China’s Import eCommerce Kept Booming in 2015, Boding Well For The Future

According to the stats from iResearch, China’s online shopping market showed robust growth even the country’s economic growth slowed down in 2015.

by Azoya

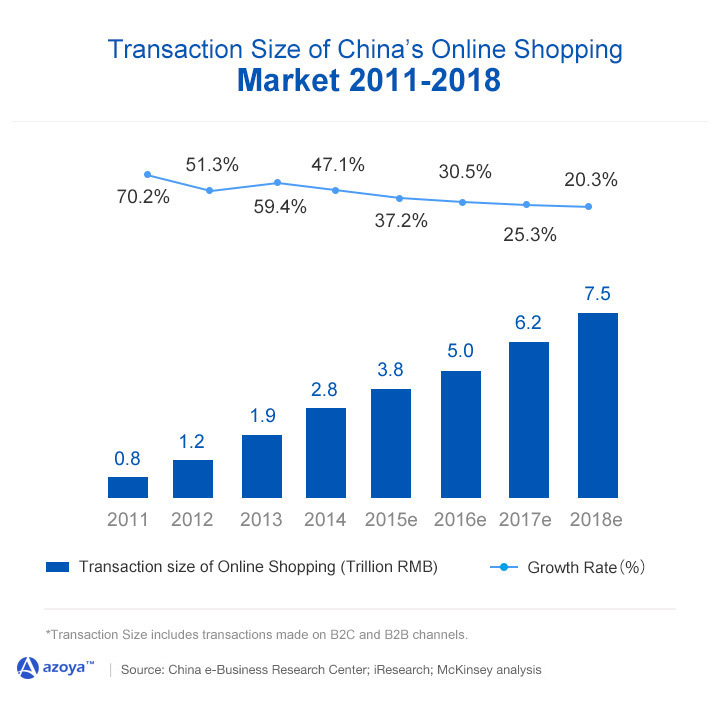

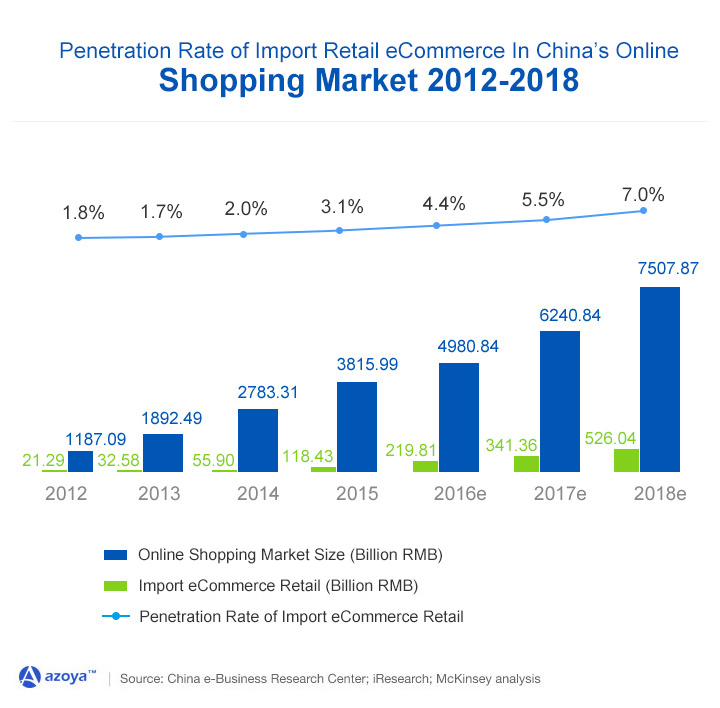

According to the stats from iResearch, China’s online shopping market showed robust growth even the country’s economic growth slowed down in 2015. The transaction size of China’s online shopping market hit 3.8 trillion Yuan in 2015, growing by 37.2% as to the previous year. The growth trend is projected to continue.

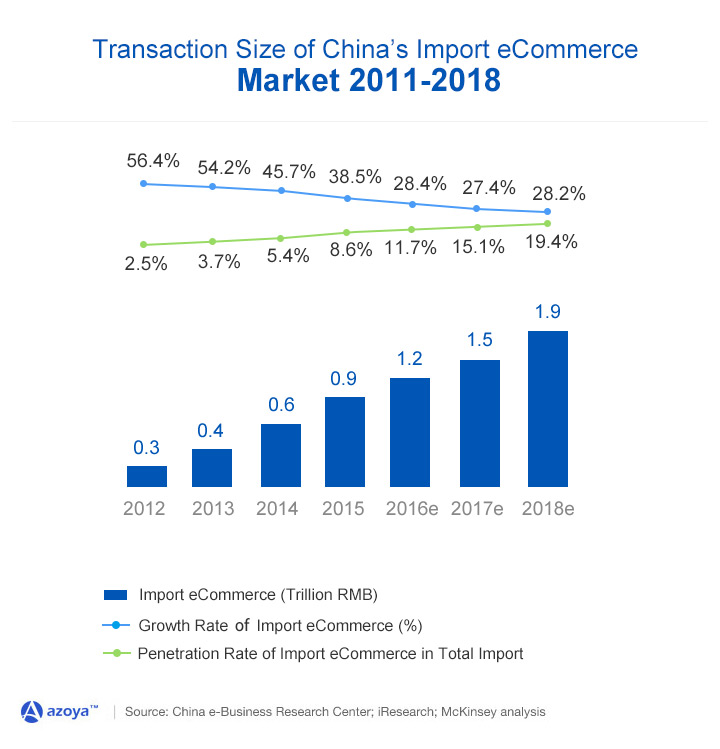

Along with the development of domestic eCommerce, import eCommerce has gained great momentum and showed a considerable growth rate. The penetration rate of import eCommerce has been keeping rising. In 2015, the transaction size of import eCommerce reached 900 billion Yuan, increasing by 38.5% as to the previous year, with the penetration rate in the total eCommerce being 8.6%.

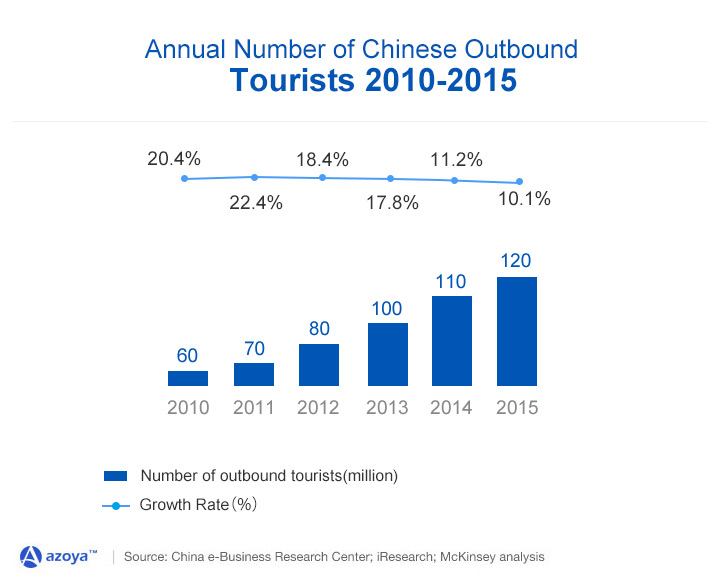

As more and more Chinese tourists go to abroad, Chinese consumers gradually get to know more about overseas-manufactured products and take a liking for those high quality and reliable products. As the safety and quality concern over domestic products has not yet been relieved, Chinese consumers will continue engaging in cross-border online shopping. Overseas retailers will continue benefiting from this market need.

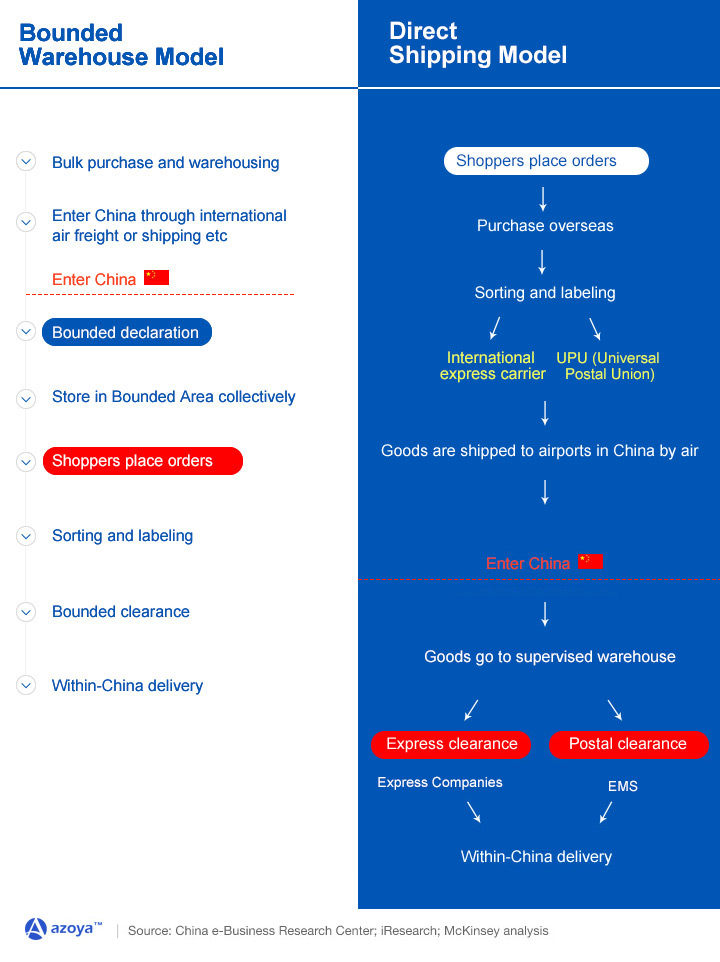

Currently, there are two models in Chinese consumers' cross-border online shopping. One is Bounded Warehouse Model, the other is Direct Shipping Model. China has recently updated its tax policy on import eCommerce, both the Bounded Warehouse Model and commercial express clearance route under the Direct Shipping Model will be applied to a unified tax system. However, postal clearance route still applies to the old rules, under which parcels are spot checked and only charged with postal tax when the custom authority finds the parcels taxable. The postal tax rate has also been slightly modified based on the old one. For more information about the new tax policy, check here.

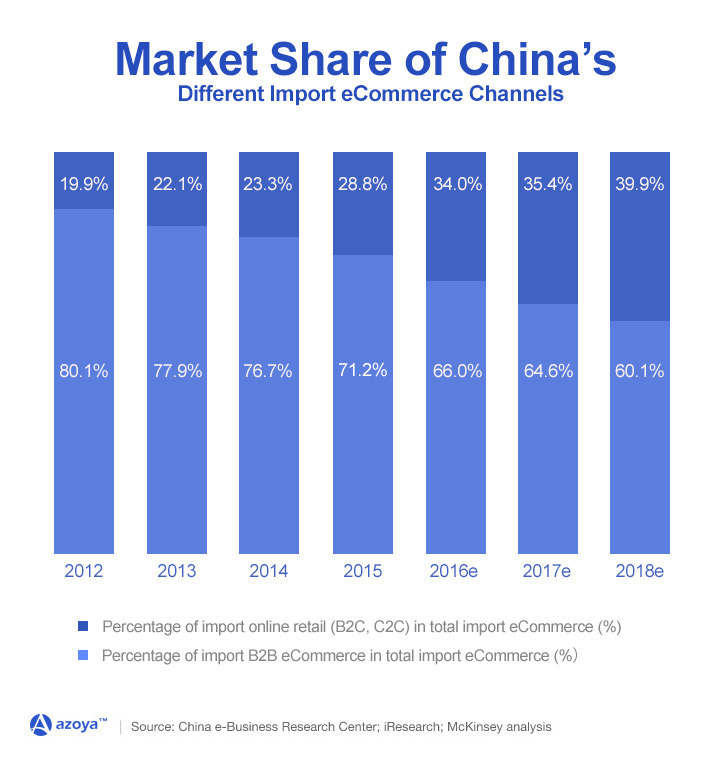

Currently the import eCommerce mainly takes the form of B2B, However, the market share of import retail eCommerce (B2C and C2C) keeps increasing and will continue growing in the future. According to the estimation of iResearch, the import retail eCommerce will keep growing at a quicker pace than the import B2B channel. In 2018, the market share of import retail eCommerce is projected to reach 39.9%.

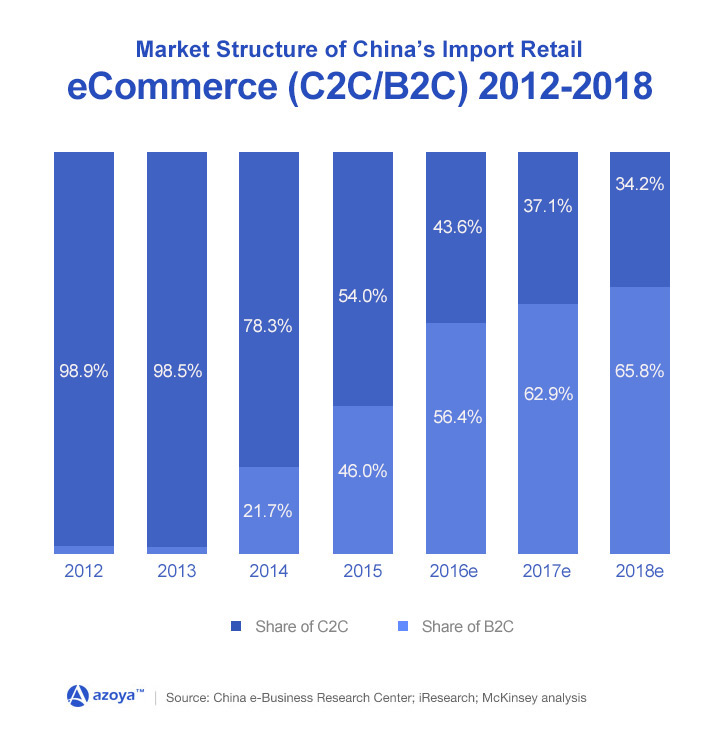

On the other hand, market share of B2C in import retail eCommerce will grow in a fast rate and will take over C2C in near future. This is because more and more overseas retailers start to directly sell to China via cross-border eCommerce. The space left for buying agents gradually shrinks.

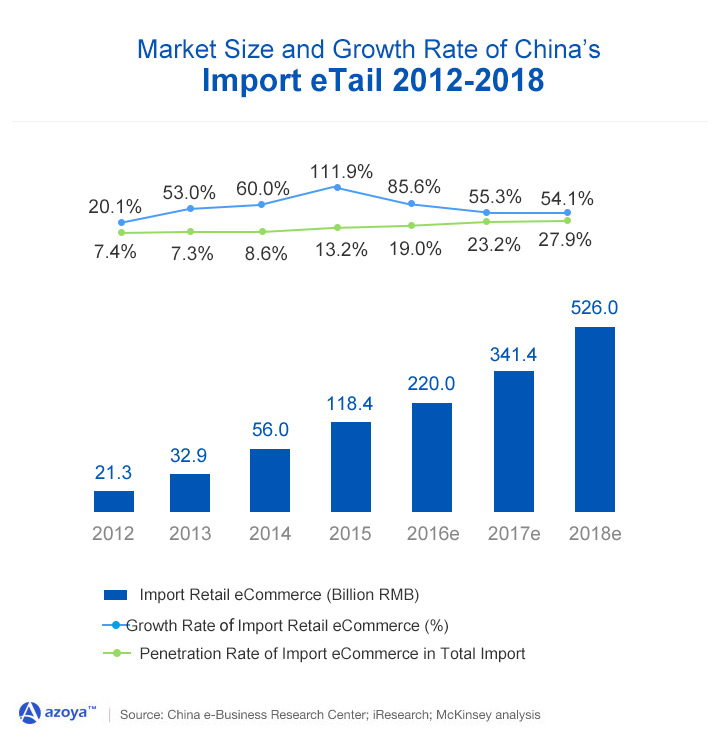

China's import retail eCommerce kept growing in an accelerated rate in the past few years, with the penetration rate increasing steadily. In 2015, this market reached a volume of 118.4 billion Yuan, growing by 111.9% YoY. The penetration rate of import retail eCommerce in total import eCommerce reached 118.4% in 2015. iResearch predicts that China's import retail eCommerce will keep growing at a steady pace in the near future.

China has a huge eCommerce market. It's still projected to grow rapidly. The import retail eCommerce takes a larger and larger share in China's booming eCommerce, with the penetration rate increasing steadily. iResearch believes that the penetration rate of import retail eCommerce in total eCommerce will reach 7% in 2018.

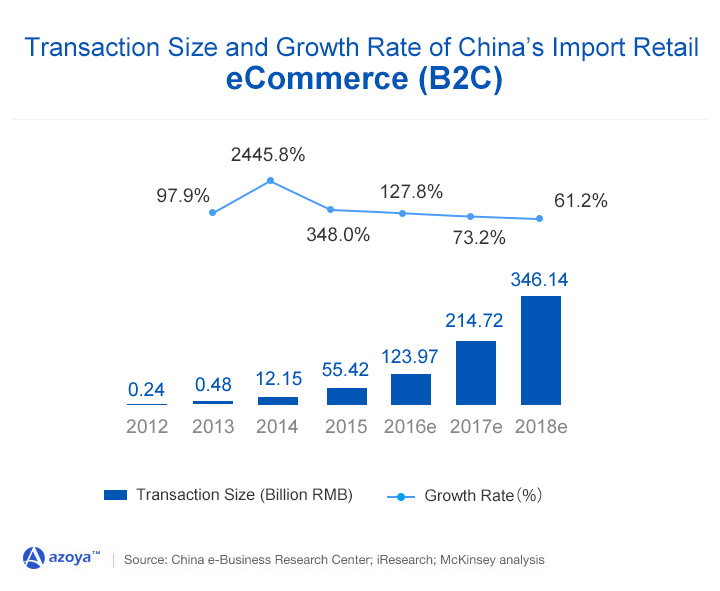

The B2C model in import retail eCommerce started at 2014, registering a staggering growth rate of 2445.8%. In 2015, China's import B2C eCommerce reached 55.42 billion Yuan, growing by 384% YoY.

The B2C model in import retail eCommerce started at 2014, registering a staggering growth rate of 2445.8%. In 2015, China's import B2C eCommerce reached 55.42 billion Yuan, growing by 384% YoY.

Overseas retailers will find more sales opportunity in China. Cross-border eCommerce is the most viable and commonly practiced way for oversea retailers to break into the China market. As the import eCommerce eco-system matures, Chinese consumers will get better and better shopping experience. This will further encourage them to engage in overseas online shopping. Azoya believes there're a lot of opportunities out there in the China market, overseas retailers need to find the right way to capitalize the growth trend.