What Amazon Luxury Can Learn From China's Cutting-edge Experience?

by Queenie Yao

The global pandemic and travel limit took a heavy toll on the global luxury sector in the first half of 2020, the new launch of Amazon’s new luxury business suggests strong demand for luxury merchandise still exists. Amazon is not alone, Alibaba's e-commerce arm Tmall now has nearly 200 high-end brands on its Tmall Luxury Pavilion, up from 150 before the Covid-19 outbreak.

In this article, we took a look at China’s growing luxury market and what Amazon and other companies can learn from global luxury best practices.

Amazon‘s foray into the luxury sector

A month ago, Amazon announced its new shopping experience, Luxury Stores, offering both established and emerging luxury fashion and beauty brands access to their premium users. Luxury Stores is built as a separate space on Amazon e-commerce platform, which is only available by invitation to Prime members in the U.S.

Amazon's move into the luxury sector makes sense. That’s because the opening of Luxury Stores is initially intended to cater to consumer demands from Prime members, said Christine Beauchamp, President of Amazon Fashion. "They want to purchase their favorite luxury brands in Amazon’s store." Also, the unpredictable Covid-19 pandemic has accelerated the shift to online shopping, even for luxury products.

Currently, Amazon has over 112 million Prime members in the U.S., but the global e-retailer is eyeing more than just the colossal size of this audience. It's rolling out Luxury Stores as a concession model that gives high-end brands independent power on pricing, inventory and selection, with the e-commerce giant offering backend and merchandising tools and support.

With its massive customer base, Amazon can share rich data insights to give brands a better picture of the customer by analyzing their product preferences, tracking sales results, and engaging the right consumer.

But the central question is how Amazon will convince brands to embrace its online experience and marketing tools, as the multisensory, attentive in-store experience is an indispensable part of the luxury experience. For these reasons, major luxury houses still view e-commerce with skepticism.

Tmall Luxury Pavilion, a seasoned counterpart

Given similar e-commerce concerns, it's worth looking at Tmall Luxury Pavilion, which has just celebrated its third anniversary. Luxury Pavilion has done a lot to reassure luxury brands to win over Chinese luxury shoppers.

Alibaba launched Luxury Pavilion in 2017 for selected or invited luxury brands only, which offers brands a visible space where they will not be crowded by high-volume or best-selling mass brands. The exclusive high-end brand hub is an invite-only service for the customers who spend over $159,000 on Alibaba's. After three years' development, Tmall's luxury club features a wide assortment of offerings, including ready-to-wear items, accessories, handbags, beauty and footwear.

To date, it boasts 180 luxury brands like Chanel, Valentino, Prada, Cartier, Bottega Veneta, La Mer, YSL Beauty. Its site as well provides access to many premium designer brands including KENZO, Alexander McQueen and Golden Goose. Marc Jacobs is the latest fashion label to open a digital flagship store on Tmall Luxury Pavilion, to expand its brick-and-mortar presence in China.

Tmall Luxury debuts new features to connect brands with Gen-Z

Tmall Luxury Pavilion stresses the connection between top-tier brands and Gen Z consumers. In August this year, Tmall has rolled out three new features designed to educate, entertain and engage younger luxury buyers:

- Soho Live, a daily live streaming service focused on all updates on luxury;

- Soho Mag, online content and a channel sharing the latest fashion news;

- An upgraded loyalty program offering tailored service for high-value customers.

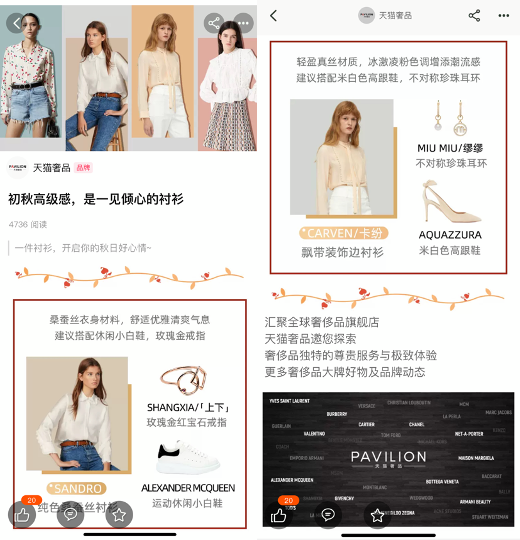

To captivate Gen Z luxury consumers, Soho Mag updates the latest autumn fashion trend

For brands, these moves combine Gen Z’s consumption trends with popular live streaming and e-magazines to open up a new gateway for upscale brands to showcase their new products and trendy models. For young consumers, Tmall’s moves open up a new channel for them to engage with luxury houses and get instant access to the latest luxury offerings.

A luxury consumption report from Alibaba and CBN Data in 2019 shows that 80% of luxury product buyers are 35 years old and under, and 18-to-25-years-olds are the fastest-growing segment, who happen to comprise the majority of live streaming viewers.

Bottega Veneta hit sales record in livestreaming

With U.S. retailers still catching up to the live-streaming trend, Tmall Luxury can dodge live-streaming hype and meet its targets. When Austin Li, a top-tier live streaming influencer, endorsed a luxury bag from Italian luxury brand Bottega Veneta during his live streaming event for the first time, consumers snatched up 230 bags in less than 10 seconds.

This marketing tactic was an unusual experiment in e-commerce live-streaming, which is usually driven by low prices. However, this bag is priced at 12,300 RMB ($1835 US), nearly 100 times higher than the most common 100 RMB ($15 US) price band in the live sessions.

In fact, brands have never had confidence in luxury brands to sell via live streaming. They worry that the low-cost history of live e-commerce will ruin the image of high-end brands in consumers’ minds.

Moreover, as online shopping enters the stage of audio-visual integration, live streaming is an alternative option that can maximize the advantages of product marketing and celebrities’ influence to drive sales. That’s why more and more brands and celebrities are flocking to live streaming for e-commerce.

Yet one’s honey, the other's arsenic. In China, the emergence of live streaming with goods is more like bridging the immature business model loopholes in the live streaming industry. Meanwhile, in the United States, the influencer economy already has a very mature business model. If Amazon Luxury rashly jumps into livestreaming, it may not be suitable for American consumers' habits.

More broadly speaking, Amazon needs to consider how to approach the luxury market and engage brands. For instance, Amazon can catch up with Tmall Luxury Pavilion in optimizing its in-site resources and offer a suite of digital tools to help brands promote their online shopping experience.

Alternatively, reshaping Amazon’s luxury business model to a sales-driven one like pure play e-tailer Farfetch, a British-Portuguese online luxury fashion retail platform that sells products from over 700 boutiques and brands around the world. According to Farfetch’s fiscal report, its sales-oriented model is unscathed while digital platform Gross Merchandise value witnessed a surprising 19% year-over-year growth rate in Q1 2020.

Key takeaways

Accurately understanding the new generation’s consumption trends and achieving rapid digital transformation can give e-commerce players an edge in the luxury market. Digital technology and e-commerce platforms have emerged as a second choice for luxury houses to seek an online partner to tell the brand story and reach younger online shoppers.

Alibaba’s ascent to its current spot as the preferred e-commerce partner of luxury brands in China didn’t happen overnight. E-commerce platforms like Amazon Luxury Stores need to be clear on their intent to build either a mature luxury ecosystem for brands or a discount-driven platform like Farfetch, which would scale faster, driven by a sales-oriented business model.