Tmall Global and Other Marketplace Changes in 1Q 2019

Tmall Global is raising standards for merchants on its platform this year, and other platforms are making changes as well.

by Ker Zheng

In 2019, there have been a flurry of updates regarding rules and changes on China's top cross-border e-commerce platforms. This includes Tmall Global, JD Worldwide, Netease Kaola, and Xiaohongshu (Little Red Book).

The overarching theme is that the platforms are all raising requirements and compliance standards for merchants, in an attempt to assuage consumer concerns over product authenticity. Recently, the cross-border e-commerce industry has been rocked by multiple accusations of merchants selling fake goods; the most notable was Kaola's PR incident with a fake Canada Goose jacket in January.

Some platforms are rumored to be introducing measures that require merchants to trace the authenticity and origins of their goods throughout the entire supply chain.

We break down some of the recent changes below.

Tmall Global Changes in 1Q 2019

Tmall Global Expands Inventory to >1 million items

Tmall Global announced on February 28th that it will expand the number of cross-border items on its platform to over one million within the next year.

This will make it the first CBEC platform to surpass one million SKUs, making it the largest in China.

Beauty will also be a focus, as Tmall Global pledged to add 1,000 new beauty stores to its platform this year.

Earlier this year the central government announced that 63 new product categories(incl. certain F&B products, home appliances, and pharmaceutical drugs) would be added to the list of approved products for cross-border e-commerce.

Tmall Global's expansion plans could be a response to this policy change, as China appears to be opening up cross-border e-commerce to more categories.

Tmall Global Expands Overseas Warehousing Solutions

Tmall Global also noted that multi-brand retailers shipping through cross-border direct shipping must store their inventory in overseas Cainiao warehouses.

The air waybills on each package must show that the package originated from Cainiao warehouses.

This is because Tmall wants to assure customers that its products are authentic and originated from trustworthy overseas suppliers.

Cainiao will also be providing more services to help with overseas warehousing, packaging, and fulfillment.

These requirements will take effect beginning May 15th.

Looking to get on Tmall? Check out our Marketplace Operation Services: Tmall and Other Marketplace Services |

Tmall Global Rolls Out New Quality Assurance Plan

As China's cross-border e-commerce industry continues to heat up, the big players are investing more and more in customer experience.

Guaranteeing product quality and authenticity is one initiative that all the major players are pushing.

On February 12, Tmall Global announced a new quality assurance plan that will focus on four key measures:

- brand authorization

- service commitment

- quality certification

- strict supply chain assurance

The plan will first focus on nine major industries, including apparel, beauty, mom & baby, etc. and later expand to other industries.

The quality assurance plan requires that businesses provide a certificate of authorization from the brands they're selling (trademark owner). The authorization must be valid within that particular time period, and need to be updated if they expire.

Other guarantees include refunds for customers who find that they're allergic to certain cosmetics items, and refunds for certain items that are found to be broken upon arrival.

Source: Tmall Global Official Website

Other Rules and Changes

New rules announced on February 15th also note that if customers cannot provide their national ID information or happen to provide incorrect information, the transaction will be closed within 30 days after payment.

Also, if customers surpassed the new annual transaction limit on cross-border e-commerce purchases (26,000 RMB), the transaction will be closed after 30 days.

Lastly, rules announced on January 21st also raised the deposit amount required for merchants selling health-related products.

Brand flagship stores selling OTC pharmaceutical drugs, medical devices, and family planning products have to post 300,000 RMB in deposits, while multi-brand retailers have to post 800,000 RMB in deposits.

Brand flagship stores selling contact lenses and solution now have to post 500,000 RMB in deposits, while multi-brand retailer stores have to post 800,000 RMB in deposits. These changes came into effect on January 28th.

Tmall Global Fees & Commissions

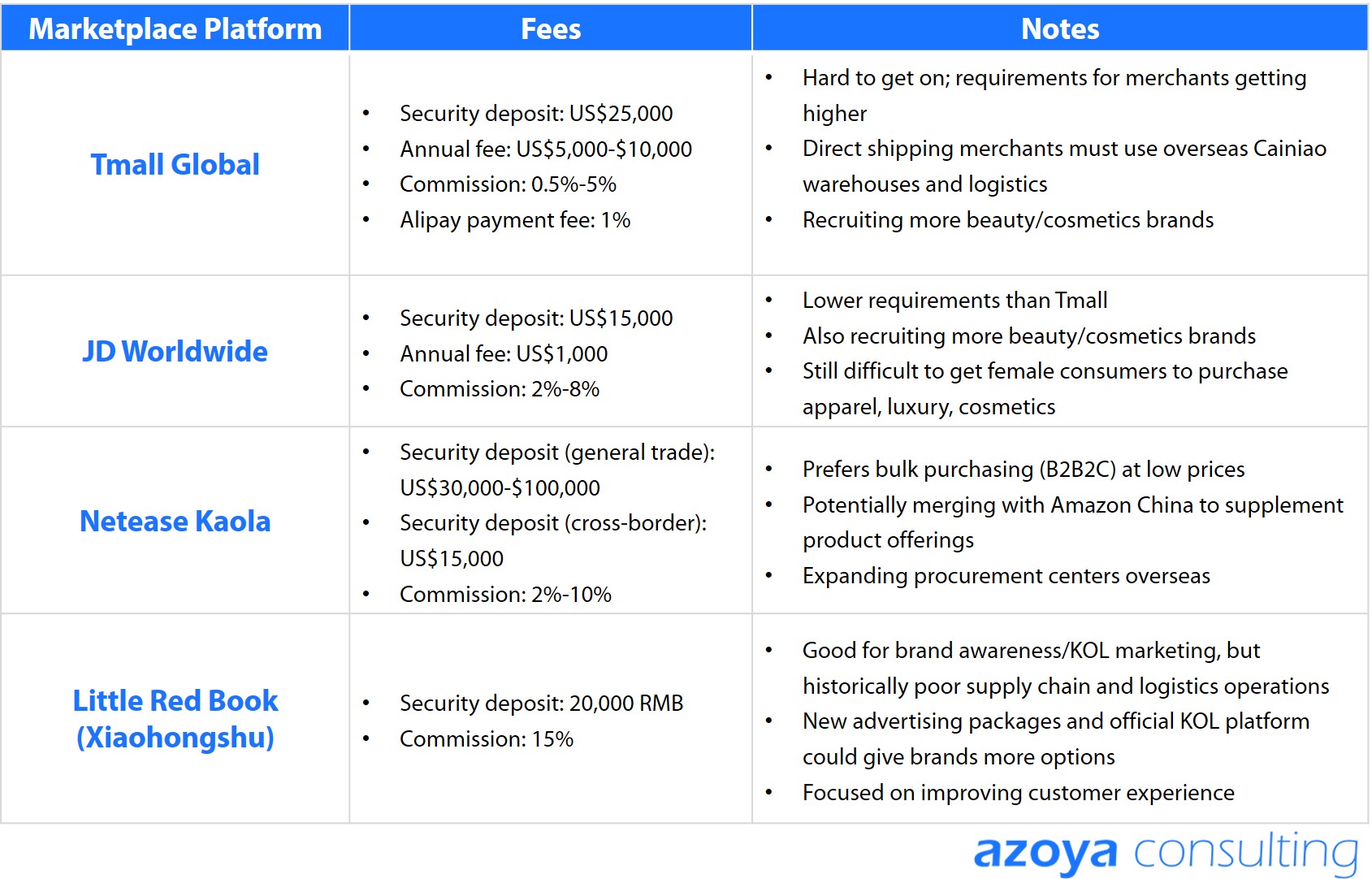

For most categories, Tmall Global requires a US$25,000 deposit, an annual service fee of $5,000-$10,000, a commission of 0.5%-5%, and a 1% Alipay transaction fee.

JD Worldwide Changes in 1Q 2019

JD Worldwide Eliminates Minimum Revenue Thresholds for Sellers in Certain Categories

On December 4th, 2018, JD Worldwide eliminated the requirement that priority one category (food & beverage, alcohol, fresh seafood, animal-related products) sellers had to reach 50,000 RMB in sales a month to renew their licenses for 2019.

However, those selling home appliances, pharmaceutical drugs, and health & nutrition products were not so fortunate, and their requirements remained at the 50,000 RMB mark.

Those who cannot reach this benchmark will be designated Class B merchants, and this means that JD.com will remove half of these sellers from the platform.

The threshold for apparel, bags/luggage, and outdoor equipment/apparel categories remained at 20,000 RMB/month, while the threshold for beauty/cosmetics remained at 10,000 RMB/month.

This indicates that JD Worldwide may be saturated with home appliances and health & nutrition drugs, but could have a shortage of merchants selling F&B, fresh food, and cosmetics products.

JD Raises Requirements for Sellers

On February 27th, JD Worldwide notified merchants that it will require copies of their business licenses and licenses that show that they're an official agent of the brands they represent. Additionally, there must be a domestic Chinese party willing to take responsibility for the imported items in case any incidents with fake or shoddy products occur.

JD Worldwide Fees & Commissions

JD Worldwide has lower requirements than Tmall Global.

JD Worldwide requires just a US$15,000 deposit, an annual US$1,000 service fee, and 2-8% commission rates depending on the product category.

Netease Kaola Changes in 1Q 2019

Kaola's platform may be set for major changes this year, given its recent PR incident surrounding a potentially fake Canada Goose jacket in January.

It now requires a domestic party in China to pledge responsibility for imported products in case issues with fake/shoddy goods arise. And Kaola is developing a system to automatically deduct from merchants' deposits if something does happen.

The domestic party has to provide a copy of a Chinese contract that shows that a foreign brand/retailer has entrusted the importing company with responsibility for importing products.

The party also has to provide a copy of a business license, customs registration certificate, etc.

Materials also have to demonstrate that the party has the authority to sell products through e-commerce.

Kaola adds requirements for key account clients

Lastly, Kaola may be adding additional requirements for its key account (KA) clients. While this is a relatively new guideline, it indicates that these merchants should have:

1. a globally recognized reputation,

2. be in the top three of the respective categories in their home countries

3. have more than 10 offline physical stores, or a gross floor area of over 2,000 sqm.

TPs must demonstrate proof that they have the authorization to represent the brand in China.

Additionally, if any PR incident arises that pertain to authenticity issues, the brand must provide proof of product authenticity and origin, in order to assuage customer concerns over fake products.

Lastly, key account clients must agree to occasional quality assurance inspections of their warehouses.

Little Red Book Changes in 1Q 2019

Little Red Book Opens Up Advertising for Brands

Xiaohongshu this year launched advertising packages for brands.

Instead of a CPC advertising model, it will offer fixed price packages to select brands - the ads will show up on the Discover tab, which consists of a news feed of interesting updates.

However, the ads also are not very targeted, as brands have no way to target users by geography or interest.

Little Red Book Launches Official KOL Platform for Brands

Xiaohongshu also launched an official influencer platform, through which brands can select KOLs and view their fees per post.

KOLs have to tag the brands' official accounts in their posts.

KOLs must have at least over 1,000 followers with a certain number of average post views per month.

Little Red Book Launches Product Review System

Lastly, Xiaohongshu also launched a product review system for its e-commerce products (Feb 15).

Reviews will appear below product listings, and customers will have the opportunity to leave reviews within 90 days of receiving their products.

Key Takeaways

1. Marketplace platforms are investing in a better customer experience. This makes sense. Since they are all selling the same brands, they are providing a commodity service. To differentiate themselves, they need to 1. reduce shipping times, 2. guarantee product authenticity, and 3. procure a wider array of products to create a one-stop shop for everything cross-border-related.

2. Some of the platforms are requiring merchants to have a trusted China-based party to take responsibility for product authenticity. This is likely because of the Kaola / Canada Goose incident, which dramatically reduced consumer confidence in Kaola's ability to prevent fakes.

3. Little Red Book is doubling down on monetizing its lucrative user base. In addition to e-commerce, it is providing more advertising options for brands on its platform. This is smart - it realizes that its user base is highly loyal, and brands are willing to pay up for access to this lucrative base. The two questions going forward is 1. will monetizing the platform negatively impact the user experience and 2. can it provide better, more targeted ad features in the future?