Watch Out for These Beauty & Cosmetics Trends on Singles Day

Azoya Consulting takes a deeper look at what's going on in the industry

by Azoya Consulting

All eyes are on Alibaba as we draw closer and closer to Singles Day, which generated $25.3 billion in GMV for the e-commerce behemoth last year. At Azoya, we are particularly excited to see how skincare and cosmetics will fare – the market in China is expected to reach US$38 billion[1] by the end of 2018, putting it second behind the US’s $71 billion market.

Singles Day is a good barometer for the rest of the year, so it’s important to keep an eye on what’s happening. Competition is intensifying amongst both Chinese and international brands, but we think that international brands will still dominate the mid-high end of the market.

Chinese consumers are changing, however, and the market is splitting into different niches as customers become more sophisticated and develop more unique tastes. Azoya Consulting takes a look at what’s going on and highlights a few major trends that may give us a clue as to which segments will perform well during this year’s Singles Day.

Chinese Brands Are Growing Rapidly, But International Brands Will Still Dominate the High-End Market in China

Typical foreign brands such as Lancome, Estee Lauder, SK-II, and Olay topped the sales rankings on Tmall during last year’s Singles Day, but local Chinese brands such as Pechoin, Chando, and One leaf also placed in the top ten.

Chinese brands represented 23.1% of the market for China’s top 30 brands last year, up from 12.9% in 2012 and 5.1% in 2008, according to a report from Euromonitor. And yet international brands still occupied 92.3% of the high-end (>200 RMB/item) market for skincare and cosmetics last year. HKTDC notes that the high end segment currently accounts for 31% of the market, up from 27% in 2012 and growing at around 25% a year.

While international brands have more capital to invest in R&D and long-term branding, Chinese brands are known for their high quality-to-price ratios and are popular in smaller cities, where they tend to have stronger offline retail networks.

Chinese brands Dr. Plant and Timier House each have 2,500 and 1,000 offline stores, respectively, compared to just 400 for Innisfree and 357 for The Face Shop. Some international brands have even acquired local Chinese brands to make use of their extensive distribution networks; for example, Johnson & Johnson purchased lotion maker Dabao in 2008 and Coty purchased skincare brand Tjoy in 2010.

With that being said, there are still many opportunities for international brands as the market for skincare and cosmetics is trending upscale as consumers are becoming more sophisticated and are searching for more specialized, niche products.

Cosmetics Brands Will Benefit from Chinese Consumers Upgrading Their Makeup Routines

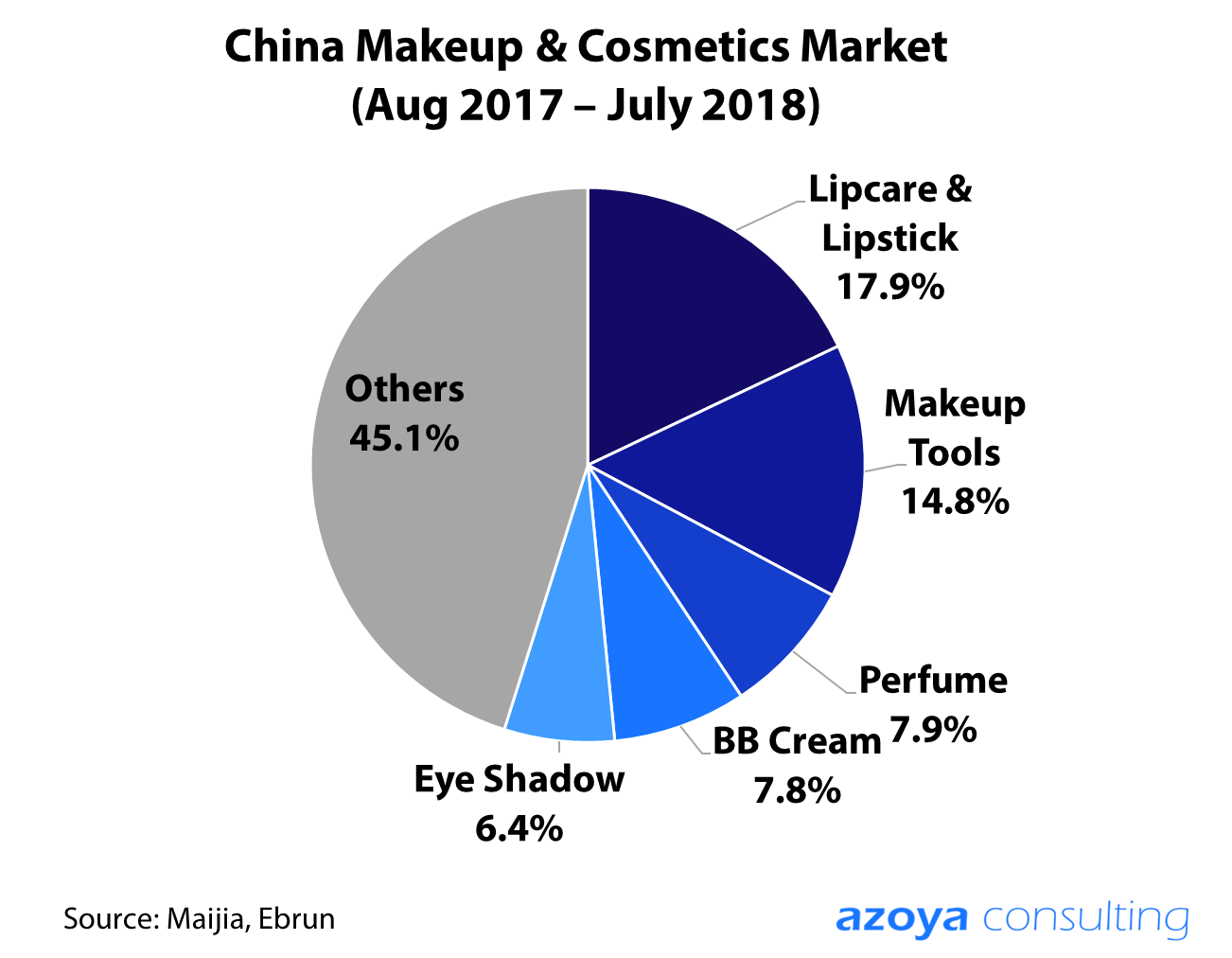

36% of Chinese cosmetics customers are adding steps to their makeup routines, according to a report[2] published by Chinese e-commerce site Ebrun.com. They are progressing from “basic” makeup items such as lipstick, BB cream, and perfume, and starting to purchase “advanced” items such as foundation, makeup tools, and eye shadow. This helped drive a 56% YoY growth in the color cosmetics industry last year, according to Kantar Retail[3].

In the past, Chinese consumers had been primarily focused on skin care and basic cosmetics products such as lipstick, BB cream, and perfume. These are relatively simple and easy to use, and considered fairly basic products for those new to cosmetics.

For example, cosmetics amateurs may initially prefer multipurpose BB creams that help even out skin tone and double as moisturizers and sunscreen – important features for Asian women that prefer lighter complexions. But as consumers start to develop more advanced, multi-step makeup routines, they start using foundation, which is like BB cream but is just one step of the process.

Items such as foundation, eye shadow, and makeup tools are more complex to use and often require tutorials. These products are commonly used in the West and Youtube influencers such as Michelle Phan have popularized online makeup tutorials.

In China, consumers are still getting to know these products, as basic products such as lipstick, perfume, and BB cream occupy 33.6% of the market, according to Maijia and Ebrun. But CBNdata reports that foundation and eye shadow have lower penetration rates and are the top two fastest growing cosmetics categories on Alibaba’s platforms, as Chinese consumers continue to add more steps to their makeup routines. Foreign brands are expected to benefit as they have more experience with designing and selling these types of products.

Using KOLs to provide makeup tutorials through livestreaming or short videos is a good way to educate customers. KOL MeililimFU has nearly 900,000 followers on Weibo and has done tutorials on Meipai and Douyin, using an assortment of brands that includes YSL, M.A.C., and more. She notes that the market is still in early stages as most Chinese consumers have historically looked towards Japan or Korea for inspiration, and have yet to develop their own distinct style[4].

Brands with Bold Offerings Will Appeal to Chinese Consumers Looking to Differentiate Themselves

As Chinese consumers become more sophisticated, they are increasingly looking to express themselves through the apparel and make-up they purchase. They want to differentiate themselves from their peers and are more open to adopting bolder looks.

For example, strawberry and bean-paste pink lipstick have been most popular in past years, but this year bold red has become the dominant color of choice[5] for women’s first lipstick purchases. Popular product lines include M.A.C.’s Ruby Woo, Dior 999, and Tom Ford’s Ruby Rush #07. Other emerging colors also include mermaid pink, grapefruit, and pumpkin, all eclectic colors that indicate Chinese consumers’ growing interest in differentiating themselves.

Some lipstick products have become popular after being associated with certain characters on TV dramas, such as the Legend of Fuyao, a popular ancient China drama series that stars celebrity Yang Mi, who is also a key spokesperson for Estee Lauder and Michael Kors. Estee Lauder’s and Yang Mi’s new line of lipstick has been showcased on the popular TV series.

The same goes for color cosmetics. Nars Cosmetics, owned by Japan-based Shiseido, launched an “Orgasm” makeup line late last year that included provocatively named products such as “Do Me Baby” lip pencil and “Sexy Fantasy” blush[6]. Nars is known for having a more colorful pallet with a wide range of different options.

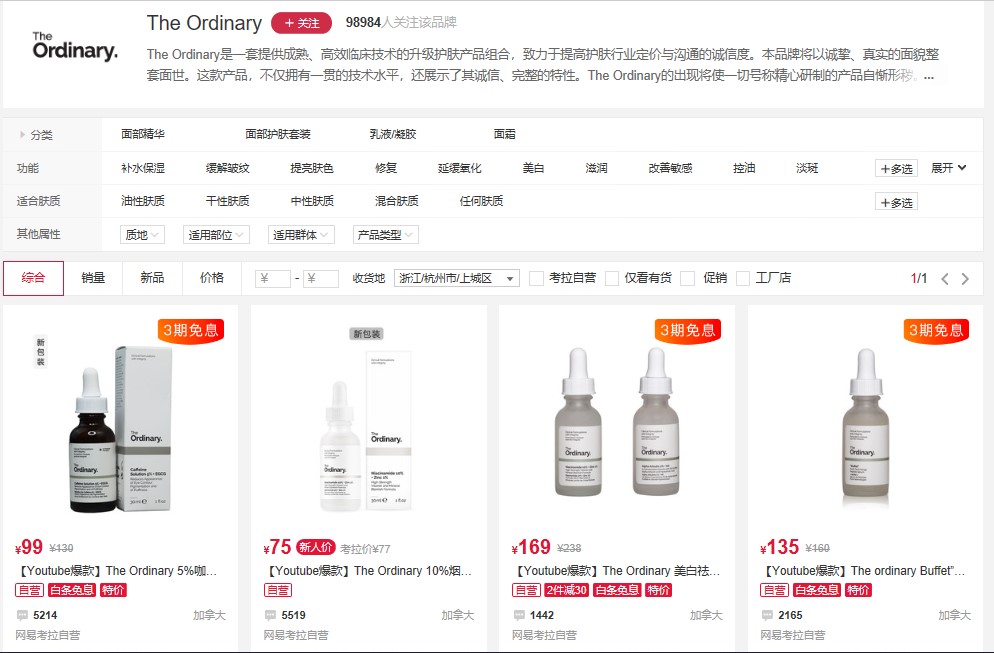

The Ordinary is one skincare brand that has been exceptionally popular amongst Chinese audiences, being known for selling simple, high-quality products at near-cost prices. On cross-border e-commerce platform Netease Kaola, the brand has accumulated nearly 100,000 fans and sold thousands of bottles.

The Ordinary on Netease Kaola

The products’ minimalistic, indiscriminate dropper bottles have plain white labels that clearly display the simple ingredients and formulas used. This strikes a positive chord with Chinese consumers who may be new to using these types of products and are also wary of fraudulent items.

Key Takeaways

1. Chinese brands will continue to grow rapidly in China, but international brands will still dominate the high-end skincare and cosmetics market. Their advantages in R&D capabilities and branding are unlikely to be replaced anytime soon. They will, however, see more competition as they move deeper into smaller Chinese cities, where Chinese brands are dominant and have stronger distribution networks.

2. Chinese consumers are upgrading their makeup routines, creating an opportunity for foreign brands who already have experience selling more advanced cosmetics products and tools. While items such as lipstick and BB cream will still see strong growth, expect more advanced items such as foundation, eye shadow, and other tools to see a jump in sales. Using KOLs and makeup tutorials will be instrumental in educating customers and expanding this market going forward.

3. Brands who diversify their offerings and design products for different types of customers will succeed. Chinese customers want more individualistic products that fit their individual tastes and needs. Brands who can appeal to those needs and resolve consumers’ pain points will do well. Product lines with a large array of different colors and options are likely to sell better.

[1] “China’s Cosmetics Market.” 23 Jul 2018. HKTDC. 2 Nov 2018. < china-trade-research.hktdc.com/business-news/article/China-Consumer-Market/China-s-Cosmetics-Market/ccm/en/1/1X000000/1X002L09.htm>

[2] “亿邦动力研究院:中国美妆新零售研究报告,” 27 Sept 2018. Ebrun. 2 Nov 2018 < http://www.ebrun.com/20180927/299195.shtml>

[3] “凯度:2018年中国美妆品牌足迹排行,” 24 May 2018. 199it. 2 Nov 2018. <http://www.199it.com/archives/727968.html>

[4] “China’s beauty trends: KOLs, organics, more make-up, and men.” 2 Sept 2017. SCMP. 2 Nov 2018 <https://www.scmp.com/lifestyle/fashion-luxury/article/2109267/chinas-beauty-trends-organics-live-streaming-influencers>

[5] “2018美妆趋势报告.” 7 Jul 2018. CBN Data. 2 Nov 2018 < https://cbndata.com/report/954/detail?isReading=report&page=1>

[6] “Cosmeics Brand Nars Creates Online Frenzy in China with Unveiling of ‘Orgasm’ Line.” 6 Sept 2017. Jing Daily. 2 Nov 2018 < https://jingdaily.com/trending-nars-rattles-with-orgasm-line-shanghai-store/>