Affordable Luxury in China: Unveiling the E-Commerce Strategies of Coach and Michael Kors

In this article, we explore how Coach and Michael Kors navigate the Chinese market, influencing their different performances.

by Azoya

In the post-pandemic landscape, ordinary consumers are increasingly prioritizing value-driven purchases, seeking products that offer tangible benefits. In contrast, the affluent continue to pursue high-end luxuries. This dynamic places affordable brands in a challenging position, navigating the delicate balance between these two consumer segments.

In August 2023, Tapestry Group acquired Capri Holdings for $8.5 billion, challenging luxury giants like LVMH and Kering. The Tapestry Group owns Coach while Capri Holdings owns Michael Kors (MK), both of them are the representative brands of affordable luxury. In Q1 2024, MK experienced a 13.08% decline in revenue, totaling $787 million. Meanwhile, Coach reported a noteworthy 9% year-over-year growth in Greater China, as disclosed by 36Kr, the Chinese economy and technology media outlet. This article explores how Coach and Michael Kors navigate the Chinese market, influencing their different performances.

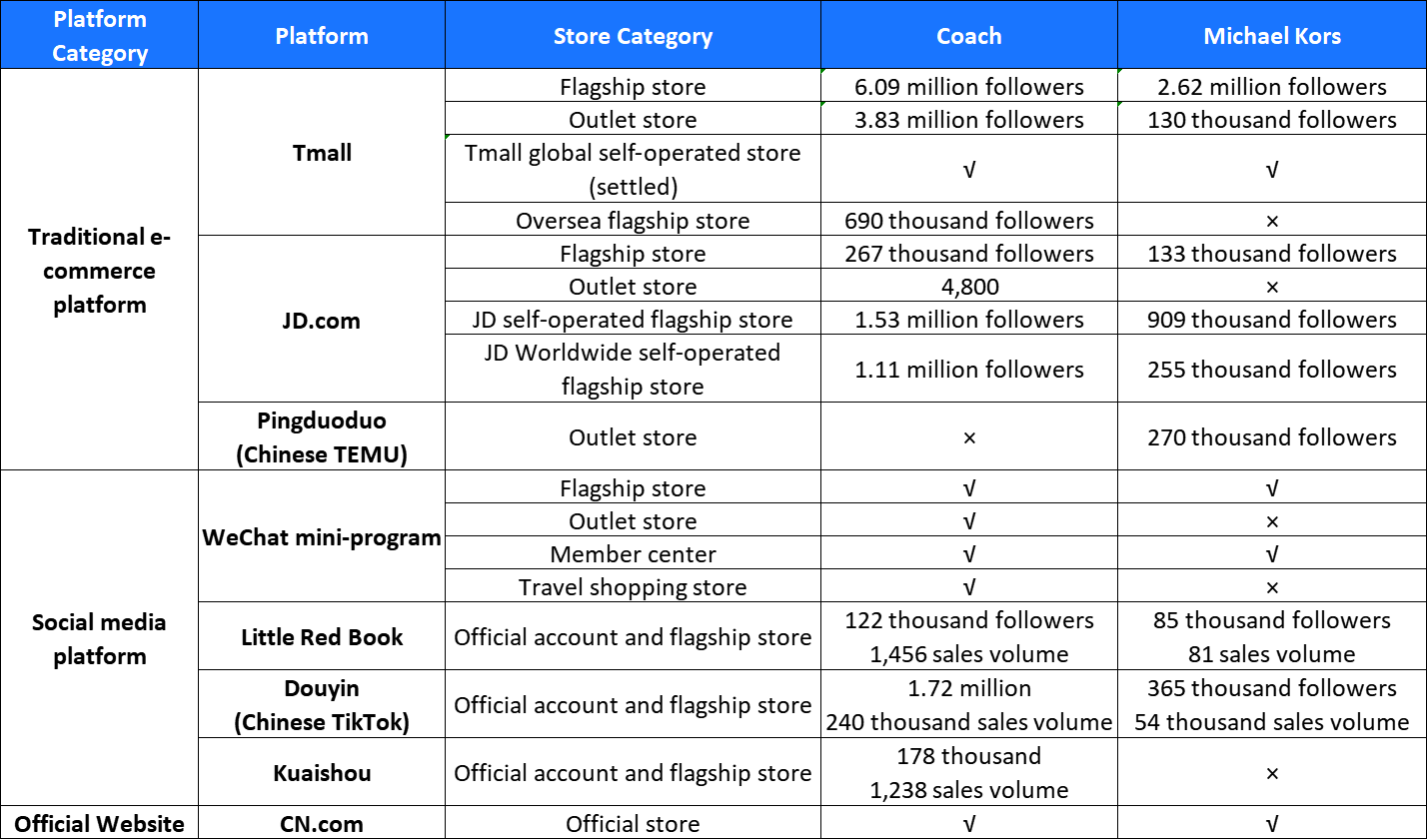

The Comparison of sales channels between Coach and MK

Coach and MK employ a multi-channel strategy to expand their brands in China, utilizing traditional e-commerce platforms, social media, and official websites. Notably, Coach has established both inbound and outbound flagship stores on Tmall, China's largest e-commerce platform. This move reflects their ambition to attract both local and cross-border customers. While the delivery time may be longer, consumers have the advantage of purchasing the latest or limited editions not yet launched in the Chinese market.

On Pinduoduo, a platform known for great deals (Chinese TEMU), Michael Kors takes a different approach by opening an outlet store to sell fashionable products at discounted prices. While Pinduoduo is effective for driving sales with its attractive deals, it may not be the ideal platform for brand development, especially for luxury brands. The consistently low prices on Pinduoduo could potentially dilute the brand value.

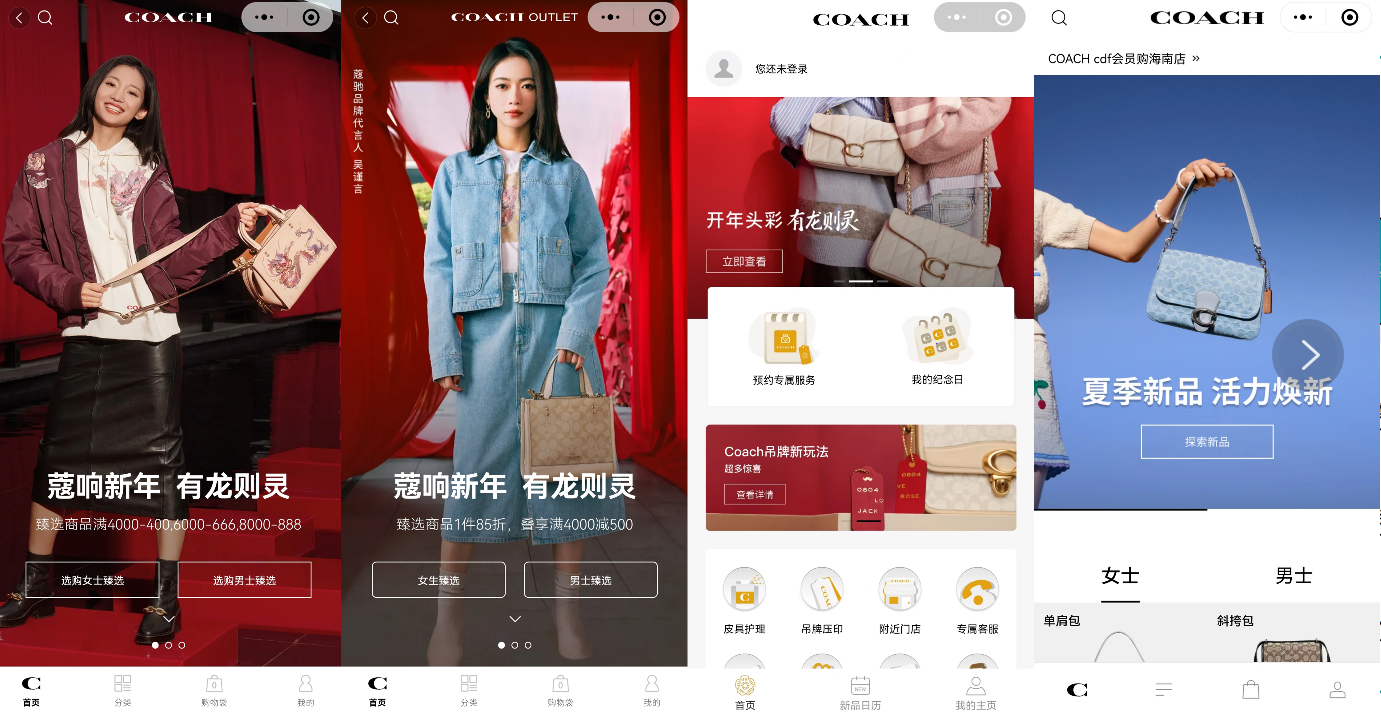

Coach and MK leverage China's largest social media platform, WeChat, with mini-programs to tap into its 1.33 billion monthly active users (MAU). MK uses two types – an official program and a member center – to maintain customer relationships and boost repurchase rates. Coach extends its reach with mini-programs for its outlet store and travel retail. The 'Coach Travel Shopping' program allows users to buy from Coach's duty-free stores in Hainan, China, with options for delivery or in-store pick-up. This aligns with the remarkable 25.4% YoY increase in duty-free sales on Hainan Island in 2023, reaching 43.76 billion yuan (US$6.13 billion). These travelling traffic provides a key opportunity for brands to drive sales.

Coach’s WeChat mini-program matrix

The Comparison of marketing between Coach and MK

Coach and MK engage in live streams on Douyin and Taobao Live to attract new customers and boost sales. With the Chinese Lunar New Year approaching, their livestream focuses on releasing new year limited products and promoting holiday season offers. In addition to Douyin and Taobao, Coach is expanding its live-streaming presence to platforms like Little Red Book (LRB) and Kuaishou. LRB, a social commerce platform and UGC community with a user base primarily consisting of females from one or two-tier cities serves as an ideal platform to connect with Coach's targeted audience.

Both Coach and MK enhance their brand presence in China through collaborations with celebrities and Key Opinion Leaders (KOLs). Coach partnered with actress Jinyan Wu, while MK joined forces with actress and singer Jianci Tan, leveraging their influence to expand their businesses. However, MK distinguishes itself with a focus on the 'Big Product Strategy' ('大单品策略' in Chinese). They engaged various stars, including Zi Yang, Mengyao Xi, Xin Qiao, in the Tribeca handbag launching event. All these KOLs showcased the same series product, aiming to not only boost Tribeca sales but also drive sales for other products, contributing to overall growth.

MK Tribeca Handbag

While MK focuses on the 'Big Product Strategy,' Coach invests in Search Engine Marketing (SEM) on Baidu, China's largest search engine with 663 million Monthly Active Users (MAU) in 2023. When users search for terms like Coach, '蔻驰' (Coach in Chinese), affordable luxury, luxury bags, MK, and Michael Kors, Coach's official website ads appear. Similarly, when searching for MK and Michael Kors, MK's ads are displayed. This strategic use of relevant keywords enhances their visibility and increases opportunities to reach potential customers.

Coach is actively transitioning into a younger and more contemporary brand to meet the demands of the younger generation. Introducing new elements like rivets, camellias, and dinosaur motifs in their products, Coach is challenging consumer stereotypes and attracting a younger demographic that values style, personality, and quality over just prices. Embracing localization, Coach collaborates with Chinese brands, such as partnering with 'Big White Rabbit' (‘大白兔’ in Chinese), a traditional milk candy brand of Shanghai, during the Year of the Rabbit in 2023. aiming to evoke nostalgia and strengthen emotional connections between brands and the young generation. Additionally, Coach collaborates with platforms popular among the youth, such as Poizon, Little Red Book, and Kuai, offering exclusive versions of products.

Coach × Big White Rabbit collaboration

In conclusion, While still transitioning, Coach is positioning itself as a high-end lifestyle brand. In 2022, they adjusted their pricing strategy, raising product prices and reducing discounted items to maintain brand value and establish a 'high-end' image. The multi-channel strategies, innovative designs, and various marketing events employed by Coach resulted in positive outcomes in 2023.

On the other hand, MK maintains its 'Jet Set' brand style, rooted in the 1960s concept when elites and celebrities travelled in private jets but kept camera-ready. Retaining classic design elements, adopting a 'non-radicalized' live stream approach, and strategically partnering with the 35th Golden Rooster Film Awards in September 2022, MK conveys a timeless and iconic style.

Key Takeaways:

After reviewing the strategies Coach and MK took to develop in China’s market. We provide some tips for affordable luxury and niche designer brands for their startup in China.

Emphasize brand development over discounts. Excessive discounted products would diluting brand value. The first step is to clearly define the brands’ positioning and unique selling points to attract the targeted audience effectively. Additionally, boosting brand awareness through events and collaborations like exhibitions, social media campaigns and collaborations with influencers and other brands.

Moreover, adapting to Chinese e-commerce and social media platforms. Understanding the differences between Chinese and Western ones and providing tailored selling strategies based on each the unique characteristics of each platform.

Localizing the products in terms of product design, marketing and brand stories would build closer connection with the consumers. In China’s highly digitized landscape, utilize technology, such as VR, AI, live streams to provide personalized product & service recommendation. This would enhance the shopping experience increase the repurchase rate and the build brand loyalty.