Amidst store closures in China, Pandora turned to JD Worldwide for growth

The jewelry maker launched official cross-border e-commerce channel to compete for attention from luxury shoppers in China

by Yufan, edited by Davy Huang

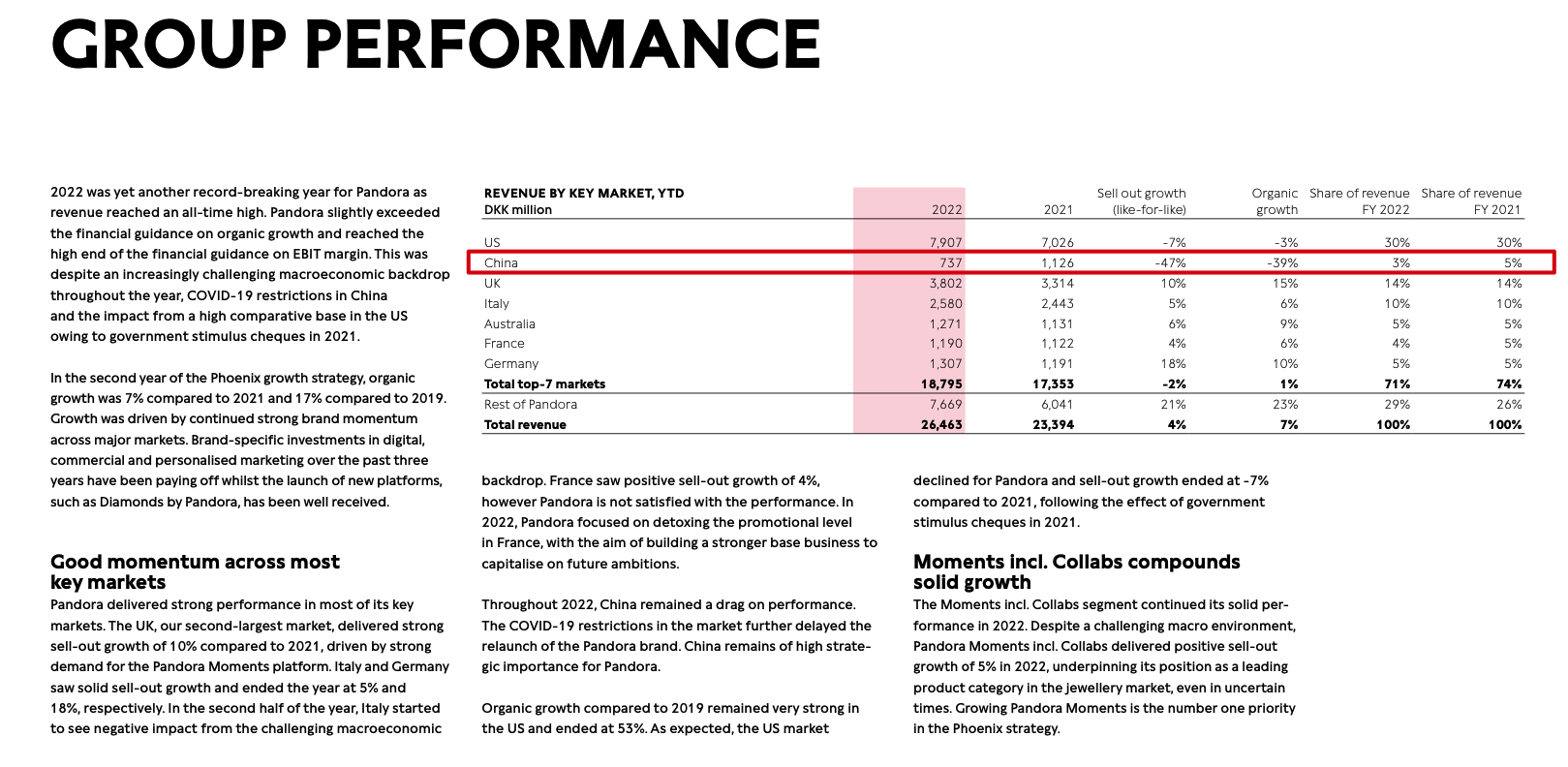

The Danish jewelry firm Pandora, positioned within the affordable luxury segment, and known for its customizable charm bracelets and necklaces, has been a global success. As of 2022, it has 214 stores in China. However, the company has faced declining sales pressure in China in recent years. To counter this, Pandora is increasing its marketing investments and broadening its product range through JD Worldwide, JD.com's cross-border e-commerce channel, aiming to seize a portion of the expanding Chinese jewelry market.

The Chinese market offers significant potential for companies like Pandora. In 2019, Chinese consumers made up 35% of global luxury purchases, totaling $115 billion. Furthermore, the Chinese jewelry market was one of the world's largest, with a market size of $21.6 billion in 2020, as per Euromonitor International.

The brand's growth was suddenly stalled during the pendamic - which lastes over 3 years that put the offline foot-traffic in terrible low. According to Q4 financial report of Pandora, the brand's official bricks & mortar store numbers in China had shrunk to 209, from it's peak of 240 in 2019. The iconic Sanlitun store was now replaced by another emerging Danish fashion brand GANNI. The brand had since luanched various digital initiatives including a joint livestream with Danish Embassy on JD.com in 2020's June 18th campaign, partnering with influencers and releasing over 2,000 short videos in Albaba's Tmall to reach out to luxury consumers, as well as developing official private domain via WeChat's social group communities.

Utilizing JD Worldwide to expand its product range could be a wise move for Pandora. Cross-border e-commerce is gaining popularity in China, with total sales reaching $176.2 billion in 2020, as reported by Statista. JD.com held a 30.2% market share in the cross-border e-commerce market in 2020, according to The Economist Intelligence Unit. By tapping into JD.com's support services and infrastructure, Pandora could effectively compete in this highly competitive market and seize a portion of this growth.

JD Worldwide offers multiple benefits to companies like Pandora. For instance, JD.com assists with logistics and customs clearance, providing essential support to businesses exporting products to China. JD.com has built a solid logistics network in China, encompassing warehouses, transportation, and distribution centers, helping companies like Pandora swiftly and efficiently ship their products to Chinese customers. Additionally, JD.com offers marketing and advertising support, including targeted campaigns, to help businesses reach Chinese consumers and increase brand awareness. JD.com's reputation for quality and authenticity also fosters trust among Chinese customers, a valuable asset for foreign brands aiming to succeed in the Chinese market.

However, success in China is not guaranteed. The competition is intense, with numerous domestics jewelry companies competing for Chinese consumers' attention - many of them are launching their DIY jewelry with charms that originated from Chinese traditional culture, and better value proposition. There is no doubt that Chinese customers are becoming increasingly sophisticated and selective in their purchasing decisions. Businesses must effectively convey their products' value to stand out from the competition, necessitating successful localization efforts, such as creating products and marketing campaigns that resonate with Chinese customers. The brand is also now launching lab-grown diamonds that could potentially attract to the Gen-Z consumers in China.

To some extend, cross-border e-commerce platforms such as JD.com does offer added value to fashion & jewelry business, by connecting with target users and the brand's global inventories. JD.com offers both bonded warehouse fulfillment options & international shipping solution, that help consumers to look for niche design that with a travel destination feature. This is a strong value add to customers - who are now still troubled with limited air-liner capacity and long waiting line to obtain a travel visa.

In conclusion, while Pandora has already established a presence in the Chinese market via its online store on JD.com, broadening its product range through JD Worldwide could be a strategic move to help the company effectively compete in this highly competitive market. The Chinese market offers significant potential for companies like Pandora, but success requires effective localization efforts, differentiation from competitors, and overcoming various regulatory and logistical challenges. By leveraging JD.com's support services and infrastructure, Pandora may be able to seize a portion of the growing Chinese jewelry market.

References

Pandora Annual Reports, https://pandoragroup.com/investor/news-and-reports/annual-reports

Euromonitor International. (2021). Jewelry in China. https://www.euromonitor.com/jewellery-in-china/report/

Pandora CEO says recession "could be a positive thing for us".", Fortune. Fortune. Available at: https://fortune.com/2023/02/15/pandora-ceo-alexander-lacik-recession-positive-jewelry-maker-growth-economic-slowdown/

Pandora JD Worldwide Flagship Store, http://mall.jd.hk/index-1000450813.html