Key Trends of Health Supplement Markets in China 2022

by Queenie Yao & Davy Huang

Last June, GNC, the health product giant from the United States, declared bankruptcy. Yet, in China, the health supplement dividend is set to release, as consumer awareness for personal fitness is spurring after the Covid-19 pandemic, increasingly larger aging while wealthier population, and the influence of the popularization of nutrition and health knowledge, signaling a rapidly growing market in China.

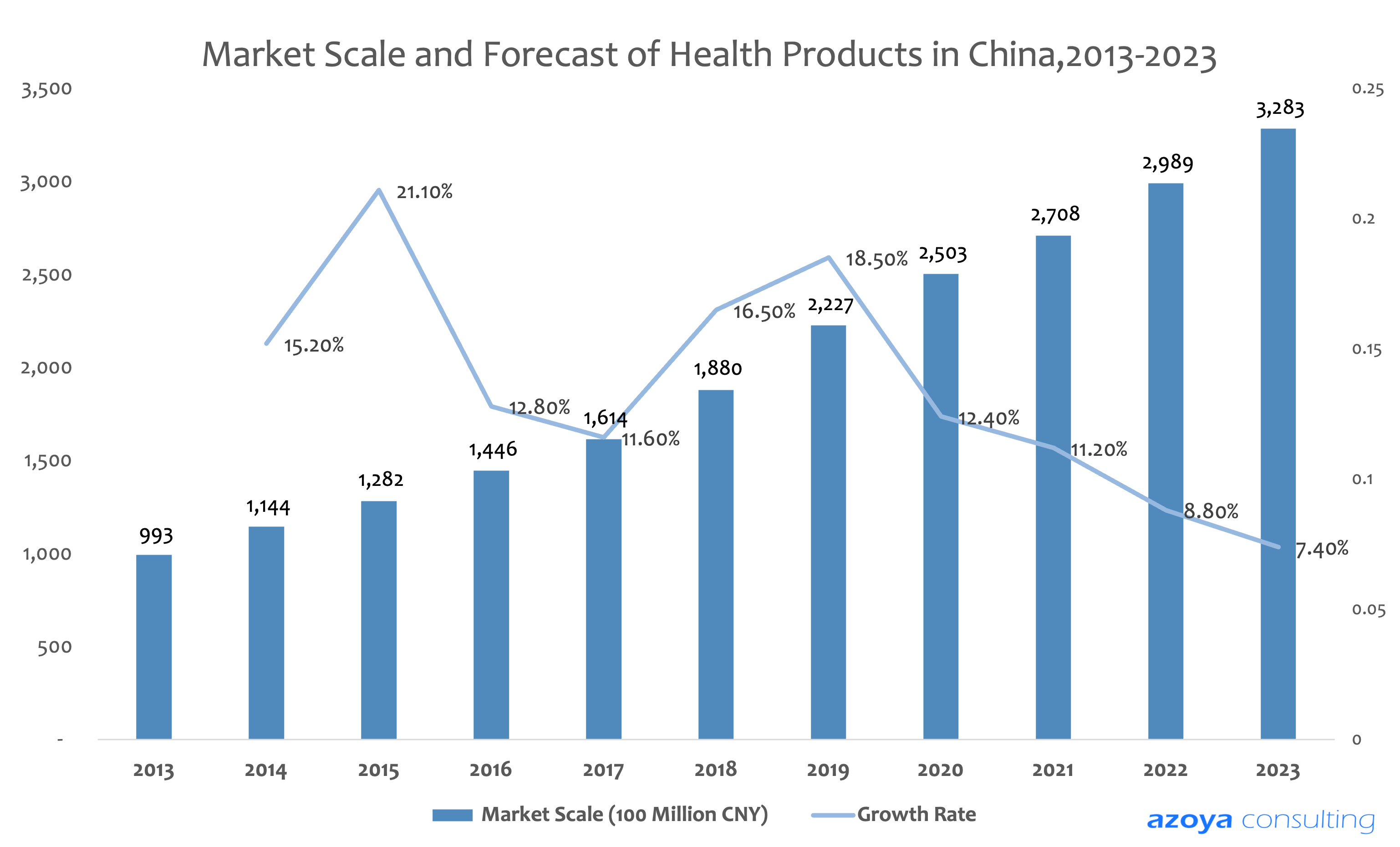

According to iiMedia Research[1] latest report on China's Health Supplement Market, in 2015, the scale of China's health care products market was only 128.2 billion RMB, and in 2019 it increased to 222.7 billion RMB, making it the second-largest consumer of health care products in the world. It is forecasted that the market size of health products in China will reach 328.3 billion RMB in 2023. Consumers' consumption willingness for health products has seen significant changes. The consumption attribute of health products will gradually move beyond from optional consumers goods to compulsory consumer ones.

| Read our 2023 version Key Trends Shaping The Health Supplement Market In China 2023. |

Post-90s and Gen-Z are the Emerging Consumers of Healthy Supplements

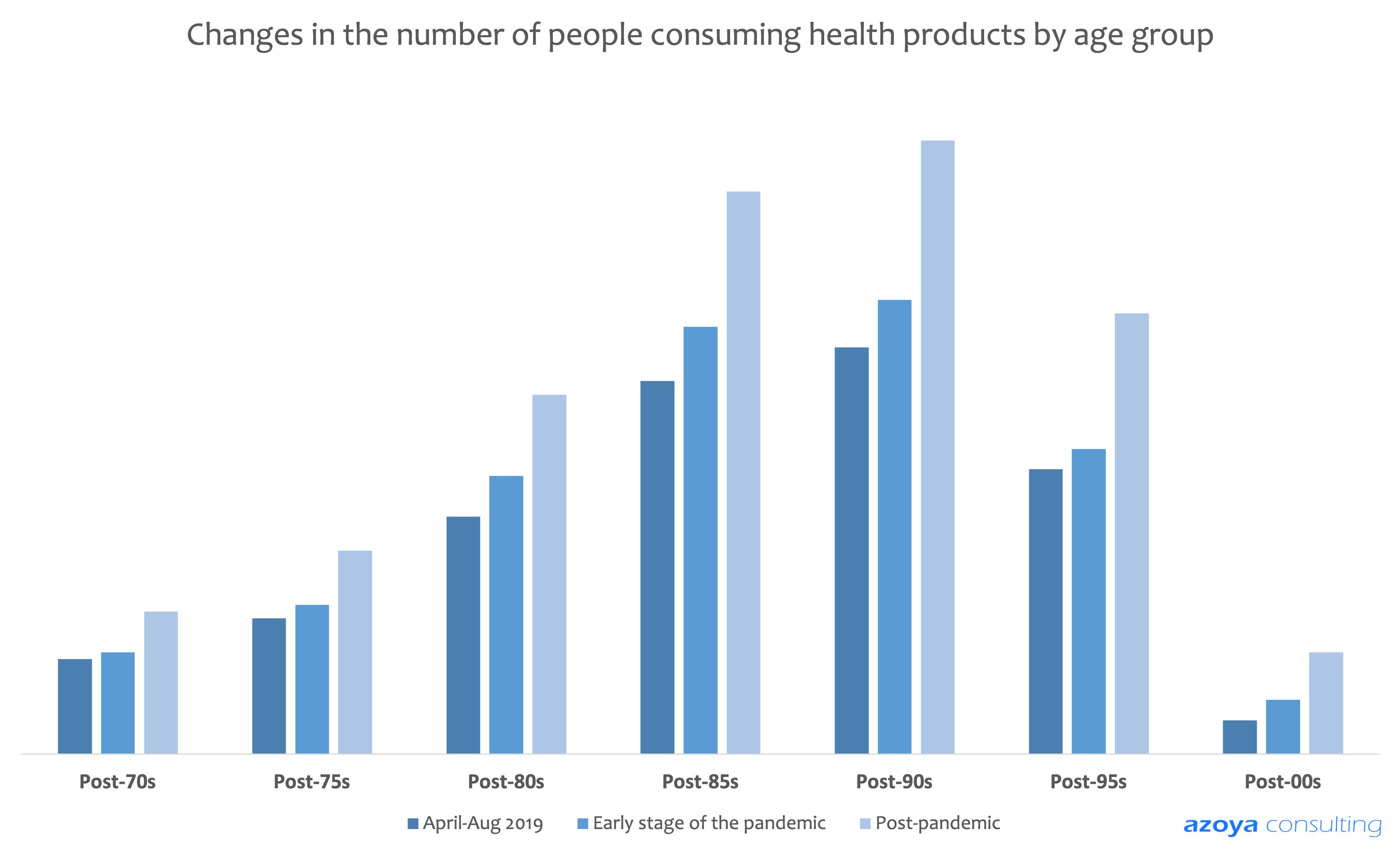

Younger generation of consumers demonstrated significant demand increasing for imported/functional healthcare products. Statics from Deloitte x Tmall Global's post-pandemic imported market show that the frequency of use and acceptance of health care products is exceptionally high among the post-85s & post-90s generations, and the post-95s consumption growth rate is increasing.

Regarding the spending on the imported health supplement, post-90s spending amount witnessed an increase of 51% YoY[1], compared to the pre-pandemic era. The growth is driven by increasing awareness for taking supplement to maintain nutrients balance, immunity, better digestion, hair & skin benefits, as well as functional support such as sleep and focus. Significant amount of consumers in Chinese tier 1 cities developed "health Anxiety" symptoms due to fast pace lifestyle and excess work life (996)

Source: Deloitte x Tmall Global, 2020

What nutrition supplements are popular in China?

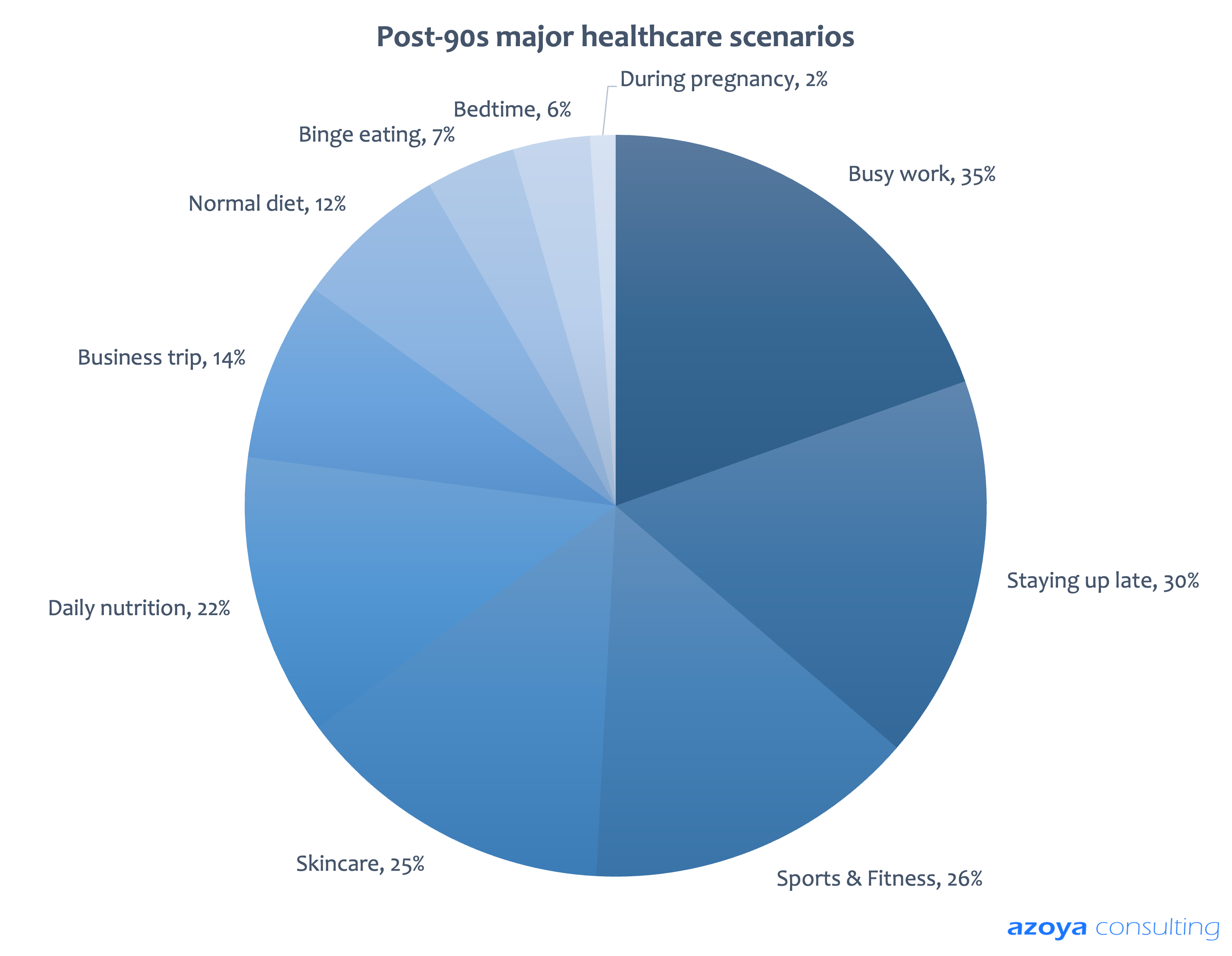

Longer working hours in Tier 1 cities, combined with rising disposable incomes, led to increasingly conscious of the physical toll on their bodies. For students, heavy schoolwork and busy work are also squeezing their sleep time. For these consumers, most in-demand products are integrated nutrition, melatonin, anti-fatigue products to reduce stress, increase energy and improve sleep quality.

Despite working overnight, "staying up late" presents the 2nd most popular lifestyle. The increasing number of young people are adopting so-called "retaliatory staying up late", which means sacrificing sleep time to eke out some personal time. Anti-fatigue, probiotics, eye vitamins, and liver detox products are therefore become a daily essential to ease out or recover from the discomfort from staying up late.

Sports and fitness nutrition consumption continue to rise along with the growing consciousness for body building and sports. Young people take exercise as an essential part of their daily life and want to maintain a good figure and emotional state of mind by choosing the proper form of exercises including yoga, body building, jogging, or ball games. Along with regular exercise, consumers often consider the intake of dietary supplements to consolidate their fitness results and achieve more significant exercise effects. Protein powders, meal replacements, nutritional complexes, joint health, etc., are the main products that customers would purchase.

The beauty ready-to-drink market, driven by the "beauty from within concept," is gaining attention from young female consumers and presents increasing demand. The Chinese Women's Health Consumption Report 2021 conducted by Alibaba Health shows that annual "Beauty from within" products rose by 100% YoY in 2020.

However, women of different ages have different needs for health products. The post-00s are more concerned about personal shape. Post-90s are awakening to the concept of health management and prefer clinically formulated probiotics for women. Simultaneously, the post-80s are worried about retaining balanced, healthy skin and anti-aging products. Their most in-demand products are collagen drinks, sleep support, and biotin supplements to prevent hair loss.

Apart from these specific scenarios, the Chinese consumer's changing attitude towards healthy living can be proven by 'Daily Nutrition' weight. As Kantar points out, immunity-enhanced segments such as vitamins[2], calcium, protein, and probiotics supplements are highly demanding for consumers.

Functional gummy is in growing demand in China

Functional gummies for the beauty-from-within and vitamin category have exceptional growth in China. Gummy vitamins taste like snacks, without the psychological burden of taking supplements and making them quite suitable for young people and many first-time vitamin users.

In terms of the growth rate of consumption of different forms of health care products, health care products in the form of snacks such as gummies and jellies are increasingly favored by young people. In terms of preference, young people who love to try new things are more likely to be attracted to snack-shaped health products.

Young women have a much higher preference for snack form health products than men and are more willing to pay for attractive, fresh, and fun health products. The rich taste and mouthfeel of snack products do not feel like taking health care products in similar effects.

When supplements are like snacks for consumers, and they can continue to eat for a long time. More than gummy, jelly, freeze-dried food, and ready-to-drink are popular product types on Tmall Global. Sleep aid, multi-vitamins, maintain body shape category have gone viral on Tmall Global, CBN Data[3] highlights. Melatonin gummies, enzyme jelly, are popular among young people.

Competition is also growing, as both domestic and international brands are capitalizing on this market. BuffX, a local mass-market function food brand launched in 2020 had generated over 20m CNY sales within shortly 2 month of launching on Tmall and JD. The brand received investment from GGV and Sequoia, with valuation around 200 – 500m CNY. International brands are launching via cross-border e-commerce, and working closely with marketplaces including Tmall Global to expand their reach to Chinese consumers. To date there are over 80 gummy vitamin brands launched their flagship stores in Tmall Global, including Vitafusion, One-a-Day under Byer, Olly, Unichi, Nature’s Bounty, and SugarBearHair.

On-demand customization is growing in China

One of the major pain points of Chinese healthy supplement consumers is that they are not sure what market available products are best suitable for them. To discover the right products, one need to make extensive research, and often being misguided by the false information in search results or social media contents. For many customers, they don't have enough time to screen the health products on the market, and are looking for tailored dietary and nutritional supplement plan.

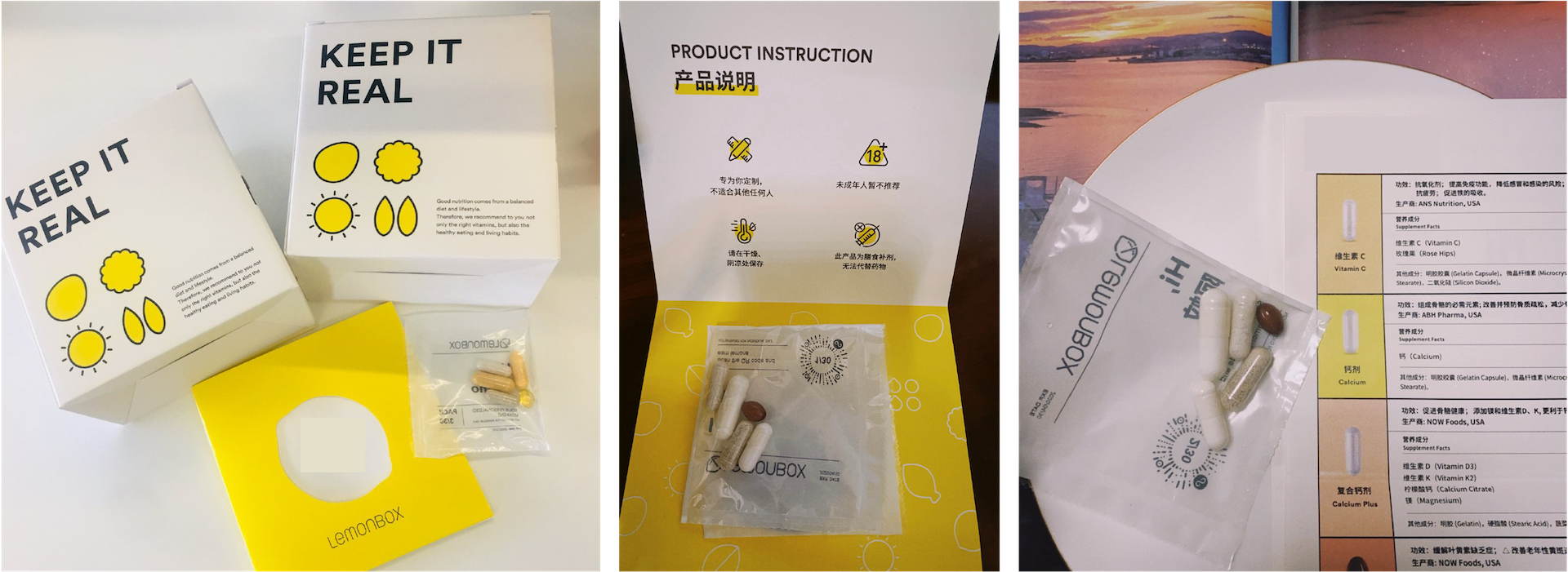

Witnessed this specific scenario, several health supplement brands have developed customization offerings to target Chinese customers. With "ingredient customization" as the core feature, LemonBox leads the personalized vitamin concept in the market. LemonBox leverages WeChat mini-program to develop an online questionnaire, where consumers are requested to complete a questionnaire about their health conditions and diet habit, before the system provide a recommended list of dietary support. Customers can then order supplements ‘prescribed’ by the mini-program, and receive the orders shipped from a bonded warehouse.

Complete questionnair for personal supplement recommendations. Source: LemonBox WeChat

LemonBox discovered a new way to sell vitamins - it is better to analyze specific demands of customers, and make a good recommendation, than persuading customers to buy something they don’t need. Consumers would clearly understand which vitamins to take every day. Another innovation is that instead of selling by bottle, LemonBox customizes consumer orders by providing daily packs of various supplements.

LemonBox Unboxing Experience

LemonBox Unboxing Experience

Unlike product ingredients, FANCL will customize products according to customers' age and gender. FANCL offers a comprehensive nutritional supplement and health care product divided into male and female models in terms of gender. The period is divided into the 20s, 30s, 40s, and 50s customers. According to the growth of age, consumers need more types of supplements.

Consumers are more willing to buy from trusted international brands

According to a study by the Chinese Nutrition Society, nearly 60%[5] of the participants said that they had purchased imported supplements before. They reckon the authenticity of imported products by referring to their original country of production.

The report emphasized that consumers have preferences on the country of production when deciding to buy imported products. Health supplements from Australia, New Zealand, Canada, and the US are most popular among Chinese consumers.

What’s more, the popularity of e-commerce in the health care market has increased significantly, with a share of nearly 30%. By 2021, China's cross-border consumption users are expected to exceed 200 million people, and online cross-border consumption is gradually becoming a shopping destination for imported health supplements.

Cross-border e-commerce platforms with significantly lower barriers, such as Tmall Global and JD Worldwide, are primary sales channels for international DTC brands to break into the Chinese market.

[1] iiMedia Research: Health Supplement Market in China, 2021; URL

[2] Deloitte x Tmall Global: China Post-pandemic Imported Goods Market, 2020; URL

[3] Kantar Worldpandel: Health Supplement, 2021; URL

[4] CBN Data: Online Health Supplement Consumption Insight, 2021; URL

[5] Chinese Nutrition Society: China Imported Supplement Consumption Behaviour White paper;