Douyin or Tmall Global? A Guide to Launch Your Brand in China in 2022

by Maggie Yu

China is no doubt the biggest e-commerce market in the world, and the rapid development of China's e-commerce market has been a major opportunity for international brands. However, there are a growing number of options of entering China via cross-border e-commerce, such as Tmall Global, WeChat, JD Worldwide, independent shops, etc.

More recently, Douyin (the Chinese counterpart of TikTok) flagship store emerged to become a popular option for brands. In this article, we compare the main differences between Douyin and Tmall Global.

The difference between Douyin and Tmall Global

In recent years, consumers have gradually been willing to spend more time on short video platforms such as Douyin and Kuaishou. For brands, the short video format is also gradually becoming a very important focus of their marketing strategies. According to the report released by CNNIC, as of December 2021, the size of the short video user market is 934 million, with a usage rate of 90.5%.[1]

Given the popularity and high marketing efficiency of short videos, more and more brands are embracing the short video market. According to ASKCI data, the short video market size is expected to approach 300 billion RMB ($45 billion US) in 2021.[2] Douyin has a complete process from short video seeding to livestreaming conversion and has a strong ability to incubate new products. Douyin e-commerce data shows that, in the past year, 1.8 million new merchants have entered Douyin.

However, Tmall Global is still the cross-border e-commerce platform with the largest market share in China. According to public data, Tmall Global still ranks first with 37.7% of the market share of cross-border import retail e-commerce in China in Q1 2022.[3] Consumers still choose to buy a large number of cross-border goods from Tmall Global because of its strong brand endorsement capabilities.

At the business cooperation level, the rules are different for Tmall Global and Douyin. The security deposit for Tmall Global is different depending on the nature of the store and the standard is different, ranging from 50,000-300,000 RMB ($7,00-$45,000 US) and the annual services fee is 30,000-60,000 RMB ($4,500-$9,000 US).

The security deposit range of Douyin is mainly within 100,000-400,000 RMB ($15,000-$60,000 US) and the annual service fee is $ 1,000 US.

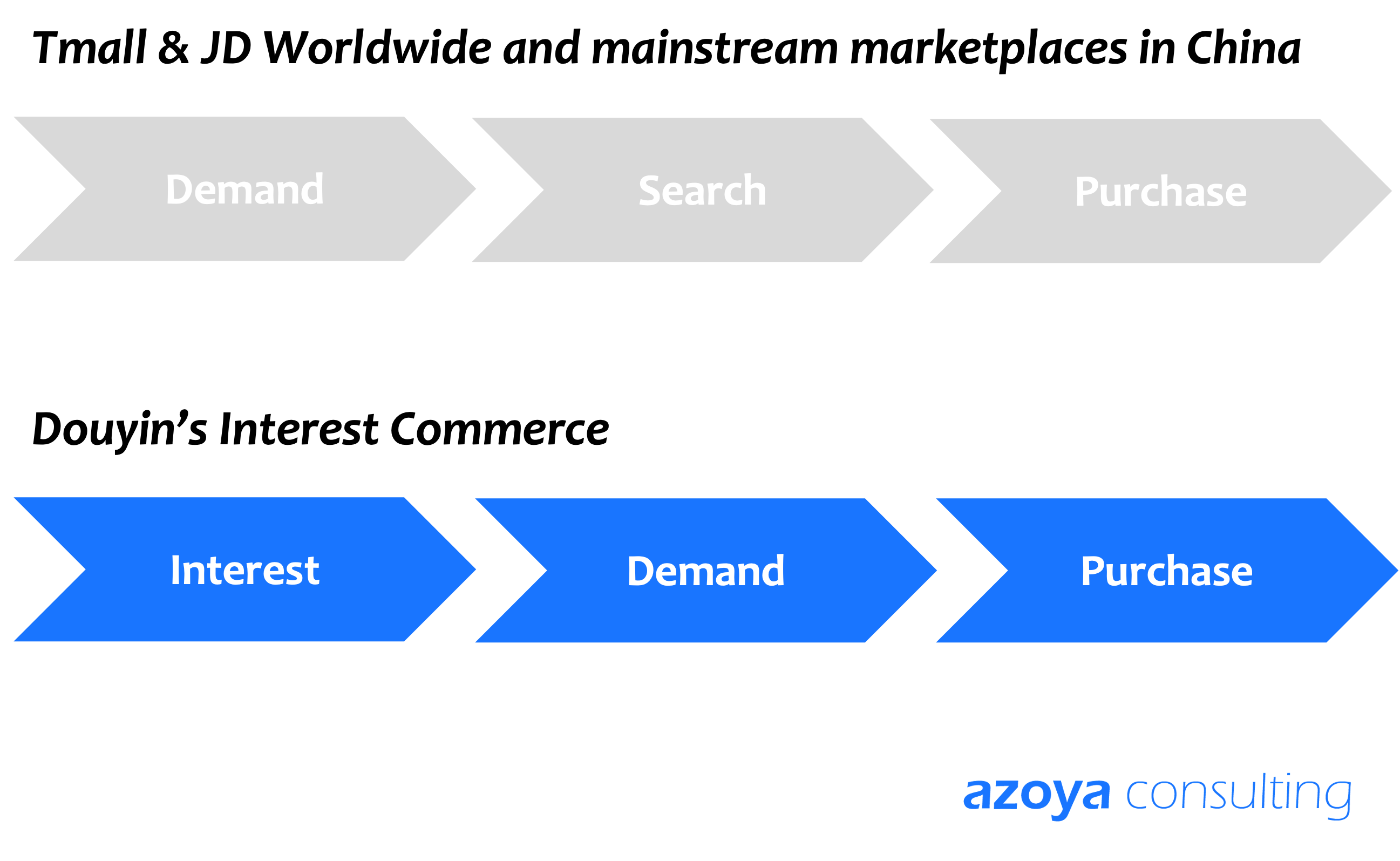

From the consumer's point of view, there is also a clear difference between the two platforms in terms of shopping experience. On Tmall Global, consumers mainly have clear purchase intent, they usually intend to buy a specific product, and leverage the marketplace’s search function to get product and price information, then make a purchase.

Compared with Tmall Global, the product sales model of Douyin is “interest e-commerce.” For consumers, Douyin e-commerce can take "interests" as a clue to help consumers find potential products to satisfy their needs.

Douyin livestream set to occupy a larger market share

For a long time, "content seeding + top anchors promotion" has been the guideline of growth for many emerging brands.[4] On last year's Singles Day, Austin Li generated 10.653 billion RMB ($1.6 billion US) GMV through livestreaming on the first day of the pre-sale, with a large number of emerging brands and first-time China entrants. This year's 6.18, with Viya's withdrawal due to tax evasion and livestreaming star Austin Li's sudden disappearance, Taobao livestreaming was dealt a serious blow.

According to an MCN company, "This year's 618 Austin Li livestreaming room originally cooperated with nearly 400 brands. Austin Li's absence has a huge impact on the brand side because merchants need to prepare their inventory in advance."

Although Taobao is increasing its support for medium and micro anchors, it has not been able to get rid of its reliance on top anchors. After the 6.18 shopping festival, many brands started to contact new anchors to prepare for their livestreaming campaigns. According to Pengpai, "A beauty company insider reflected that they are now looking for new anchors for the Douyin platform. "

Douyin has gradually started to attract the livestreaming traffic from Taobao during this "vacancy period," and the recent explosion of the New Oriental livestreaming room is undoubtedly proof of this trend. It is reported that the current cooperation with the New Oriental brand has been scheduled until October, and the New Oriental has also launched its own beauty independent Douyin account. Public data shows that during this year's 6.18 campaign, the New Oriental livestreaming room sales ranked second, and the cumulative sales during 6.18 exceeded 300 million RMB ($45 million US).[5]

With the industry trend of getting rid of top anchor dependency, Douyin is undoubtedly a platform with obvious decentralization characteristics and rich traffic resources.

UBRAS, an underwear brand whose experience focuses on comfort, has created its own talent matrix on Douyin. According to a report by Data Insider, UBRAS cooperated with 92 influencers in February 2022. According to statistics, more than 80% of UBRAS' sales are generated by medium influencers (fans with between 100,000 and 1 million followers) and top influencers (fans with more than 10 million followers).[6]

It can be seen that Douyin's top and medium talent matrix creates great opportunities. Brands can leverage the huge talent resources to quickly build awareness, while the diversified influencers can reach multiple circles of customers.

In addition to the abundance of creators, Douyin also launched a "Dou Brand" incubation support policy. Specific support includes traffic support, branding resources, and marketing campaign exposure, etc.

On Douyin, brand awareness is no longer the main reason for traffic recommendations, but it is more focused on the brand's content creativity, traffic operation ability, and product power, which are friendlier for emerging brands’ growth. Being interesting is the number one rule of gaining popularity and consumer attention on Douyin.

In the current competition among e-commerce platforms, the content capability is central to capturing the user's attention. Major e-commerce platforms like Taobao and JD.com have noticed the potential of short videos to seed products and attract users' attention, so they have started to build up their content ecology to attract consumer interest and increase the length of time users stay.

However, Tmall Global is still the first choice for early-stage international brands

From the industry’s perspective, the brand multichannel operation has become a trend. However, Tmall Global is still the leading position for international brands to invest resources. After all, Tmall Global has a mature e-commerce ecosystem and is still optimizing merchants and the user experience this year. For example, shopping guarantees, product quality, refunds and returns service, 88 VIP membership benefits, etc.

According to the founder of a research institution, users' consumption habits on Taobao or Tmall have been formed, and most users still think Tmall's shopping experience is more trustworthy for relatively high-priced products. But on Pinduoduo, Douyin, and Kuaishou, for some expensive items, most customers are unable to buy them directly. The overall credibility of the platform and the after-sales system need to be gradually improved.[7]

In addition, Tmall Global will also provide support for new overseas brands in terms of traffic resources and policies. Such support includes providing commission subsidies for key new businesses and improving customized supply chain services, among other benefits.

In September 2021, Tmall Global announced the beauty brand incubation program. It said it planned to introduce 1,000 new overseas beauty brands, with the goal of incubating more than 50 new brands with an annual turnover of over 10 million RMB ($1.5 million US).

Tmall Global has launched a series of service initiatives to help overseas brands reduce the cost of entry into China and help emerging brands realize the landing from 0-1 and the value growth from 1-10. In the past year, the growth rate of overseas brands entering Tmall Global is close to 200%, 40 brands with sales exceeding 100 million RMB ($15 million US) have been added, and the growth rate of new products is more than 100%.[8]

This year's 6.18 shopping festival saw 410 new brands increase their turnover by more than 100% YoY (year-over-year). 67.2% of companies consider Tmall to be the most important platform in the 6.18 campaign, according to Ebrun Research.[9]

It is worth mentioning that Tmall Global data shows that the post-00s cross-border online shopping population has increased by nearly 70% YoY in the past year, and the post-90s and post-95s young customers account for about 50%. The amount of post-95s buying luxury co-branded and limited-edition models on Tmall also continues to grow.[10]

Multichannel parallel launch strategy worthy of brand investment

In fact, it is indeed important for brands to choose the right platform according to their own development stage. More importantly, the platform has formed its own ecosystem and operating rules. Understanding the marketing strategies of each platform is essential for business growth.

Douyin, a platform with more media attributes than e-commerce, has obvious advantages in terms of traffic and marketing. But compared with traditional e-commerce platforms, Douyin lacks a mature e-commerce system and supply chain.

In addition, compared to the comprehensive e-commerce platform, Douyin e-commerce lacks core categories. On the contrary, Taobao and Tmall have formed superior categories of lifestyle and beauty, JD.com digital appliances occupy consumers' minds, and Pinduoduo’s food and agricultural products are deeply popular.

But Douyin's greatest strength is undoubtedly its daily activity of more than 600 million users and the technical algorithm distribution mechanism of interest e-commerce, which can provide users with tailored content that is relevant to their interests and preferences. However, interest e-commerce is often stimulating consumption, which makes customers on Douyin usually only engage in one-time consumption, as the repurchase rate is not high.

A market researcher said: “We have observed that most brands are still sharing content on Douyin and attracting traffic to Tmall. Douyin itself is a content-sharing platform, so many brands want to through content seeding on Douyin to arouse user interest or increase brand exposure.”[11]

In general, traditional e-commerce platforms like Taobao and JD.com are transaction-based. Brands can precipitate customers, strengthen brand awareness, and increase user customers to inspire repurchases.

The supply chain ecology, logistics and delivery, and after-sales service are the problems that Douyin e-commerce needs to face at the moment. Currently, many brands go through Douyin to complete traffic acquisition and early-stage conversion, and then go through Taobao to do precipitation, and management of consumer assets.

Brand growth cannot be achieved without seeding and sales conversion, and seeding and conversion must go hand-in-hand as a seamless process. Nowadays, Chinese online consumers' daily shopping behavior and screen hours are increasingly scattered. For merchants, this means that traffic is now more fragmented.

Therefore, relying on one platform alone can no longer continue to create growth myths, and getting more free or low-cost referral traffic and search traffic is the core factor for brands to break the ice and grow quickly. That’s why both Tmall and Douyin are indispensable.

How are emerging brands leveraging Tmall Global and Douyin to boost sales?

Dermalogica is a professional-grade skincare brand founded in the United States. It has positioned itself as an expert skincare brand that is used in spas. Besides launching on the e-commerce channel Tmall and offline multi-brand beauty stores Harmay, Dermalogica officially entered Douyin in 2021 and it has achieved rapid sales growth on Douyin e-commerce.

Due to the global pandemic, lockdowns blocked consumer access to professional institutes and spas for beauty care. As a result, overseas "professional beauty" brands have a new round of opportunities in China. Imported "professional beauty" with facial masks, essences, and beauty instruments are the main products with rising demand on Tmall Global. According to official data, the consumption of imported professional beauty masks increased by over 500% in 2020, and Dermalogica increased by over 400%.[12]

Five months after Dermalogica entered Douyin e-commerce, it achieved more than 50% continuous growth through brand self-livestreaming. In October 2021, with the help of “Big Day Brand Fans Activity” and Douyin platform resources, Dermalogica successfully achieved GMV exceeded 1 million RMB ($150,000 US) in a single week. [13]

Five months after Dermalogica entered Douyin e-commerce, it achieved more than 50% continuous growth through brand self-livestreaming. In October 2021, with the help of “Big Day Brand Fans Activity” and Douyin platform resources, Dermalogica successfully achieved GMV exceeded 1 million RMB ($150,000 US) in a single week. [13]

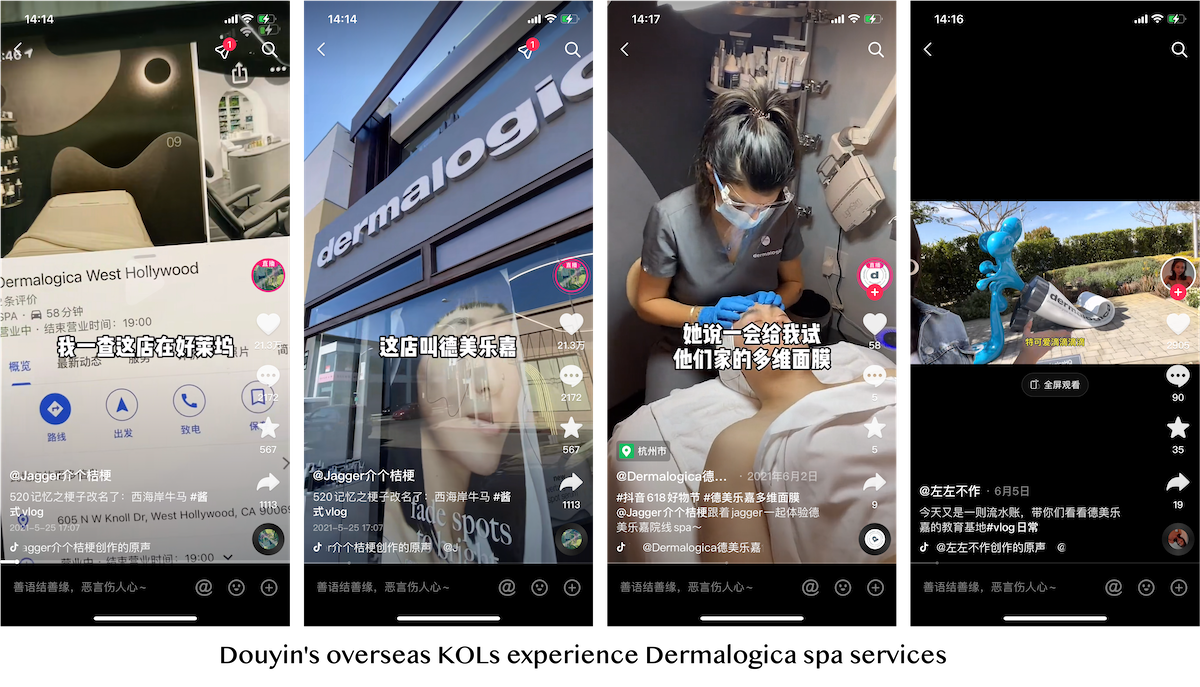

In Douyin's e-commerce operations and marketing, Dermalogica cooperated with overseas Chinese influencers called key opinion leaders (KOLs) to consolidate a professional international brand image in the form of short videos of experiencing spa services in offline stores and visiting brand companies.

At the same time, Dermalogica uses brand self-livestreaming to deliver brand stories and product introductions to customers. For example, in response to the pain point of customers' desire to remove yellowing and brighten their skin without irritating it, Dermalogica made the "combination" of short video content + livestreaming seeding to make Dermalogica multivitamin power recovery mask. As a result, weekly sales exceeded 3,000 units.

At the same time, Dermalogica uses brand self-livestreaming to deliver brand stories and product introductions to customers. For example, in response to the pain point of customers' desire to remove yellowing and brighten their skin without irritating it, Dermalogica made the "combination" of short video content + livestreaming seeding to make Dermalogica multivitamin power recovery mask. As a result, weekly sales exceeded 3,000 units.

Key Takeaways

• When customer traffic to a brand becomes fragmented, brands cannot only rely on a single sales channel or social media platform to achieve marketing and sales purposes.

• The proliferation of new e-commerce channels over the past few years has significantly transformed how brands approach customers in China. Understanding the constant evolution of behavior, trends, and market shifts are requisite for success in China's retail market.

• The typical path of how brands reach consumers remains the same: generating brand awareness, debuting the channel, and maintaining customer relationships.

[1] https://baijiahao.baidu.com/s?id=1725843781108768059&wfr=spider&for=pc

[2] https://baijiahao.baidu.com/s?id=1727990633515597095&wfr=spider&for=pc

[3] http://www.jseca.org/content-17-4403-1.html

[4] http://www.199it.com/archives/1323692.html

[5] https://www.cbndata.com/information/248374

[6] https://www.gxmry.com/4102.html

[7] http://finance.sina.com.cn/tech/csj/2021-04-15/doc-ikmyaawa9747360.shtml

[8] https://baijiahao.baidu.com/s?id=1695183396251566896&wfr=spider&for=pc

[9] https://baijiahao.baidu.com/s?id=1702860781367627275&wfr=spider&for=pc

[10] https://www.chinaz.com/2022/0228/1368555.shtml

[11] https://m.sfccn.com/2021/6-16/yNMDE0MDdfMTY1MDIyNg.html

[12] https://baijiahao.baidu.com/s?id=1678139902913830982&wfr=spider&for=pc

[13] https://www.sohu.com/a/506438352_120932824