How can Douyin Live (Chinese TikTok) Unlock Your Brand's Growth Potential in China?

This article examines Douyin (Chinese TikTok) Live's development, business model, leveraging methods, and best practices.

by Azoya

The surge of live commerce in China has been propelled by key platforms like Taobao Live, Douyin Live, and Kuaishou Live. Douyin Live, regarded as the largest live stream platform in China, has achieved $274 billion in e-commerce sales in the first ten months of 2023, with 65% attributed to short videos and live streams. This article examines Douyin Live's development, business model, leveraging methods, and best practices.

In 2017, Douyin officially entered the realm of Chinese live-commerce by introducing its live stream function. Since 2020, However, Douyin cut off links to external e-commerce platforms, opting to exclusively support internal ones. By 2021, Douyin positioned itself as an 'interest e-commerce' (‘兴趣电商’ in Chinese) platform in the Chinese market. This unique model leverages its huge user traffic and advanced recommendation algorithm to discern and cater to users' specific interests. Unlike conventional e-commerce platforms where users actively search for products, Douyin's approach revolves around enabling products to seek out individuals in need. This innovative strategy streamlines the process for brands to reach out to their target audience and drive sales effectively.

The key characteristics of Douyin Live

Product: Douyin adopts the 'seeded-purchase' model, strategically presenting products in short videos and live streams to captivate users and prompt them to recognize their needs and place orders. Transitioning users from A1 (Aware) to A3 (Ask), Douyin seamlessly provides purchase links, encouraging immediate action and increasing conversion rate through live streams, short videos, and its own stores. The Chinese Consumer Association notes that live-commerce consumers exhibit a preference for apparel, daily necessities, food, and beauty products, with over 60% purchasing apparel during live streams. Furthermore, the '2023 Chinese Live-Commerce Opportunity Insight Report' highlights a significant surge in live stream sales for niche industries like pet, household appliances, and wellness products, emphasizing their great potential.

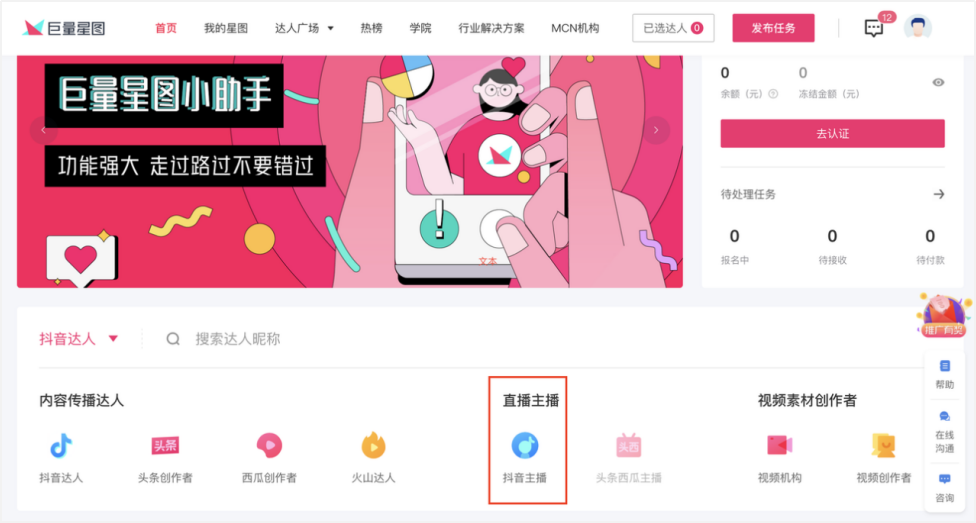

Place: To cater to the main audience, the style of Douyin Live tends to be more youthful. There are two main categories: KOL (Key Opinion Leader) live streams and self-operated live streams. The extensive KOL pool of Douyin, with detailed information available on Xingtu.com, includes style preferences, Gross Merchandise Volume (GMV), follower demographics, and pricing details. This aggregated platform empowers brands and merchants to efficiently collaborate with suitable KOLs, enhancing their business impact. Additionally, it provides a lucrative space for KOLs to generate income, encouraging the creation of more high-quality content and forming a virtuous circle. On the other hand, self-operated live streams are conducted directly by brands and merchants. This approach allows them to build their own user base, foster brand loyalty, and mitigate risks associated with KOLs, such as personal statements with potential negative effects.

The user page of Xingtu.com

Consumer: In November 2023, Douyin reached 752 million monthly active users in China, offering a huge consumer pool. Mainly composed of females from tier-3 cities, the platform has seen rapid growth in tier-1 and tier-4 cities. The majority are individuals born in the 1980s and 1990s, with the post-1995 generation growing the fastest. These users, characterized by substantial consumption power, hold immense value for Douyin.

How could brands leverage live stream for a higher conversion rate on Douyin?

Maximizing the recommendation algorithm of Douyin and completing the ‘seeded - -purchase’ process is the key to a higher conversion rate. OceanEngine, the official marketing platform of Dytedance released a solution called ‘KOLs, Advertisement, Search, Live Stream’ (‘星推搜直’) in 2023. The solution revolves around the A3 group, combining KOLs collaboration, advertisement in different source places, an internal search engine of Douyin and the live stream.

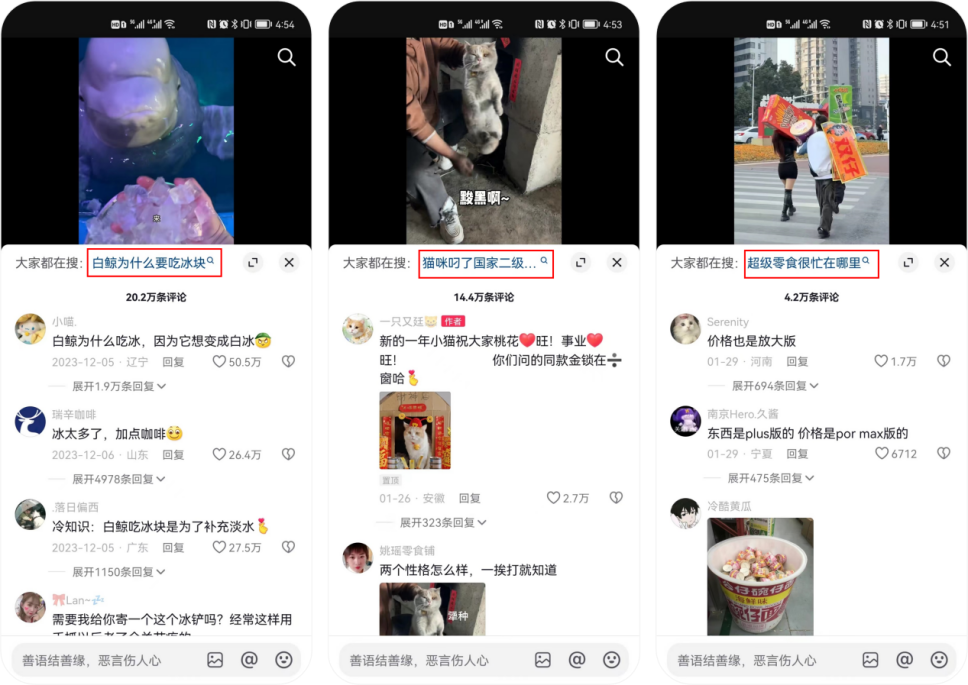

Brand seeding begins with the strategic engagement of Key Opinion Leaders (KOLs) as the initial catalyst. Collaborating with KOLs of various levels enables brands to amplify their exposure and attract a larger number of A3 users. Leveraging high-quality content from these KOLs maximizes influence and increases the Return of Investment (ROI). Once users are captivated by the products or brands, the subsequent steps involve utilizing search engines and live streaming to guide them further. The search engine facilitates efficient discovery and ordering. For example, the 'Little Blue Words' (‘小蓝词’ in Chinese) at the top of the comment section in each short video will increase 528% search volume and direct users to the result page with product recommendations, according to OceanEngine.

‘Little Blue Words’ on the top of the comment section of short videos on Douyin

Moreover, Douyin strategically recommends relevant live streams to the users being seeded, employing encouraging language and competitive pricing to drive purchases. The sales efficiency in this live stream approach surpasses that of short videos and product cards by five times. This streamlined process establishes a closed loop in the customer journey from being 'seeded' to making a 'purchase,' enhancing the overall effectiveness of marketing efforts. The solution also gives niche brands opportunities to expand because of its content recommendation algorithm.

Best Practice: Kans

GF Securities reported a remarkable 70.3% surge in Kans's sales during the first half of 2023, reaching an impressive 1.03 billion yuan ($144.7 million) and securing the top spot on Douyin's beauty sales list. This growth can be attributed to Kans' well-crafted Douyin strategies. One key factor is the perceived value of Kans' products, resonating with consumers who prioritize cost performance. For instance, the 'Red Waist' set, comprising essential products like essence, cream, cleanser, toner, and lotion, is attractively priced at 399 yuan ($56.02).

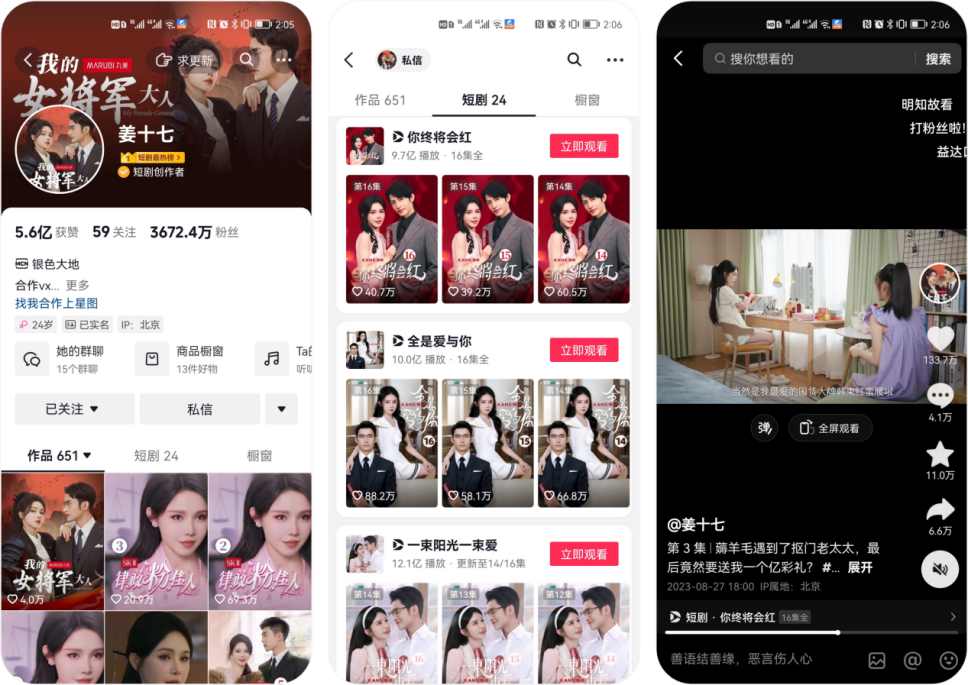

Moreover, Kans strategically partners with key opinion leaders (KOLs) and key opinion consumers (KOCs) to promote the 'Red Waist' set, expanding its reach and cultivating an image as 'the light of Chinese beauty products.' According to Chanmama, a data platform, Kans achieved a brand exposure of 196 million from September to October 2023 only through short videos on Douyin. Notably, KOL Jiangshiqi (‘姜十七’ in Chinese), boasting 36.72 million followers on Douyin, created five playlets with Kans, garnering over 600 million views on average for each 16-episode series cleverly exhibits the ‘Red Waist’ set but not affect users’ watching experience. Kans adeptly understands Douyin's 'content drives traffic' dynamic, utilizing short, impactful playlets for marketing, catering to users' fragmented time and delivering emotional value. Shanghai Securities reports that, as of January 2024, over 5.87 million 'Red Waist' sets have been sold.

Jiangshiyi’s playlet cooperated with Kans

The final stage motivating consumers to make purchases once they are familiar with and attracted to the products is live stream. Xindou Data reveals that from October 2022 to April 2023, Kans hosted 549 self-operated live streams, amassing over 87.6 million views and generating 250 - 500 million yuan ($35.1 - 70.2 million). These extended live streams enable Kans to connect with a broader audience. During the 2024 New Year holiday season, Kans offers enticing 'purchase with gift' deals to boost the conversion rate. This comprehensive approach has effectively positioned Kans as a notable success story in the competitive beauty market.