What Does Topshop's Breakup with Shangpin Tell Us About Fashion Retail in China?

The suddden announcement of Topshop breaking off its four-year long exclusive partnership with Shangpin leaves lessons for other foreign brands in the industry

by Azoya Consulting

On August 10th, British fast fashion retailer Topshop made the sudden announcement that it was breaking off its four-year partnership with Chinese luxury fashion e-commerce platform Shangpin. The two had been working together since 2014, and as recently as late 2016, planned to open over 80 offline retail stores in China together.

Shangpin was instrumental in helping Topshop cultivate a loyal fan base of over 3 million customers in China, but recent financial difficulties for both sides and diverging interests led to the inevitable breakup as Topshop sought to significantly increase its presence in the market.

Shangpin Helped Topshop Cultivate a Small but Loyal Fan Base in China

As a newcomer to the China market in 2014, Topshop lagged behind its peers Zara and H&M, both of whom had established a large network of offline retail stores years before. As a smaller brand with more limited financial resources, Topshop had no choice but to play a more conservative game by testing the China market through e-commerce, instead of taking a full omni-channel approach.

So in 2014, Topshop appointed Shangpin its exclusive partner in the China market. Shangpin was a suitable partner at the time, being a smaller, upscale e-commerce player with lower barriers to entry than Tmall. Shangpin focused on smaller Tier 2 and 3 cities, where customers lacked access to quality international brands and luxury goods. Shangpin procured inventory in bulk from distributors around the world, and offered its goods at relatively low prices.

In order to pay for this access, Shangpin’s customers bought into a membership program that would enable them to obtain discounts on such brands. And yet its average order size hovered around 1,200 RMB, six times that of typical e-commerce transactions, according to a 2015 interview with its CEO Shicheng Zhao. This demonstrated the loyalty of its customers.

For Shangpin, Topshop was a big win, as small e-commerce platforms typically have a very loose relationship with the brands they carry and exclusive partnerships are generally out of the question. Shangpin was also given the responsibility of operating Topshop’s flagship store on Tmall.

![]()

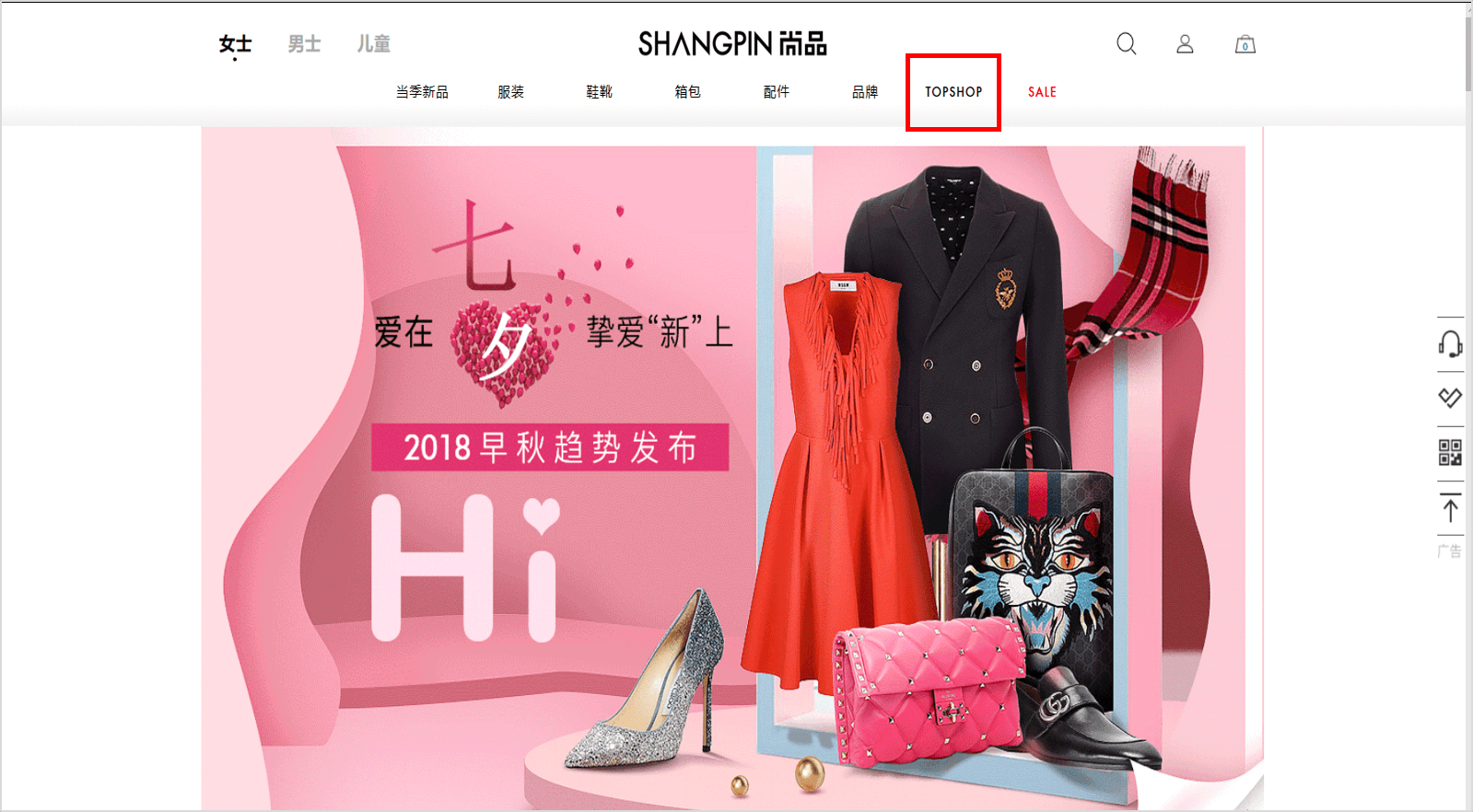

Topshop occupies a prime location on Shangpin’s front page

Topshop had an exclusive entry spot on Shangpin’s front page, and grew to become a crucial part of Shangpin’s business over time, becoming synonymous with Shangpin’s name in China. Shangpin’s membership-based model enabled Topshop to reach a select base of affluent, dedicated fashion consumers. In 2015, Topshop sold over 1 million pieces of clothing on Shangpin and its fan base grew to over 3 million. The two companies even announced in late 2016 that they planned to set up over 80 Topshop retail stores in China, though this would later come to naught.

Topshop’s Ambitions in China Outgrew Shangpin

But over time, Topshop’s ambitions soon came to outgrow Shangpin, which had a registered user base of only 30 million. Despite its initial success, Topshop’s growth in China soon reached a bottleneck and its business was still miniscule compared to those of Zara’s and H&M’s.

Topshop’s declining fortunes in the UK, Australia, and New Zealand also presented an issue. In the fiscal year leading up to August 2017, Topshop saw global revenues decline by 6%, and profits slipped to a loss of 10.9 million British pounds. The company resorted to closing many stores in Australia and New Zealand.

Topshop needed to expand its base of customers, but its weak financial position and lack of offline retail stores put it at a disadvantage when it came to brand building, especially since the majority of Shangpin’s customers were based in smaller cities. Since it was stuck in an exclusive partnership with Shangpin and couldn’t expand to other e-commerce channels, Topshop’s long-term growth prospects were held back in the market.

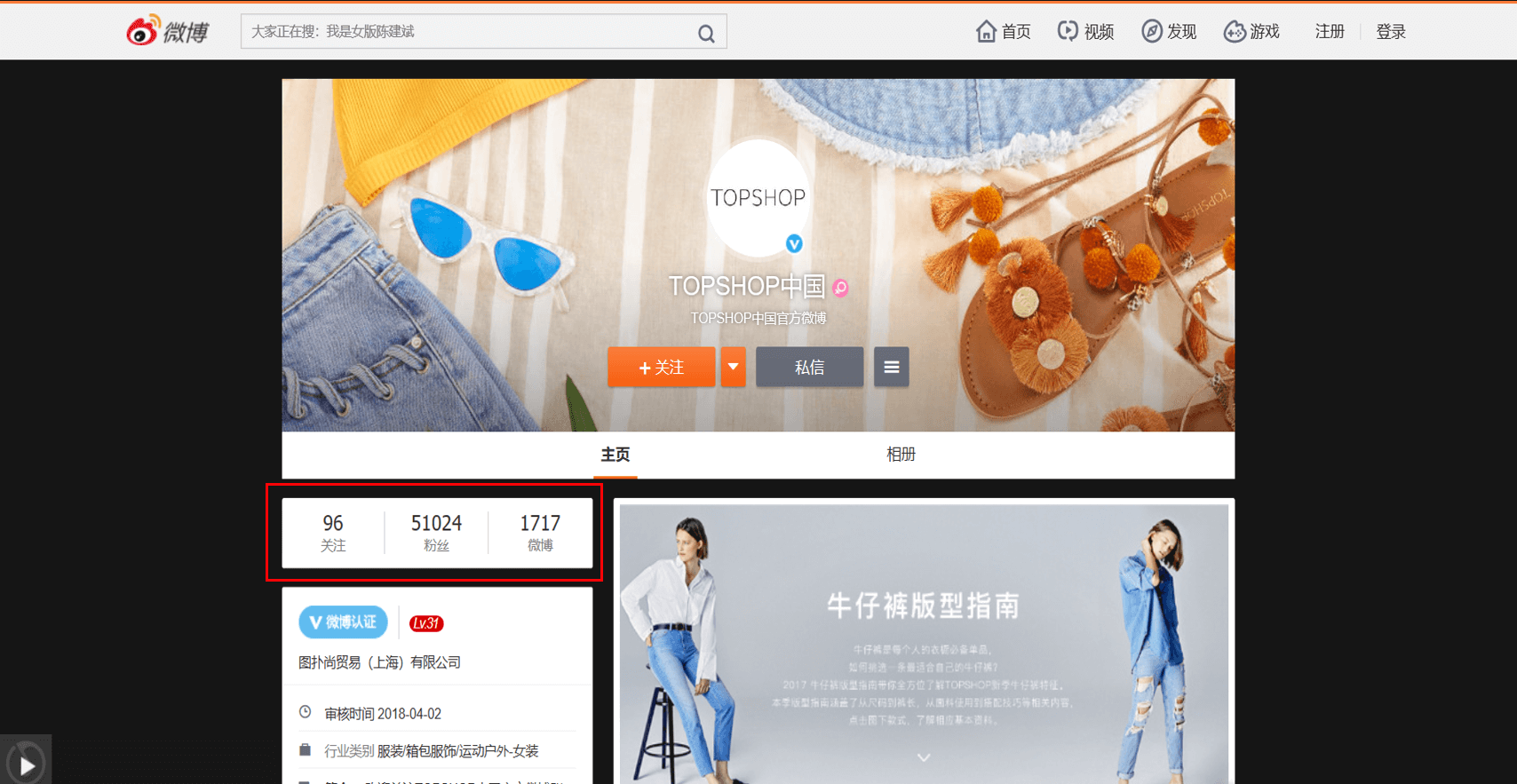

Topshop was also criticized for not localizing its product offerings for the China market, as some of its winter clothes did not fit the smaller body frames of female Chinese consumers. Some also say that Topshop’s social media initiatives were lacking and out of touch with rapidly changing fashion trends. Topshop’s Weibo fan base topped out at around ~51,000, and its WeChat posts garnered only a couple of thousand views per post.

![]()

Topshop’s Weibo page has just ~51,000 followers

Shangpin Sells to Luxury Goods Distributor Hemei Group

Financial troubles at Shangpin also put the relationship in jeopardy, as Topshop needed a partner that could help with further brand development and expand into offline retail.

Competing with the likes of Tmall and Taobao requires a hefty amount of capital, and over the last year or so, competition in the industry has heated up as JD.com and Tencent poured money into competitors Vipshop and Meili. With flash sales fashion site Mei.com having sold a large stake to Alibaba in 2015, Shangpin became one of the only independent, fashion-dedicated e-commerce platforms left standing.

The company had faced cash flow issues for many years, and eventually caved in when its founder sold the company to luxury goods distributor Hemei Group for just 250 million RMB this past January.

It is likely that the recent sale of Shangpin to Hemei Group was the last straw for Topshop. Hemei Group, which is a luxury goods distributor and operator of over 260 offline brand retail stores for the likes of Armani, Hugo Boss, and Furla, purchased Shangpin to complement its growing offline business.

Shangpin has since trended more upscale, and it is difficult to say how Topshop, a fast fashion retailer, would've fit in with Hemei's broader portfolio of luxury brands. It is highly possible that Hemei wasn’t very interested in working with Topshop, let alone be willing to co-invest in a string of 80+ offline retail stores across China.

Topshop’s Future in China Remains in Question

For Topshop, it will pull its products from both Shangpin and Tmall by the end of November. Its original plan to set up a four story, 3,400 sqm flagship store in downtown Shanghai this September remains in doubt, as there are rumors that Topshop has cancelled its contract with the property’s owner.

If the plan were to go through, the flagship store would be the company's largest store in the world, and an indication of Topshop’s dedication to the China market. However, due to Topshop’s still weak financial position, it remains to be seen how it will finance its offline expansion, as it has yet to find another local China partner to shoulder some of the burden.

Key Takeaways

1. Fashion e-commerce businesses are difficult to operate and scaling requires a tremendous amount of capital to succeed in the long run. Mogujie and Meilishuo merged in January 2016 due to difficulties raising further rounds of funding. Mei.com sold a large stake to Alibaba in 2015 in exchange for $100 million and a prime spot on Tmall’s front page. Farfetch also entered into a strategic partnership with JD.com after receiving a $397 million investment from the company.

2. An omni-channel approach is important if you want to make it big in the Chinese fashion world. Having an offline presence was a crucial part of Zara’s and H&M’s early strategy in China, and this helped them significantly with brand-building purposes. While Shangpin had a strong user base in smaller cities, the vast majority of affluent cross-border shoppers tend to be in the bigger cities. While Topshop may attempt to catch up on this front by building more offline retail stores, it may be too late for the ailing retailer.

3. Starting small with one channel is ok, but expanding to multiple channels over time enables one to hedge against risk and target new users. Each platform has its different set of users. By limiting itself to just Shangpin and Tmall, Topshop failed to gain mainstream traction over time and ran into a bottleneck with regards to traffic and sales. Shangpin’s sudden sale to Hemei Group also demonstrates the risk of relying on just a single partner. Hiring a local partner that can help expand to multiple different sales channels hedges against this risk.

4. Localization is also important. Topshop was criticized for not localizing its product offerings for the Chinese market and its lack of social media engagement. By maintaining an active social media presence, a brand can retain customer loyalty and encourage repeat business. Having a dedicated partner on the ground to run day-to-day marketing and keep abreast of local trends can help build a stronger relationship with customers.