Brands Are Doubling Down on WeChat Channels -- Here's What DTC Brands Can Learn From Them

by Davy Huang & Maggie Yu

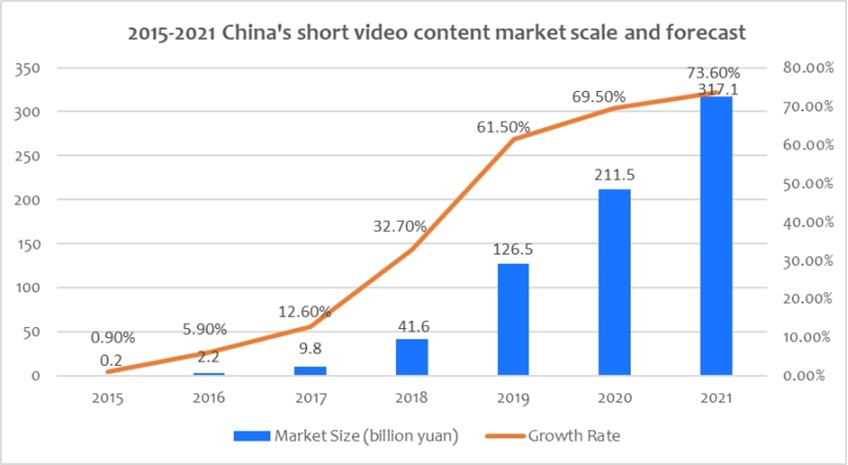

Short video marketing is becoming an indispensable part of brand's digital journey in China. With the rapid evolution of the mobile Internet technology and the advancement of mobile network infrastructure, the short video content market is booming. The scale of the short video content market increased from 200 million CNY ($31 million US) in 2015 to 126.5 billion yuan ($19 billion US) in 2019, with an average annual compound growth rate of 401.5%[1]. It is expected to continue to grow substantially to 211.5 billion CNY ($32 billion US) and 317.1 billion CNY ($48 billion US) from 2020 and 2021.

Source: China Business Intelligence Network

Amid the explosive growth of the short video industry in the past few years, Douyin(TikTok)and Kuaishou are undoubtedly the leading platforms. In the context of the short video industry pattern that seems to have been firmly established, social media powerhouse WeChat launched its WeChat Channels feature in 2020. So, what is the difference among WeChat Channels and TikTok and Kuaishou? Will WeChat Channels still have a chance to win back market share in short videos? How should brand owners start with Wechat Channels?

What is WeChat Channels?

WeChat has gained global marketing power, as it is the most popular social network app in China. This dominance became its biggest advantage when launching WeChat Channel – tech giant Tencent's version of TikTok.

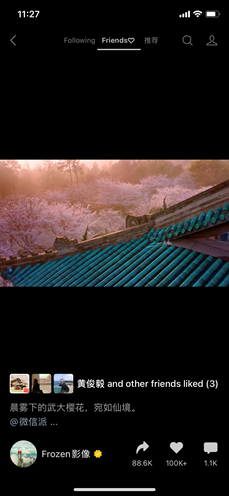

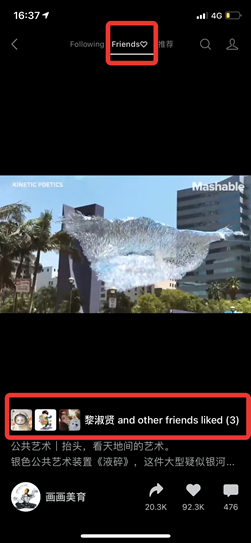

WeChat Channels screenshot

Douyin (TikTok) and Kuaishou both possess a huge number of daily active users – but neither of them possesses the sophisticated social connections among users like that of WeChat's friendship network. The most prominent feature of WeChat Channels is the superposition of converging private domain traffic and public domain traffic.

Unlike TikTok and Kuaishou, which rely on algorithms to distribute content, WeChat depends more on users’ social connection. WeChat Channels will give priority recommendations based on what your friends post, what your friends like, and the accounts they care about. This recommendation mechanism ensures that videos that get popular have a strong social function – they are much better suited for social networks.

The picture above is a screenshot of a video recommended by a friend

DTC brands are doubling down on WeChat Channels

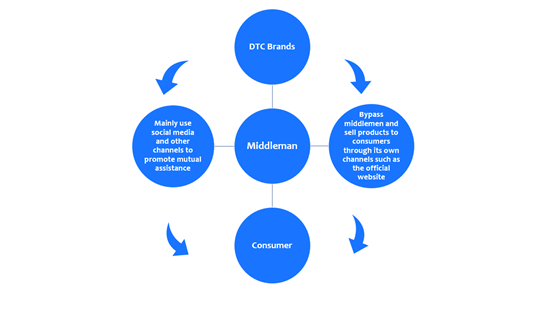

Direct-to-consumer brands often use WeChat Channels via the brand's official website, direct sales and delivery of goods to consumers. As far as China’s domestic market is concerned, some new and cutting-edge brands have taken advantage of the rise of social media and online marketplaces to grab market share from many big brands.

Consumer data is the core of the DTC business. That’s because owning customer data and being able to directly reach consumers are the foundation of DTC business model. WeChat Channels come into play where brands noticed that they can leverage the new media channel to increase market awareness and build brands.

![]()

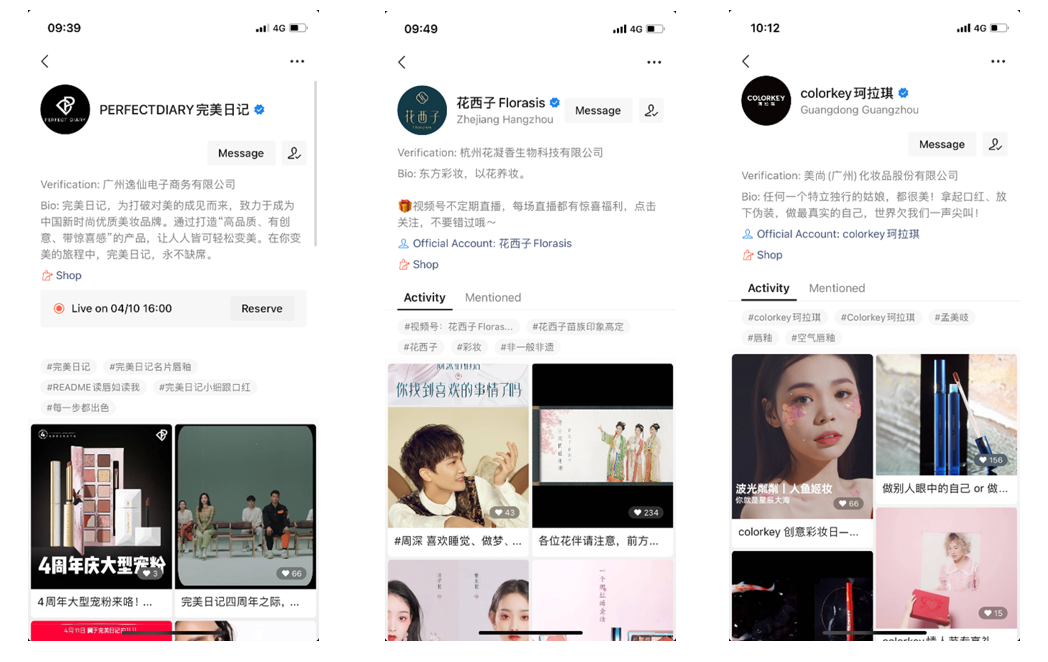

Chinese DTC brands on WeChat Channels

Overseas DTC brands on WeChat Channels

The above screenshots are the DTC brands stationed in WeChat Channels, except for Chinese makeup brands Perfect Diary, Florasis and Colorkey. There are also overseas cosmetics brand Fenty Beauty, skin care brand Filorga and perfume brand ACQUA DI PARMA.

Features of WeChat Channels that attract consumer engagement

As of June last year, WeChat Channels' daily active users exceeded 200 million. Among these users, there are outstanding creators and professional bloggers in more than 60 vertical topics[2]. These people key opinion consumers (KOC), which consist of WeChat Channel Creators. These key content creators influence users in their WeChat moments to extend brand reach to fans in a much larger online social circle. Brands can leverage KOC to speak for the brand and spread the content through friendship recommendations.

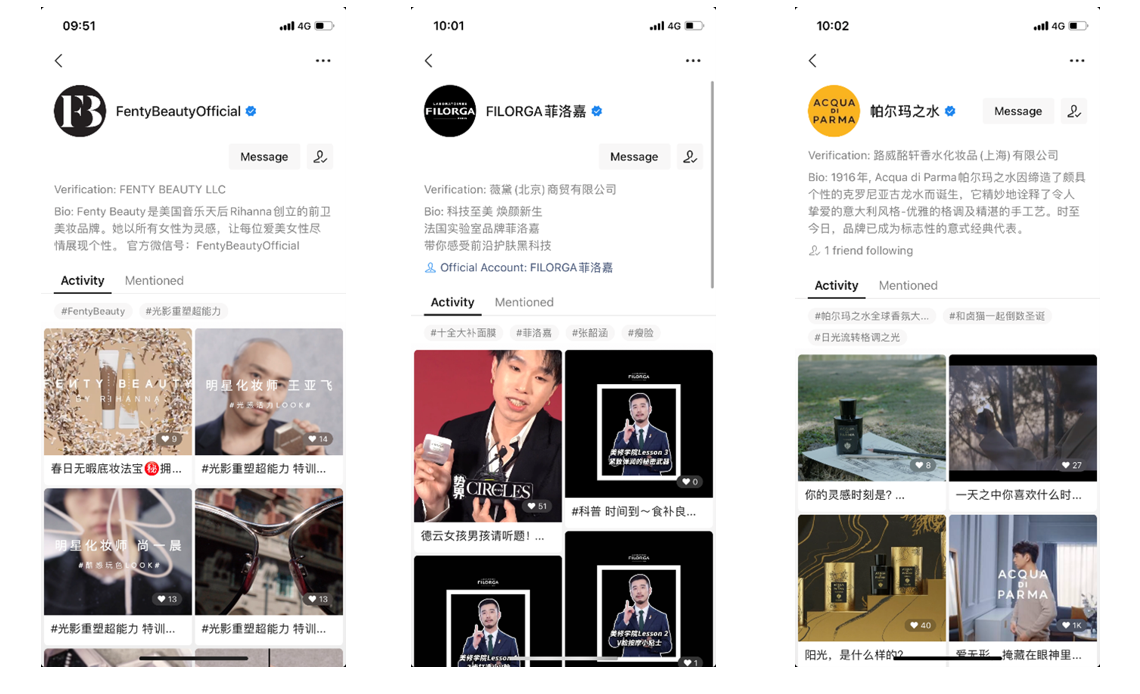

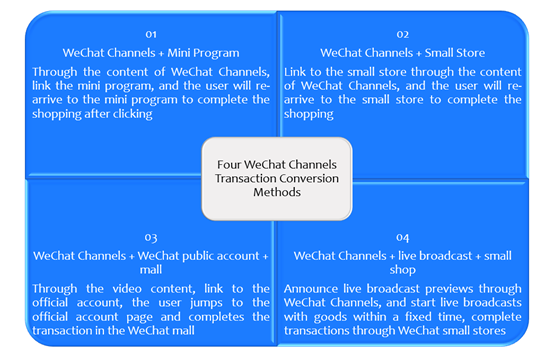

For example, Perfect Diary, a Chinese DTC cosmetics brand, has its achievements for all to see. It took three years to run a valuation of $4 billion U.S.[3] Last year, the Double 11 (Single’s Day) shopping carnival overpowered M.A.C and became the first domestic brand to top the cosmetics list in 11 years. There are so many blog posts on planting grass that even boys who don't use make-up know. Search for Perfect Diary on Red (a well-known grass planting platform in China), and there are more than 290,000 notes. Perfect Diary has collaborated with nearly 15,000 key opinion leaders (KOL) as influencers. Today, the fans of Perfect Diary on Red have reached 1.95 million in size, while big international brands like Estée Lauder and L'Oréal have only about 200,000[4].

Screenshot of Perfect Diary on Red

Perfect Diary launched a marketing campaign after its new makeup remover was on the market. As long as consumers publish short videos with makeup remover products and add the #PerfectDiaryremover hashtag, they will have a chance to get a gift from Perfect Diary. Through this event, Perfect Diary can use KOCs through their recommendations and sharing on social media, guide more people to consume, and increase new products' exposure. Secondly, Perfect Diary can also use hashtags and other tools to find out who posted videos with more likes and comments and find active KOCs. In the future, Perfect Diary can maintain a good relationship with these newly discovered KOCs to promote new products through them to expand brand reach.

The emergence of new models such as short video, live broadcast, and content-grazing has brought about new brand marketing methods in recent years. KOCs are closer to ordinary users and their recommendations are more realistic. In the era of social media, many brands are paying more and more attention to directly facing consumers. Then KOCs are actually every user of the product. It can help brands get closer to consumers and collect consumer opinions more efficiently. It can also influence user decision-making more.

WeChat Channels is based on the social model of WeChat acquaintances, which makes it more convenient for the recognition and dissemination of content. WeChat Channels highlights comments, encourages interaction, and adds comment barrage for fun, real-time interaction. If the content of WeChat Channels is already high quality and suitable for sharing, combined with public attention for trending topics, it's is highly likely to go viral.

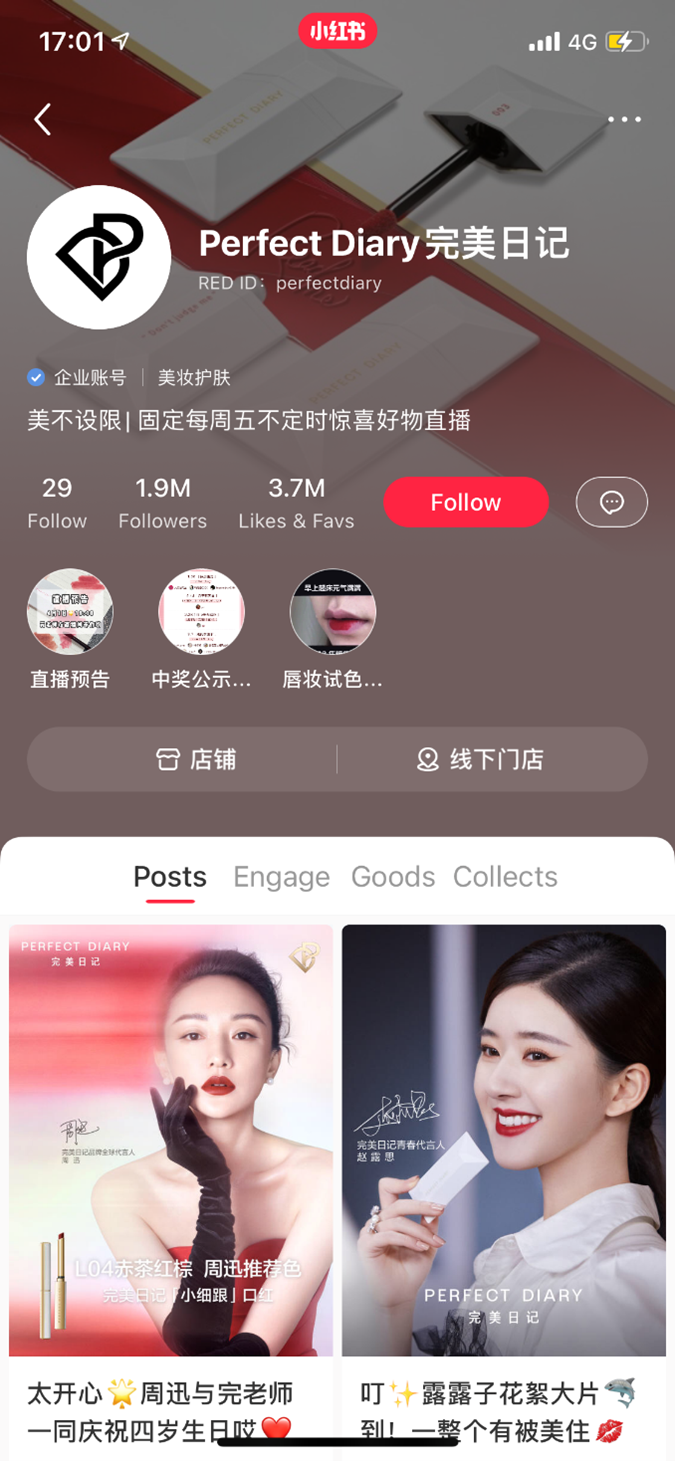

WeChat Channels has a wide coverage of content from different industries. With a new version release, WeChat Channels now support livestream campaigns. When connecting to WeChat's Small Stores, merchants can drive private-domain traffic to store without paying any advertising fee. High quality campaigns and those with proven sales results, could be handpicked by editors to the WeChat Channels homepage – which is public domain traffic for the merchant.

Practical tips for WeChat Channels

How can brands and companies use WeChat Channels successfully? Azoya summarized the following directions for brands to try out WeChat Channels:

l The founder appeared on the scene: personally build IP and tell the brand story

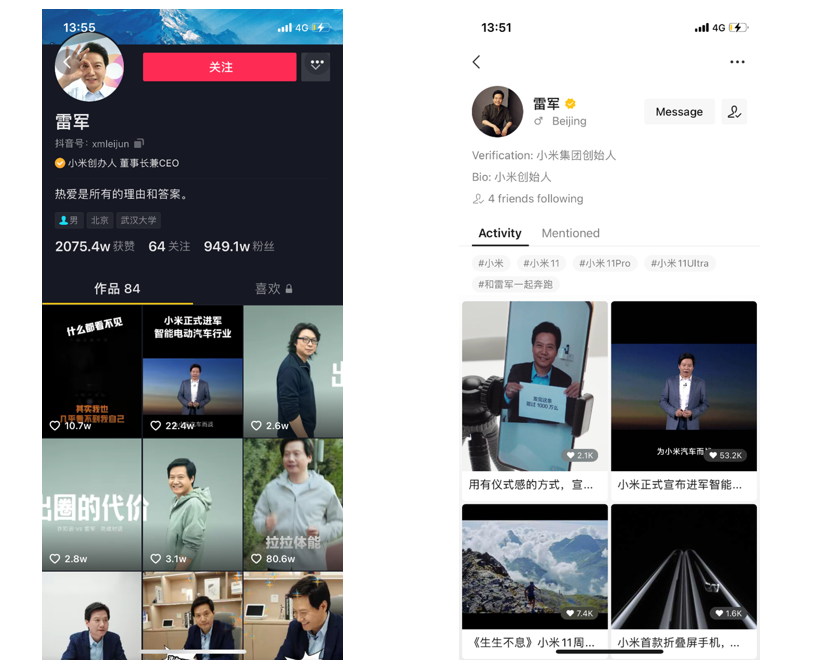

The company's founder is a potential IP to leverage. We have seen leading companies are building their company founders as the KOL in the industry – such as Xiaomi's Lei Jun, Huawei's Ren Zhengfei, New Oriental's Yu Minhong, among others. Lei Jun recently migrated to WeChat Channels after a successful TikTok operation, and intends to build another major KOL accounts. Lei is famous for his bold arguments and fun accents, and his videos in WeChat Channels received a lot of likes from authentic real person users in WeChat.

Screenshots of Lei's Tik Tok and WeChat Channels accounts

l Build trust with customers

For brands that own relatively large and complex business operations, introducing the story behind the brands can help the brand build trust.

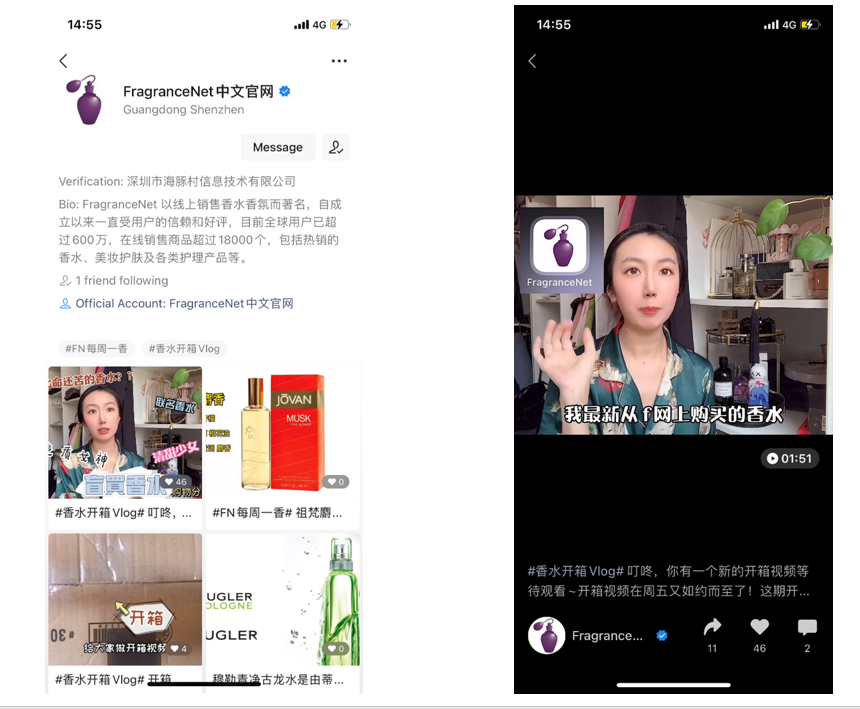

For example, FragranceNet is Azoya's partner. We work together with FragranceNet to set up and operate its official China e-commerce website and also operates FragranceNet's Tmall Global Web2Web shop. Besides, We helped it settle in WeChat Channels. Regularly share tagged topics "FN Weekly Perfume" and "Perfume unboxing vlog." In this serial mode, we continuously create high-quality content to attract users' attention and stickiness.

Screenshot of FragranceNet on WeChat Channels

l Invest in content

Once the goal is determined, the most important thing for brands to do is to continuously generate content while maintaining high-quality production standards. In this era of "ruled by algorithms," the intermittent content output will be monitored and judged by the system, thereby affecting traffic resources' tilt. Fashion brands can offer a series of content, including "new arrivals," while cosmetics brands can publish "real user makeup" content.

Key Takeaways:

l The WeChat ecosystem is still the platform with the closest relationship with users and the highest monetization value.

l Compared with TikTok, the recommendation mechanism of WeChat Channels can fully tap the value of the user's acquaintance relationship chain and network resources to help brands expand private domain traffic and influence.

l DTC brands can use WeChat Channels as a platform to attract and retain customers. Through consistent investment in content marketing, brands can establish their private domain traffic, and potentially touch on much larger public domain traffic.

[1] China Business Intelligence Network:China's short video industry market size and development prospect forecast analysis, 2021;URL

[2] Group quantity theory: WeChat Channels|"refined content+KOC+e-commerce" may become the mainstream of brand realization, 2021;URL

[3] Future consumption: The most complete perfect diary in history revealed, 2020;URL

[4] Cucumber Media: "Perfect Diary" brand marketing strategy, 2020;URL