The Most Frequently Asked Questions We Get About Cross-Border E-Commerce

We break down the basics so that you can better understand how cross-border e-commerce works

by Azoya Consulting

Entering the China market is hard. The language, ecosystem, and rules are very different from those of overseas markets, and many foreign executives are often overwhelmed by the complexity of the market.

With that being said, cross-border e-commerce has emerged as a great, lightweight approach to testing the China market, without having to register a local entity or deal with extensive product registration processes.

We answer some of the most frequently asked questions for those looking to learn about cross-border e-commerce in China.

1.What is the definition of cross-border e-commerce in China?

To put it simply, cross-border e-commerce is the online purchase of goods from abroad, typically from merchants that operate in different countries, different jurisdictions, and even different languages.

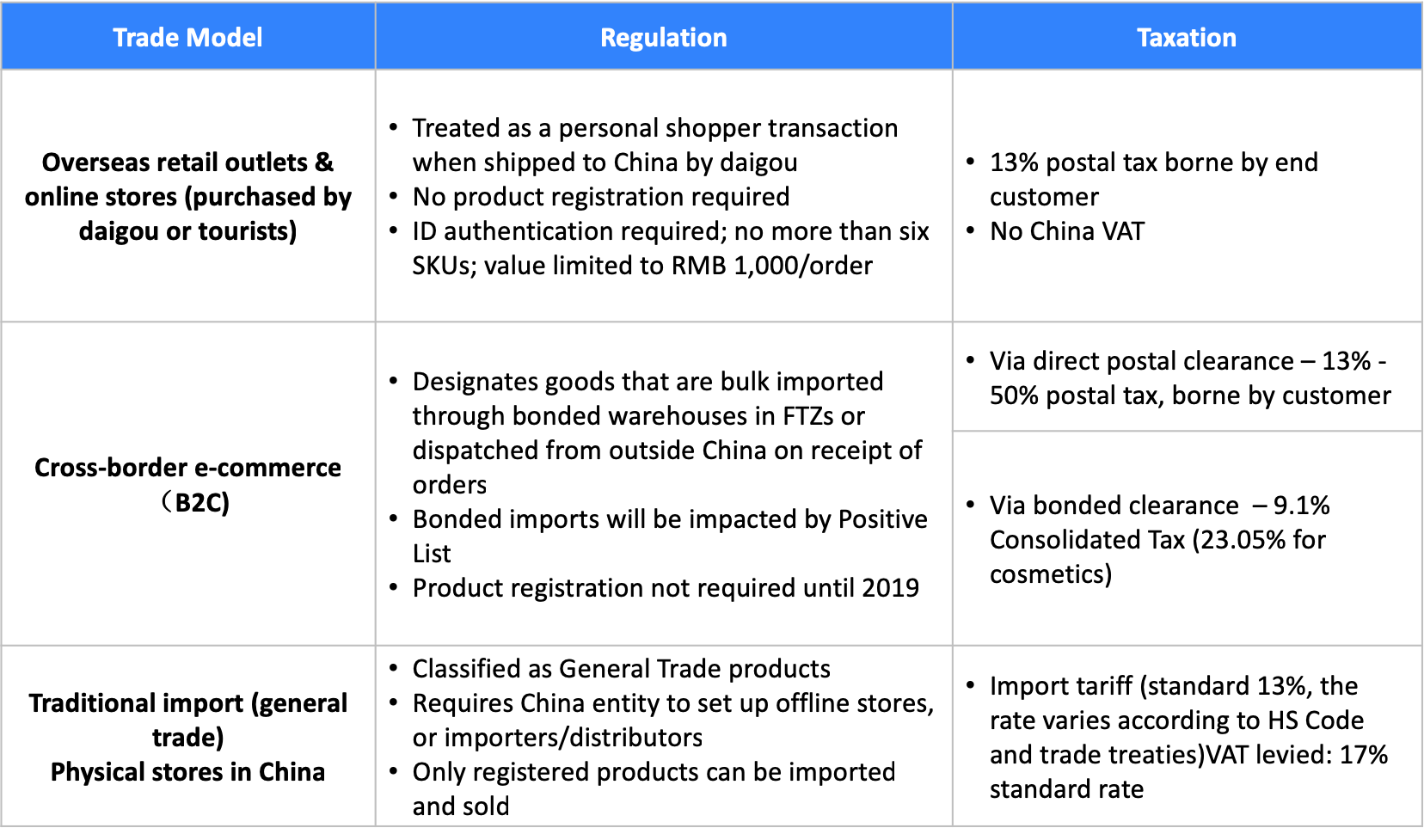

This means that brands can sell and ship products directly to Chinese consumers, through special customs clearance regulations that are different from those of general trade. China’s CBEC pilot zones and their special customs clearance gateways enable them to do this.

International retailers and merchants can stock goods in their home countries or bonded warehouses in Hong Kong or Chinese free trade zones, reducing the inventory risk of exporting to China and stocking them in Chinese warehouses. This also eliminates the need for wholesalers or importers in the middle.

2.What are the common ways for products to enter mainland China via cross-border e-commerce?

There are generally three legal ways for products to enter via cross-border e-commerce and it depends on where the warehouse is located.

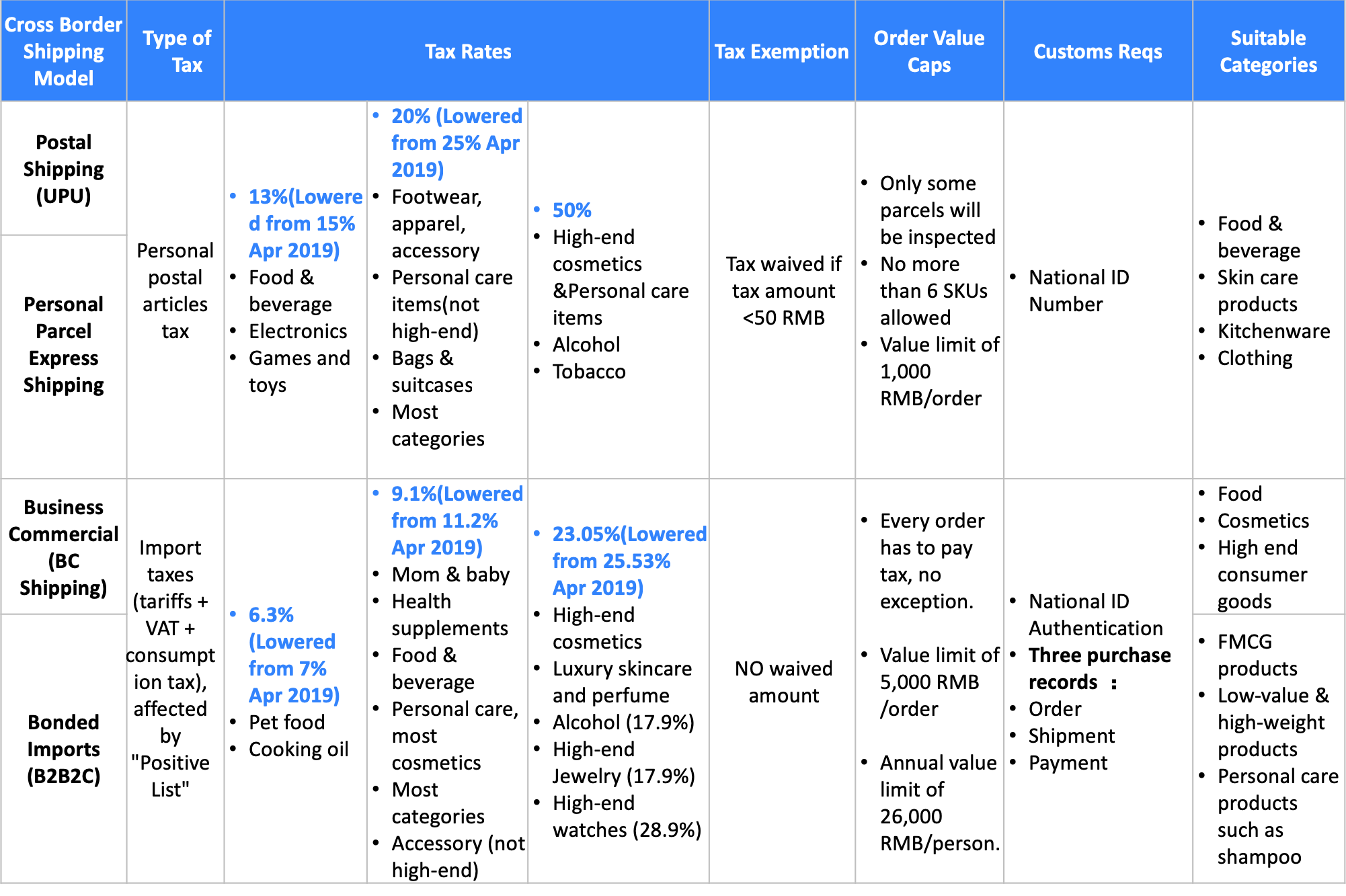

Under UPU (universal postal union) postal shipping, different postal offices around the world collaborate to ship small personal packages across borders; in China, government-run China Post Group handles last mile delivery for cross-border postal shipping.

Postal shipping corresponds to personal customs clearance, and products do not have to have import permits or registration filings. While most packages go through customs without a hitch, customs officials may inspect a small percentage of packages, which may be levied a postal tax of 13%, 30%, or 60%, depending on the product category.

Business Commercial shipping (often referred to as B2C imports) is a formal import e-commerce model that was introduced in 2016. Under this model, merchants who sell directly to Chinese consumers pre-register their products as B2C shipments and three types of information (order, payment, and delivery info) are provided to Chinese customs authorities before the packages arrive.

The bonded importing model involves the stocking of inventory in bonded warehouses in Hong Kong or free trade zones in mainland China, so as to facilitate the faster fulfillment of orders.

This drastically cuts down shipping and customs clearance times, but creates larger inventory risk in that merchants must be able to forecast customer demand to figure out how much inventory to stock.

3. What are the restrictions for cross-border import? What is the ‘Positive List’?

Postal Import (or UPU for reference)

For postal shipments, there should not be more than six items, and altogether the value of the items should not be more than 1,000 RMB.

However, if the shipment consists of just one item, then there is no limit on the value of that one item. Merchants should think carefully, however, if they want high-value items such as handbags to be handled by postal couriers.

Products cannot be on the list of banned items of either the national post office or China customs.

There is no requirement for the products to acquire import permit from the Chinese customs or registration filing. Retailers should provide details of the products and the recipient for customs declaration purposes.

Cross-border E-commerce Import

The Positive List was introduced in April 2016, and the government designates certain items as eligible, and other items as ineligible.

Products not on the list need to have import permits, registration forms (e.g. nutrition products need to apply for CFDA permit for domestic circulation and sales) and other filings, which are pre-requisites for customs clearance certificates.

However, these requirements have not been enforced and all items are still regarded as personal items, though they are taxed under the Business Commercial tax rates.

Each transaction is limited to 5,000 RMB per order, and each person has an annual limit of 26,000 RMB. These limits were raised on November 21st, 2018 by the State Council.

4. Is cross-border e-commerce a long-term solution for me?

For some brands/retailers, cross-border e-commerce is a stepping stone for those who want to test the market but eventually move to general trade, where they can stock inventory in China and set up offline retail operations.

For others, cross-border e-commerce can be a long-term solution for those who choose not to build out complete retail operations in China. Sometimes going through the general trade import channel is a major hassle.

For health & nutrition products, entering China through general trade requires an expensive and lengthy product registration process with the China Food & Drug Administration, which sometimes can take years.

For cosmetics products, entering China through general trade requires animal testing for product approval purposes, which many international cruelty-free brands refuse to do.

For other categories such as mom & baby or luxury products, consumers may prefer to purchase from abroad because of the prevalence of fake goods in China. Since China customs is cutting down on the gray-market daigou trade, cross-border e-commerce is likely to become more popular over time.

5. How Should I Budget for a Cross-Border E-Commerce Strategy?

Retailers that choose to enter the China market via cross-border e-commerce need to invest in these areas:

· Setting up and maintenance of IT systems

· Modification/upgrading of existing WMS/OMS/ERP systems

· Warehousing and stocking inventory

· Cross-border shipping

· Promotional campaigns and other marketing activities

· Payments integration

· Daily operations for China market and miscellaneous spending

6. Do I need a warehouse in the free-trade-zone?

If you are just starting to sell to China, the answer is most likely no. Free-trade-zone warehouses, also known as bonded warehouses, store goods that have not gone through customs clearance but can fulfill orders quickly due to their close proximity to Chinese consumers.

However, the inventory risk is high as a newcomer to the market; if you cannot sell your inventory you will likely have to write it down.

Bonded warehousing is more for larger players who have predictable volumes. Once you build up your business and customer demand, then you can think about moving your stock to a bonded warehouse for a better customer experience.

7. Where should I launch my online store?

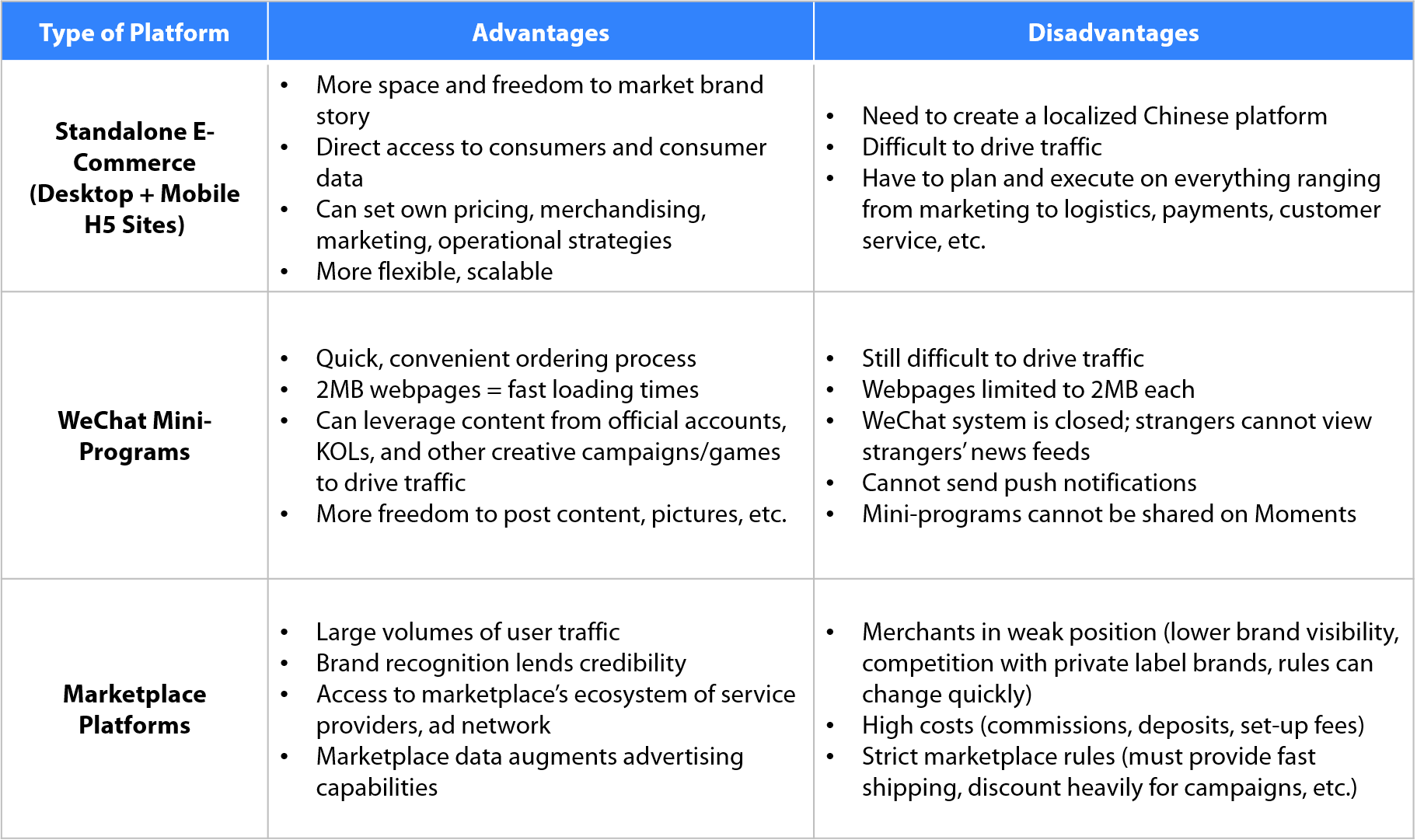

There are many reasons you need to take into consideration when launching a cross-border e-commerce store in China. You can either set up your own standalone e-commerce presence, get on a large platform such as Tmall Global, or launch your own WeChat mini-program to take advantaeg of WeChat's billion-plus user base.

Factors include your budget, how much control you want over data and the customer experience, what kinds of profit margins you're looking for, and more.

We present a brief overview below:

8. Do I need a local partner for cross-border e-commerce?

In most cases, yes. Many marketplaces such as Tmall Global and JD Worldwide require that international brands/retailers use a local service provider to set up and operate their stores, because there are many rules and guidelines that must be complied with to ensure a positive customer experience.

For standalone e-commerce stores, some of the larger F500 companies may have the resources to do everything in-house, but some may still choose to outsource set-up and operations because it can oftentimes be more efficient than coordinating a large organization.

The value of a good local partner:

· They can provide turnkey, end-to-end solutions that are oftentimes more efficient than what international brands/retailers can coordinate on their own.

· They are more knowledgeable of the local dynamics in the market, including consumer trends and regulatory changes.

· They are motivated by shared financial incentives resulting from the long-term success of your China business

9. Do I need to register a Chinese Trademark to do business in China?

· To ensure the sustainability of your business, brands are usually advised to register a trademark in China. It's crucial to have the trademark in your possession before launching any marketing efforts to prevent its misuse.

· For cross-border e-commerce, multi-brand retailers may not necessarily require a Chinese trademark. Most cross-border e-commerce platforms only request overseas retailers to provide registered Class 35 trademarks (and retail venue trademarks).

· Brands can register their trademarks in China through an attorney or specialized intermediaries. We recommend prioritizing Madrid Protocol trademark registration to cover the Chinese market.

· Before engaging with Chinese agencies or business entities, we also recommend that brands sign non-disclosure agreements or proactively protect their trademark.

For more information about registering a Chinese trademark, please read this article.

See the rest of the article