Chinese Government Lowers Postal Taxes Again to Stimulate Imports and Consumption

This is the second time in six months that the government has lowered taxes on postal imports

by Ker Zheng

Last week China Premier Li Keqiang announced additional tax cuts on consumer products purchased overseas, in an attempt to boost imports and stimulate domestic consumption.

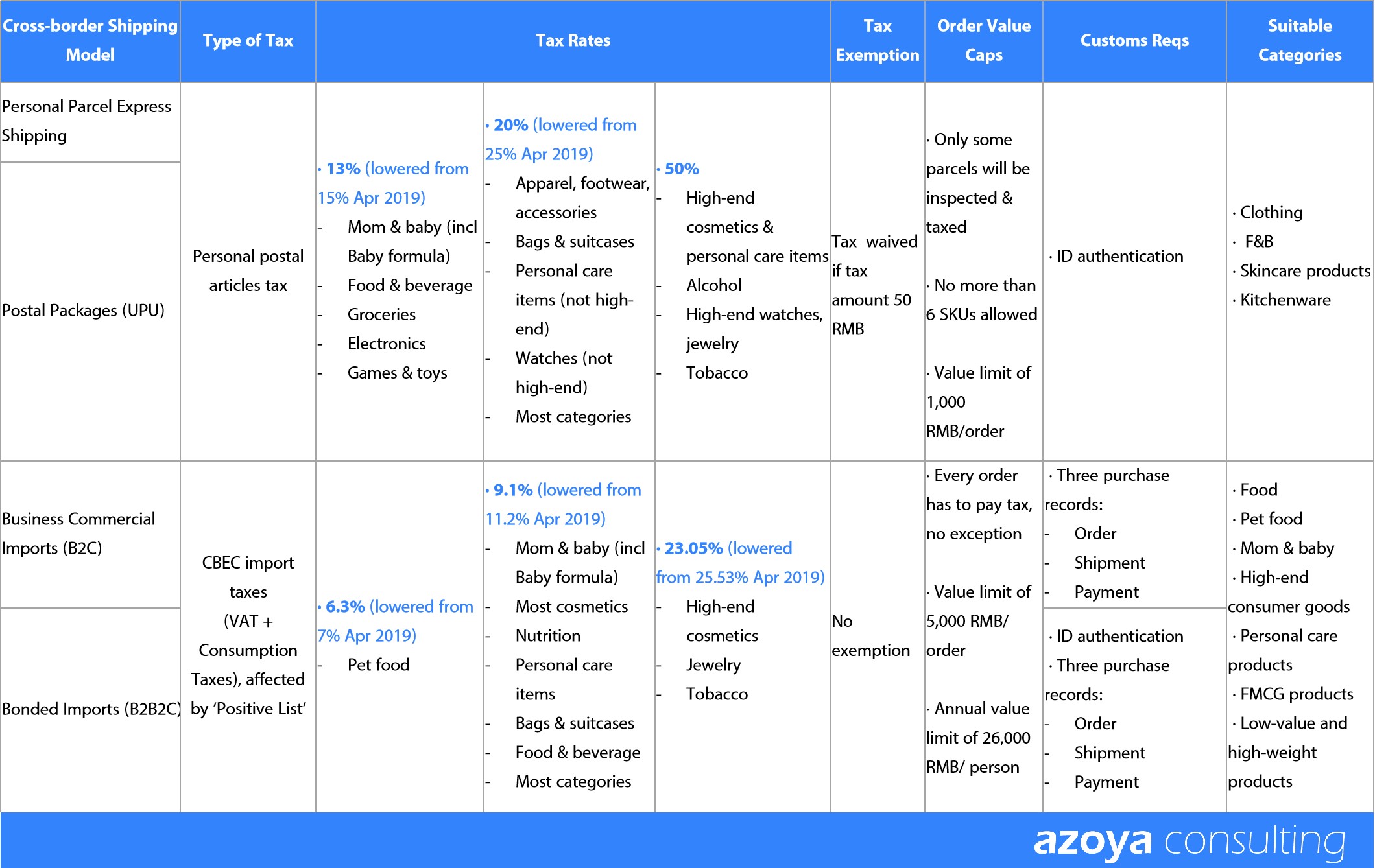

The tax cuts affect postal article taxes, which applies to items brought into China as personal items or shipped through customs as personal items rather than business items.

Prior to the cuts, there were three tax brackets: 15%, 25%, and 50%. The first two brackets will have rates lowered to 13% and 20%, respectively.

The first bracket affects computers, food, gold/silver items, furniture, and medicine, while the second bracket affects most other non-luxury categories.

The last tax bracket, which affects premium products such as wine, cigarettes, jewelry, golf equipment, luxury watches, and high-end cosmetics, will maintain the current tax rate at 50%.

This is the second tax cut on personal postal articles in six months, an indication that the government may be desperate to stimulate consumption in a slowing domestic economy.

In November 2018, the government lowered taxes on the highest bracket from 60% to 50%, and the middle bracket's tax rates were lowered from 30% to 25%.

Looking to enter China through cross-border e-commerce? Check out our Services: China E-commerce Services |

How Exactly will Cross-Border E-Commerce be Affected by the Tax Cuts?

The tax cuts will generally benefit the import cross-border e-commerce industry in China.

While the personal postal articles tax is separate from cross-border e-commerce tax, many daigou and cross-border e-commerce sellers still ship goods to China as personal items, which are sometimes (but not always) held by customs and subject to the personal postal articles tax.

This is because the official cross-border e-commerce tax limits individual purchases to 5,000 RMB per transaction and 26,000 RMB per year.

If you're selling high-priced electronics or luxury goods, customers could easily surpass these limits. That's why sellers of these types of goods tend to use postal shipping, which isn't subject to the official cross-border e-commerce tax.

Additionally, only a handful of personal postal shipments are held by customs and taxed, whereas all shipments going through the cross-border e-commerce customs clearance channel are pre-registered with customs and taxed.

However, keep in mind that the government lowered value-added taxes across the board in March, which affects the cross-border e-commerce tax. The cross-border e-commerce taxes were lowered from 11.2% and 25.53% to 9.1% and 23.05%, respectively.

The first category applies to grocery goods, baby supplies, nutritional products, and personal care products, whereas the second category applies to higher-end skin care, cosmetics, and perfume products.

The fact that the government has lowered both the cross-border e-commerce tax and postal tax means that China is eager to encourage imports and consumption.

What Should Cross-Border E-Commerce Sellers Do?

Deciding between shipping through personal postal channels or cross-border e-commerce (business commercial) channels can be tricky. It largely depends on the items you're selling, and what they're priced at.

In general, cross-border e-commerce shipping and customs clearance takes longer to get products set up and registered with customs, but the customer experience is far better as the products are pre-registered with customs and go through clearance channels more smoothly.

While all of these items will be taxed at the 9.1%/23.05% tax rates, sellers can mark up items ahead of time to take this into account.

With postal clearance, <10% of items are flagged by customs and taxed, but those items may be held for longer periods of time and lead to a poor customer experience, especially since not all the items are taxed and sellers may have to refund customers to compensate.

While postal shipping is easier to set up for new entrants to the China market, customers that run into customs clearance issues may be harder to retain as repeat customers. They may even leave negative reviews online about your business.

Those that start off selling to China through postal shipping channels should strive to move to cross-border e-commerce (business commercial) shipping as soon as possible to provide a stronger customer experience.

See the rest of the article