Beauty Samplings Spike: How should brands adapt to this emerging trend?

by Maggie Yu & Davy Huang

Samples are forming a new interactive relationship between products, consumers, and brands. According to online statistics, a search for the keyword ‘samples’ on Chinese social shopping platform Little Red Book led to more than 530,000 related notes. And on social media platform WeChat, the public account related to sample collection has also reached more than 200.[1] In the Chinese beauty industry, samples are playing an important marketing role to build brand awareness and trust.

Handing out samples is an effective way for beauty brands to convert potential customers and capture attention in this crowded, competitive category. Brands often send samples via their flagship stores on e-commerce website Tmall to people who register and join the membership programs. This approach has proven to be a low-cost way for brands to acquire new consumers. If consumers find that the product works well with their skin, they are likely to buy the full-size product. According to a report by Euromonitor, samples are the third-largest driver of full-size product purchases, superseded only by past experiences and recommendations from friends and family.[2]

In addition, Tmall opened a specific channel named Tmall U Xian (天猫U先), in which consumers can purchase samples from big brands at a low price. According to data from Tmall U Xian, the supply of SKU samples during this year’s Singles Day (also called Double 11) was three times the usual level, and the number of new products has increased by 20%.[3] Since 2018, Shiseido has distributed more than 2.3 million samples on Tmall U Xian. The conversion rate among consumers who purchased full-size products after they used samples reached 4%. Samples have also become a big driver for consumers to buy full-size products.

Why are samples so popular among Chinese consumers?

Small samples can satisfy consumers' curiosity and allow them to invest in lower trial costs when trying new brands or products and make purchase decisions more easily. For example, consumers are often not satisfied with a single color or type of lipsticks and perfumes. This is especially true for skincare products or foundation, as consumers would like to spend a much smaller amount of money on samples to see if the products work well with their skin condition or complexion.

According to iResearch data, consumers who spend between ¥300-500 CNY (approximately $50-$75 US) per month on cosmetics are most likely to be attracted to small samples.[4] Most of their target shoppers are in the Generation Z cohort, with strong consumption habits, a willingness to spend time and budget carefully, and high demand for diversified product functions. With a convenient size and lower price tag, samples provide an appealing alternative for China's young beauty audience.

How beauty players leverage samples to appeal to Chinese consumers

• "Membership Gifts" guide consumers to register as members and receive exclusive sample benefits

Many brands’ official flagship stores on e-commerce platforms attract consumers to become store members by the way of "membership gifts." When consumers register as members, they can get samples of popular products or new products at low prices. In this way, the brand can drive traffic to the store and reach the target group more precisely.

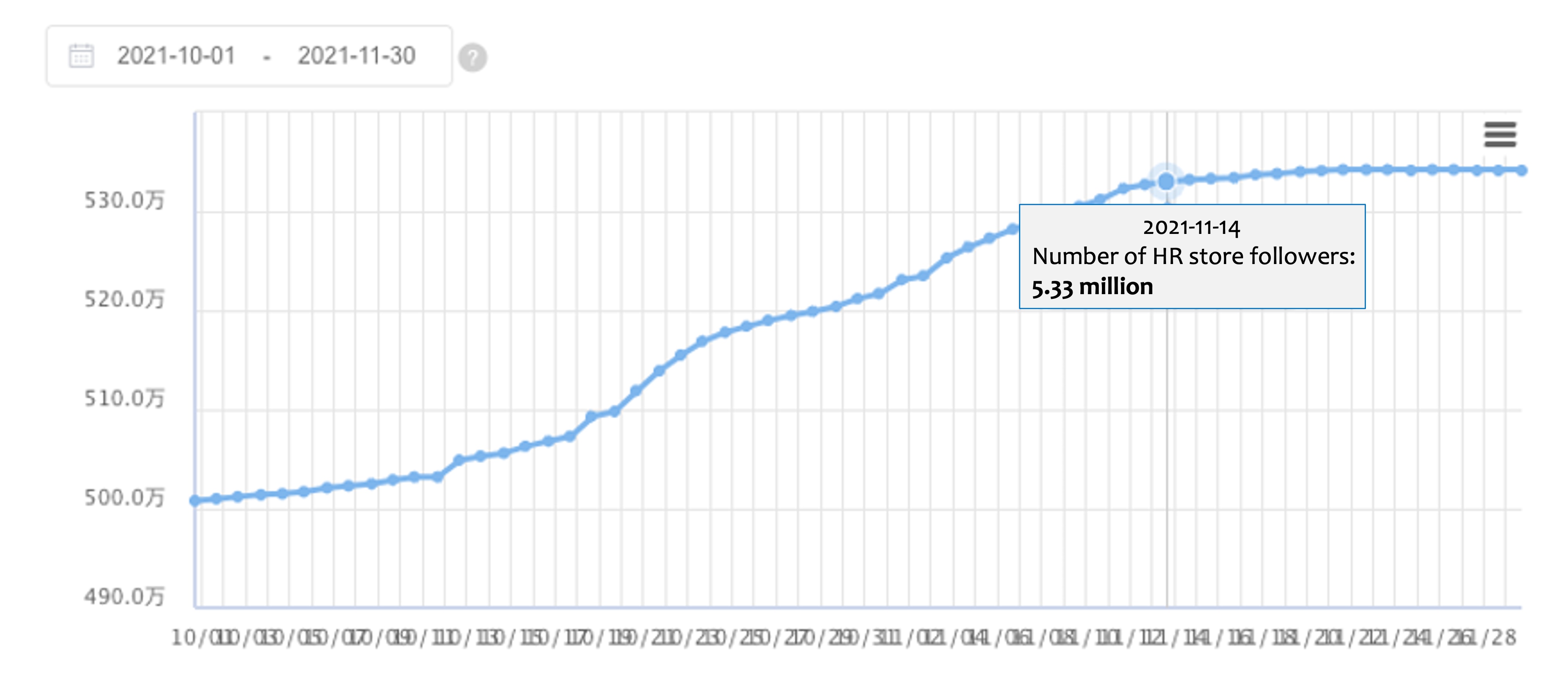

Take Helena Rubinstein, a brand of L'Oréal Group, for example. HR distributed a large number of samples before the 2021 Double 11 shopping festival. Consumers could get a generous coupon exclusively for full-size products while registering for membership to pay for the samples, further motivating consumers to use the coupon to buy the full-size products during the Double 11 campaign. According to the Tmall public data, the number of HR's Tmall store followers increased significantly in November, reaching 5.33 million on November 14.

2021.Oct - 2021.Nov HR Tmall Store Followers Growth Data

• Brands use WeChat communities to distribute samples and drive consumer activity

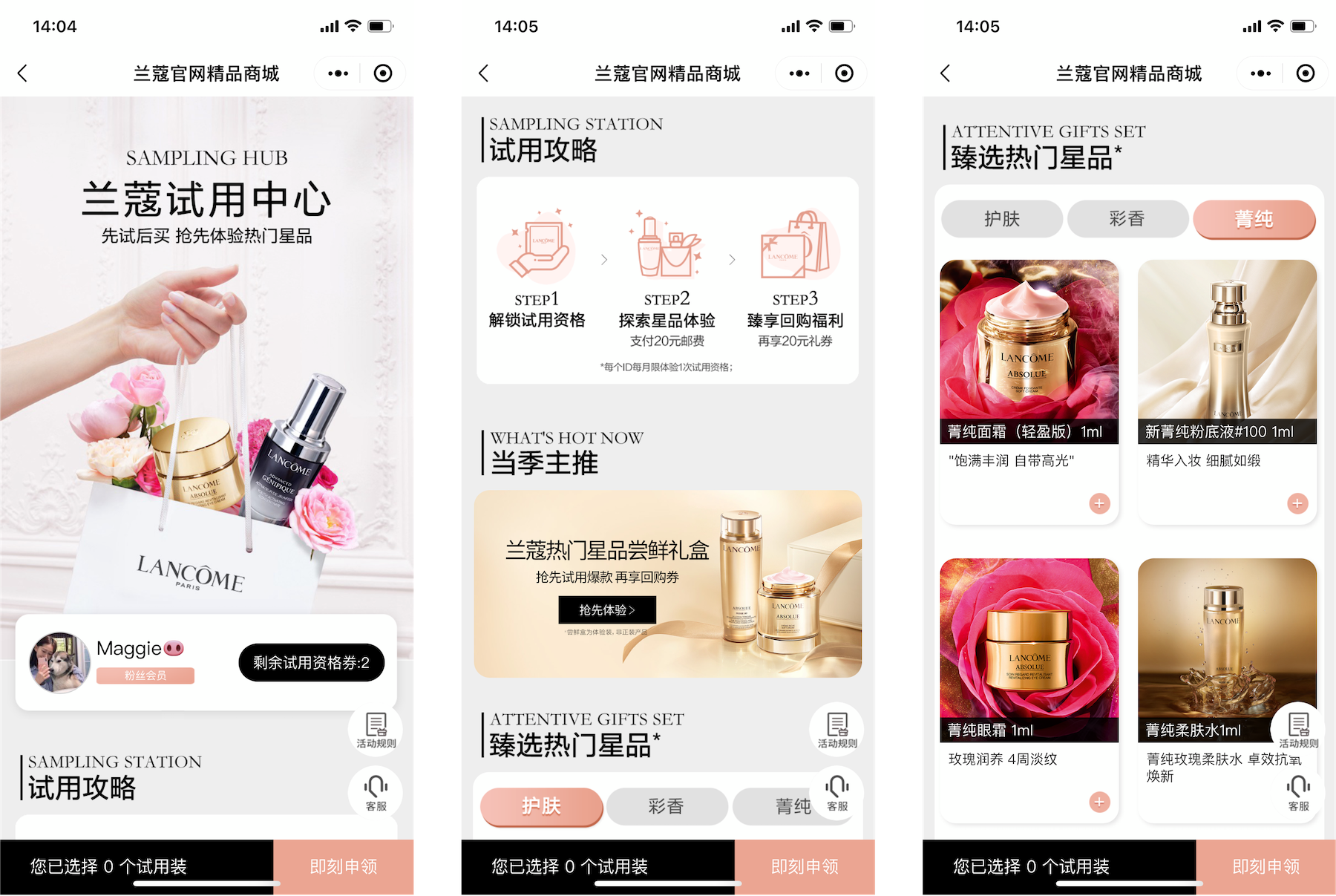

WeChat community building is beneficial for long-term consumer education, loyalty-building, and conversion optimization for brands. Distributing samples can enhance the influence of products in various ways on the basis of the private domain. Lancôme has developed a product sample center that’s only available via the official Lancôme WeChat mini program. According to annual data from 2020, Lancôme sent out 400,000 samples, leading to a repurchase rate of trial users of 10% and repurchase revenue of more than 10 million yuan (more than $1.5 million US), which are remarkable results.[5]

Lancôme’s community often organizes sample lottery campaigns from time to time, and the threshold for participation is very simple, as long as consumers leave a message to participate. This way of distributing samples increased the interaction of fans in the community, and deepened consumers' brand awareness to a certain extent.

Lancôme product sample center

Also, some brands use WeChat search to combine sample marketing. This is also a good way to acquire consumers and inspire repurchase. By putting the sample campaign in the WeChat search, brands can present the campaign to users in the WeChat public domain with the shortest path. Brands do not need to filter people, because those who actively search for the brand are high potential consumers.

At the same time, using WeChat search as the entrance to the brand’s private domain can more quickly guide users to the brand for a faster journey and superior traffic conversion. HomeFacialPro (HFP) used WeChat search to promote new product samples, and successfully achieved public domain acquisition. According to statistics, the sample order rate of the HFP WeChat search exclusive link is 1.5 times that of the WeChat mini-program channel.[6]

• Group cross-brand marketing, abundant sample format

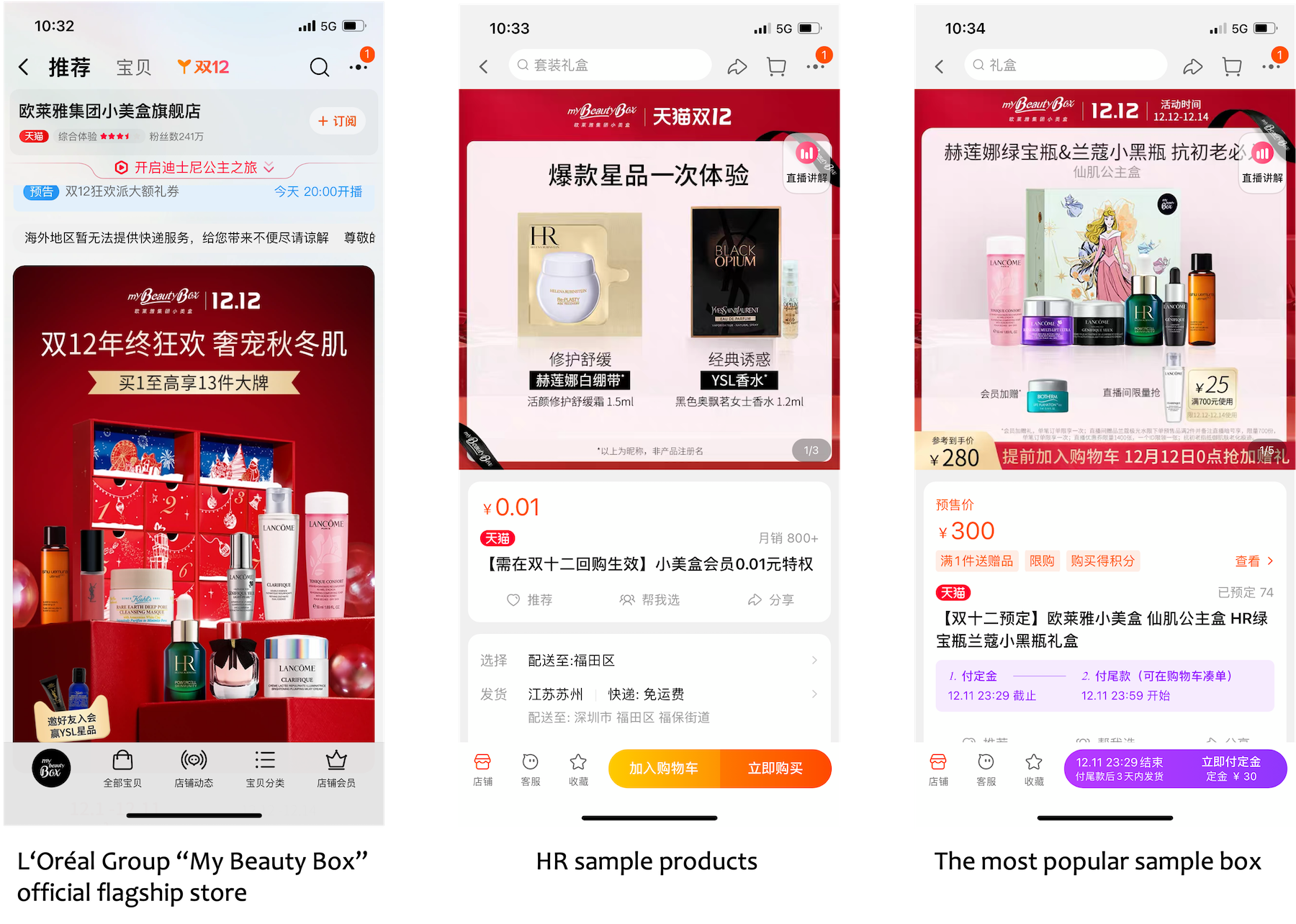

Other brands like L’Oréal are stretching the recruitment concept even further by turning sampling into a customer-paid premium model. In 2018, L’Oréal launched a Tmall store called “My Beauty Box,” which contains products from multiple brands in the L’Oréal Group, and now has about 2.4 million followers. Its most popular product is a gift box with more than six samples, including HR Soothing Cream (5ml), Lancôme Essence Muscle Foundation (7ml), and Shu Uemura Amber Cleansing Oil (14ml).

Surprisingly, these gift boxes are popular in the market. According to practitioners, these mini sample kits are beneficial to establish greater reach and deeper connections with consumers, increasing overall consumption frequency, and improving brand exposure. L’Oréal My Beauty Box operators also pointed out that "some people may have limited consumption ability at present, but they want to try some high-end products, so it is also a good choice to cultivate consumers through sample combination."[7]

• Samples appear in shopping festival campaigns for a superior consumer shopping experience

During peak sale sessions, brands are launching gift-with-purchase campaigns instead of offering a direct discount off the product price. Brands will combine multiple samples so the overall volume or grams are the same or higher than the full-size volume or grams. For example, during Double 11 shopping festivals, most cosmetics and beauty brands no longer reduce prices to stimulate purchase; instead, they use the support of various gift samples to satisfy consumers and make them feel like they are getting a terrific deal. Livestream selling also provides benefits by adding samples, which avoids the impact of direct price comparison by consumers on different platforms. For example, the messaging in teasers of livestreaming campaigns include, "Buy one to get 32 pieces," "Take away 1000ml at a time," "Equal to 2.5 times the full-size quantity," and so on. Such advertisements are often more likely to give consumers the shopping experience of being more cost-effective.

Both international brands and emerging new brands are beginning to use product samples to enhance sales competitiveness. During 2021’s Double 11 event, the supply of SKU samples were three times as usual, and the number of new products increased by 20%. In beauty influencer Austin Li's livestreaming room during last year's Double 11, his team not only kept the price of HR powercell skinmunity serum at CNY 580 ($91 US), but they also increased the sample size to 80ml from 45ml.[8]

• Brands use advent calendar marketing campaigns to promote popular products and new product samples

Advent calendars are one of the most loved pre-Christmas traditions: a creative way to count down the 24 days of December ending on Christmas Eve. Today they can be quite innovative marketing tools, especially in the beauty industry. Beauty brands often add samples or full-size products behind each box, allowing people to enjoy a selection of items from a specific brand.

For brands, access to the advent calendar is an unmissable opportunity to promote new product samples and enhance the consumer engagement experience. For consumers, limited-edition products always trigger an impulse to buy. The appeal of knowing that the total value of all the products inside is far larger than the price of the calendar itself is fairly irresistible in itself.

YSL also launched a 2021 advent calendar. The gift box included 24 mini and full-size bestsellers. The advent calendar aroused great interest from consumers after its launch and sold out on the YSL website. In addition to beauty brands, fragrance brand Jo Malone and jewelry brand Tiffany & Co. both launched their own advent calendars. Among them, Jo Malone sold out within 7 minutes of its advent calendar launch in 2018.[9] Advent calendars have become an important focus for brands, and more and more brands want to reach consumers in this way to offer them greater value.

YSL beauty advent calendar box

How should brands leverage the sampling market?

As the Gen Z beauty market in China continues to expand, we will likely see more brands adjust their retail approaches to court younger consumers. Behind the sample market, brands need to consider the diversification of consumer demand, and the segmentation of consumer groups. In order to adapt to increasingly diversified and personalized consumer demand, major brands should actively adjust the product structure, so that samples become an important and effective tool to drive traffic.

For brands, product sample strategy can quickly expand their target groups and act as a powerful conversion tool. In addition, brands will also obtain market feedback through sample sales data to provide support for subsequent marketing strategy adjustments.

However, the sample could also be a "double-edged sword" for brands. If consumers frequently use a large number of samples, it will also reduce brand loyalty. The sources of samples in the market remain a mystery. In addition to the samples sold on the brand's official store, many brands deny that they have licensed their samples to third parties to sell. Therefore, it’s hard for consumers who purchase samples from third parties to protect their consumer rights properly once they encounter quality problems.

There is no denying that beauty samples have great potential as an effective marketing tool for beauty brands to reach consumers whether it’s through marketing gamification or distribution channels. But at the same time, brands also need to be aware of the related risks. We will continue to pay attention to this market and provide more valuable insights to help guide brands’ marketing strategies.

[1] Woshipm: Hidden in the cosmetics market "sample economics”, 2021; URL

[2] Iqingyan: From “gift” status to an independent market, 2019; URL

[3] Ebrun: " sample girl" shopping for singles' Day, 2021; URL

[4] iResearch: China Beauty Collection Store Industry Report 2021, 2021; URL

[5] Tencent smart retail: Tencent’s 2021 Smart Retail Growth Guideline whitepaper, 2021; URL

[6] Tencent Ads: Small samples release big energy, 2021; URL

[7] CBNData: What kind of business is it to have a small sample of a big brand? 2021; URL

[8] Wangyi: The rise of the small sample economy,2021; URL

[9] Sohu: How should brands focus on the beauty advent calendar? 2021; URL