DEEPDIVE: Where Are Brands Spending on Advertising in China in 2024?

The increasingly fragmented China digital landscape require brands to be on multi-channel - but how to do it properly?

by Davy Huang

In the past 2 years, we have witnessed the slump global economy and weak recovery of Chinese consumer appetite. It is becoming a consensus for many brands that China had become an "expensive" market to operate, where advertising cost are high while conversion rate may not live up to expectation.

A recent study published by CTR Market Research showed that Chinese advertisers were cautious on advertisement budget for China in 2023. Only 31% of advertisers was planning to increase spend, 39% of advertisers had same level of marketing spend in 2022, and 30% planned to reduce advertisement budget.

More recent report by QuestMobile had a rather optimistic outlook for 2024: data showed that the Chinese internet advertising market reached 714.6 billion Yuan in 2023, with YOY growth of 7.6%; in 2024 it is forecasted that the market size will reach 788.3 billion Yuan with YOY growth above 10%.

On the agency side, our interviews with various agencies specialized in China inbound also showed slowing budget from advertisers for the Chinese market, and challenging to maintain return on ads spend in the market. However, there are still opportunities with emerging channels such as Chinese social media, especially short-video related ads spend are picking up. This brought us to explore the current mindset of advertisers in China – whether they are continuing the path of 'involution' (内卷), or to 'lie flat' (躺平).

Branding or Marketing? It's a Tough Question

Brands in China often face a question whether to spend their ads budget for brand building and awareness building, or for performance based marketing campaign. As suggested by various industry experts, brand building is a crucial path to success in China, and as brand grow more market share, they need to find ways to defend their market position from insurgent brands. This often mean increased spend in advertisement and offline sales channel expansion that comes along.

However, given the rise of online shopping and social media, especially the unique live-streaming frenzy in China, emerging brands, or insurgents as referred to David Zehner from Bain, are gaining more market share by leveraging these new channels to access consumers in China. These domestic brands tend to focus on leveraging influencers, livestream campaigns and performance based advertisement to drive instant revenue, compared to the traditional approach to build a brand before building sales.

The trends have influenced the approach for many international brands and their local partners in designing the strategy for advertising in China. According to a recent study published by Morketing, Chinese brands and advertisers tend to split their marketing budget for 'brand awareness' and 'performance based' campaigns. Performance based campaign can sometimes take over 95% of the total budget while 'brand awareness' based campaign is less than 5%.

It is not unexpected that Chinese advertisers wish to earn quick revenue from ads spend. The root cause is the increasing fragmented digital traffic in China, while Alibaba (owner of Tmall, Tmall Global and Taobao), ByteDance (owner of Douyin, Chinese version of TikTok, and Toutiao, a popular digital news outlet), Tencent (owner of WeChat), Little Red Book, have built walls against each other that limits the flow of traffic between platforms.

Advertisers, mostly SMB businesses, have discovered that it is ineffective and even impossible to build overall brand awareness via multi-channel ads spend before driving sales channel growth. For emerging brands, focusing on single channel and convert to sales in-channel had become the priority in most cases. Advertisers may choose a combination of channels depending on target audience and industry, such as Tmall + Little Red Book, or Douyin + Tmall had becoming more popular channel strategies for most businesses.

Content, Especially Short Video Content, is Everything

Morketing's study also highlighted that content-based marketing had become the priority for most advertisers in China. As social media platform daily active users continue to grow, Chinese mobile phone users are spending in average 160 hours per month (close to 5.3 hours per day) on mobile apps according to QuestMobile. Chinese short video audience size is now close to 1 billion – almost 95% of total Chinese internet users are watching short video and around 1/3 of users spend as long as 3 hours in browsing short video content.

ByteDance, the owner of TikTok and Douyin, enjoyed $120 billion revenue in 2023 with 40% YOY growth according to FT, with China accounts for a big portion of the company's sales. A Chinese third-party research firm QD Review estimated that ByteDance may have surpassed Alibaba to become the top internet advertising company in China by reaching 400 billion RMB (roughly 55 billion USD) advertisement sales in 2023, while Alibaba had around 300 billion RMB (41.6 billion USD) advertisement sales ranked as 2nd in place. Following by PDD of 153 billion RMB (21.25 billion USD), and Tencent 101 billion RMB (14 billion USD).

Underneath the exchanges of top seats in the advertising market, consumer behavior change had hit brands unprepared. In a 2023 Q1 research published by iResearch, short video platforms' outranked messaging apps for usage time as top 1 app format in China. Our interview with several brand managers helping international brands sell in China have highlighted that they can generate much more meaningful exposures and sales via short video content – than traditional ads spend. Agile brands are also increasing the portion of short video content collaboration with influencers from total product seeding budget – while others are struggling.

The results are an emerging group of Chinese brands from Douyin, often referred to as 'Dou-Brands', such as QuaDHA, a beauty brand from Bloomage BioTechnology, have leveraged Douyin's short video and livestream campaigns to create significant revenue. Many smaller Dou-brands may not have the same level of impact and influence at other platforms such as Alibaba or Little Red Book as these brands focus their resources on Douyin. This recalled us of an earlier period of time when Taobao have built significant brands which people referred to as Tao-brands, and history are happening again.

But the Dou-brands are fundamentally different to Tao-brands for several reasons: their capabilities in leveraging influencers, celebrities, live-streamers and organic customer reviews to create buzz and awareness are much stronger than traditional brands who rely on bidding for search traffic. Douyin adopts an entirely different traffic distribution mechanism to Taobao, as Taobao mainly use searches and shopping behavior to distribute products, Douyin distribute content to customer based on algorithm such as interest and intent. Creating contents and launching livestream campaigns that fit the Douyin's algorithm and user behavior had become a must-have capability for all the brands.

Little Red Book Doubles Down on Seeding & Search Engine Ads

Baidu had been a traditional leader in Chinese search engine advertising market, but is gradually loosing its appeal to younger generation of Chinese internet users. Statcounter's data showed that by 2023 March, Baidu is still the market leader of generic search engine in China with over 49.1% market share. Following Baidu, Bing.com gradually increased market share to 14.95%, Sogou with 12.71% market share, and Google with 6.69% market share.

But the stats may not reflect actual Chinese consumers search behavior. In our interview with staff, partners and a small number of customers, we noticed that Little Red Book surpassed Baidu as the top platform for everyday searches, followed by Baidu, Douyin and WeChat.

Little Red Book is not a traditional search engine platform, but as the social media apps boast a large community of UGC creators and urban female users, the search engine of LRB provides more influential search results that could lead to a product or service purchase decision. In April 2023, Little Red Book reported 79% increase in consumer product searches, lead-generation (for travel, tourism, destination, etc) increased by 172%. Little Red Book also officially announced in 2023 that daily search volume in Little Red Book app had reached 300 million requests.

An independent Chinese media Qioupai (Parity) once conducted a poll involving 50 students and asked them for the top channel to research post graduate program, 28 students replied Little Red Book, 16 chose Baidu and 5 for other Apps. When searching about 'post graduate program' in Little Red Book, the platform showed over 12.6 million results with personal experience and guidance; while the search results on Baidu were mostly advertisement.

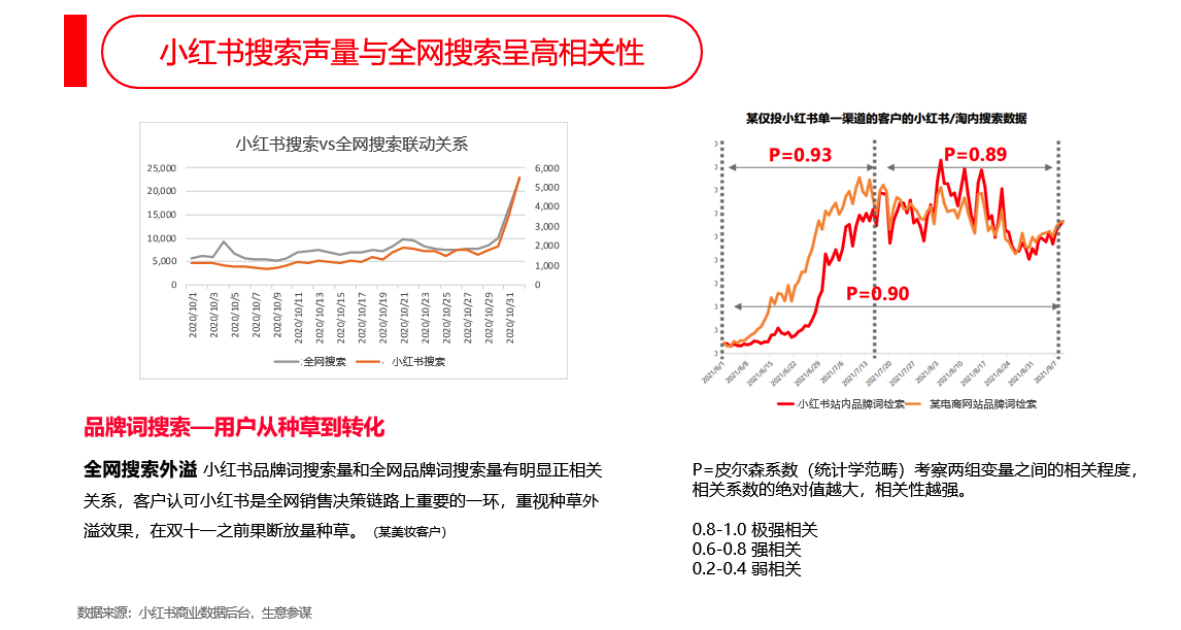

In Juguang Platform, Little Red Book's native advertisement platform, Little Red Book also presented data showing high relevance of search index compared with other search engines and Alibaba's Tmall. Data of a selected company's branded term search volume (upper right image) showed that the search volume increase in Tmall is highly relevant to Little Red Book search, with P=0.9.

For brands targeting middle class consumers in China, Little Red Book had become an inevitable platform for advertisement. Little Red Book recently published a methodology in collaboration with Philip Kotler as 'The Third Marketing Category: A Methodology for Seeding Recommendation" which is essentially a Chinese version of 'Zero Moment of Truth' concept first introduced by Google in 2011.

In the report, Professor Philip Kotler, a master of marketing, highlighted that consumers have become 'active co-creators of value with brands', and that brands need to develop Human2Human marketing designed for more humanized, sentimentalized, and contextualized marketing strategies.

Back to the question: where are brands spending on?

The diversification and fragmented online traffic in China require brands to really be on multi-channel, and inevitably there are repeated efforts and investment for each channels. There is no one-size-fit-all strategy for all brands, as each brand may have audience and customer bases scattered across in China.

Nevertheless, for emerging international brands in China, given the nature of most imported brands are to provide added value to domestic alternatives, Little Red Book and Douyin present enormous opportunities for brands wishing to develop presence and tell stories. It is likely that majority of brands will continue investing in KOL and KOC collaborated product seeding campaigns in the social media platform, but to increase targeted exposure with advertisement tools.

For e-commerce business, Alibaba and JD.com still capture significant market share, will continue to be the place for brands and retailers to heavily invest in. Thanks to the lower competition of merchants in JD.com, we believe performance-based marketing campaign will have better results for retailers and brands who are selling products with existing demands.

Douyin appeal to both branding awareness and performance-based advertisers because of its huge reach and the unique short-video exposure + livestream marketing loop, will continue to attract advertisement spend. But with increasing participants and lowering qualification for merchant recruitment, we believe the average cost for marketing and acquisition could be slightly increasing. Again – short video marketing is not a capability mastered by most companies now, and early entrants can still capture a decent market share and return.

Although Tencent's WeChat Video Channel had not been mentioned in this article – voices from the market also indicated that it could be the last gold mine for brands to capture in 2024. Unfortunately, as of today, WeChat Video Channel still do not accept cross-border merchant with overseas entity – but content marketing & KOL sponsorship still works for most international brands and can fuel private-domain growth for most cross-border e-commerce businesses.

For all above channels, creativity and productivity remain the biggest challenges for brands because value-adding content are crucial for most of the advertisement methods. With AIGC becoming more accessible for brands and marketers, we believe that there are a lot of areas where technology innovation could help increase return on ads spend in China.