China's Sports & Outdoor Market Recovery Beats Expectation

In this article, we will analyze the shift in the Chinese sports & outdoor gear industry in terms of development, consumer behaviours and industry best practices.

by Yiting Lin and Davy Huang

Oct 24, 2023: After a long period of depression, NIKE's FY2024 Q1 report showed the brand's Greater China revenue returned to the growth trajectory, and surged 8% to $1.74 billion dollars. As Chinese consumer spending continues to improve, consumers are gradually coming back to the stores for sneakers and clothing – and it seems that the impact of the 'Xinjiang Cotton' incident started to fade.

Sports leisure and activewear markets are benefitting the most from the recovery of the retail sector in China. Lulumelon, one of the biggest competitors of NIKE in the activewear industry, reported a 69% YOY increase in H1 2023 revenue, reaching $527 million in China, the fastest-growing market of the brand.

2023 is a monumental year for the Chinese sportswear industry, as consumers' bursting eagerness for outdoor activities penetrates from professional performance to daily lifestyle, contributing to the rapid growth of revenue for named brands. The Chinese Sports & Outdoor market is projected to reach $28.72 billion in 2023. In this article, we will analyze the shift in the Chinese sports & outdoor gear industry in terms of development, consumer behaviours and industry best practices.

Elevated Health Awareness, Sporting Events, and Policies

The recovery of the Chinese sports industry in 2023 can be attributed to several factors. Firstly, the pandemic has prompted a remarkable shift in behaviour. According to the Tmall Innovation Centre (TMIC), roughly 70% of the Chinese population has increased their participation in sports activities compared to the previous year. The change in consumer habits is one the biggest factors contributing to the segment growth – as we are seeing increasing non-professional participants in gym, running, skiing, skateboarding and hiking.

The most significant surge in outdoor activity posts on social media in MAT2023 has been in camping, cycling, skiing, and fishing, with impressive growth rates of 195%, 185%, 182%, and 135%, respectively, as reported by CBN Data.

2023 Spartan Kids Race in Beijing, China (Image from China Daily)

The Spartan Race, an obstacle race format first introduced to China in 2017, has recently hosted its biggest event in Beijing – with 12,705 kids participants joining the campaign. As a competition that promotes "Earn, not Given", the Spartan Race is hosting various events in China covering both professional and amateur, as well as adults and kids. Such races that encourage people to build endurance and performance are becoming even more popular in China. The most recent 2023 Shanghai Marathon received over 170,000 applications, with only a 13.7% success rate to apply. Over 600 participants are aged above 60.

Diverse international sporting events have inspired people to participate in physical exercise. The 19th Asian Games, held in Hangzhou, China from September 23 to October 8, received sponsorship from over 170+ companies. Well-known sportswear brands such as ANTA and 361°, leverage the event's massive audience to promote cutting-edge technology with traditional Chinese design elements in their products.

The Chinese government has introduced a range of policies aimed at promoting citizen health and fostering the growth of the sports industry. Initiatives such as the "2021-2025 Sports Development Plan" and the "National Fitness Program," launched by the General Administration of Sport of China in 2021, have significantly expanded the availability of fitness facilities, encouraged commercial contests and events, and enhanced public services to support these events. These policies have not only increased awareness about sports and health but have also stimulated greater public participation in physical activities.

Diverse Preferences Trigger Demand for Professional Sportswear and Equipment

As a result of the increased participation in racing and training, NIKE FY2023 has delivered robust growth in shoe sales, with 8% YOY growth. HOKA ONE ONE, the shoe brand which excels at performance training & running shoes, entered China's market in 2017, highlighting the plan to expand around 200 offline stores in China. The recent Q1 2024 financial report of Deckers Brands, owner of HOKA ONE ONE and UGG, showed that the international market, including China, delivered 11.4% YOY growth. Swiss sports shoe brand ON, shared in a recent investor day event that the company plans to increase China's revenue to 10% of global revenue income, achieving 20% - 50% YOY growth after 2026.

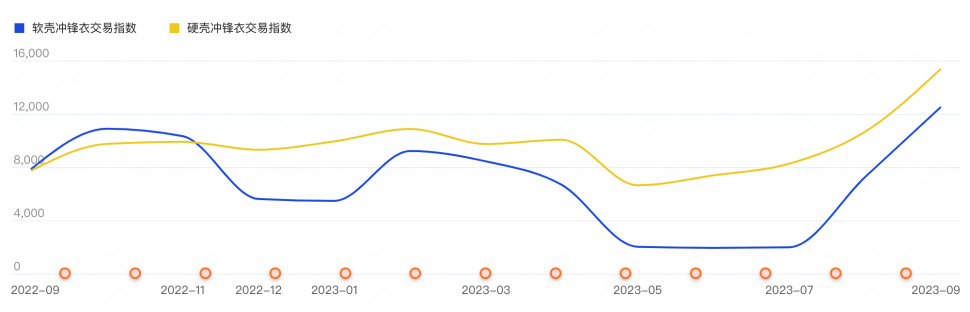

While the shoe category has benefited from the renewed demands, the Chinese sportswear category is delivering mixed results. As NIKE talk about the decline in apparel sales in China, Tmall's Outdoor Category Director mentioned above 50% yearly growth of sales in products such as outdoor jacket and UV protective clothing, according to 36Kr. Tmall's business intelligence engine SYCM showed that during September 2023, the search popularity of '冲锋衣' outdoor jacket surged 88.1% MOM and 58% YOY, while the hard-shell jackets and soft-shell jackets trading index grew 2 times and 1.6 times respectively.

Sports apparel sales in China are experiencing a major change in consumer preference – with everyday sports leisure encountering inventory and discount pressures, while activewear and outdoor clothing sales are accelerating. China became the first Asian markets to expand into Vuori, a Men's athleisure rival to "Lululemon" that produces activewear targeting men's sports and leisure demands. Since 2022 the brand launched exclusively on Tmall with a DTC approach in China, the brand quickly launched the first offline pop-up store in Jing An Kerry Centre (JAKC) in Shanghai.

Material innovation, style, comfort, and brand reputation became major buying factors. Usage of materials such as eVent, Gore-Tex, and Sympatex are becoming prevalent among leading brands which provide waterproof while ensuring endurance. The surging popularity of ARC'TERYX in China promotes consumer awareness about the materials behind waterproof and windproof claims, and consumers are looking for the diverse choice of soft- & hard-shell products which leverage innovative materials to build lasting and sustainable clothing.

The emergence of elite sports like golf and riding also contributes to higher sales of relevant equipment. According to CBN data, golf accessories sales in China have surged over 140% to the top of the sports equipment list, followed by soccer in the first half of 2023. Notably, the top domestic golf apparel operator in China, Biem.L.Fdlkk, has consistently sponsored the 19th Asian Games in Hangzhou for 13 consecutive years, strategically building brand presence and equity. The company also recently acquired Kent & Curwen and Cerutti 1881, aiming for further growth in the luxury space.

ANTA: A Standout DTC & Multi-Brand Performer

ANTA Sports Group is a sports equipment multinational corporation headquartered in Jinjiang, China. On August 22nd, ANTA Group released its revenue for the first half year of 2023 reaching $4.1 billion with 14.2% YoY, ahead of both NIKE China and ADIDAS China. The great performance could be attributed to the multi-brand synergies and the focus on DTC transformation.

DTC has been widely mentioned in sports brand's financial reports, such as NIKE's establishment of in-house digital DTC capabilities by developing and reinforcing the customer community with the SNKRS app, and collaborating on new product development (NPD) with the community members. Swiss shoe brand ON also underscores the importance of the brand's DTC presence in China, before attracting wholesale partners for effective growth.

ANTA is following the strategy closely to relaunch its official China website, and using WeChat Mini-program as the medium for customer engagement and monthly new product releases. ANTA is also actively turning their China distributors into DTC channels by merging or shareholding agreements, which protects the brand equity and profit of the portfolio brands.

ANTA Sports Group's strategic acquisition FILA proved to be a fruitful deal. The profit margin for FILA surged from 7.2% to 29.7% in the first six months of 2023. Additionally, in 2019, Anta acquired a share of Amer Sports Corporation which owns ARC-TERYX, WILSON and SALOMON, targeting middle-class citizens in China looking for something new and different. Amer Sports has recently filed for a US initial public offering (IPO) that could value the group as much as $10 billion. ANTA also operates DESCENTE and KOLON SPORTS in China, which are aiming to become the next ¥1.4 billion brands among the company's broad portfolio, by riding the boom of elite sports such as golf and skiing.

Furthermore, in October 2023, ANTA Group made headlines once again by acquiring Maia Active, a Chinese designer sportswear brand. This strategic move emphasizes ANTA's commitment to strengthening communication with female consumers, particularly in categories such as yoga clothing, as it aims to compete with industry giants like Lululemon.

Notably, the running shoe brand Salomon, a part of Amer Sports, has witnessed extraordinary growth, with a triple-digit increase in revenue between 2020 and 2022. Shoes contributed to over 70% of the brand's growth in China. The marketing strategy of SALOMON involves widespread product experience sharing on Chinese social media platforms that fuel consumers' desire to purchase its products. The brand also hosts regular offline community race events in major cities that draw customers closer to the brand, even if they are wearing other brands. Such events are very helpful for brand awareness building and have proven to be effective at generating in-store traffic and sales.

Key Takeaways

• Consumer participants in sports and outdoor events are promoting the sales and diversification of professional running shoes and apparel.

• Chinese middle-class consumers are actively looking for new materials, new technology, functionalities, and styles from international brands.

• Sports events, either public or hosted by the brands, can be effective at building brand awareness and promoting sales.

• DTC are instrumental for brand growth in China thanks to the direct engagement with customers.