Deregulation is needed to ease cross-border payments in China

China's canceled implementation of certain cross-border regulations will ease entry process for both brands and retailers that wish to tap the growing local e-commerce market.

by Azoya

April 11, 2017; Payment Source

Chinese policymakers’ latest talk on cross-border e-commerce regulation reveals that future cross-border import will be categorized as ‘personal article,' which prompted a new round of discussion over future policy in this emerging industry.

China's canceled implementation of certain cross-border regulations will ease entry process for both brands and retailers that wish to tap the growing local e-commerce market.

The Ministry of Commerce in March of 2017 redefined cross-border imported products as ‘personal articles,' which implied that future taxation and import clearance policy would be different to that of traditional bulk trade model to sell to China.

If the cross-border trade is categorized as ‘personal article,' there’s a big chance that obtaining the import permits, registration and filing could potentially be less complex, or removed.

Why is that? Unlike bulk trade business, personal cross-border shopping is featured with low volume, small order, and wide variety. If Customs is to treat all cross-border import with same ways as the traditional import, the complex procedures will be an intimidating entry barrier

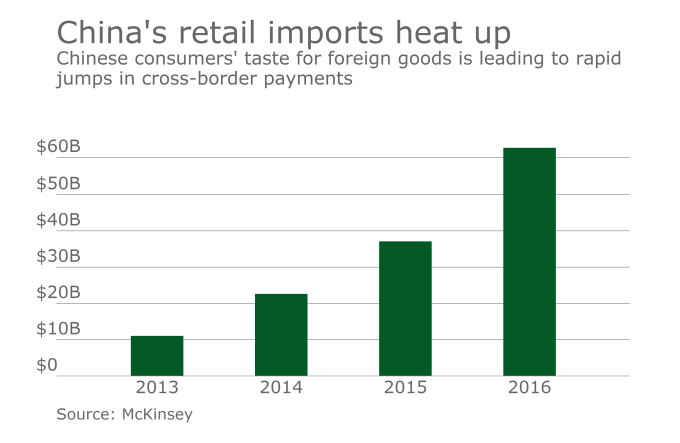

Cross-border trade in China has witnessed fast growth in China for the past three years as burgeoning Chinese middle classes unleashing great purchase power, facilitation of international payment and logistics, and regulation approval on cross-border import. Chinese consumers are shopping from the world for premium products that were not on the shelves in mainland China previously.

But the booming of cross-border shopping also triggered the alarm of the local authority --- for every order sold through personal shopping agents (also referred to as ‘Daigou’), there’s potential loss of tax revenue in import, transportation, and sales. Other issues such as the lack of quality inspection and impacts to traditional import and distribution network were also irritating the nerves of policy makers.

In June of 2014, the China Customs officially announced new personal express clearance model, often heard as business commercial clearance model (BC). And the same year in December, the Customs officially supported bonded warehouse import clearance (BBC) model, and since then the cross-border clearance model is complete.

On April 8th, the Authority released new taxation policy and import permit requirement, and the latter one was devastating to the industry since ‘positive list’ regulation approach barred out a lot of qualified products. But fortunately, the import permit was lifted effective until 2018 and will likely to be revoked.

By the look of the policy, it seems that the policymakers in China are happy about current rate on cross-border e-commerce and its effect in curbing personal shopping agent activities. Future policy will strike a balance between cross-border e-commerce and traditional import, while further shrinking the space for personal shopping agents.

Cross-border c-commerce enables retailers and brands to sell directly to China with lower tax and competitive price, and the cross-border shoppers are shopping for quality, affordable premium and assurance for authenticity. 3rd party researcher CIW estimated that the number of shoppers would reach 740 million in 2018. Even if there is a 20,000 RMB cap annually for every Chinese citizen, the possible cross-border e-commerce market volume will still be more than $1 trillion.

China’s lucrative consumption market and the prevalent mobile shopping habit are good news for overseas retailers, as they can enter the market via cross-border e-commerce with a modest investment. While Daigou can still serve as a potential channel for distribution, many brands had expressed concern for Daigou’s damage to the brand image. Bellamy, an Australian baby formula brand, has decided to abandon the Daigoudistribution network and sell directly to Chinese consumers, while surprisingly discovered that customers still have high loyalty to their products.

For both retailers and brands, the digital transformation could be the future as we are seeing new brands and retailers entering China without setting up their physical entities in China. With accurate localization and e-commerce strategy, overcoming challenges of cultural differences and different commercial environment, global businesses can still expect a good result from their export business to China.