4 Categories Booming Among Chinese Female Consumers

by Queenie Yao & Davy Huang

Key takeaways:

· "Anti-aging" is one of the top keywords in online searches among Chinese female consumers. This trend sparked a boom in beauty drink supplements, which often tout the concept to support and promote total beauty from within.

· Professional and premium skincare are in high demand in China, as female consumers are willing to spend more on trusted, safe and luxury positioned products.

· Niche fragrances are in high demand in China due to increased penetration of premium fragrance products in China and higher average spending.

· Fine and upscale jewelry sales in China are steadily increasing – but more consumers view these items as investment-worthy fashion merchandise.

The Chinese female consumer is a strong force in the e-commerce market and her influence cannot be underestimated. The latest report from Quest Mobile showed that Chinese female consumers have a staggering 84.3%[1] online shopping penetration rate, accounting for 547 million people. They are the most important source of spending power in China because they are often the main buyer for the family, socially active, increasingly educated, and attuned to trends.

In response to the robust growth of Womanomics, major e-commerce platforms and brands with an acute sense of evolving consumer demands have started to differentiate their offerings. Urara, owned by Shiseido Group, is one of the beauty brands developed for Chinese consumers and available in cosmetic stores across China since 2006. Urara segments the needs of consumer to develop varieties of basic skincare products to reflect diverse regions and differentiated skin types in China, based on research of Chinese women’s skin and living environments. After 14 years in China, the high-end anti-aging line, Urara Prime Collection, launched last September. And the results are fascinating.

However, it can be challenging to localize the offerings to Chinese female consumers as their demands are becoming increasingly complex and segmented. Young female users seek personalization and like to show their unique taste by sharing their experiences with the products they are using, according to the QuestMobile reports. Demands from female consumers in different age groups also showed profound differences, with young females attracted to celebrity beauty, while older female consumers, who often have families and children, are more inclined to focus on different categories, and can be more price sensitive.

We highlight the top categories that international retailers should pay attention to this year.

Beauty & Cosmetics

China's beauty and cosmetics sector had witnessed consecutive growth over the past 10 years. Even under during the Covid-19 pandemic, data from Tmall Global[2] reveals an 85% increase in average spending on beauty products among the post-90s female consumers. The rapid growth in consumption of beauty and cosmetics products is driven by rising awareness and vertical category surges.

Premium skincare

The trend of the high-end anti-aging consumer behavior is irreversible. According to CBNData’s Beauty Industry 2020 data, 83%[3] of people spending on luxury goods are female. The pandemic has undeniably triggered a self-care, beauty & skincare boom. In terms of demographics, post-90s and post-85 women are investing more in anti-aging than other generations. They are more keen to buy high-end anti-aging skincare products, driving the high-end upgrade of the anti-aging market.

Professional beauty

Since the government encouraged people to stay at home during the pandemic's peak, lockdowns blocked consumer access to professional institutes and spas for beauty care. Users are turning to professional beauty products – and completing the treatment at home to avoid unnecessary outdoor activities. In the post-Covid era, we will continue to see the increase of professional product growth because consumers awareness has consistently grown, and new opportunities will arise for more targeted treatments.

More than 40 new American and European professional-grade skincare brands debuted on Tmall Global in the past year. Thanks to cross-border e-commerce, international brands do not need to go through a lengthy process to set up local operations and register products. With two to three months of preparation, most brands can successfully launch on the platform. Chinese domestic marketplaces are also boosting awareness of professional beauty. Last year, Tmall Global collaborated with Erno Laszlo, Medspa, Repacell, Dermalogica, and other international beauty brands and formed a global effort to further develop exclusive experiences for beauty consumers. Professional beauty services are provided on-site or through offline branches of Helijia, a beauty service online-to-offline (O2O) player whose investors include Alibaba.

Consumers can book online and enjoy professional beauty services at Helijia's offline stores. Source: Helijia Weibo

Clean & organic

Chinese consumers are increasingly interested in clean and natural beauty brands. According to Mintel’s latest study on China’s Clean Beauty Market, Chinese beauty consumers’ demand for beauty and personal care products with natural or organic ingredients is growing.

Consumers’ needs for clean beauty are mainly focusing on product safety and effectiveness. Notably, 77%[4] of Chinese consumers responded that healthy or clean products are safer than ordinary beauty products, the respondents consider product safety assurance as the most important purchase consideration. In terms of product effectiveness, clean beauty is recognized by over 60% of consumers as being more effective than ordinary beauty products.

Niche fragrance

Just before the Covid-19 pandemic started, China's demand for fragrance had been on the rise. China's fragrance market revenue is expected to reach US$1226.5 million in 2021, growing by 7.1% YoY, Euromonitor estimates.

Chinese fragrance shoppers are tapping into niche names. Euromonitor has projected that the niche and premium fragrance market in China would increase by 18%[5]. Results from Tmall Global also support this trend: niche brands earned the fastest growth rate, with three-digit growth year-on-year.

Consumers check on fragrance products at its atelier. Source: China Daily

Consumers today prefer personalized, intimate and de-labelled products, with 45.7%[6] of perfume consumers moving from mass fragrances into niche designer fragrances, according to China’s Fragrance Market Research 2020 of iResearch, and 68% of the niche fragrance consumers are female. Customers' preference for wearing different scents also presents a potential opportunity for less well-known or niche brands in the market to earn sales and loyalty.

According to iResearch reports, consumers prefer to get perfume information from social media platforms such as Little Red Book, Weibo and Douyin (the Chinese version of TikTok), which make up 69.7%, 38.8% and 25.3% respectively. With Little Red Book and Weibo being the most preferred seeding platforms, users are willing to try the products that appeal to them. This type of behavior is especially prominent among users aged 23-25. Consumers are also seeking third-party samples off C2C platforms, such as Taobao, to try new products with less upfront investment.

Jewelry & accessories

In China, jewelry industry growth is fueled by the increase in spending power among female consumers[7] in tier 1 and tier 2 cities. According to iiMedia Research, the jewelry purchase behavior should see a shift from buying as gifts for others to buying for oneself.

We can notice from the current jewelry market that a high-end player like Tiffany & Co. and Swarovski have been making active efforts to gain the attention of increasingly discerning and affluent Chinese consumers.

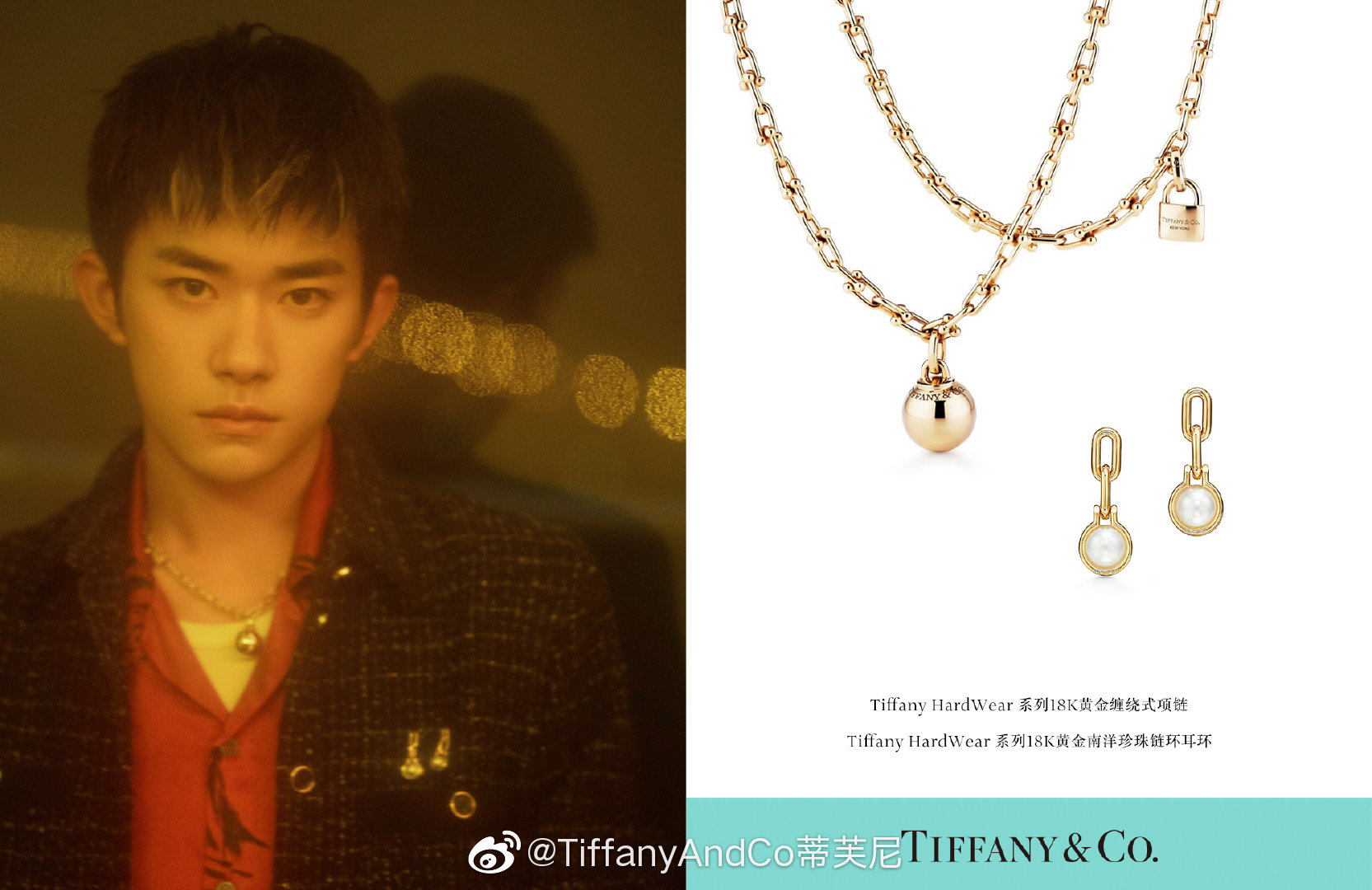

Tiffany & Co. leverages celebrity power to optimize digital strategies and recover their China business since the start of COVID-19. Last year, the 183-year-old jeweller announced that Jackson Yee, the wildly popular singer, dancer, and actor, would be the iconic Tiffany T collection brand ambassador. Yee boasts colossal influence among Chinese Gen Z females, with a whopping 84.6 million Weibo followers.

Jackson Yee wears Tiffany latest HardWear Collection. Source: Tiffany&Co. Weibo

Millennials and Generation Z are becoming mainstream consumers. Unlike their predecessors, Generation Z are more focused on personalized experiences, according to iiMedia research reports. Co-branded limited editions work extremely well among Chinese female Gen Z consumers.

Luxury jewellery brand Chou Tai Fook also partnered with video-sharing platform Bilibili to launch a co-branded necklace that targets esport consumers. As one of Gen Z and Millennials' favorite video websites, Bilibili offers a unique opportunity for brands looking to market to younger audiences.

Beauty drinks and supplements

The Chinese Women's Health Consumption Report 2021 conducted by Alibaba Health shows that young females are more serious about beauty and wellness.

Women's health spending has increased annually in recent years, with an average increase of 20% YoY[8], with overall women's health spending 38% higher than men's in 2019 and the gap between the two sides widening further to 63% in 2020. These results show that women have become the absolute mainstay of health spending.

The beauty drinks market, driven by the "beauty from within concept", is gaining attention from female consumers and shows increasing demand. The report shows that annual sales of “Beauty from within” products rose by 100% YoY in 2020.

But women of different ages have different needs for health products. The post-00s are more concerned about personal shape and prefer meal replacement products and enzymes. Post-90s are awakening to the concept of health management and prefer clinically formulated probiotics for women. Simultaneously, the post-80s are concerned about retaining balanced, healthy skin, and anti-aging products. Their most in-demand products are collagen drinks, sleep support, and biotin supplements to prevent hair loss.

The Covid-19 pandemic has spurred consumer awareness of personal fitness. Younger adults now show more significant demand for imported healthcare products like immunity-enhanced segments, such as vitamin B[9], protein supplements, and probiotics, as Kantar points out.

To add, functional gummies for the beauty-from-within and vitamin category have exceptional growth in China. Gummy vitamins taste like snacks, without the psychological burden of taking supplements and making them quite suitable for young people, and many first-time vitamin users.

High-quality mom & baby offerings

Females aged 25-35 have a significant preference for mother and baby products, QuestMobile reports. Mom & baby are the Top 1 search terms among post 80-90 female customers, the report highlights. Since the two-child policy was introduced in 2016, newborns' birth rate has continued to decline, with a birth rate 0.1% in 2019. The main contributor is that improving prenatal and postnatal care has become the choice of many people with economic development. This has led to a growing preference for having children between the ages of 25 and 34, with post-90 – 95s women becoming the most dominant proportion of new mothers, accounting for 64.7% [10]and 81.8%.

Data from iiMedia Research reveals that mothers prioritize health, safety, and quality when spending on mom & baby products, accounting for 87.9%, 84.8%, and 72.7%, respectively. The post-90s mothers began to pay attention to nutritional intake, lifestyle regimen, and shopping for mother and baby products during pregnancy preparation, iiMedia indicates.

The new generation of mothers changes their consumption mindset, and sophisticated self-consciousness is very different from the previous generations.

Post-90s mothers are buying different products beyond nutrition, food and "pregnancy-specific" beauty products. Balancing the baby's development with the mother’s health is the main driving factor of maternal nutritional intake and health care products during pregnancy of post 90-95 mothers in China.

The demand for skincare and makeup products has increased. Facial beauty gradually penetrates the pregnant mother community, the Mom & Baby Market Research by popular forum YuEr Net emphasizes. For instance, 60% [11]of mothers use pregnancy-specific skincare products during pregnancy, and nearly 50% of the interviewees will wear makeup.

It’s noticeable that post 90/95s mothers’ demands are also evident. For instance, they don’t want to lower their quality of life during pregnancy – as they believe that paying more attention to personal health and beauty will also benefit their infants.

[1] Quest Mobile: She-Commerce Report, 2021; URL

[2] Tmall Globalx Deloitte: China’s Imported Goods Market Research 2020; URL

[3] CBN Data x alimama: Beauty Industry Report 2020; URL

[4] Mintel: Clean Beauty – China, 2020; URL

[5] Euromonitor: Fragrances in China,2020; URL

[6] iResearch: China Fragrance Market,2020; URL

[7] iiMedia Research: She-Commerce Report,2021; URL

[8] Alibaba Health: Women’s Health Consumption Report,2021; URL

[9] Kantar Worldpandel: Women x Health Supplement, 2021; URL