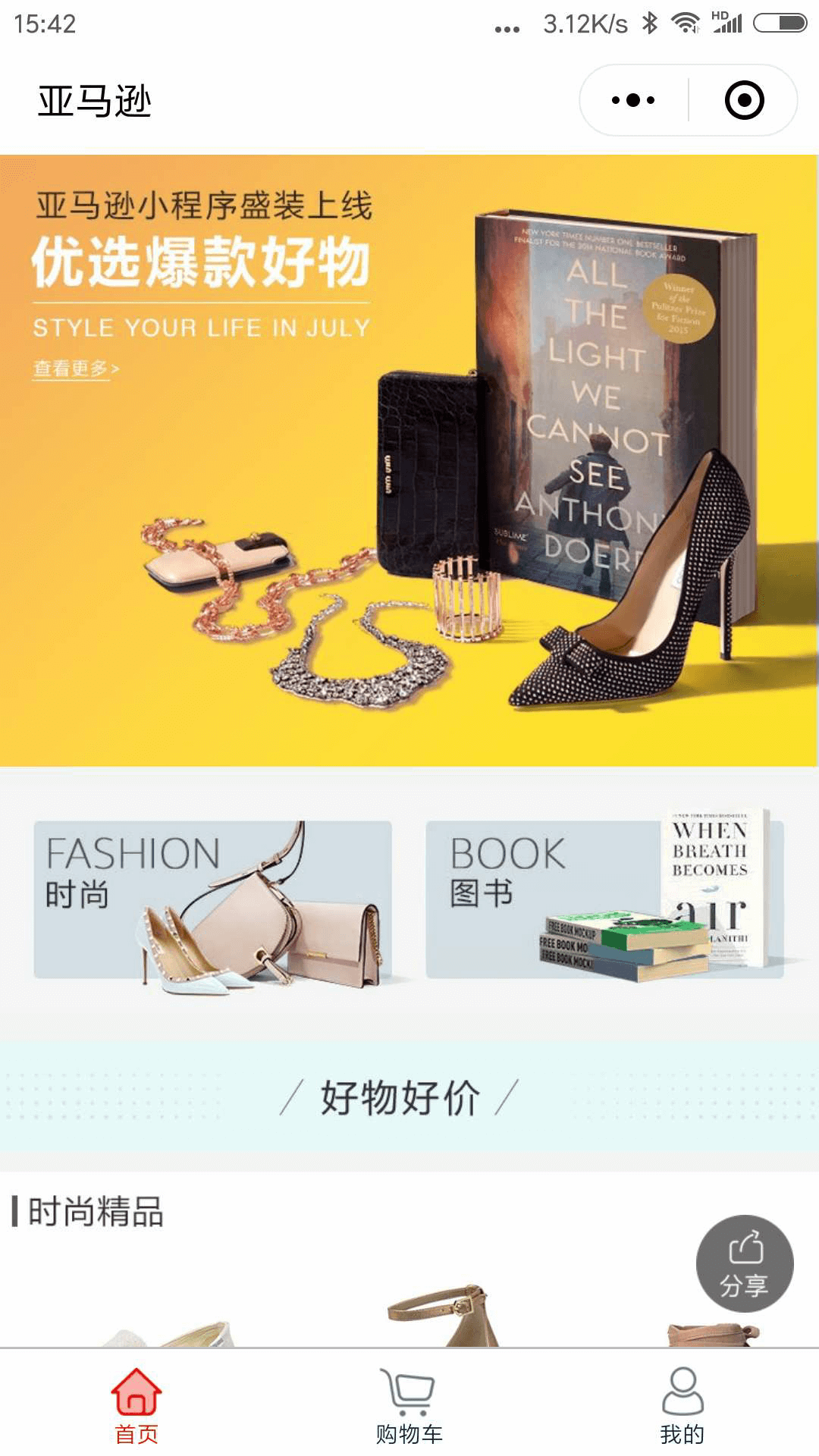

Lastly, Amazon China launched its own WeChat mini-program on July 3rd, in preparation for Prime Day, focusing on selling fashionable clothing and books.

This demonstrates that Amazon may be experimenting with social commerce as well.

The mini-app has a refined feel to it, including a content-rich shopping guide that highlights some of the most popular items, falling in line with the notion that Chinese consumers prefer to see more content when shopping online.

![]()

Why US Retailers Should Pay Attention

The characteristics of the China e-commerce market demonstrate how the US e-commerce market could change in the future, especially as Amazon continues to dominate the retail industry and more and more brands plan to list products on the Amazon platform.

As US retailers and brands continue to struggle in the face of falling foot traffic and increased online competition, perhaps they could learn a lesson or two from their Chinese counterparts, who have learned how to create a more wholesome, interactive shopping experience online that enables them to stand out from their competitors and build a stronger connection with their customers.