Douyin (TikTok) E-commerce: A New Playground for Brands

by Maggie Yu & Davy Huang

Douyin, the Chinese version of TikTok, is a booming short-video app in China, with over 600 million daily active users.[1] In 2021, Douyin was building its own e-commerce ecosystem, launched flagship stores for brand accounts, and created platform-owned payment solutions to close the loop on its e-commerce operation. Today, Douyin is used by brands to reach affluent Chinese consumers. More and more international brands are exploring Douyin's e-commerce services. Big players, such as Lancôme, Estée Lauder, Make Up For Ever, and Coach, have also realized the potential of Douyin. These brands all opened their official accounts and stores, and promoted them within Douyin as a marketing strategy.

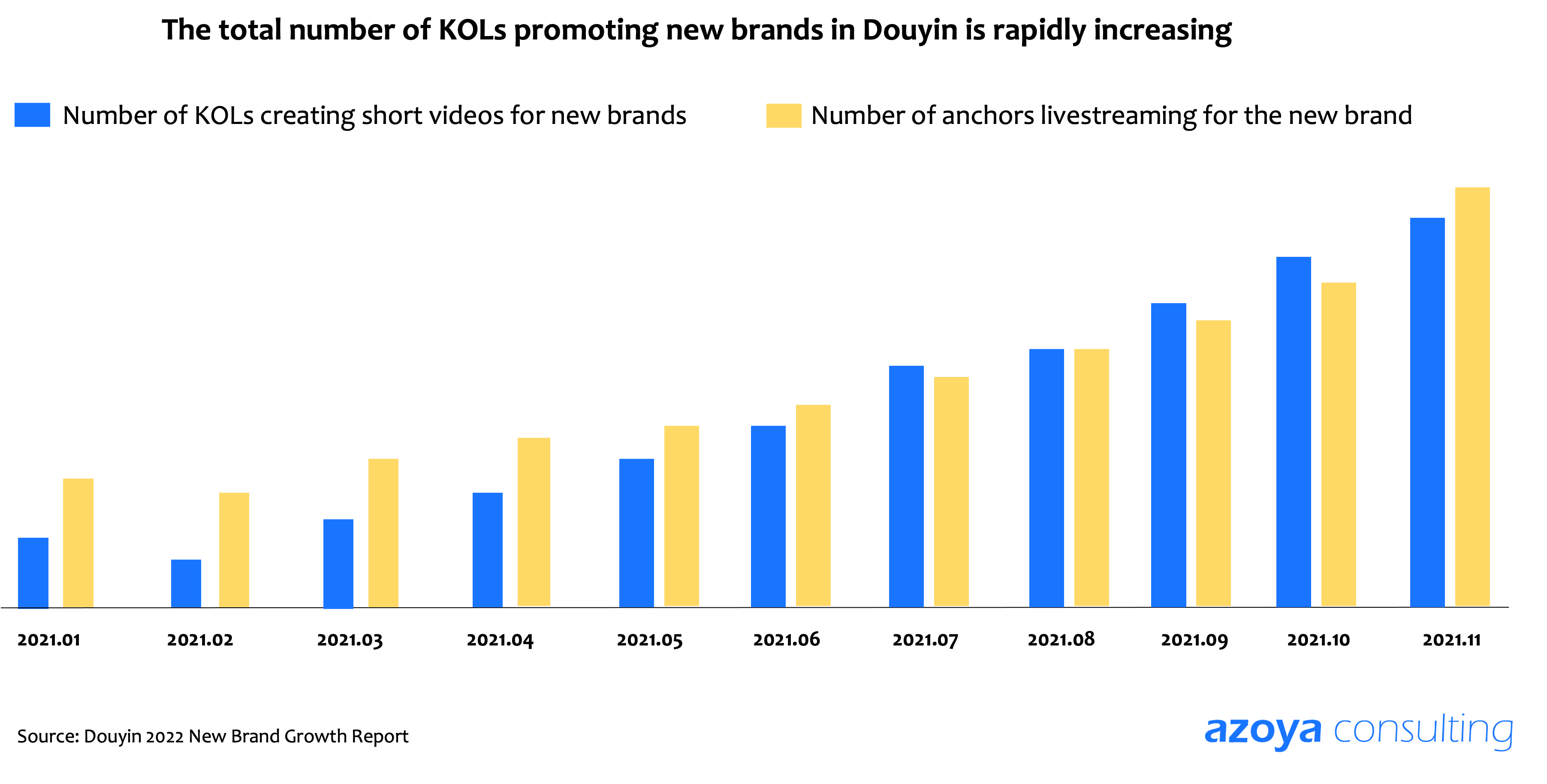

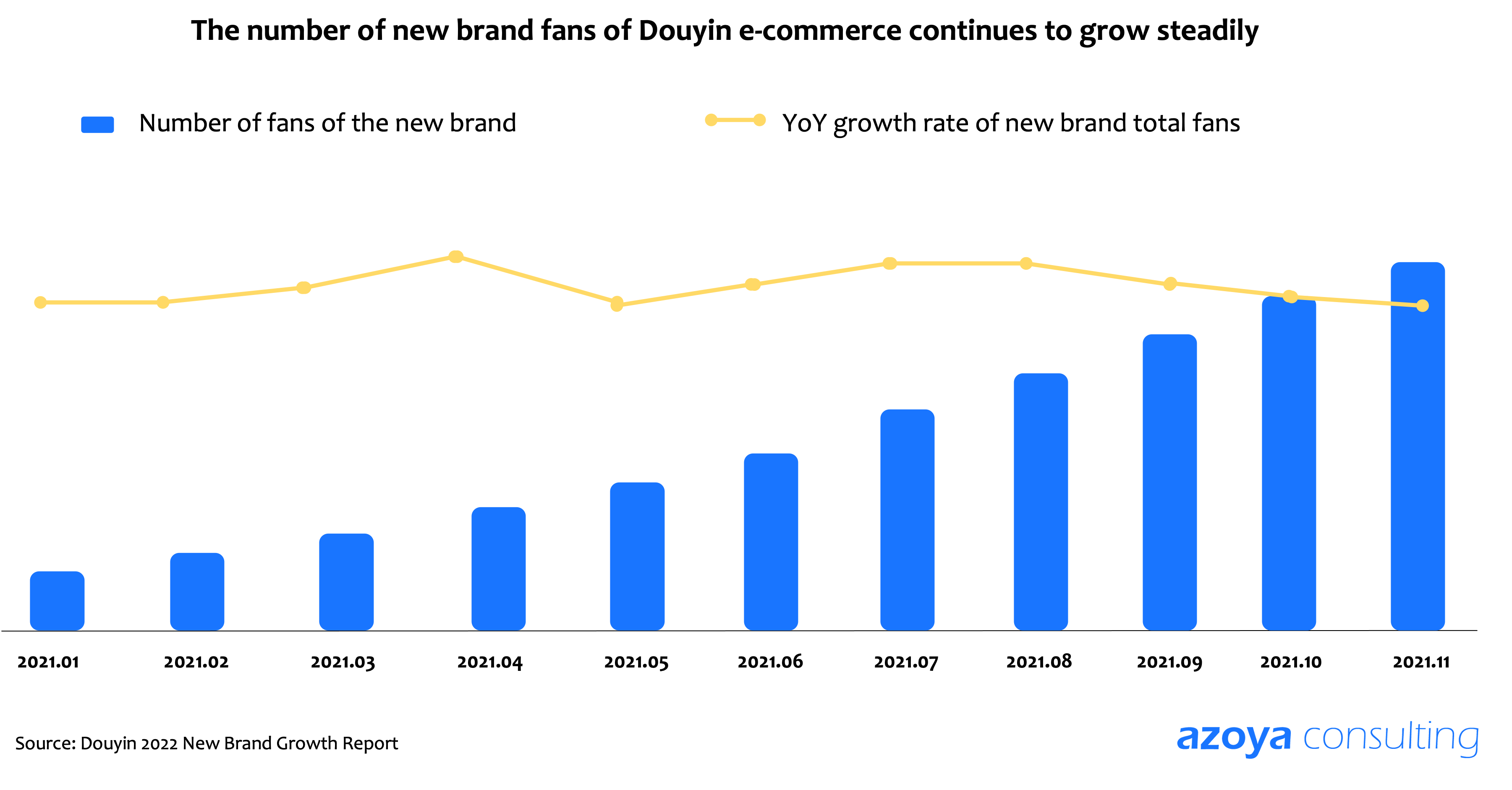

According to public data, Douyin's annual gross merchandise value GMV in 2021 is expected to reach 800 billion RMB ($126 billion US).[2] In 2021, a large number of new brands achieved rapid growth in Douyin e-commerce. They connect with potential consumers efficiently and build relationships with them through short videos and livestreaming. From January to November 2021, the monthly transaction scale of new brands using Douyin e-commerce maintained steady growth, with an average month-on-month growth rate of over 24%, according to Douyin official data.[3]

As a social giant that has captured younger generations, Douyin may be an interesting testing ground for brands to develop their e-commerce business. Let's take a look at how brands leverage this new battlefield to attract consumers.

How is Douyin different than Tmall or JD?

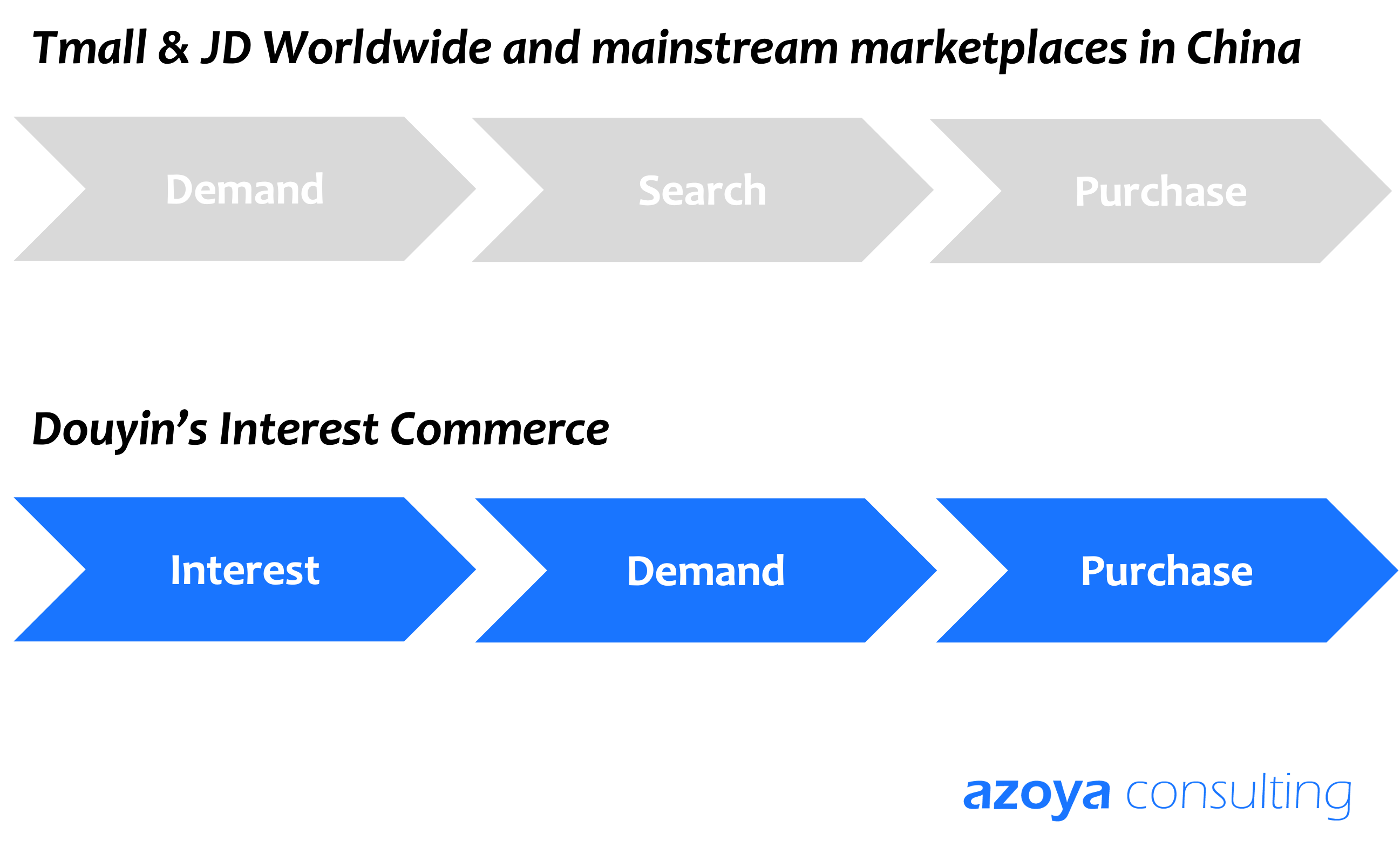

On traditional e-commerce platforms like Taobao and JD.com, the sales format can be seen in the form of a supermarket where products are displayed on shelves. The main way of finding products through this medium is only through a clear purchase intent and an active search for the actual product.

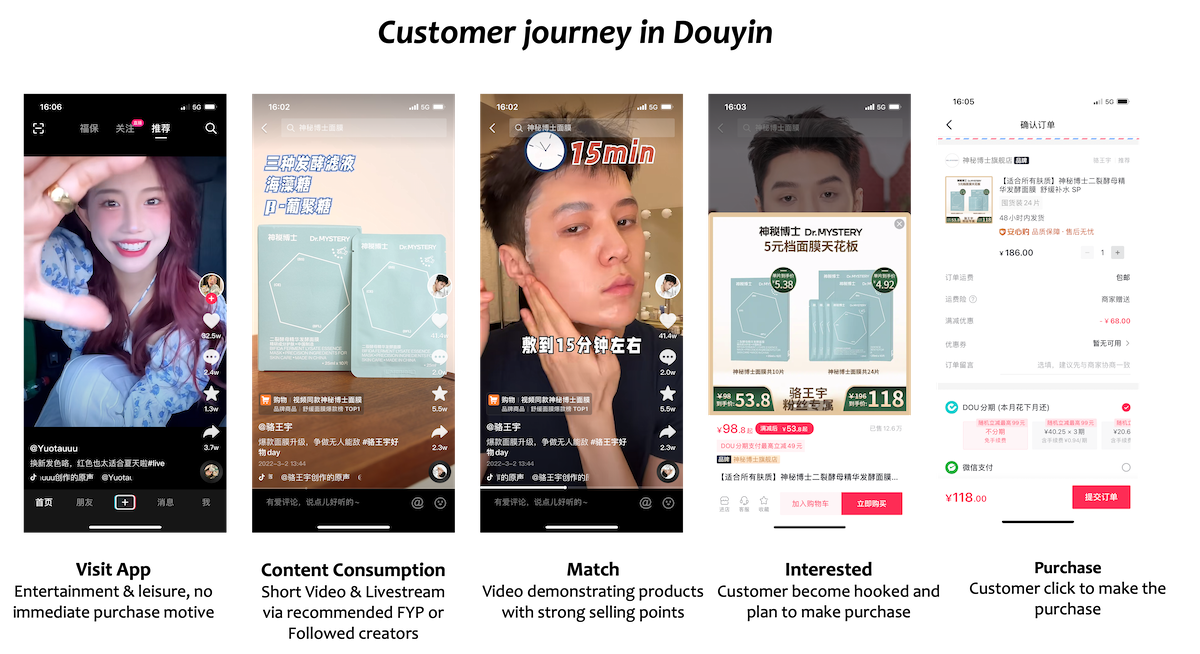

How about Douyin? Douyin is a short-video social platform where everyone can share all kinds of videos. In terms of the nature of transactions, if users want to buy a specific product, they will enter keywords to search on Taobao or JD, which makes online shopping active. On the contrary, the user's purchase behavior in Douyin is largely unconscious or passive. They will unintentionally be attracted to the content in the short video or key opinion leaders’ (KOLs) product seeding.

The product sales model for “interest e-commerce” is "Products looking for people." According to the algorithm developed by Douyin, the app is far more effective at understanding customer demand and provides users with tailored content that is relevant to their interests and preferences. As an example, if a female user browses 3 to 5 short videos of skincare types every day for a month or even half a year, Douyin’s algorithm can basically filter content to reflect her strong interest in skincare. Douyin will also categorize customers searching for lipstick as prospective customers for cosmetics, and increase the chance for these consumers to be exposed to cosmetics content and products. This shows that for consumers, interest e-commerce can meet everyone's potential consumer needs.

According to Douyin, the interests of users are diverse and changeable. On the Douyin platform, users show their interest and attitude towards content and products through purchases, product browsing, and other behaviors. These actions also enable the platform to continuously track the user's variety of interests, thereby achieving in-depth exploration and accuracy of product matching to the user’s interests to earn more efficient conversion and repurchase rates.

Compared with Douyin's interest e-commerce, marketplaces such as Taobao and JD.com belong to “shelf e-commerce.” The native model of shelf e-commerce is “People looking for products”. When consumers come to marketplaces, they usually intend to buy a specific product, and leverage the marketplace’s search function to get product and price information, then make a purchase. It still applies to the classic Attention, Interest, Search, Action, Share (AISAS) model. The classic customer journey of shelf e-commerce model involves buying after showing interest and taking action by doing a product search. The key advantage for Douyin’s interest e-commerce is that the whole process, from product seeding to the final purchase, is integrated. There is almost no need to switch platforms and minimum research is involved.

For consumers, Douyin e-commerce can take "interests" as a clue to help consumers find potential products to satisfy their needs. For merchants, interest e-commerce can help them reach consumers more accurately and efficiently. According to survey data, many merchants have gained new growth and customer acquisition opportunities after entering Douyin e-commerce. Among the consumers of this platform, more than 85% are new customers.[4]

The opportunities of Douyin e-commerce

• Douyin's short-video model and abundance of creators help new brands achieve effective promotions, increased market awareness and sales growth. According to the data of Douyin, from March 2020 to November 2021, 23% of Douyin e-commerce consumers purchased new brand products, and this proportion is still increasing. In Douyin e-commerce, new brands can attract more users' attention by creating high-quality content, creating an image that fits the brand's positioning and establishing trust with more consumers.

On the other hand, all users in Douyin are creators. That’s because in Douyin, every user has the opportunity to gain attention and exposure through video creation. Lancôme once launched a "foundation holding time challenge" in Douyin. All creators could participate in the challenge, and the 30 creators with the highest video volume had a chance to win the full-size foundation.

The campaign attracted many Douyin creators to participate. The total number of short videos related to this challenge eventually exceeded 200 million views, and Lancôme’s official Douyin account grew by 28,000 followers.[5]

• For new brands, Douyin will provide support programs, aiming to help 100 new brands achieve sales of over 100 million RMB in 2022. Specific support includes traffic support, branding resources, and marketing campaign exposure, etc.

Also, Douyin has launched marketing activities to support important e-commerce festivals throughout the year, such as Queen's Day, 6.18 Promotion, 8.18 Promotion, National Day, etc. Brands can use marketing campaign resources to gain exposure and drive sales growth. According to official data, during the Douyin 8.18 campaign last August, the GMV of a single livestream by L’Oréal Paris exceeded 2 million RMB ($314,000 US), an increase of 110% compared to the brand’s 6.18 campaign in June.[6]

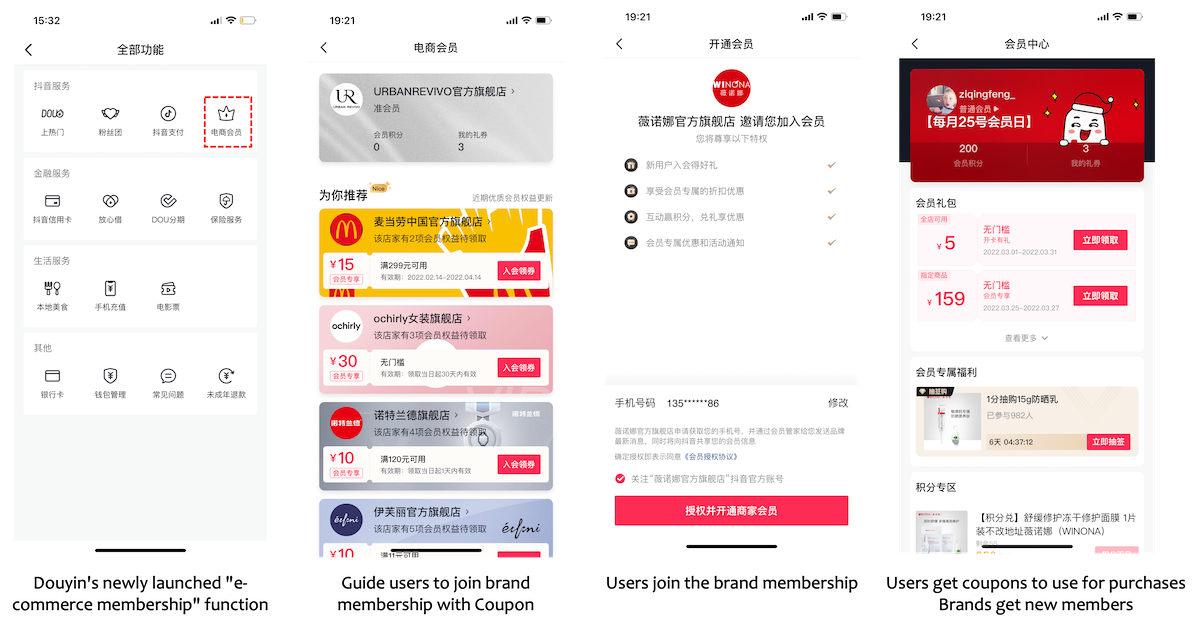

• Launch private domain functions to help brands deepen engagement and loyalty. Douyin's huge user base can help new brands cover a wider consumer audience, especially young users. In addition, many new brands have gradually started establishing membership systems in Douyin e-commerce to deepen their relationship with consumers.

Recently, Douyin added an "e-commerce membership" function. Users can click on this page to recommend brand members and join immediately. After authorization, they can receive the merchant's membership card, and users can collect points and coupons. For merchants, setting up a membership system and providing multiple membership activities, such as membership points, birthday gifts, coupons, invitation coupons, and lucky draws, can strengthen customer loyalty and contribute to sales conversion.

How are niche brands growing their sales in Douyin?

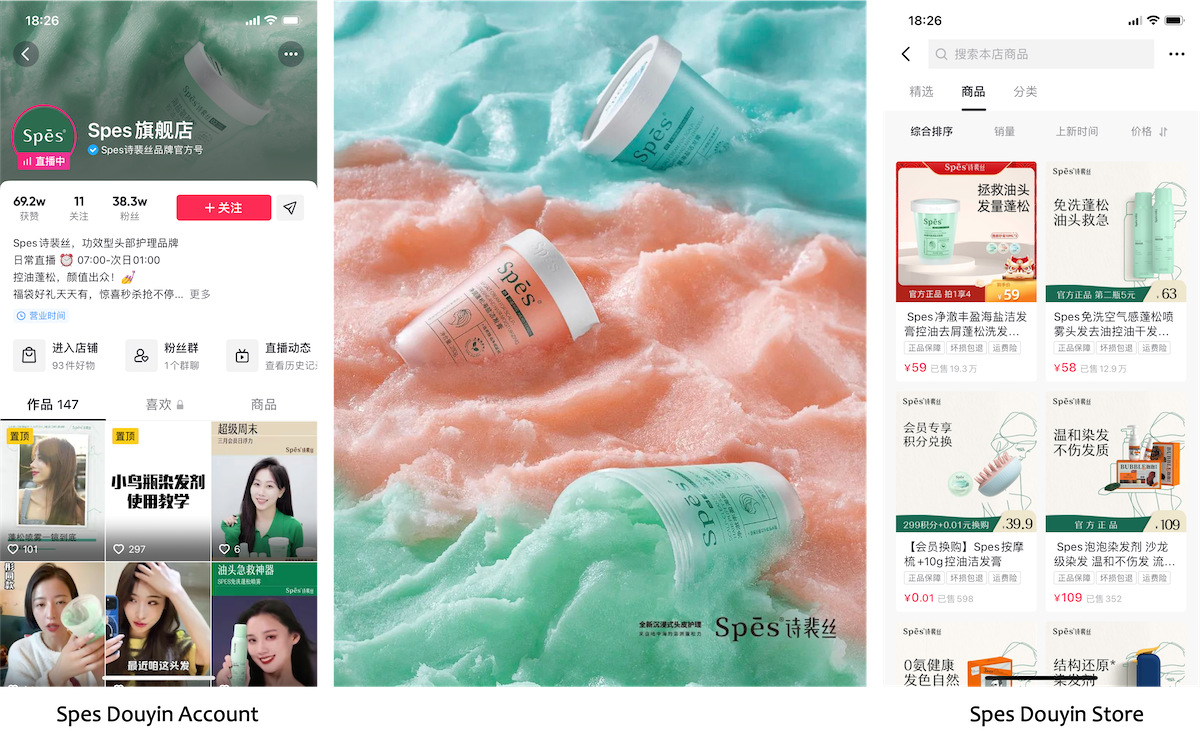

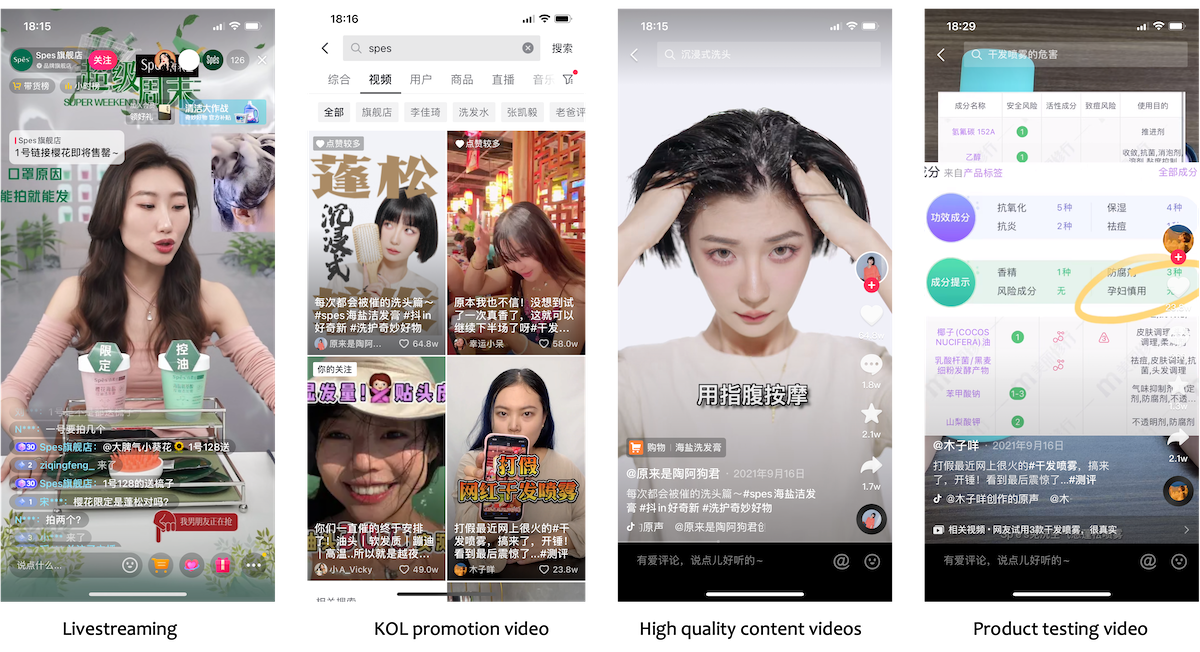

Spes, a niche hair care brand, has achieved rapid sales growth on Douyin e-commerce. Its hero product washing-free hairspray sold 200,000 bottles during the Douyin 8.18 event, driving the overall GMV to exceed 20 million RMB. The real reason for Spes’ explosive growth is the integration of content strategy and Douyin’s scene-based experience. Spes transformed the product selling point from text description to short video content in terms of specific content presentation. The brand used short videos type to launch more engaging content for young consumers, completing an efficient link from introducing selling points to displaying effects, realizing product promotions and sales conversion.

In addition to the content form, the traffic support provided by Douyin e-commerce has also provided great help to Spes. By participating in a series of promotional campaigns, Spes continues to amplify its brand voice and marketing effects. Secondly, Spes uses the characteristics of Douyin's interest e-commerce and KOL resources to form a talent matrix that matches the brand positioning. Spes cooperated with more than 1,000 KOLs in 2021. The high-quality video content created by KOLs brings users into a variety of real scenes, effectively reaches potential consumers, and motivates them to buy.

Key Takeaways

• With the introduction of its native e-commerce functionality and platform-owned payment solution, short-video giant Douyin has now expanded its reach to even more consumer touchpoints.

• Douyin e-commerce is growing extremely fast, and great content can give new brands a chance to create sensational campaigns - making it an effective channel for niche brands to kickstart their business.

• The core of Douyin's interest e-commerce is to actively help users discover their potential needs, then accurate match those needs with merchants' products. Turning users’ interests into new business opportunities lowers the decision threshold for consumers.

[1] Statista: Number of daily active users of Douyin (TikTok) in China, 2021; URL

[2] Bianews: Douyin e-commerce 2021 projected GMV, 2021; URL

[3] Douyin: 2022 Douyin E-Commerce new brand growth report, 2022; URL

[4] Sohu: Douyin e-commerce will launch "three support" plan, what are the new opportunities for merchants and influencers? 2021; URL

[5] Sohu: Lancôme foundations set off the Douyin craze, 2020; URL

[6] Cosmetic Newspaper: Douyin is reshaping the brand marketing ecosystem, 2021; URL

See the rest of the article