Tapping into the Explosive Growth of Personalized Beauty in China

by Mona Tong

Think about it: personalization has always played a significant role in the beauty and cosmetics industry. Traditionally, when you go to an offline store or retailer, beauty assistants often greet you warmly, try to understand what you are looking for and recommend products. These associates consider which products best suit your needs based on their training, experiences and possibly some monetary incentives if they could earn commission from it. This pattern has its own advantage – consumers feel cared for and they get to try products before they buy, which can spark engagement, trust and sales.

However, with the enchantments of technology, people can access gigantic volumes of information in a few simple clicks at home. Algorithms help with narrowing down the information pool; other consumers’ ratings and reviews on social media help to verif whether a product really works. Spending time talking with a beauty assistant in stores and trying before buying seem less essential because technology has already elevated personalization to a whole new level.

Timeline: Tech-powered beauty

2014

L’Oréal released Makeup Genius, an augmented reality (AR) app that allows users to virtually test out an eyeliner or new eye shadow with a smartphone or tablet1.

2017

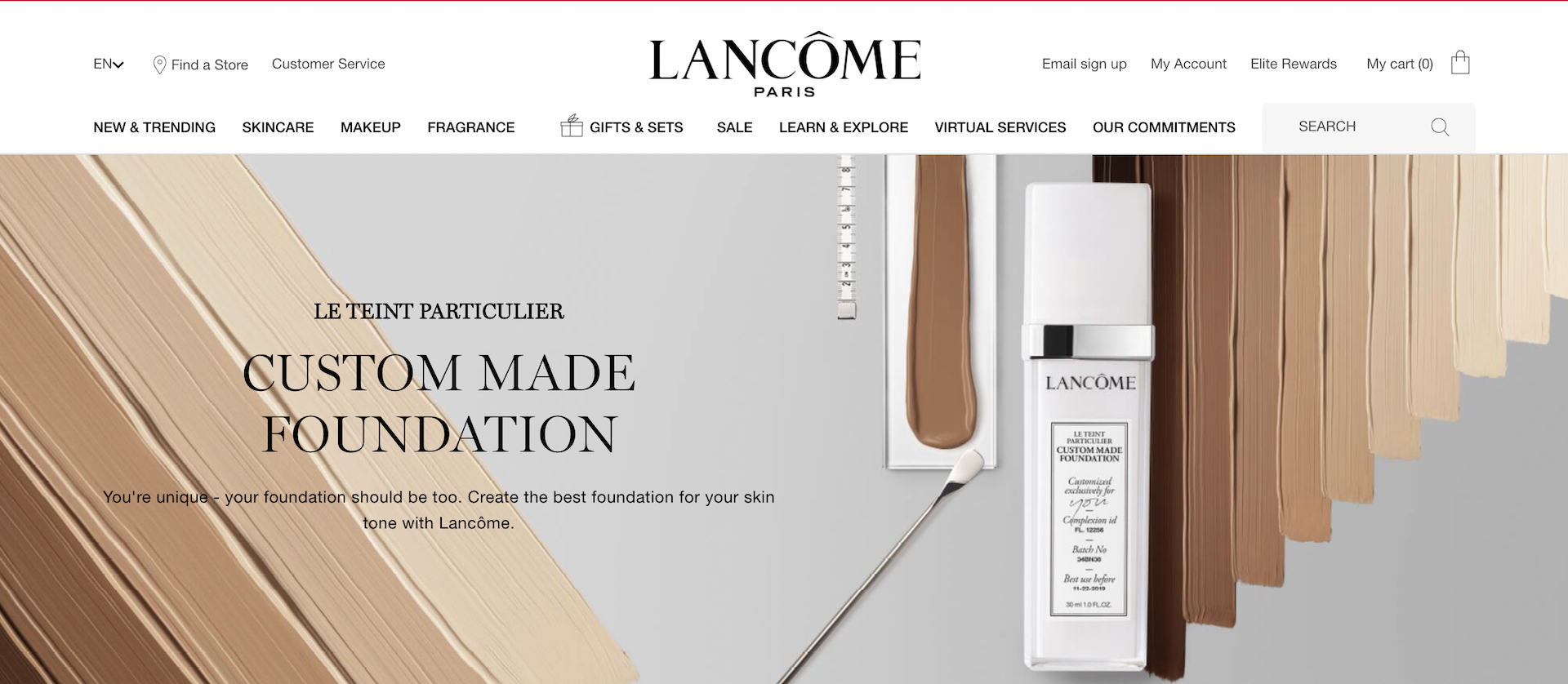

Lancôme launched Le Teint Particulier Custom-Made Foundation using a proprietary algorithm that analyzes then matches consumers’ exact skin tone2. The service is only available at certain high-end retailers, such as Nordstrom and Bloomingdales. Kérastase introduced Kérastase Hair Coach powered by Withings, a France-based division of Nokia and L’Oréal Research and Innovation technology incubator that can analyze and monitor your hair's health.

2018

One of the Chinese e-commerce tycoons, JD, announced its alliance with hundreds of AR and retail partners, including Intel, Walmart and Lenovo. JD also presented its AR try-on gadgets for better online shopping experiences.

2019

Shiseido launched a member-only Internet of Things (IoT) skincare service brand, Optune, which “offers 80,000 skincare patterns matched with individual user’s daily skin conditions and living environments which change day to day.”

Customized cosmetics: Lancôme’s Le Teint Particulier foundation uses an algorithm to match consumers’ skin tones to enhance satisfaction and sales.

These innovations, together with other personalization methods and tools, did not win large crowds back then because they were perceived as convenient but unnecessary and fun but indulgent. Yet, the pandemic is changing everything. It has absolutely contributed to consumers increasingly seeking solutions targeted to their specific needs and injected new perspectives into the trend of personalization in the beauty industry.

“Consumers’ shift to a rational, healthy and eco-friendly lifestyle and self-expression are changing the product landscape.”

While certain consumer segments are still learning about beauty products (teenagers, for example), a growing number of consumers are becoming knowledgeable, sophisticated and confident enough to determine what products are best for them. Plus, there are also many accessible diagnostic tools, artificial intelligence (AI), widgets, apps, online quizzes, as well as online experts to guide them. Their behavioral shift towards a rational, healthy and eco-friendly lifestyle and strong sense of self-expression are changing the product landscape in almost all categories.

Personalized Hair Care

Function of Beauty, a beauty brand founded in 2015, provides science-backed ingredients and creates personalized hair care products tailored to its consumers’ specific hair profiles and needs. Consumers first take a quiz then customize their formula by choosing fragrance, color, size, delivery frequency and pay to finalize the order. The whole process takes less than 5 minutes, which is even faster than buying a ready-to-go product.

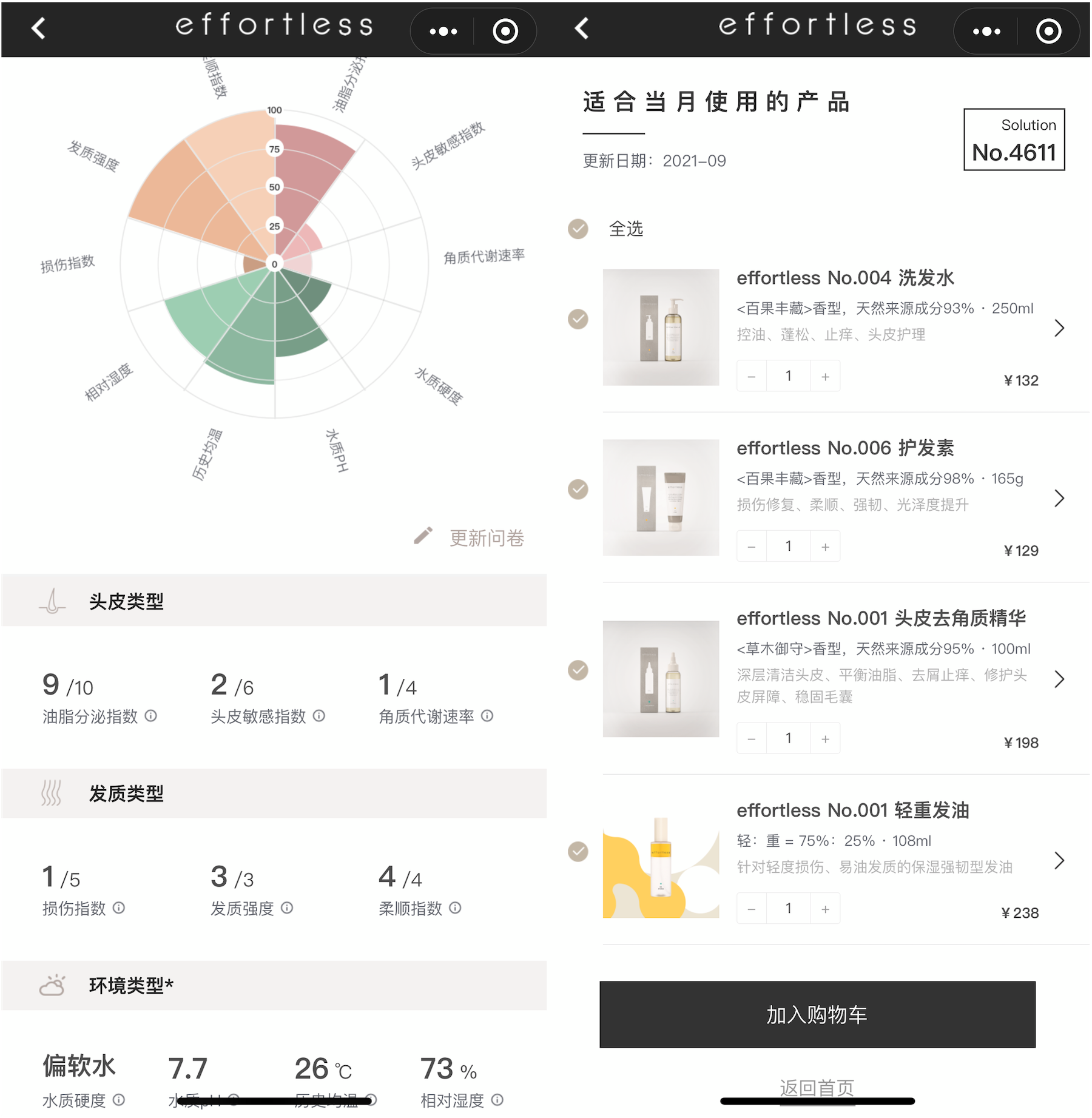

Similarly, a Chinese personalized hair care brand Effortless goes deeper and provides customized formulas to consumers based on their gender, age, hair type, environment, and lifestyle using their own RAPELTM algorithm. Consumers provide information about themselves and get a report about their hair condition and up-to-date living conditions before Effortless reveals their personal hair care recipes.

Designed for your ‘do: Hair care brand Effortless customizes product formulas according to consumers’ gender, age and hair type.

Personalized Cosmetics

If you really think about it, cosmetics products are already customized. For example, there could be hundreds of colors for a lipstick and consumers can even create a new shade simply by overlapping two colors. The thrill of experimentation could explain why people are crazy about cosmetic products – they have many choices and also get to create their own combination.

However, while it might be easy to add a lipstick or an eye shadow palette straight into the virtual cart, foundation could block consumers’ path to checkout. With so many shades, not to mention undertones, selecting a base product without really trying it out is rather annoying.

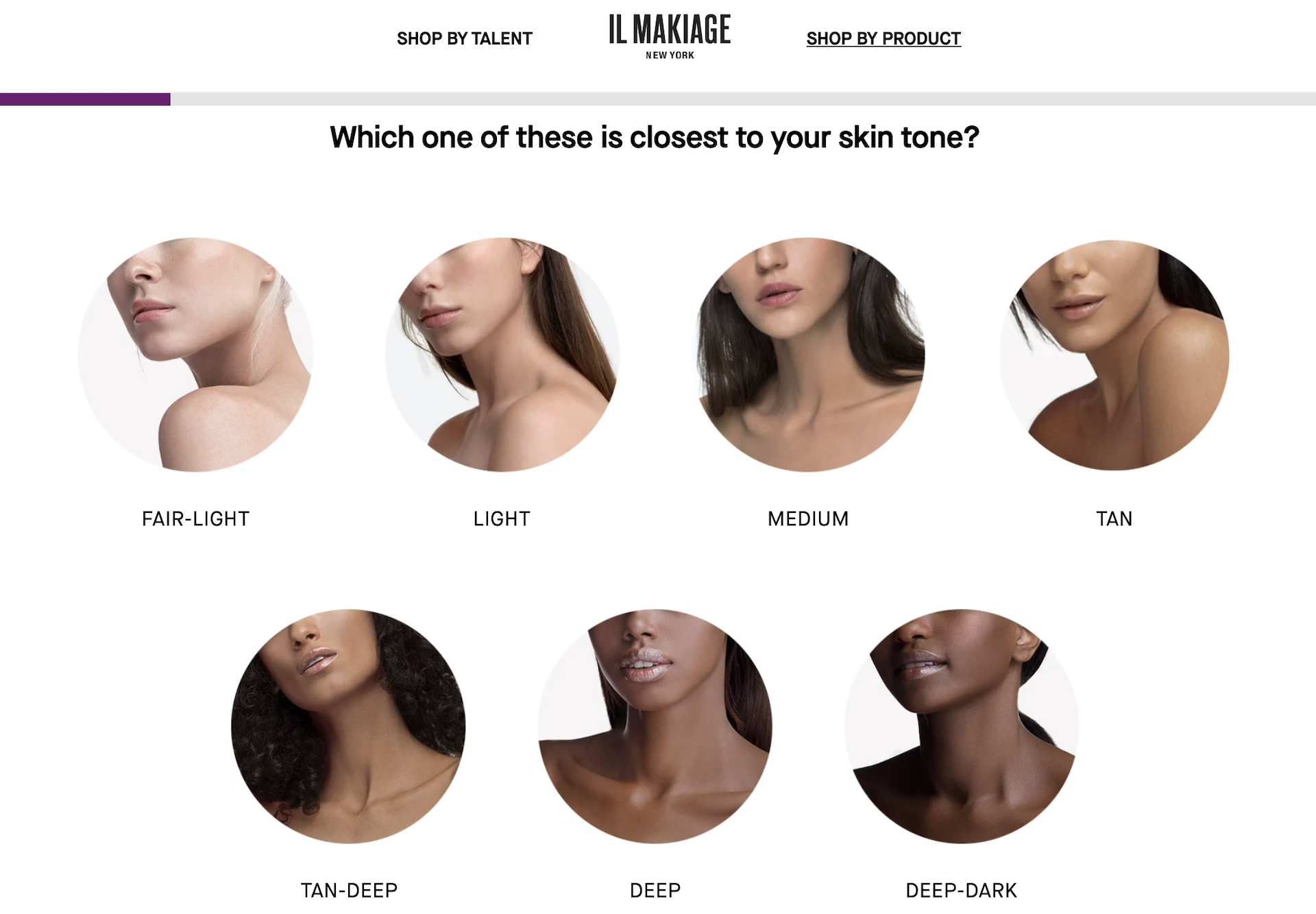

The huge success of Fenty Beauty started with 40 shades of foundation, which made girls feel understood and represented. And the New York based, tech-driven beauty brand Il Makiage goes even deeper. By taking simple quizzes about skin type, the kind of coverage and finish you would like to have, your skin tone, undertone, your habits with foundation, the foundation you currently use and your age, you get a flawless base foundation with a personalized shade. Again, this process only takes a few clicks and then you can wait for the “perfect” foundation to be delivered to your door.

An accurate reflection of your complexion: Il Makiage uses personalized quizzes to overcome consumer reticence to buy foundation online.

Personalized Skin Care

Among all the beauty categories, skin care is the trickiest. On the one hand, it takes years or even decades to discover or create an effective ingredient, and even more years to test out the formulas. Not to mention the product still needs to go through complicated procedures and get approved by authorities before going to market.

On the other hand, a skin problem could be the result of very different causes. For example, acne could be due to an allergy reaction to UV light, too much sugar or diary in the diet, or impaired skin barrier or hormones. An acne treatment product may be able to treat the symptoms temporarily, but it never tells you what exactly went wrong.

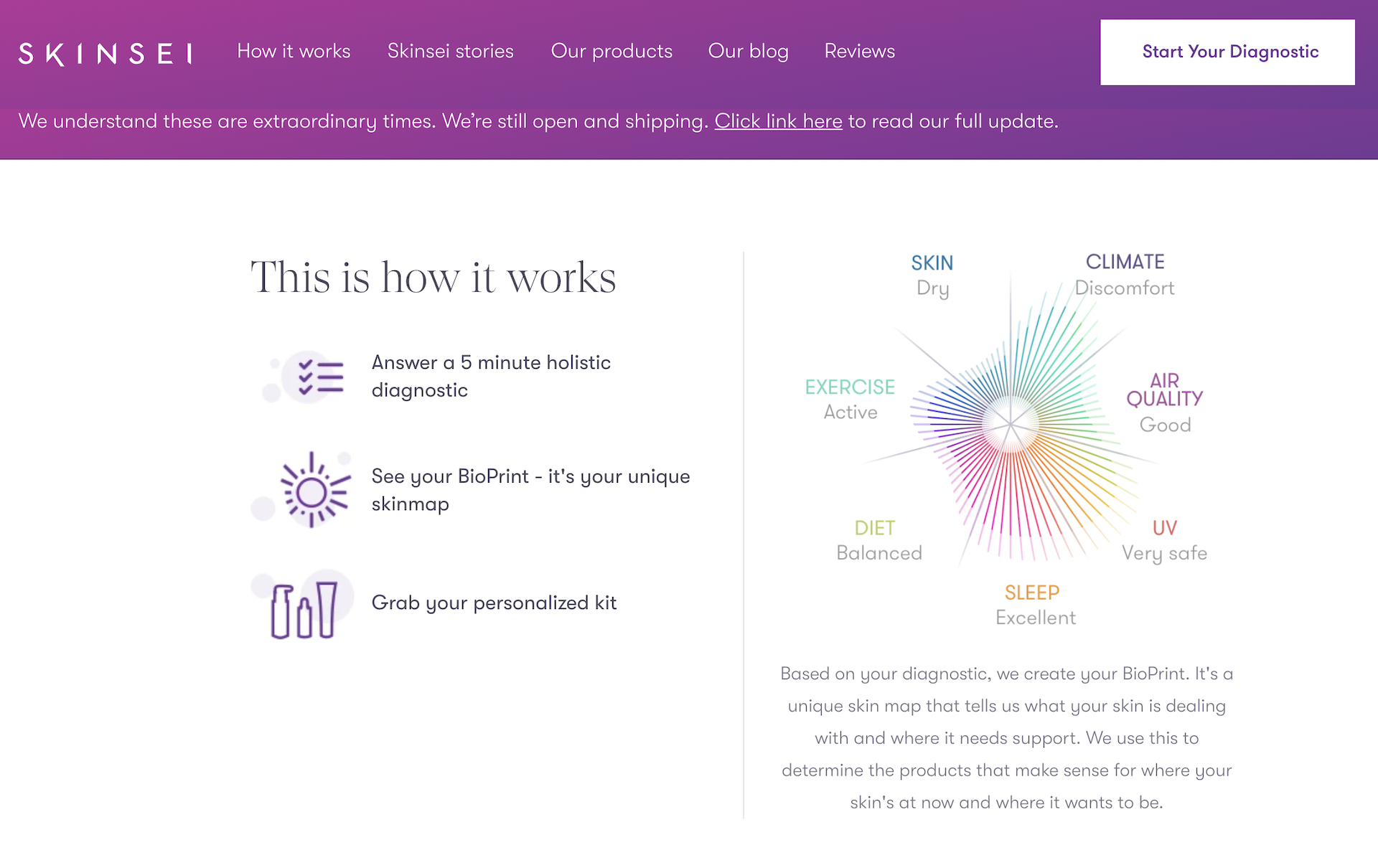

This uncertainty is one of the reasons why Unilever launched a personalized skincare monthly subscription service, Skinsei. Among the seven indices Skinsei evaluates, skin condition is only one of them; the other six are exercise, diet, sleep, UV, air quality and climate. Based on the diagnostic, Skinsei creates a unique skin map and uses it to determine the products that make sense. The depth of Skinsei’s personalization is close to a clinical diagnosis.

Individualized beauty: Skinsei’s quizzes ask consumers about holistic lifestyle factors for a customized beauty experience.

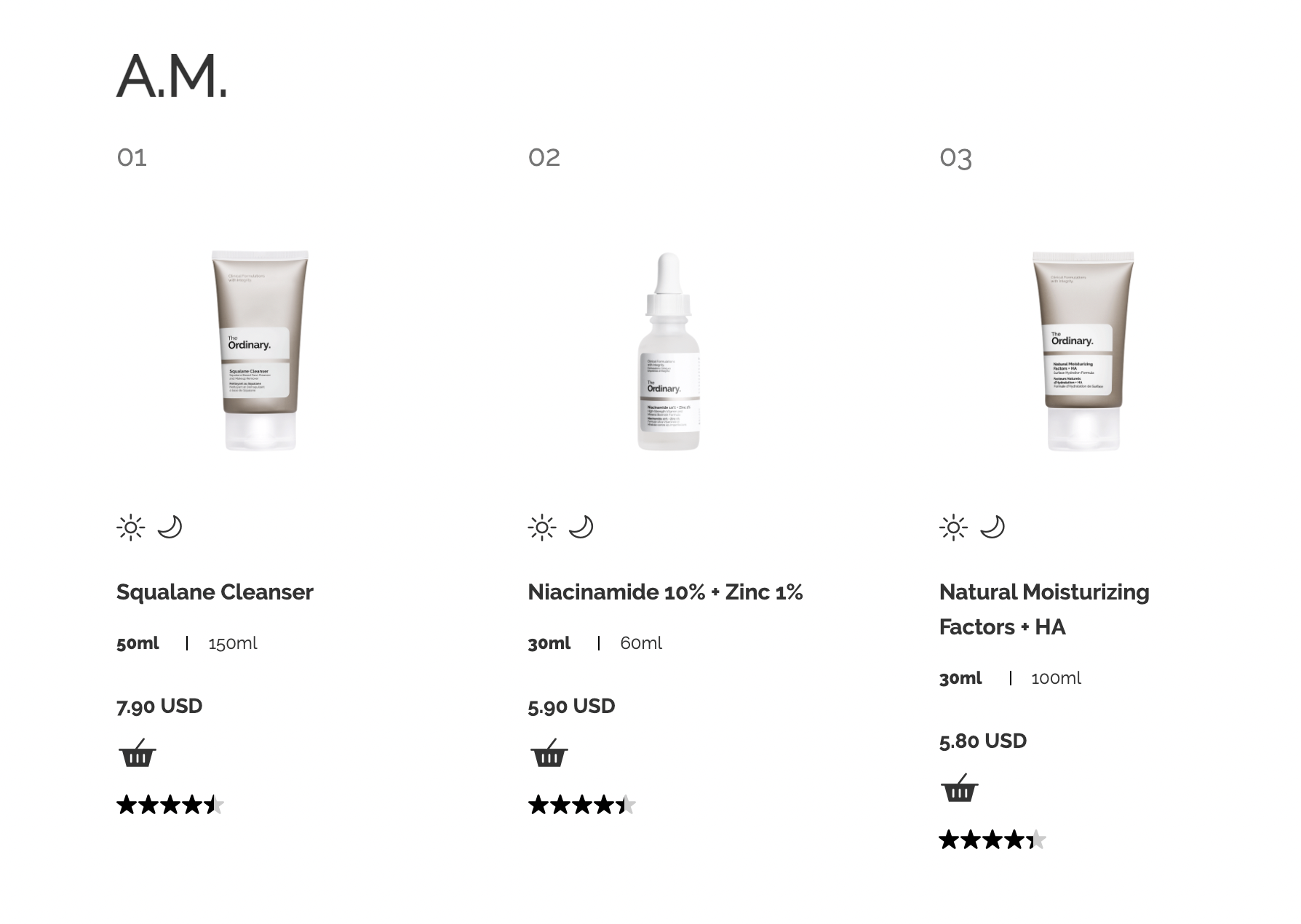

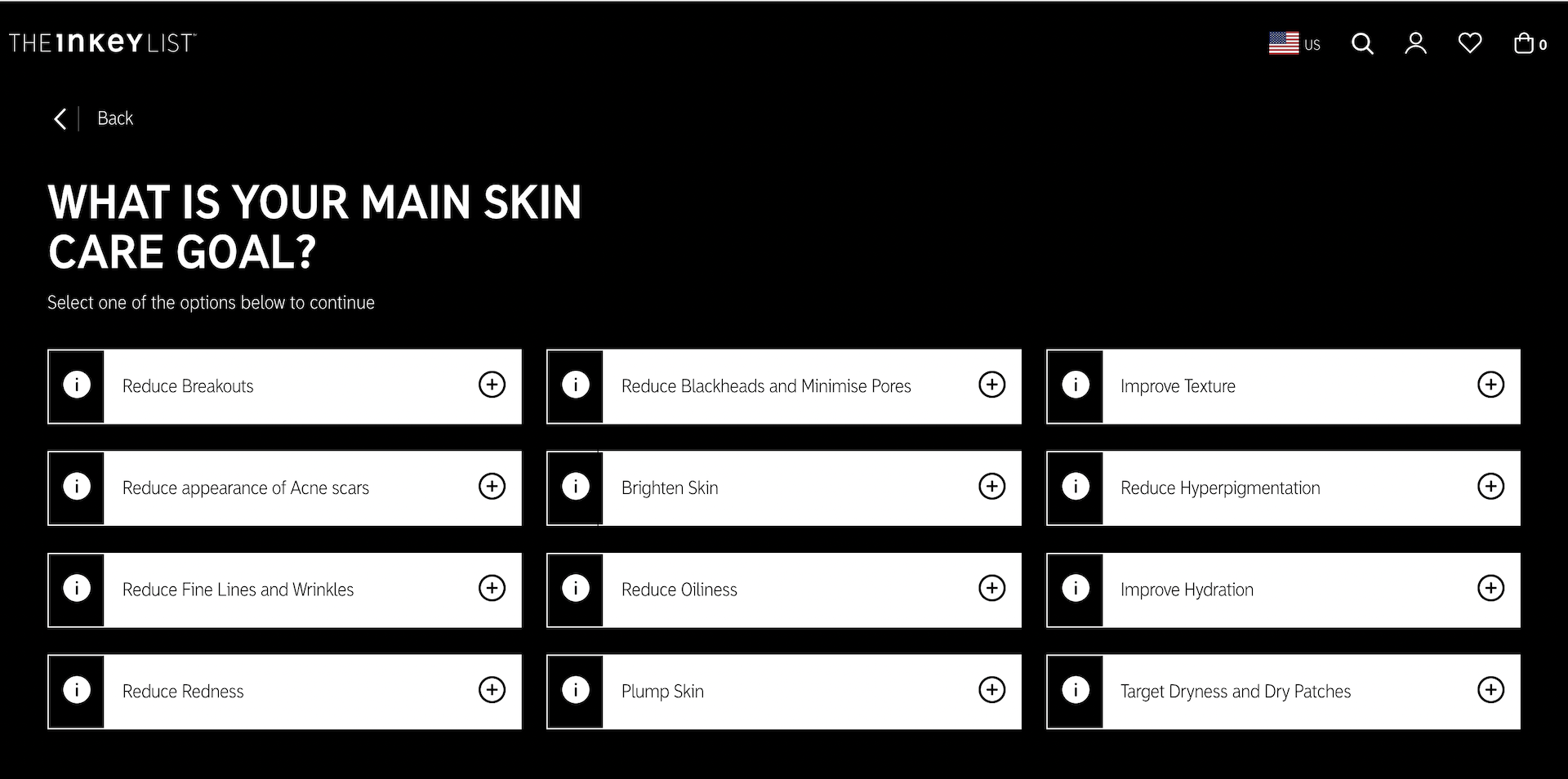

While this approach may seem too involved and come with certain economic pressure, another kind of clinical-like yet cheaper personalization is emerging – the personalized combination of single-ingredient high-performance products. Brands like The Ordinary and The Inkey List sell ready-made clinical ingredients often found in expensive skincare products at a very affordable price. They also offer personalized a.m. and p.m. skincare recipes via online quizzes.

Affordable and effective: Beauty brands like The Ordinary offer value for money sell proven, ready-made clinical ingredients without the premium price tag.

Why personalization matters in beauty

With countless brands and products already on the market, it should be possible for consumers to find what suits them. However, without an experienced beauty assistant or sophisticated algorithms, it can be like looking for a needle in a haystack. For consumers, personalization can help them understand their specific needs, reduce the hassle of searching for products and streamline purchase decisions. For instance, by simply taking Il Makiage’s quiz, a consumer can easily discover their undertone. Meanwhile, The Inkey List’s quiz reveals exactly which concurrent problems individual consumers have with their skin.

The InKey List and Il Makiage ask more questions to get more intimate with beauty consumers and serve them more effectively

For brands, personalization elevates their offerings above rivals’ and helps them collect well-targeted user profiles within minutes. These massive data insights are the invaluable asset that helps beauty brands improve their online algorithms. In return, better algorithms provide more accurate, personalized service while laying a foundation for more advanced products in the future. What’s more, the more fun the consumers experience in creating their own unique products, the more likely they are to repurchase and recommend the brand to others. Once this virtuous circle takes shape, the whole beauty industry could be revolutionized.

How mature is personalized beauty in China?

It is just getting started for sure. The most common service or products that reflect personalization in China are related to augmented reality (AR) or AI technologies. In 2020, Vaseline Tmall Store launched an AI skin testing function5 for recommending body lotions targeting different skin problems. International brands, such as M.A.C and L’Oréal, also provide virtual try-on services to improve consumers’ shopping experiences.

AI-driven beauty: Vaseline’s Tmall store uses AI to recommend body lotions to address different skin concerns.

However, if you seriously think about it, none of the products are personalized. The technologies in discussion are more for speeding up consumers’ decision process rather than catering to their real needs. Once consumers realize this trick, they are less likely to fall for it again. This implies great potential in personalization waiting to be explored in China.

How brands can capitalize on China’s personalized beauty boom

This brings us to the ultimate question: how can U.S. and global brands enter the personalized beauty market in China?

First and foremost, brands need to determine which products and services they will offer. For products falling in the hair care and makeup categories, consumer behavior is more about mix & match, which emphasizes the accuracy of the algorithms, on the basis of safe ingredients and formulas.

For skincare products, it is more about safety, effectiveness and efficiency. China was once one of the few countries in the world that required mandatory animal tests on imported cosmetics products. Only by obtaining approval by the CFDA (China Food and Drug Administration) could products be imported and distributed in China. This no doubt stopped many international cruelty-free brands from entering Chinese market.

However, in March, National Medical Products Administration just released Provisions for Management of Cosmetic Registration and Notification Dossiers and announced that imported “ordinary” cosmetics, including shampoos, makeup, and fragrances, will not be required to undergo animal testing starting on May 1, 2021. In order to be qualified for the exemption, brands must obtain a good manufacturing practices (GMP) certificate issued by the relevant regional authorities where the company is located, and provide safety assessment results that can fully confirm the product’s safety.

If this still sounds complicated, as an alternative, cross-border e-commerce could be the link between brands and Chinese consumers because no CFDA certificate is needed for this business model. However, the after-sale could be a headache – it may take much more effort and higher costs to recycle exchanged or returned products. Il Makiage has a possible workaround, as it offers free return within 14 days in the U.S. and a 60-day warranty to consumers in U.K., Germany and Australia.

Once brands pinpoint products, it is time to decide on a platform as their main “battlefield.” Independent e-commerce site could be an appropriate option. Brands can develop their own algorithms and design the personalization processes. Nonetheless, it is more challenging to attract traffic compared with registering on mature platforms, such as Tmall and JD, as it relies more on off-site marketing.

"WeChat’s powerful ecosystem offers a complete cycle of data collecting – branding – marketing – selling – brand refresh"

WeChat mini program is an alternative that’s more catered to Chinese consumers. The powerful ecosystem of the popular social media platform WeChat could form a complete cycle of data collecting – branding – marketing – selling – brand refresh. Once a brand is established, the business could expand to other shopping platforms.

Effortless’ personalization algorithm and data collection rely on WeChat mini program as it is much more convenient for users to take the quiz on an app that they already use every day and share the links to others. Then Effortless launched a Tmall store to sell normal ready-made hair care products. The company still encourages consumers to follow its WeChat account and take the quiz if they are not sure about which products to use.

Effortless relies on WeChat mini program as an effective channel to reach beauty shoppers where they already spend their time.

Aside from product and placement considerations, there are also numerous details brands need to consider, like how to rejuvenate personalized beauty in China, how to make the most of current platforms, how to adjust their customer relationship management (CRM) systems to cater to Chinese consumers, etc. Be that as it may, there is no doubt that personalization in the beauty industry is back with fresh look and more advanced technologies. The big questions are more about How rather than Whether and When beauty brands will pounce on China’s lucrative personalization trend.

2. https://www.lancome-usa.com/le-teint-particulier.html

3. https://www.allure.com/story/kerastase-hair-coach

4. https://corp.shiseido.com/en/news/detail.html?n=00000000002712

5. https://www.sohu.com/a/376521892_209089