The Anti-aging Market in China: A Burst of Momentum

by Mona Tong

If COVID-19 has taught Chinese consumers one thing, it is that health is rather earned than given. This applies to both physical health and skin health. The pandemic has fostered the overall awareness of self-care and extended the focus to skincare products, as consumers are paying more attention to skin health. Meanwhile, after the 2020 Chinese Census released the preliminary results in May that the age group of 60 and over accounts for 18.70% of all population1, “aging” has drawn unprecedented attention. Aging is unstoppable, yet anti-aging is becoming attainable. With average incomes continue to rise, advanced technology becomes more accessible and affordable, domestic e-commerce booms and the consumer behavior shifts towards health and quality conscious, anti-aging products are no longer a luxury.

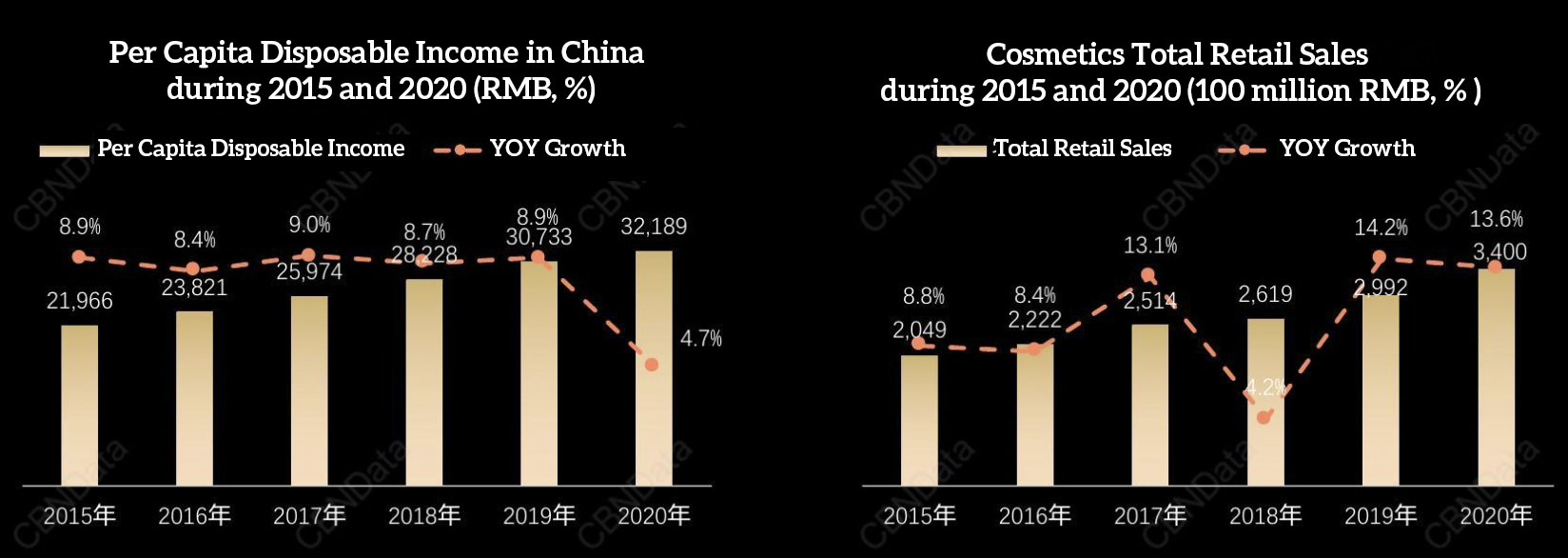

According to ResearchAndMarkets.com's, the global market for Anti-Aging Products estimated at US$52.5 Billion in the year 2020, is projected to reach a revised size of US$83.2 Billion by 2027, growing at a CAGR of 6.8% over 2020-2027. And China, the world’s second-largest economy, is forecast to reach an estimated market size of US$18.4 Billion in the year 2027 trailing a CAGR of 10.5% through 20272, which accounts for almost 22% of the global market. Moreover, as the data from the National Bureau of Statistics of China suggests, despite that the growth of per capita disposable income in China is slowing down, people are still willing to pay for cosmetic products. Among all the keywords most searched-for in the skincare category, “anti-aging” definitely has a place. According to a poll conducted by CBNData and Effectim, anti-aging ranked top among all skincare needs, followed by moisturizing and acne treatment.

One may think the majority of users of anti-aging products are senior citizens or the middle-aged. Well, not quite. According to a report by Forbes, in China, Millennials and Gen Zs have become the biggest consumer segment, and 39% of females aged 20-24 use anti-aging skincare products that can prevent and eliminate signs of early aging, especially anti-wrinkle products to prevent the occurrence of lines and wrinkles4. Even though Millennials and Gen Zs are not considered as aging population, they still face premature skin aging problems. Factors including ultraviolet rays, smoking, unhealthy diet, drinking, late sleep habit, and pressurecould lead to premature skin aging. Luckily, scientific studies make sure many of the outward physical signs can be addressed with the right treatment or ingredients. Therefore, it comes as no surprise that people in their 20s or early 30s are already starting to tackle the aging problem.

Five consumer trends in the anti-aging market in China

The popularity of premium anti-aging products keeps rising. According to the same report by CBNData and Effectim, the percentage of consumers spending over RMB 1000 on a single anti-aging product is growing rapidly. And among them, Millennials take up the highest proportion. This uncovers an important fact: anti-aging still relies on advanced technologies that domestic skincare product companies are still trying to catch up with. It is fair to say that international big-name brands still are in a favorable position. Millennials whose anti-aging needs are more pressing than Gen Zs’ are more willing and determined to pay more for more effective ways to tackle the aging problem.

Aesthetic medicine, or often rephrased as ‘beauty from within’, is becoming the highly anticipated anti-aging means. It is generally divided into surgical procedures (e.g. reconstructive surgery, liposuction, facelifts), and non-surgical procedures (e.g. Photorejuvenation, radio frequency skin tightening, chemical peel, Thermage). Based on a report by Deloitte and Meituan, the Chinese aesthetic medicine market is estimated to reach RMB 227 billion in 2021 and RMB 311.5 billion in 2023. Among all the users, 20-35 age group accounts for 3/4 and the 20-25 age group’s share is steadily increasing5. As the market becomes more regulated, information and pricing more transparent, aesthetic medicine is no longer a lucky straw - it’s easy to know what you are paying for. Compared with working out, using skincare products, keeping a diet and taking supplements, aesthetic medicine could be the most efficient means but also the most expensive one.

Professional at-home beauty devices are becoming the new normal. The pandemic keeps people at home and accelerates the commercialization of professional at-home beauty devices. The consumption penetration rate of anti-aging beauty devices keeps rising through 2018 till now. Moreover, more and more consumers tend to purchase premium professional beauty devices that are over RMB 3000. Among all the key functions of anti-aging beauty devices, Radiofrequency, Thermolift, Infusion, Microcurrent and Untrasonic rank top 5. These seemingly high-tech terms are now becoming more affordable and tangible.

Niche single-ingredient products are winning Gen Zs’ hearts. On the one hand, Gen Zs were born with better living conditions and are the most-educated generation yet. For them, there is no waiting to anti-aging - the sooner they start, the better off they will be. On the other hand, Gen Zs are also digital natives who know how to search for information and share their opinions out loud via social media. They realize that anti-aging is not a myth - there are feasible means and reliable ingredients to treat aging. With the mindset of “it’s never too early to anti aging” and the tool of Internet, Gen Zs have more sophisticated appreciation of ingredients and no craze for big-name brands even though they could afford them. This enables purse-friendly brands such as The Inkey List and SkinCeuticals to raise brand awareness and gain more users.

Cutting-edge aesthetic treatments foster demand for anti-aging products. From the perspective of purpose, more and more consumers take aesthetic treatments in order to counter aging and rejuvenate. There is no doubt that they will keep using anti-aging products and even invest more in the anti-aging trek. In regard to post-treatment skin care, be it a serious treatment in a clinic or using at-home beauty devices, it is always about healing, anti-inflammatory, repair, protecting the skin from sun damage, and boosting nutrients. This may not 100% align with anti-aging. Yet, the fundamental principles are relatively the same - refresh the skin by repairing the damaged cells, stimulating metabolism of the cells, and preventing further damage. Thus, most aesthetic treatment users are starting to apply anti-aging skincare products.

Exclusive formulas VS easy-to-get ingredients

It is fair to say that international big-name brands are still leading in the anti-aging market. Their R&D technology, patented formulas and ingredients have entitled them to higher pricing. SK-II, for instance, centers around a unique ingredient called Pitera, which is the lifeline of the whole line. Estee Lauder’s everlasting Advanced Night Repair is credited as the first product to use skin-plumping hyaluronic acid (透明质酸). La Mer is able to succeed with only one product worldwide because of its Miracle Broth™. La Prairie’s Cellular Complex, Augustinus Bader’s TFC8…The exclusiveness of these brands is bound to raise their prices and limit the range of users to more affluent consumers. However, a large group of Millennials and Gen Zs may not fall into this category. This is where brands with much more affordable yet effective ingredients jump in.

One of the top three anti-aging ingredients is Retinoid(维A), which is made up of forms of vitamin A (retinol视黄醇) or derivatives of the vitamin (such as tretinoin 维A酸) . It can reduce discoloration and stimulate the growth of new cells. RoC, Neutrogena and Murad all launched products featuring this ingredient. Another one is Peptides (胜肽), which are proteins that stimulate the growth of new cells and facilitate cell turnover while you sleep. They can also stimulate the production of collagen. Emerging brands such as The Ordinary, NIOD and Filorga all have star products containing Peptides. The last one is Pro-Xylane, a sugar-molecule derived from the beech wood tree utilizing green chemistry, developed and created by L’Oréal Research and Innovation. It stimulates the production of proteoglycans (蛋白聚糖), a water-absorbing molecule in human reconstructed skin, and thus can counterbalance sighs of aging6.

New brands also stand a chance as long as there is a differentiation

Among the best-selling anti-aging products during 618 on Tmall, several brands stood out among big-name brands and domestic brands - one of them is Kate Somerville. Founded by Kate Somerville and originated in Hollywood, this brand is backed by clinic-level formulas and many Hollywood celebrities including Taylor Swift.

It aspires to combine advanced technology and high-performance ingredients to deliver safe, efficient, convenient, aesthetic medicine-like effects.

Its top 1 anti-aging product is +Retinol Vita C Power Serum, which has a spooky-at-first but then catchy name “Phantom Lady”(女鬼精华). It combines 0.5% Retinol and Vitamin C at the same time to reduce discoloration and stimulate the collagen synthesis to eliminate wrinkles, which also makes it possible to use it both day and night because most products containing Retinol can only be applied at night.

![]()

In terms of marketing, Kate Somerville has been working on PR seeding with all levels of KOLs and KOCs on social media platforms including The RED, Weibo and WeChat. It also has launched free-sample trial campaigns and a livestream campaign with Austin Li. For brands that intend to enter Chinese market with limited budget, choosing a catchy and special name could be a good start. And a star product definitely helps with defining the brand positioning. In Kate Somerville’s case, the “Phantom Lady” serum indicates that this brand aims to deliver efficient and fast results, which suits the fast pace of modern life and is more likely to attract less price-sensitive consumers, because to some extent, they are willing to trade time with money.

In terms of marketing, content seeding and PR seeding is relatively slow in boosting sales compared with working with Austin Li, but keeping existing users and attracting new consumers are equally paramount. Consumers who feel they belong to a group tend to stick longer and are more willing to spread word of mouth spontaneously.

Another similar case is Amala, a German organic skincare brand with pioneering research and groundbreaking biochemistry formulas. After months of seeding, promoting and a livestream campaign with Austin Li, it is now a rising premium skincare brand on Tmall and attracting increasing attentions from affluent consumers who desire organic anti-aging experiences.

1: http://www.stats.gov.cn/english/PressRelease/202105/t20210510_1817185.html

3: https://www.cbndata.com/report/2558/detail?isReading=report&page=9

4: https://www.sohu.com/a/410899349_118622?_f=index_pagefocus_4&_trans_=000014_bdss_dknfqjy

5. https://www.cbndata.com/report/2524/detail?isReading=report&page=9&readway=stand

6. https://www.lorealparisusa.com/ingredient-library/pro-xylane.aspx