LIVE BLOG: Essentials for Singles‘ Day Shopping Festival 2022

by Azoya

As October began, brands in China started to gear up for Singles Day (November 11th) promotions. As in past years, Singles Day is the biggest retail event in the world, as many brands can earn over half of their annual sales from November alone because of this shopping festival. Last year's Singles Day saw Alibaba's platforms, Taobao Tmall's and JD.com's gross merchandise value reach US$139 billion together, a record-breaking number.

As Alibaba will kick off its pre-sale period for Singles Day on October 24th, we saw some updates coming up in this year's Singles Day. This year, we invite you to follow our live blog as we provide updates, analysis, and an inside look at how the largest shopping festival in the world is put together.

(November 15, 2022) This Year Singles Day Marks the New Shift: Loyalty > Mega Sales

At 0 o’clock on November 12, 2022, the Singles Day festival finally comes to an end.

Despite the uncertainties, Tmall Double 11 still performed steadily - "steady to good" is the keyword.

Continuing for 14 years, Singles Day has become a mirror of the consumption vitality and trend of the whole market. In this year's shopping gala, the Chinese market still showed consumer confidence and economic resilience.

We noticed that the market embraces emerging categories with consumers’ new demands.

On the consumer side, consumers still have a high propensity to spend; on the supply side, new products and new categories are constantly debuting based on ingenuity and supply chain capability. This year, there are 148 segmented trend categories have obtained year-on-year growth of over 100%.

Apart from growth, merchants are gaining certainty for their future business - members. 130 brands have over 100 million RMB in membership turnover, and over 5,600 brands have doubled their membership transaction volume year-over-year.

Members with customer loyalty have become the main driving force of brand growth, and the question of “How to enhance customer loyalty” is more worthy of commitment for brands in China.

| Missed the memo? Catch up with our deep dive into How Emerging Brands Succeed in China. |

(November 14, 2022) She Economy Remains Strong Vitality

1. The beauty category grew healthily

On Tmall, dozens of well-known beauty brands exceeded the 100 million RMB in transaction volume made by brand’s members, including SK-II, Estee Lauder, L’Oréal, Lancôme, Kiehl’s, La Mer, YSL, Armani Beauty, MAC, Fresh, Sisley, and more.

During JD 11.11, the cumulative transaction volume of 299 beauty brands on J Shop was more than 10 times that of last year. The GMV of 952 brands, such as La Mer, increased by more than one time compared with the same period last year.

2. Fashion boomed

J Shop witnessed the apparel sector climax during Singles Day, with Bosideng, EVISU, Bananain, 73Hours, FILA Kids, Bromen, etc., over 4,000 new and existing domestic and foreign brands saw their turnover increase more than 1 time year-on-year.

Seasonal mass warmth products such as down jackets, thermal underwear, cashmere sweaters, and winter boots saw a 160% year-on-year increase in GMV. As the most popular consumer goods category, apparel has a remarkable characteristic of being just in demand in the change of seasons.

3. Luxury accessories double

JD’s “Peak 28 hours” started at 8 pm on Nov 10th, the transaction volume of top fashion brands from LVMH Group including BVLGARI, CELINE, FENDI, and LOEWE increased 18 times.

High-end glasses, watches, and other accessories are also hot sellers, and European and American watch categories increased more than two times year-on-year. The turnover of more than 300 international brands such as LONGINES, Armani, Oakley, and CK increased more than 2 times year-on-year.

(November 8, 2022) GMV Growth for 750 Global Brands Doubles

750 global brands on Tmall Global more than doubled their GMV growth during the first sales window of 11.11 compared to the same period last year.

Among new overseas brands on Tmall Global, 300 exceeded RMB 1 million (US$140,000) in GMV, and 20 exceeded RMB 10 million.

Source: This news was originally released by alizila.

(November 3, 2022) New Consumption Trends from Singles Day This Year

A significant consumption observation is: This year, new faces from toys, pets, jewelry, and outdoor categories are more active. Data from Tmall shows that in the past year, more than 400 subdivided categories rose from these four categories, with 358 brands selling over 100 million RMB and 3,434 brands selling over 10 million RMB.

Take the pet industry as an example, the care for pets has gone into a more comprehensive and detailed phase. Tmall Double 11 pet daily necessities, health care products for cats and dogs, and pet life service products have strong growth.

In the outdoor sports industry, more pan-sports people have joined the team of snapping up equipment, and new sports tracks such as camping, skateboarding, and fishing, which saw a 100% increase in the first hour of sale on Tmall.

A special phenomenon in the toy industry is that adults have their own toys. For example, more and more young people are playing with building blocks and model features.

Buying gold jewelry has been a particular consumer phenomenon this year. Gold derivatives and IP co-branded jewelry have the advantages of both wearing and keeping their value well. As of 8 PM on November 1st, the gold category of jewelry track on Tmall has increased by more than 30% year on year, and six brands have sold more than 100 million RMB.

(October 31, 2022) Resilient Consumption: Singles Day Sales Boomed

At 8 PM on Oct 31, the first round of Tmall Singles' Day sales officially kicked off. In the first hour of the formal event, 102 brands recorded 100 million RMB in gross merchandise value (GMV) on Alibaba’s Tmall Taobao. Data show that domestic consumption enthusiasm is not reduced, consumption demand is strong. The first Singles Day check-out window opened on October 31 at 8 PM CST and will close at midnight on November 3. Customers have the option to finish the items in their shopping carts and secure the 11.11 offers.

JD.COM also witnessed robust consumption power from its Singles Day shoppers.

J Shop reports transaction volume for luxury products in the first 10 minutes increased by 113% year on year. The GMV of LVMH's top brands such as Bvlgari, Celine, Fendi, and LOEWE in the 10 minutes increased by more than 8 times YoY. MCM, BALLY, and Tory Burch saw transaction volume year-on-year growth of 200% last year. More than 100 international beauty brands such as L 'Oreal, Helena Rubinstein, Shiseido, OLAY, and other players have achieved a year-on-year turnover growth of more than 100%.

Within 10 minutes after the formal event, JD’s cross-border e-commerce arm JD Worldwide observed that the volume of transactions of more than 600 overseas brands increased by more than 100% year on year, the transaction volume of the national pavilion increased by more than 12 times year on year, and the transaction volume of cross-border wine category increased by 588% year on year.

(October 27, 2022) How Douyin Brings New Opportunities For Brands During Double 11 This Year?

In the past two years, the prevalence of the Singles Day shopping festival has gradually spread from traditional e-commerce platforms to social platforms and short video platforms. China's e-commerce industry has entered an era of rapid development, which also makes it necessary for brands to plan for Double 11. Think more thoroughly.

The huge traffic pool is the biggest asset of Douyin.

So far, Douyin has more than 600 million daily active users and targets to upgrade interest e-commerce to universal interest e-commerce.

Oriental Select livestream session on Oct 27 (right)

Universal interest e-commerce, defined by Douyin, is that in the universal interest e-commerce scenario, short videos, live streaming, and other content streams are the main driver of users' potential interests, where users make purchase decisions efficiently.

Simply put, Douyin provokes users' desire to buy products through short-form videos or livestreaming campaigns and then makes users get used to buying the products in Douyin Mall. Compared with Douyin's previously proposed interest-based e-commerce, it upgrades traffic management to user management.

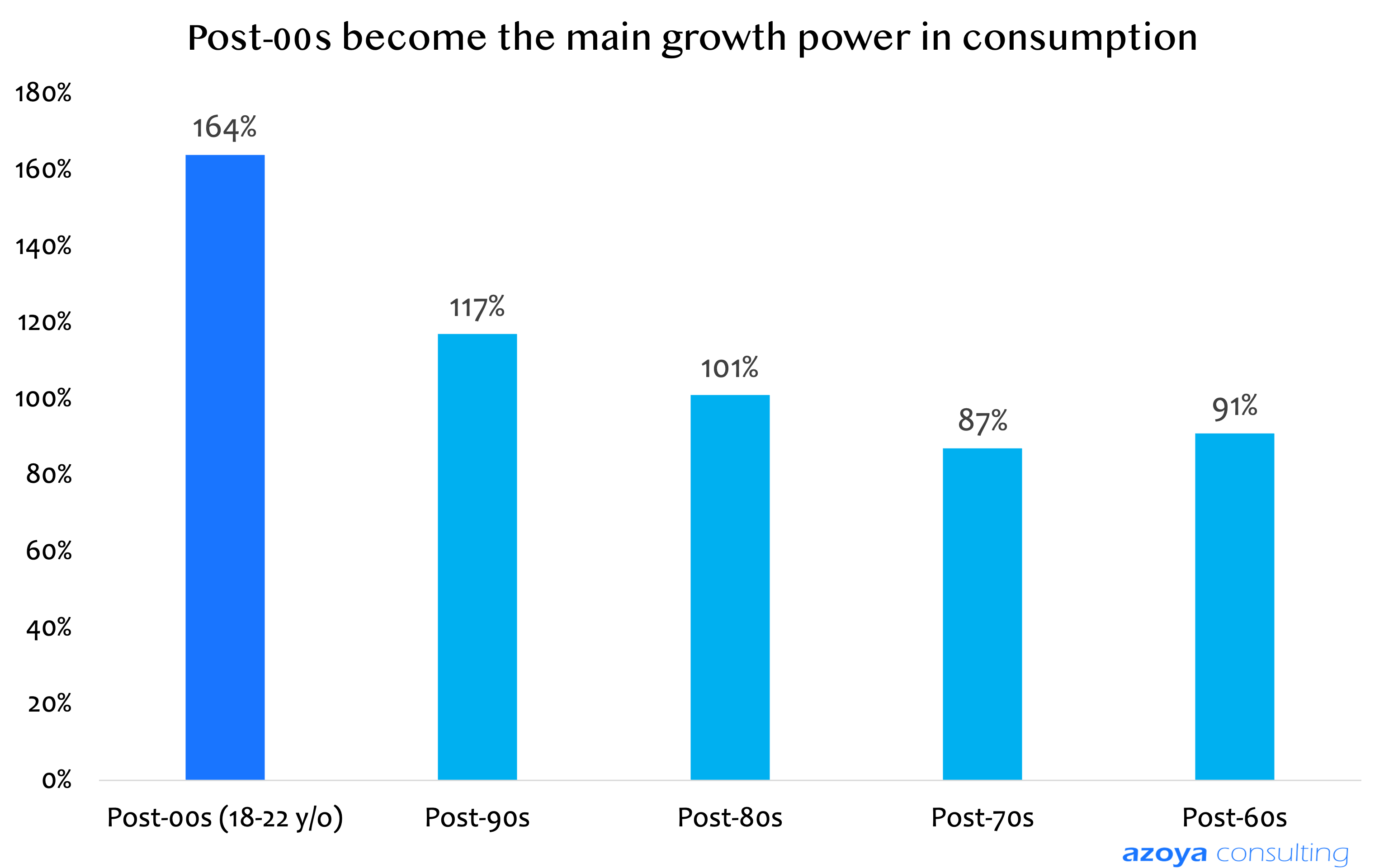

Gen Zer is the main consumption power during Douyin 618 2022

Douyin Double 11 Good Products Festival officially started at 00:00 on October 24th this year, how will Douyin perform from the 2022 618 event and last year’s Singles Day? Perhaps the pre-sale event of the shopping bonanza will provide the clue.As of October 26, the cumulative number of users who paid the deposit for the Douyin Double 11 Goodies Festival pre-sale is 2.6 times of last year's Double 11 whole event; the cumulative sales volume is 4.7 times of last year's performance; the merchants participate in this year-end event is 3.8 times more than 2021.

(October 24, 2022) International Brands Remain Positive Performance

Pre-sale kicked off at 8 pm China time. As the only super livestream celebrity in China's e-commerce industry, Austin Li set a new record with his livestream session. According to Finance China’s data, it is estimated that Austin Li‘s livestream session final sales on October 24th will reach 21.5 billion RMB, with a total of the deposit and final payment.

At 3 pm on the 24th, Austin Li's livestream campaign was initiated on time. Only in the past 40 minutes, the number of viewers exceeded 10 million, and at the end of the live broadcast, the number of viewers finally exceeded 460 million after a 10-hour length livestream.

The theme of the first day of Austin Li pre-sale is "Super Beauty Festival", the major battlefield for both domestic and foreign beauty brands. In addition to Estee Lauder, L'Oreal, Lancôme, La Mer, Guerlain, Helena Rubinstein, Olaplex and etc. Also, Li’s appealing influence attracted Murad and Cerva leading niche beauty.

Notably, international beauty brands maintain positive performance. The reserve of 89,000 Guerlain Fortifying Lotion and 220,000 sets of Guerlain Advanced Youth Watery Oil and other single products ran out of stock in a few seconds.

Austin Li (middle) ended the livestream around midnight on 24th Oct

Despite inflation rising above expectations, customers show strong demand and a willingness to make purchases during the largest year-end shopping festival.

This top livestreamer’s live show also on shelves a small number of home furnishings, home appliances, and mom & baby products.

In recent years, livestream e-commerce sales accounted for a higher proportion of the total sales of Singles Day year by year, with more well-known anchors in the game, it is inevitable to think: How will livestream e-commerce last? Will the golden age of livestream come to an end?

(October 21, 2022) Taobao launches a new feature to drive traffic for Mom & Babies merchants

Ahead of Tmall's "Double 11", Taobao mobile APP officially launched the "Kiss Baby" channel, especially catering to target customers of Mom & babies category. At present, there is already a "Kiss Baby" entrance on the second floor of the home page of the mobile Taobao APP, and users can also enter the channel by searching "kiss baby".

After filling in the baby's date of birth, consumers can see the shopping list of childbearing ages, including maternal and infant products in various child-rearing scenarios from the first trimester to the age of six.

It is reported that version 2.0 of "Kiss Baby" is currently being tested and launched, adding "Growth Weekly Journal", which is published according to the baby's age, and adding "Picture Book Recommendation", "Online consultation", "Parenting encyclopedia", "Vaccination appointment", and other services, and in conjunction with Ali Health, links with professionals such as pediatricians and baby caregivers to help mothers acquire parenting knowledge.

(October 19, 2022) Platforms prepare for Singles’ Day: Traffic Initiatives

Taobao Tmall

Taobao's Double Eleven pre-sale this year began on October 24, and a total of 12 merchant measures were released to serve merchants to prepare for Double Eleven. Among these 12 measures, Taobao mainly emphasizes the upgrading of product seeding traffic and product tools and lowering the operating costs of merchants.

JD.COM

This year, JD.COM has added a new "Product Seeding" period, which starts in October and enters the pre-sale warm-up period in late October. In the content operation, the e-tailer added challenge ranking in terms of short-form video, brand self-livestreaming, and influencer livestreaming. JD Double 11 Seeding period, on the one hand, is to give new products, brands, and merchants more warm-up preparation, and the opportunity to evaluate the market. JD side also put forward the Double 11 "four new initiatives" to recruit new merchants, establish new mechanisms, launch new services, and explore new growth.

Douyin

Short-form videos and live streaming are still the focus of the Douyin Double 11 festival.

For Douyin, which has split the shelf e-commerce, this year's Singles Day is no longer only the main battlefield of Douyin livestream e-commerce, so many mature marketing tools in the shelf e-commerce ecosystem have been introduced. Traffic is not only put into the livestream room but will be allocated to the Douyin mall and stores.

WeChat Video Channels

This is the second year for WeChat Video Channel to participate in the Singles Day bonanza, leaving enough time for the preparation stage of the promotion.

Merchants began to register on September 23, and the warm-up period began on Oct 14th, while the formal event will be initiated on October 29 officially.

The focus of this year's WeChat platform Double Eleven promotion is to pull the brand's new launches, and the second is to improve the livestream rate of merchants. As such, merchants can guide the conversion of private domain traffic and improve the GMV of the livestream session.

Source: Tmall Official Weibo Account

[1] https://www.cbndata.com/information/258212

[2] http://finance.china.com.cn/consume/20221025/5891039.shtml

[3] https://mp.weixin.qq.com/s/1VucngrqZqHf2-rA73j0vw

[4]https://finance.sina.com.cn/tech/internet/2022-10-26/doc-imqmmthc2214189.shtml

[5]https://mp.weixin.qq.com/s/xWtV57loXBIqYpq9SVYxTw

[6]https://mp.weixin.qq.com/s/nomsu1Xldg5tjpi_7nkpKw

[8]https://mp.weixin.qq.com/s/BuzHuVmw_jaf_QGF42BxaQ